insight

macroeconomics

From Tariffs to Rate Cuts: How the US-China Trade Reset Shapes Global Markets

By Ang

May 16, 2025

10 min read

This article analyzes the 2025 trade truce between the U.S. and China reducing tariffs to 30% and 10% respectively and its broader implications for global markets, monetary policy, and investor behavior. While the de-escalation offers temporary relief, the paper argues that underlying economic fragility persists, with sluggish growth forecasts, sticky inflation, and a growing disconnect between market optimism and fundamentals. It further explores how reduced expectations for Federal Reserve rate cuts (from 75bps to ~56bps) reflect this uncertainty, and provides scenario-based outlooks for the remainder of 2025, offering strategic investment insights amidst a complex, policy-driven environment.

The global economic landscape is navigating a pivotal shift as U.S.-China trade tensions show signs of temporary thaw, marked by recalibrated tariffs: 30% imposed by the U.S. on Chinese imports and 10% by China on U.S. goods. This de-escalation from previously crippling highs where U.S. tariffs reached up to 145% and Chinese retaliation hit 125% injects fresh dynamics into global markets. However, a critical question remains: Does this signal a genuine path toward global economic recovery, or is it primarily a strategic political maneuver amidst persistent economic fragility?

The central question we examine is whether the latest tariff policies will finally realign fundamental economic realities with the market's prevailing optimism. This requires analyzing several interconnected components. First, these tariff levels represent significant diplomatic signals rather than mere economic instruments. Many analysts view this as a "face-saving" truce a 90-day pause designed to facilitate broader negotiations while allowing both sides to claim they've maintained leverage. Second, market expectations regarding Federal Reserve monetary policy have moderated considerably, with anticipated rate cuts for 2025 declining from approximately 75 basis points to just 56 basis points as economic data and trade developments evolve.

Despite the upbeat market mood following the tariff reset, fundamental indicators from slowing global growth forecasts around 2.7-3.0% to cautious business sentiment suggest that optimism might be outpacing reality. The new "lower" tariff rates still substantially exceed pre-trade war levels, indicating that the global trade environment remains fundamentally altered and protectionist. This paper explores how these tariffs, potential Fed rate cuts, and the broader global economic environment interlink, and what this means for strategic investors and policymakers navigating an increasingly complex landscape.

US-China Tariff Reset: Context and Implications

Brief History

After years of escalating trade tensions, Washington and Beijing struck a tariff truce in May 2025, slashing duties from punitive highs to 30% and 10% respectively. This dramatic reduction, even if temporary, came following intense negotiations in Geneva, where both sides recognized the unsustainable economic damage from extreme tariff levels that threatened to severely disrupt global commerce and exacerbate economic slowdowns.

The U.S. 30% rate is a composite figure, including a pre-existing 20% levy related to fentanyl precursor chemicals and a 10% baseline tariff that the administration has indicated as a minimum for most global trade partners. It's critical to contextualize these "reduced" rates: they remain substantially higher than the approximate 2-3% average U.S. tariff on Chinese goods before the trade conflict intensified. This "sticky baseline" effect implies a structural shift toward a more protectionist global trade environment.

Tariffs as Diplomatic Tools

This reduction of tariffs is widely interpreted as a tactical de-escalation designed to create space for further negotiations. The preceding extreme tariff levels were economically unsustainable, characterized by some analysts as "the equivalent of an embargo," and risked severe global economic repercussions. The mutual damage likely exceeded political tolerance on both sides, compelling them to seek an off-ramp.

The move can be seen as a "face-saving" strategy for both nations. The U.S. administration can claim it maintained significant tariff pressure still considerably higher than pre-conflict levels and successfully brought China to the negotiating table. Simultaneously, China can portray the reduction as a result of its firm stance and resilience, securing relief from crippling rates while demonstrating willingness to engage. This mutual, albeit temporary, concession allows both leaderships to manage domestic political perceptions while pursuing further dialogue.

The 90-day window established by the truce is critical for addressing substantive, long-standing issues such as intellectual property protection, market access, and non-tariff barriers. The fact that these extreme tariff levels were scaled back suggests that while tariffs are potent diplomatic weapons, their most severe application has self-limiting effects, potentially paving the way for a more calibrated approach to future trade disputes.

Economic Impact Analysis of the New Tariff Regime

Simplified Cost Distribution Analysis

Reduced Impact from Chinese FX Devaluation: With tariffs lower than their punitive highs, there is less pressure on China to offset costs via yuan devaluation. During the 2018-19 trade war, the renminbi fell about 10% as U.S. tariffs climbed 10 percentage points, helping cushion Chinese exporters. However, the notion that China could readily offset substantial U.S. tariffs through currency devaluation has been largely dismissed by analysts, particularly at high tariff rates. A 30% tariff would necessitate a massive and economically destabilizing devaluation to be fully neutralized. Chinese authorities have historically shown preference for currency stability to avoid capital flight and protect RMB internationalization progress. This suggests a more stable USD/CNY exchange rate is likely under the 30% tariff regime.

Burden on Manufacturers and Businesses: While a 30% U.S. tariff still imposes considerable pressure on Chinese manufacturers, it represents a significant reduction from near-embargo levels of 145%. This provides operational relief, though many Chinese firms have already begun diversifying their export markets away from the United States. For U.S. businesses reliant on Chinese imports, the tariff reduction offers a degree of respite from crippling cost escalations. However, a 30% tariff remains substantial. The Perryman Group estimates that a sustained 30% tariff on Chinese imports could result in an annual loss of $173.3 billion in U.S. gross product and jeopardize nearly 1.4 million jobs when multiplier effects are considered.

Consumer Impact: Economic analyses suggest that tariff costs are largely passed through to consumers. According to the Yale Budget Lab, even with the May tariff reductions, the cumulative effect of all 2025 tariffs is projected to increase the U.S. price level by 1.7% in the short run, costing the average household an additional $2,800 annually. Specific categories like clothing (+14-16%), textiles, and motor vehicles (+6.2-9.3%) are expected to see notable price increases. Major retailers like Walmart, which warned it "can no longer absorb" the cost of previous tariffs, noted that even at reduced rates, some price hikes are still inevitable on narrow-margin goods.

