insight

macroeconomics

The Debt-Driven Storm: Applying Ray Dalio's Crisis Blueprint to Navigate the 2025 Market Crossroads

By Ang

May 8, 2025

10 min read

In a complex world facing persistent inflation, escalating geopolitical tensions, and increasingly fragile credit systems, Ray Dalio's comprehensive macro frameworks offer invaluable insights for anticipating potential economic paths. By applying Dalio's theories on debt cycles, the economic machine, and shifting world orders, this analysis provides strategic perspectives on the 2025 market landscape and delivers actionable guidance for investors, policymakers, and thought leaders navigating through unprecedented uncertainty.

The Fog of 2025

The global economic landscape entering 2025 is shrouded in a fog of uncertainty. Persistent inflationary pressures linger, defying initial expectations of a swift return to central bank targets and complicating the path for monetary policy normalization. Anticipated interest rate cuts have been delayed or are proceeding with marked caution in major economies, reflecting the difficult trade-offs policymakers face. Simultaneously, geopolitical flashpoints continue to simmer, from unresolved tensions surrounding China and Taiwan and instability in the Middle East to the complex domestic political and policy environment within the United States following the 2024 elections.

This confluence of factors leaves investors grappling with conflicting signals and historical analogies. Is the current environment a precursor to a systemic financial crisis reminiscent of 2007-2008, characterized by overleveraged systems and potential contagion? Does it echo the stagflationary 1970s, where high inflation coincided with stagnant growth? Or, despite the headwinds, can a "soft landing" still be navigated, avoiding a deep recession? The divergence between resilient labor markets in some regions and rising credit delinquencies, or the contrast between booming valuations in specific sectors like Artificial Intelligence (AI) and signs of broader economic deceleration, adds layers to the confusion.

In such times of disorientation, the frameworks developed by Ray Dalio, founder of Bridgewater Associates, offer a valuable compass. Forged over decades of studying economic history, market mechanics, and the timeless principles governing them, Dalio's work provides a structured way to analyze the complex interplay of credit, debt, productivity, and human behavior that shapes economic outcomes. His emphasis on understanding cycles recurring patterns throughout history is particularly pertinent. As Dalio stated in Big Debt Crises, "most everything happens over and over again through time so that by studying their patterns one can understand the cause-effect relationships behind them and develop principles for dealing with them well".

This article seeks to pierce the fog by applying Dalio's key concepts to the current crossroads. We will examine the present position within his models of the short-term and long-term debt cycles, drawing on evidence from credit markets, interest rates, and economic growth. We will overlay this with insights from his framework on the "Changing World Order," assessing signals of internal conflict, institutional trust, and global power shifts. Furthermore, we will analyze potential market mispricings through the lens of his "Economic Machine" concept and his emphasis on probabilities over possibilities. Finally, we will explore the implications for investors, considering the principles behind his "All Weather" investment philosophy and the profound personal lesson of "Pain + Reflection = Progress" derived from his own experiences with market turmoil. By connecting these distinct but interrelated frameworks, we aim to provide a more coherent understanding of the potential paths ahead and the strategic considerations for navigating them.

The Short-Term Debt Cycle: Where Are We Now?