Short-Term vs. Long-Term Implications

Short-term Effects: The immediate aftermath of the tariff reduction saw a relief rally in financial markets and an easing of fears regarding supply chain collapse. There is potential for a surge in import volumes as businesses capitalize on the 90 day window of lower tariffs. However, inflationary pressures likely persist due to the still-high tariff levels. Businesses continue grappling with logistical challenges and significant uncertainty about policy beyond the 90 day truce. Early evidence shows trade volumes rebounding: indicators of inbound container traffic had plummeted during peak tariffs but should recover with duties now "considerably less disruptive...and less inflationary" than before.

Long-term Consequences: If tariffs at the 30% level become a protracted feature of U.S.-China trade, long-term consequences could include:

- A persistent drag on U.S. GDP (estimated by Yale Budget Lab at -0.4% annually, or $110 billion)

- Fundamental reconfigurations of global supply chains

- Shifts in international trade patterns

- Some expansion in domestic manufacturing, potentially at the cost of crowding out sectors like construction and agriculture

- Depressed long-term investment, hiring, and innovation due to policy uncertainty

The World Bank warns that even a broad-based 10% tariff regime (with retaliation) could trim 2025 global growth by ~0.3 percentage points. Today's 30%/10% U.S.-China tariffs, while lower than before, still represent a significant trade hurdle. Analysts at the Bank for International Settlements caution that persistent trade frictions can have "stagflationary" side effects globally, especially if they contribute to a stronger U.S. dollar and fragmented markets.

The following table provides a comparative view of different tariff scenarios on the U.S. economy:

| Metric | Pre-May 12 High Tariff Scenario (e.g., 145% U.S. on China) | Current 30% U.S. Tariff Scenario (as part of all 2025 tariffs) |

|---|---|---|

| U.S. GDP Growth Impact | -1.1pp over 2025 | -0.7pp over 2025 |

| Avg. Household Cost (Short-Run) | ~$4,800 annually | ~$2,800 annually |

| U.S. Price Level (Short-Run) | +2.9% | +1.7% |

| Annual GDP Loss (Sustained 30% Tariff) | N/A | $173.3 billion |

| Job Losses (Sustained 30% Tariff) | N/A | ~1.4 million |

Note: Figures from Yale Budget Lab compare scenarios with and without the May 12 China tariff reduction, reflecting the impact of all 2025 tariffs. The Perryman Group figures specifically estimate the impact of a sustained 30% tariff on China.

In sum, the tariff détente is a meaningful step toward normalcy but it's only one piece of the puzzle in realigning markets with fundamentals and restoring sustainable global trade flows.

The Disconnect Between Market Optimism and Economic Fundamentals

Fundamental Conditions vs. Market Sentiment

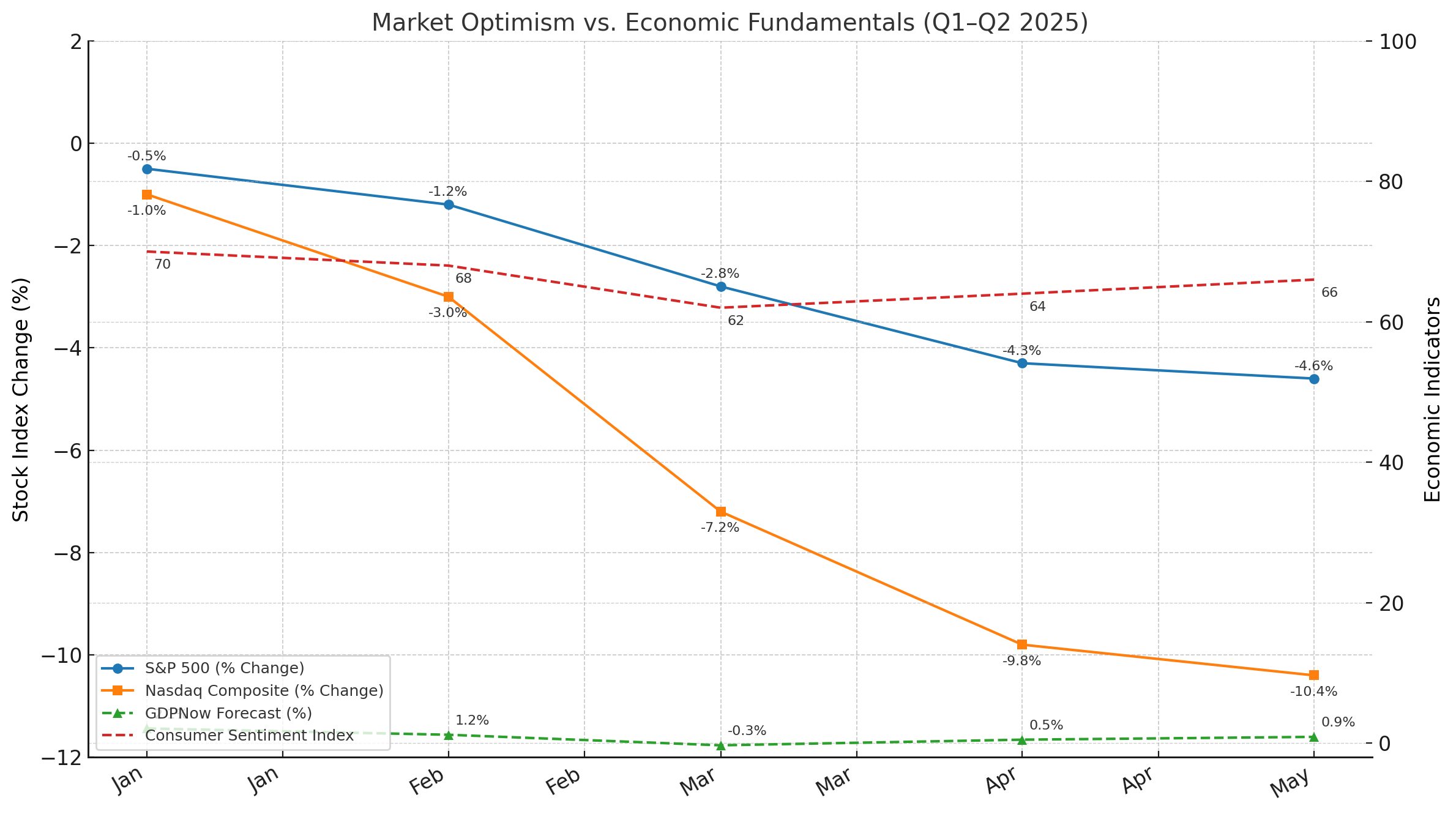

A striking feature of the economic landscape in the first half of 2025 has been the apparent disconnect between cautious, often deteriorating fundamental economic indicators and the persistent, sometimes exuberant optimism observed in certain market segments. This phenomenon has been dubbed "hopium" investor optimism fueled by hope rather than concrete data.

Global economic fundamentals have painted a challenging picture. Major international institutions like the IMF and OECD revised their global GDP growth forecasts downwards for 2025, citing adverse impacts of trade tensions, heightened policy uncertainty, and stubborn inflation. U.S. Q1 2025 GDP growth estimates indicated a slowdown, with the Atlanta Fed's GDPNow model even plunging into negative territory at one point. U.S. consumer sentiment declined sharply, reaching a 2.5-year low in March 2025, largely attributed to anxieties surrounding inflation and tariffs.

Despite these headwinds, market optimism has been evident. While U.S. domestic stock indices faced pressure in Q1 2025, with the S&P 500 declining by 4.3-4.6% and the Nasdaq falling by 10.4%, international equities demonstrated notable strength. The MSCI EAFE index rallied by 6.9% in Q1, and markets like MSCI Germany (+15.6%) and MSCI China (+15.1%) posted significant gains. Cryptocurrency markets saw record trading volumes on certain exchanges, even as overall crypto valuations experienced a pullback in tandem with technology stocks.

A key aspect of this disconnect is the bifurcation between "soft" data (sentiment surveys and future expectations, which have largely deteriorated) and "hard" data (employment figures and actual consumer spending, which showed more resilience). For example, while consumer sentiment plunged, U.S. retail sales saw a surprising jump in March, though this may have been influenced by consumers front-loading purchases ahead of anticipated tariff hikes. The job market, while showing signs of cooling, exhibited what some analysts termed a "low firing, low hiring" environment.

Evidence of Market-Reality Disconnect

Oil Price Dynamics: Global oil prices have trended lower, with the U.S. Energy Information Administration forecasting Brent crude oil to average $66 per barrel in 2025 and $59 per barrel in 2026. This reflects expectations of lower global oil demand growth (OPEC: 1.3 mb/d in 2025; EIA: 1.0 mb/d; IEA: 0.7 mb/d) and rising global oil inventories. This price behavior occurs despite ongoing geopolitical tensions that would typically support higher oil prices, suggesting concerns about economic slowdown, partly exacerbated by trade policies, are weighing heavily on demand forecasts.

Speculative Asset Markets: Speculative fever is most evident in cryptocurrency markets. The first quarter of 2025 saw Coinbase International Exchange report nearly $800 billion in notional trading volume, an all-time quarterly high. This occurred even as broader crypto valuations experienced a Q1 pullback. By May 2025, even whimsical meme coins were skyrocketing on "macro hopium," as traders bet that easier trade tensions and central bank easing would boost speculative assets. Bitcoin, for instance, surged past $100,000 amid this risk-on wave.

The broad U.S. stock market also saw pockets of euphoria from AI-driven tech stocks to retail trading favorites far outpacing what current earnings or economic indicators would justify. In other words, investors appear to be pricing in a best-case future (strong growth and policy easing) while brushing aside present weaknesses.

Understanding the "Hopium" Phenomenon

Several psychological factors drive this "hopium" phenomenon:

FOMO (Fear Of Missing Out): The fear of missing out on potentially massive returns, especially when amplified by anecdotal success stories, can lead investors to make decisions based on emotion rather than rational analysis.

Influence of Social Media and Echo Chambers: Social media platforms and influential figures can significantly amplify hype around certain assets, sometimes creating echo chambers where positive narratives are magnified and critical analysis is overlooked.

Cognitive Biases: Investors may become emotionally attached to their investments, leading to cognitive biases such as confirmation bias the tendency to seek out information that confirms pre-existing beliefs while disregarding contradictory evidence.

Herd Mentality: The behavior of other investors can exert powerful influence, leading to emotional contagion rather than independent decision-making. This can drive asset prices to overvalued levels and contribute to dramatic market swings.

Belief in Policy Backstops: There's often an underlying belief that central banks or government policies a "Fed put" or "policy put" will ultimately intervene to support asset prices, cushioning potential downside. This reliance on policy backstops can create moral hazard, where markets become less sensitive to fundamental weaknesses.

After a volatile 2022-23 period, investors became conditioned to "buy the dip" on any hint of good news. The result is a reflexive rally on hopeful narratives sometimes disconnected from concrete data. The IMF's October 2024 stability report noted an "apparent disconnect" between market buoyancy and underlying uncertainties. Such periods of low volatility and rising prices despite mixed fundamentals suggest markets may be complacent to real risks.

The danger is that this disconnect cannot last indefinitely either fundamentals must improve to meet expectations, or asset valuations will correct. History shows that when markets are propped up mainly by hopes of stimulus, trade deals, or technological revolutions, a reality check eventually comes.

Federal Reserve Policy Outlook and Rate Cut Expectations

Understanding Fed Funds Futures as a Predictor

Fed Funds Futures contracts serve as a critical market-based indicator of anticipated Federal Reserve policy. These contracts allow market participants to hedge against or speculate on future movements in the effective Federal Funds Rate. The pricing of these futures contracts can be mathematically translated into implied probabilities of different interest rate target ranges at upcoming Federal Open Market Committee (FOMC) meetings.

While not a perfect predictor, Fed Funds Futures have a strong track record of incorporating available information (economic data, Fed commentary, etc.) to forecast upcoming Fed decisions. For example, if futures indicate a rate of 4.00% at year-end versus a current rate of 4.5%, that suggests the market anticipates about 50 basis points (0.50%) of cuts. Policymakers themselves monitor these market expectations. In essence, futures distill the collective wisdom (and biases) of thousands of market participants on where rates are headed.

Evolution of Rate Cut Expectations

At the beginning of 2025, market participants were pricing in a more aggressive series of rate cuts by the Federal Reserve. Some analyses based on February 2025 data suggested market expectations for at least three 25-basis-point cuts (totaling 75 bps) by the December 2025 FOMC meeting. This followed a period in late 2024 where the Fed had already reduced its benchmark rate by a cumulative 100 basis points.