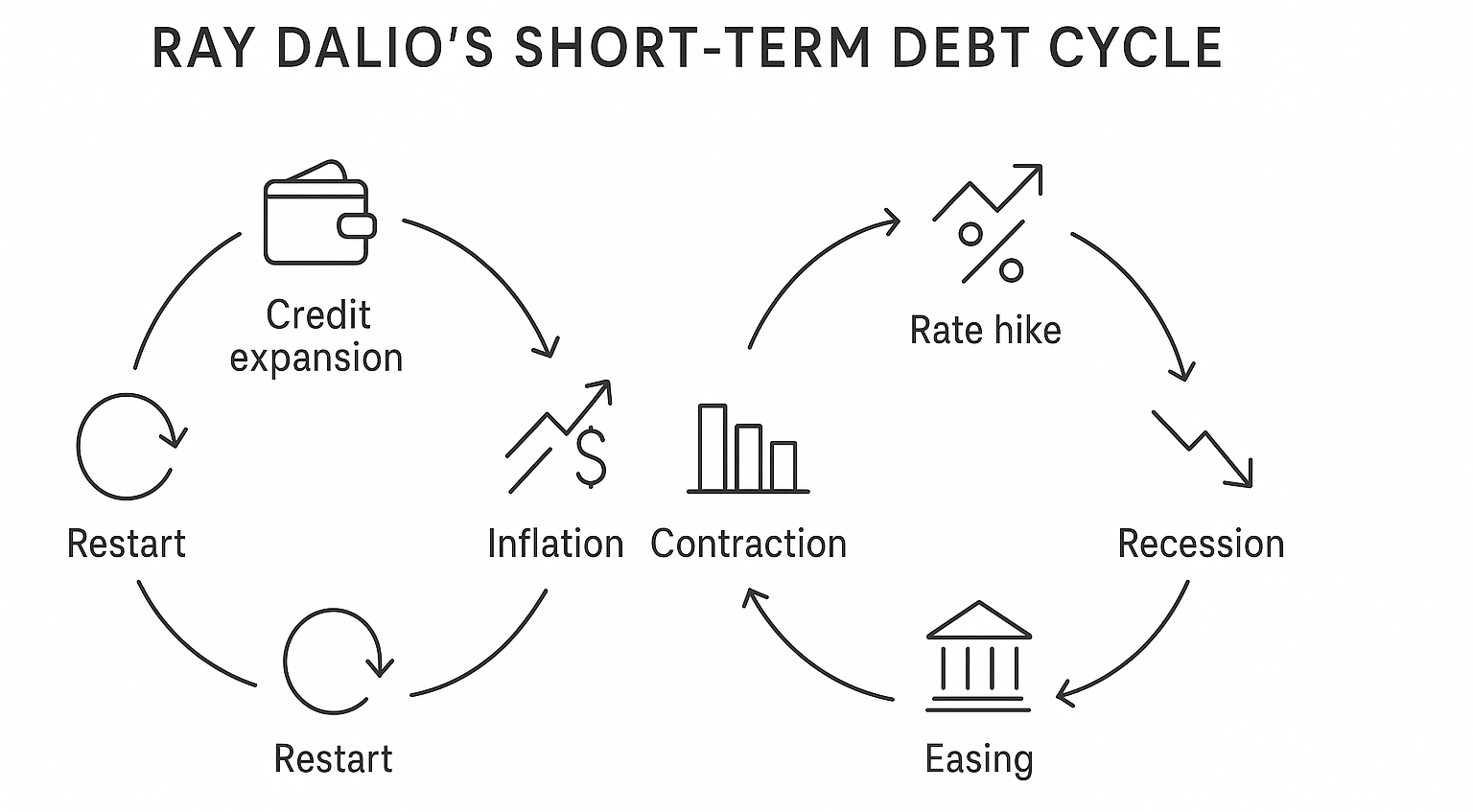

Ray Dalio's model of the economic machine posits that while productivity growth is the main driver of living standards over the long run, credit dynamics dominate short-term economic swings. The short-term debt cycle, typically lasting five to eight years, illustrates this process. It begins with an expansion phase where spending and incomes rise, fueled by increasing credit availability. As spending outpaces the production of goods, inflation accelerates. Central banks respond by tightening monetary policy raising interest rates making credit more expensive. This cools borrowing, spending, and income growth, leading to a contraction phase, potentially culminating in a recession. Eventually, as inflation subsides and economic activity weakens sufficiently, central banks ease policy, lowering interest rates to stimulate credit growth and restart the cycle. Dalio succinctly captures the essence: "Debt allows us to consume more than we produce when it is acquired, and forces us to consume less when we have to pay it back".

Observing the economic landscape in early 2025 through this lens reveals multiple indicators consistent with the later stages of this short-term cycle, suggesting a transition towards or entry into the contraction phase.

Evidence of Late-Cycle Dynamics (circa Q1 2025)

-

Rising Corporate Distress A classic sign of a maturing cycle, where tighter financial conditions and slowing demand pressure businesses, is an increase in corporate defaults and bankruptcies. Data from 2023 and 2024 showed a clear uptick in filings. In the US, total bankruptcy filings rose 13.1% in the 12 months ending March 31, 2025, compared to the prior year, with business filings increasing 14.7% over the same period. While still below post-2008 peaks, the accelerating trend is notable. Similarly, in the EU, bankruptcy declarations, despite a slight dip in Q4 2024, remained at levels higher than observed between 2018 and mid-2024, following a steady rise through Q3 2024. Global corporate defaults tracked by S&P Global Ratings also rose from 85 in 2022 to 153 in 2023 and remained elevated at 145 in 2024. Moody's analysis indicated that US firms' average risk of default hit a post-GFC high of 9.2% at the end of 2024, expected to remain elevated through 2025. This aligns with OECD reports highlighting rising refinancing risks for corporations globally, with 38% of outstanding corporate bond debt maturing by 2027 amid higher borrowing costs.

-

Consumer Strain Households are also exhibiting signs of stress. US consumer credit delinquency rates for auto loans and credit cards remained above pre-pandemic levels through 2024 and into early 2025, particularly for borrowers with non-prime credit scores. Federal Reserve data showed credit card delinquencies reaching their highest level since 2010 in Q3 2024 before a slight moderation, while subprime auto loan delinquencies rose significantly, potentially due to higher vehicle prices, interest rates, and looser underwriting standards earlier. The end of the student loan payment forbearance in late 2024 also presents a potential headwind for some borrowers in 2025.