However, by mid-May 2025, these expectations had notably moderated. While the CME FedWatch Tool on May 10 still showed a 35.8% probability of the Fed Funds Rate being in the 3.50-3.75% range by December 2025 (implying three 25 bps cuts from the 4.25-4.50% range), broader analyst commentary pointed toward a more hawkish shift. Market pricing around May 16 suggested expectations for roughly 56 basis points of Fed cuts by December 9, aligning more closely with two anticipated cuts (50 bps) with some residual probability of a third.

This recalibration was echoed by various financial institutions:

- TD Securities, on May 15, revised its forecast to two 25-basis-point cuts, expected in October and December 2025 (totaling 50 bps).

- Goldman Sachs, on May 14, pushed back its expectation for the first rate cut to December 2025.

- The Federal Reserve's own Summary of Economic Projections from March 2025 indicated a median projection of 50 basis points in cuts for the entirety of 2025.

The following table illustrates the evolution of market-implied Fed rate cut expectations:

| Date of Forecast (Approx.) | Source | Implied Total Rate Cut (bps) by Dec 2025 | Notes |

|---|---|---|---|

| Late Jan/Early Feb 2025 | CME FedWatch | At least 50 bps (likely 75bps+) | >75% prob. of at least two cuts; 44% odds of at least three cuts |

| March 19, 2025 | Fed Dot Plot | 50 bps (median projection) | Nine FOMC participants projected 50-75bps of cuts |

| Late March 2025 | Morningstar Analysis | 75 bps | Expecting year-end fed funds rate of 3.50-3.75% |

| May 8, 2025 | CME FedWatch | First cut not until July (52% odds) | June cut odds down to 20% from 55% a week prior |

| May 15, 2025 | TD Securities Analysis | 50 bps (two 25bp cuts) | Expecting cuts in October and December |

| May 16, 2025 | Market Pricing via Reuters | ~56 bps | Up from 49 bps the previous day |

Factors Driving Changing Rate Expectations

Several key factors contributed to this revision in rate cut expectations:

Stronger Economic Signals: The U.S. economy has shown pockets of resilience—unemployment remains low and recent data on consumer spending and GDP came in above expectations. This "good news" paradoxically leads investors to bet on less Fed easing (since the Fed cuts rates mainly when the economy needs help). Fed Chair Jerome Powell stated that "the economy is not sending any signals that we need to be in a hurry to lower rates."

Persistent Inflation Concerns: While inflation has moderated from 2022 highs, it remains stubbornly above the Fed's 2% target, particularly in the services sector. Crucially, the potential inflationary impact of the U.S.-China tariffs, even at the reduced 30% level, remains a significant upside risk to the inflation outlook. If a renewed trade truce boosts growth or if commodity prices rise, the Fed might worry about inflation persistence.

Federal Reserve Communication: FOMC statements and pronouncements from Fed officials consistently emphasized a "wait-and-see" approach. They highlighted data dependence and acknowledged increased risks of both higher inflation and higher unemployment stemming from the uncertain trade policy environment. Officials indicated no rush to adjust policy stance, preferring to gather more information.

Trade Policy De-escalation: The U.S.-China tariff truce, while still leaving significant tariffs in place, reduced the immediate threat of a severe economic shock that could have precipitated a recession. This lessened the perceived need for imminent and aggressive "insurance" rate cuts from the Fed. When the U.S.-China tariff truce was announced, it diminished some downside economic risks, thereby lessening the urgency for Fed stimulus.

The Nature of Potential Cuts Insurance vs. Crisis: Another consideration is the reason for cuts. If 2025 rate reductions happen, they may be what central bankers call "insurance cuts" modest easing to nudge growth along rather than emergency slashing. Historically, when the Fed eases in a relatively healthy economy, it often doesn't cut very deep. By contrast, deep rate cuts (e.g., >100 bps) usually coincide with severe recessions or financial crises.

Fed Policy Dilemma and Market Implications

The current trade policy environment creates a direct conflict for the Federal Reserve's dual mandate of achieving price stability and maximum employment. Tariffs are inherently inflationary, pushing up costs and potentially calling for tighter monetary policy or, at least, a delay in rate cuts. Simultaneously, these same tariffs and associated uncertainty can slow economic growth and increase unemployment by disrupting supply chains, reducing business investment, and denting consumer confidence.

Fed officials have explicitly acknowledged this challenging "stagflationary shock," placing them in a "tough spot" where they must carefully weigh which risk inflation or unemployment is more pressing. This inherent tension increases uncertainty about the Fed's future policy path, contributing to market volatility and heightening the risk of policy missteps.

If the Fed indeed only cuts rates marginally (50–75 bps total) over the next year, the market reaction could be mixed. Fewer cuts mean less immediate stimulus potentially a headwind for equities that were pricing in a bigger liquidity boost. However, fewer cuts imply the economy is on sturdier footing (reducing fears of a sharp downturn).

It's worth remembering that historically, Fed rate cuts often coincide with bear markets or recessions, as they respond to weakness. For instance, rate-cut cycles in 2001 and 2008 did not prevent stocks from falling because the underlying economy was in trouble. The hope in 2025 is that any Fed easing is gentle and anticipatory, rather than reactive to crisis thus providing a cushion without signaling panic.

The Interplay of Tariffs, Fed Policy, and Market Dynamics

Tariff Diplomacy's Effect on Monetary Policy

The de-escalation of U.S.-China trade tensions has tangibly altered the calculus for Federal Reserve monetary policy. Prior to the tariff adjustment, the prospect of extreme tariffs posed a significant threat of inducing a sharp economic downturn, potentially even a recession. Analysts noted that recession risks looked "uncomfortably high" under such scenarios. The subsequent rollback, while leaving tariffs at levels that are still economically impactful, has lessened the immediate "left tail risk" for global economic growth.

This improved, albeit still cautious, near-term outlook for economic activity reduces the immediate pressure on the Federal Reserve to implement aggressive "insurance" rate cuts designed to stave off an acute crisis. TD Securities explicitly stated that there is "less urgency for monetary policy support in the near term" following the trade truce.

However, the situation remains far from straightforward for the Fed. While the de-escalation reduces acute shock, the remaining 30% U.S. tariff on Chinese goods is still considered inflationary. This ongoing inflationary pressure complicates the Federal Reserve's ability to cut interest rates. The central bank remains steadfast in its commitment to bringing inflation back to its 2% target and is understandably wary of easing monetary policy prematurely if tariffs continue to exert upward pressure on prices.

In essence, trade policy is no longer a peripheral concern for monetary authorities but a direct and significant input into their decision-making framework. The tariff reduction took a weight off the global economy and by extension removed some urgency for monetary easing. Markets are in the process of repricing this new reality, but they haven't lost their optimistic bias.

Market Adjustment Process and Psychology

Global financial markets are currently navigating a complex adjustment phase, attempting to reconcile bouts of speculative optimism with an increasingly challenging array of economic data. The initial market reaction to the U.S.-China tariff reduction was broadly positive, with equity indices experiencing a relief rally. This reflected an easing of fears regarding a full-blown trade war characterized by prohibitive tariff levels.

However, this market adjustment appears less about aligning with robust positive fundamentals and more about recalibrating away from overly pessimistic scenarios. Despite this temporary reprieve, markets remain characterized by significant volatility and a lack of clear directional conviction. This is largely attributable to the temporary nature of the 90-day tariff deal and unresolved trade issues between the U.S. and China.

Analysts describe the current environment as an "event-driven market," where price movements are heavily influenced by policy headlines, rumors, and diplomatic developments rather than fundamental economic data. This "policy whiplash" effect creates an environment of heightened short-term volatility and makes traditional fundamental analysis more challenging.

The persistence of speculative optimism despite signs that economic realism is warranted can be attributed to several factors:

-

Psychological Phenomena: FOMO, confirmation bias, and herd mentality contribute to market sentiment becoming detached from underlying fundamentals.

-

Expectation of Policy Support: A lingering belief that either the Federal Reserve (the "Fed put") or the administration (the "policy put") will intervene with supportive measures if market conditions deteriorate significantly.

-

Focus on Specific Growth Narratives: Strong investor interest in particular long-term themes, most notably Artificial Intelligence, can drive optimism and investment flows into specific market segments, irrespective of broader macroeconomic concerns.

-

Front-Loading Activity: Some seemingly positive economic signals might be skewed by businesses and consumers front-loading purchases in anticipation of tariff impacts, creating a temporary illusion of underlying economic strength.

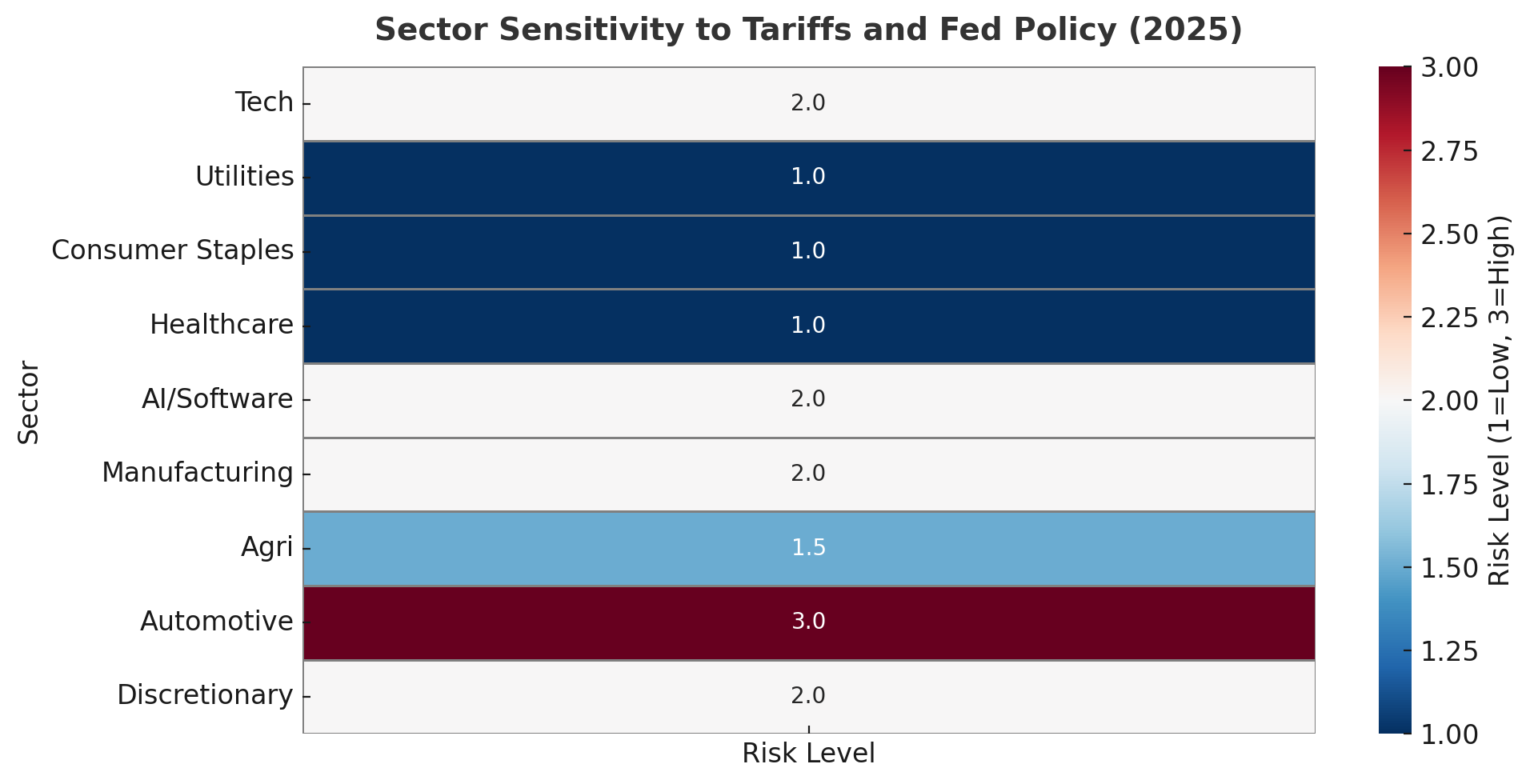

This selective market "realism" means that while there are signs of markets attempting to align with economic data, this alignment can be partial. Certain speculative narratives or asset classes can remain buoyant due to factors that transcend broad economic health. Market adjustments are likely to be uneven, with significant divergence between various sectors and asset classes based on their specific sensitivities to tariffs, Federal Reserve policy, and their connection to prevailing speculative themes.

Strategic Investor Considerations

In this environment, savvy institutional investors are treading carefully. Many are hedging their bets enjoying upside from the rally, but also positioning for a potential turn. For instance, some macro funds are rotating into quality assets that would benefit from real economic improvement (like stocks of companies with strong earnings and exposure to rebounding trade), while shorting or trimming positions in assets that look frothy purely due to liquidity hopes.

Risk management is key: the convergence of reduced Fed support and still-weak fundamentals could catch exuberant investors off guard. A scenario where the economy doesn't accelerate despite the trade truce, and the Fed also doesn't deliver cuts (because inflation is sticky), would be troublesome for markets. Thus, prudent investors are using this period of calm to re-evaluate valuations and ensure they aren't over-extended on pure optimism.

Navigating this transition from periods of excessive optimism towards a more sober assessment of economic realities requires a strategic and disciplined approach:

-

Emphasize Diversification: Robust diversification across geographic regions and asset classes is paramount in an environment characterized by heightened volatility and policy uncertainty.

-

Focus on Quality and Defensive Positioning: Investors may find value in favoring low-volatility strategies and allocating towards defensive equity sectors such as utilities, consumer staples, and healthcare, which tend to offer greater stability during periods of economic uncertainty.

-

Maintain Nimbleness: Given the Federal Reserve's data-dependent policy stance and the fluid nature of trade policy, investors must remain flexible, closely monitor incoming economic data, and be prepared to adjust portfolio allocations accordingly.

-

Identify Enduring Themes: Opportunities may exist in identifying and gaining exposure to enduring secular growth themes, such as Artificial Intelligence, or in sectors and regions poised to benefit from structural shifts like supply chain reconfigurations.

-

Strategic Fixed Income Allocation: In the fixed income space, short-duration bonds can offer attractive income and carry. Treasury Inflation-Protected Securities (TIPS) can also play a role in portfolios concerned about persistent inflation.

Going forward, a delicate balance must be maintained: enough economic improvement to justify current market prices, but not so much inflation or exuberance that central banks have to tighten again. Achieving that Goldilocks outcome is possible, but far from guaranteed.

Market Outlook and Strategic Investment Perspectives

Market Scenarios for Remainder of 2025

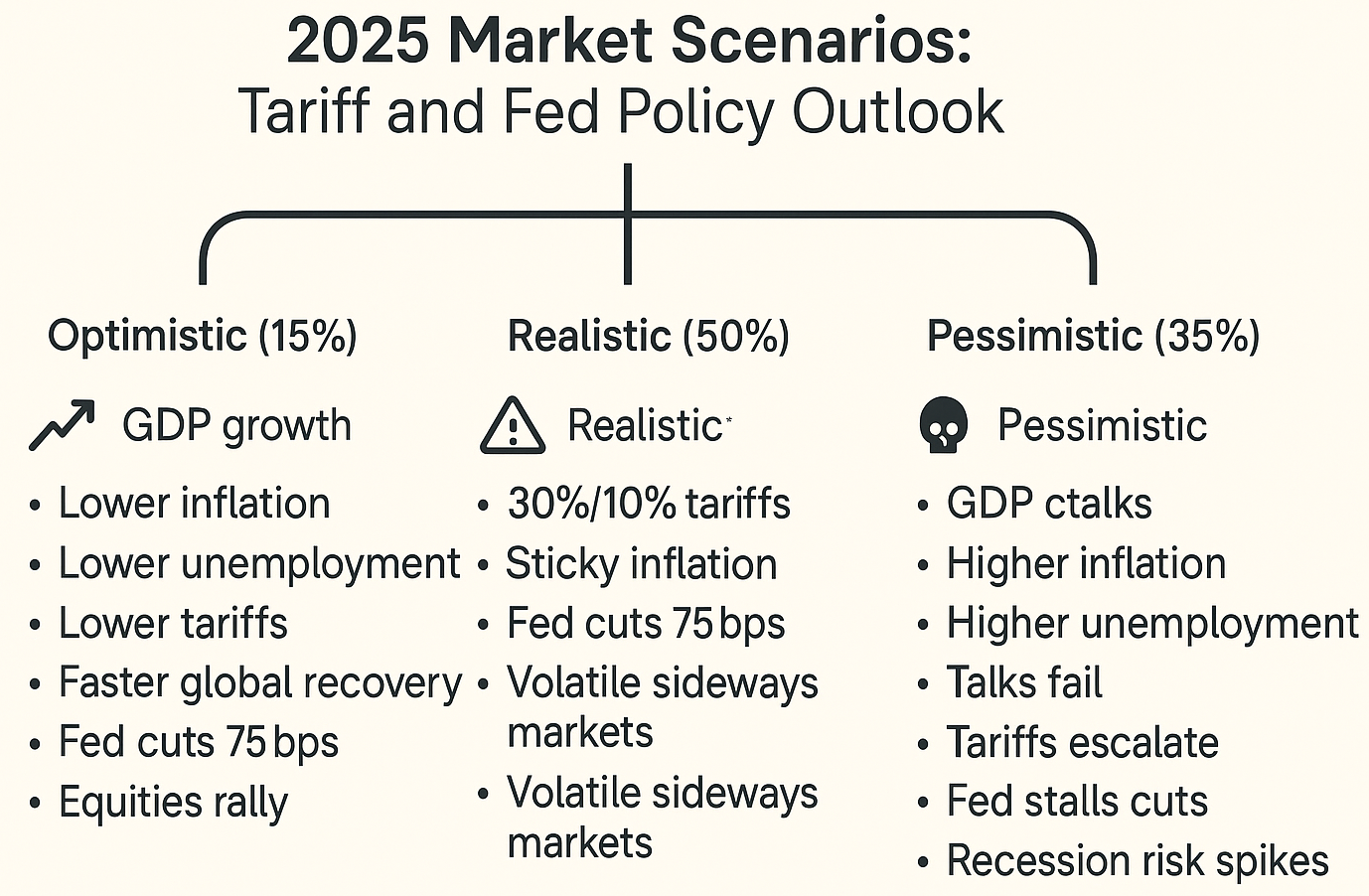

The confluence of recalibrated U.S.-China tariffs and evolving Federal Reserve rate cut expectations necessitates a nuanced market outlook for the remainder of 2025. The persistence of "temporary" tariffs is a significant variable; the 90-day window for the current U.S.-China truce is merely a placeholder in a historically prolonged trade dispute. Given these considerations, we outline three plausible scenarios:

Optimistic Scenario (Lower Probability, ~15%): This scenario would involve a significant and sustained de-escalation of trade tensions, potentially leading to average tariff rates falling below the current 30%/10% levels. Policy clarity would emerge, allowing global supply chains to stabilize more rapidly. Inflation would moderate significantly, providing the Federal Reserve with ample room to cut interest rates as part of a normalization process.

Market Response: A sustained rally in global equities could ensue, particularly benefiting trade-sensitive and cyclical sectors. Bond yields might fall moderately as inflation fears subside and Fed easing becomes more certain. Emerging market assets could also see improved performance.

Fundamental Improvement: GDP growth would gradually recover towards pre-trade-war trend lines. Goldman Sachs raised its U.S. Q4 2025 GDP growth forecast to 1.0% (from 0.5%) and its China 2025 GDP growth forecast to 4.6% (from 4.0%) following the May tariff agreement. Unemployment would likely remain low or decline.

Realistic Scenario (Higher Probability, ~50%): This scenario assumes that the 30% U.S. and 10% China tariffs, or similarly elevated levels of protectionism, persist through much of 2025 due to protracted negotiations. Policy uncertainty would remain a significant feature of the market landscape. Inflation would remain sticky and above the Federal Reserve's 2% target, partly due to ongoing tariff effects. Consequently, the Fed would likely enact only limited rate cuts (50-75 basis points) later in the year. Economic growth would remain subdued globally, but a deep recession would be avoided.

Market Response: Continued market volatility is expected, with major equity indices potentially trading within a range. Sector rotation would become a key theme, favoring defensive stocks, value-oriented companies, and specific growth narratives like AI. Bond yields would likely remain relatively elevated but could see a moderate decline later in the year if Fed easing commences.

Fundamental State: U.S. real GDP growth would slow noticeably. Deloitte's baseline projects 1.9% growth in 2025, followed by a further slowdown to 0.8% in 2026. The Yale Budget Lab estimates a -0.7 percentage point impact on U.S. real GDP growth from all 2025 tariffs combined. Unemployment could see a modest uptick (Yale projects +0.4 percentage points). Inflation would remain a persistent concern (Yale: overall price level +1.7% in the short-run from all 2025 tariffs).

Pessimistic Scenario (Moderate Probability, ~35%): This scenario envisages a breakdown in U.S.-China trade negotiations, potentially leading to a re-escalation of tariffs to previous highs. Global supply chains would face renewed disruptions. Inflation could spike significantly due to higher import costs and potential retaliatory actions. In such a stagflationary environment, the Federal Reserve would be in an extremely difficult position, potentially forced to keep interest rates high despite the negative impact on economic activity. This scenario would likely involve a U.S. and potentially global recession.

Market Response: A sharp correction in equity markets would be probable, with a flight to perceived safe-haven assets. Credit spreads would likely widen significantly. The U.S. dollar could experience initial strength as a safe haven, or significant weakness if U.S. economic fundamentals severely deteriorate.

Fundamental Weakness: U.S. real GDP could contract or experience very weak growth. Unemployment would be expected to rise sharply. The IMF has previously warned of larger economic losses for both the U.S. and China if high tariff levels persist. Elevated price-to-earnings ratios in the U.S. market suggest vulnerability to disorderly corrections in such a scenario.

A key theme underpinning these scenarios is the potential for greater divergence in global economic performance. The impact of U.S.-China trade policy and differing monetary policy responses worldwide will likely lead to varied regional outcomes. With the European Central Bank expected to maintain a more dovish stance than the Fed, a globally diversified investment approach becomes even more critical.

Strategic Investment Recommendations

Regardless of which scenario plays out, several strategic recommendations hold true for navigating the remainder of 2025:

Sectors and Assets Potentially Benefiting:

-

Defensive Sectors: Utilities, Consumer Staples, and Healthcare tend to exhibit greater resilience in uncertain, slower-growth environments and are generally less exposed to global trade disruptions.

-

Value Stocks: In an environment where economic growth is decelerating and high valuations may come under pressure, value-oriented stocks could offer a better risk-reward profile compared to growth stocks.

-

Companies with Domestic Focus: Businesses less reliant on international trade and with robust, diversified supply chains are likely to be less impacted by tariffs and geopolitical trade disputes.

-

Technology (Specifically AI and Software): Artificial Intelligence remains a durable secular growth theme, potentially demonstrating resilience due to ongoing structural capital expenditure and the falling costs of computing power.

-

Infrastructure & Real Assets: These asset classes can offer inflation protection and diversification benefits. Gold is often considered a safe-haven asset and a hedge against inflation or currency debasement in times of uncertainty.

-

U.S. Agriculture: With China's tariffs on American farm goods down to 10%, U.S. soybeans, grains, and meat exporters can regain price competitiveness in China's market after years of being shunned. Investors might look at agribusiness stocks or commodity plays that would benefit from revived U.S.-China commodity trade.

Sectors to Approach with Caution:

-

Highly trade-exposed sectors, including Automotive, certain segments of Consumer Discretionary goods, and industries heavily reliant on complex global supply chains originating from China face heightened risks.

-

Companies with high levels of debt and weak pricing power may struggle if inflation remains elevated and interest rates stay higher for longer.

Investment Strategies for Complex Market Dynamics:

-

Dynamic Asset Allocation: Actively manage portfolio allocations, making adjustments based on evolving economic data, shifts in policy, and changes in market sentiment.

-

Focus on Risk Management: In a volatile environment, capital preservation should be a key consideration. Employing strategies such as investing in low-volatility factor funds can help manage downside risk.

-

Leverage Relative Value in Rates: With Fed expectations now moderate, the bond market offers nuanced opportunities. If one believes the Fed will cut more than the current 56 bps, then longer-duration bonds are attractive before yields fall further. Conversely, if one suspects the Fed may not cut due to persistent inflation, then being underweight long bonds could pay off.

-

Emphasize Bottom-Up Fundamental Analysis: Thorough fundamental analysis is crucial for stock selection, particularly in discerning opportunities within the technology sector and in international markets.

-

Navigate Volatility: Volatility will likely persist given the many crosswinds. Use tools like options collars or volatility ETFs to hedge portfolios when volatility is too low. Maintain some allocation to uncorrelated assets like real estate or infrastructure investments.

-

Stay Nimble and Informed: Perhaps the best strategy in 2025 is agility. Policymakers are making rapid decisions, and markets are moving quickly in response. Traders and investors should stay on top of news and be ready to adjust positions. This could mean having more cash on hand than usual to deploy into opportunities during dips.

Even with potential Federal Reserve rate cuts later in 2025, the overall interest rate environment is likely to remain higher than that experienced in the decade following the Global Financial Crisis. Persistent inflationary pressures from tariffs and tight labor markets constrain the Fed's ability to cut rates aggressively. This macroeconomic backdrop suggests that the "easy money" era may not return in the same guise, favoring companies with strong balance sheets, sustainable earnings growth, and robust pricing power.

Conclusion: Policy and Investment Implications

The evolving US-China trade reset and shifting Fed policy expectations are reshaping the macroeconomic and market landscape in real time. Several critical insights emerge from this analysis:

Tariffs as Political Theater vs. Economic Leverage: The U.S. and China's move to slash tariffs to 30% and 10% represents significant de-escalation, though framed as temporary. It provides immediate economic relief and signals diplomatic goodwill. However, it doesn't erase underlying strategic tensions. The reduction demonstrates that exorbitant tariffs were hurting both sides; a longer-term lowering could aid global growth, which remains precarious at around 2.9%.

Markets vs. Reality Mind the Gap: 2024-2025 has taught us that markets can run on hopes and liquidity expectations even when real indicators flash caution. This disconnect evident in risk assets rallying alongside weak manufacturing data and growth forecast downgrades is not sustainable indefinitely. For policymakers, clear communication is key: the Fed has had to gently remind markets that actual data drives decisions, not just market cheer. For investors, the lesson is to not chase euphoria blindly. A healthy dose of skepticism and attention to fundamentals will help avoid being caught in a sentiment-driven bubble.

Structural Shifts in Global Trade: The trade tensions are accelerating a global shift from pure economic efficiency (lowest-cost global supply chains) towards economic resilience, emphasizing diversified and secure supply chains. Businesses have been compelled to seek alternative suppliers and diversify sourcing away from single points of geopolitical risk. This structural rebalancing will have long-term consequences for inflation, global investment patterns, and the types of companies best positioned to thrive namely, those that are adaptable with resilient operational structures.

Fed Policy Course Correction: The collective revision from expecting 75 bps of Fed cuts to ~56 bps shows how quickly consensus can shift. It underscores that Fed policy is data-dependent and context-dependent (trade context, fiscal context). The Fed's current stance cautious and not in a rush suggests they will not over-react to market wobbles as long as core economic trends are decent. This is a more "hawkish" posture than markets became used to in the 2010s. Decision-makers should prepare for a world with less central bank coddling. Rate cuts, if they come, are likely to be incremental, putting the onus back on governments and companies to drive growth rather than relying on cheap money.

Strategic Implications for Policy and Investment: The interplay of tariffs and monetary expectations highlights the importance of coordination. Trade policy uncertainty acts like a tax on growth, which then forces monetary easing an inefficient cycle. A more stable trade environment can give central banks room to normalize policy gently. For investors, 2025 will reward those who remain flexible and well-informed. The best opportunities may arise from mispricings for example, if markets overshoot on optimism or an overdone sell-off on a growth scare. Sector-wise, keep an eye on beneficiaries of the trade thaw (manufacturing, agriculture) and be cautious on segments that rode purely on the wave of easy money unless they have solid backing.

As we conclude, one thing is clear: The interplay between trade policy and monetary policy will be a defining theme of 2025. The recent tariff reductions and moderated Fed expectations are resetting the stage for the next act. Will it be one of harmonious growth or further tension and adjustment? The key takeaway is that fundamentals and prudent strategy must lead the way neither blind optimism nor excessive pessimism is a good guide. The global economy has avoided a worst-case spiral for now, but significant work remains to cement a lasting, stable expansion.

Given the updated tariffs and the Fed's more measured approach to rate cuts, is now the right time to take on more risk in the markets, or the time to exercise caution? Wise investors and policymakers will ponder this carefully. The answer may well depend on how convincingly economic reality catches up to the market's hopeful narrative in the coming months.

References and Further Reading

This analysis draws upon research from a range of reputable sources, including:

- BlackRock. (2025). Investment Directions, Spring 2025; Q2 2025 Investment Outlook

- Center for Strategic and International Studies (CSIS). (2025, May). Understanding the Temporary De-Escalation of the U.S.-China Trade War

- Deloitte. (2025, April). United States Economic Forecast: Tariffs Analysis

- Federal Reserve System. FOMC Statements, Minutes, and Press Conferences. May 2025

- Goldman Sachs. (2025, May). Research notes on U.S. recession odds, GDP forecasts, and Fed policy

- International Monetary Fund (IMF). (2025, April). World Economic Outlook: A Critical Juncture amid Policy Shifts

- J.P. Morgan. (2025, May). Fed Meeting: Rates hold firm again as FOMC takes 'wait and see' approach

- Morgan Stanley. (2025, April/May). The Beat; Stock Market Outlook: Q2 Update

- Organisation for Economic Co-operation and Development (OECD). (2025, March/May). Economic Outlook

- Perryman Group, The. (2025, May). The Potential Economic Impact of Sustained 30% Tariffs on Imports from China

- TD Securities. (2025, May). U.S. Economy and the Fed: De-escalating our Forecasts

- Yale Budget Lab (TBL). (2025, May 12). State of U.S. Tariffs: May 12, 2025

- Selected reports from Associated Press, Reuters, Bloomberg, Investopedia, CBS News, and other financial news outlets