-

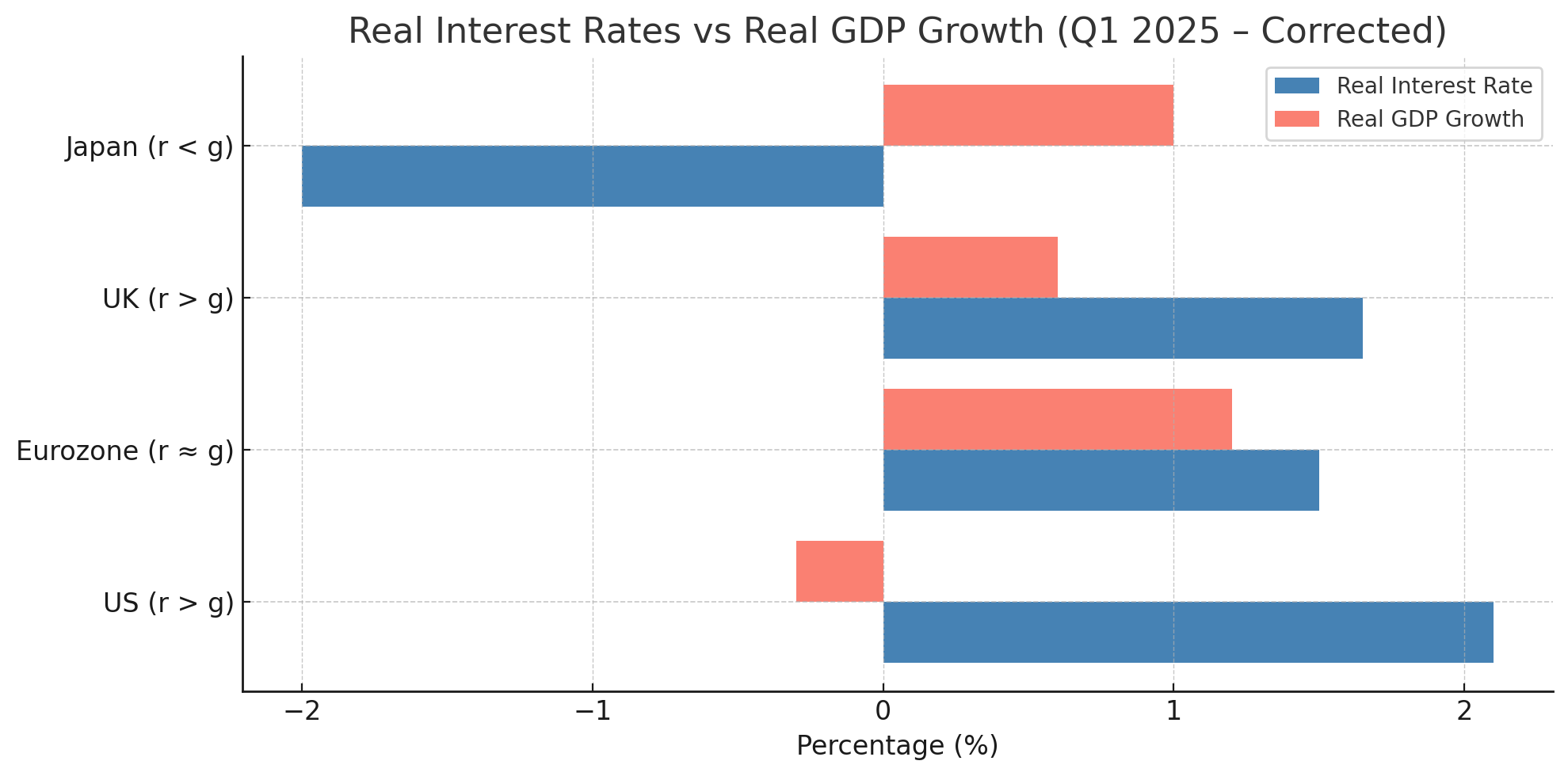

Real Interest Rates vs. Growth (r vs g) A critical factor in Dalio's cycle framework is the relationship between the real interest rate (r) and the real rate of economic growth (g). When real borrowing costs exceed the economy's growth rate (r > g), it signals restrictive financial conditions that tend to dampen investment and consumption, eventually leading to contraction. Analyzing data around Q1 2025 presents a mixed but concerning picture:

-

United States Real GDP contracted at an annual rate of 0.3% in Q1 2025, a sharp deceleration from the 2.4% growth in Q4 2024. With headline inflation measures like the PCE price index running at 3.6% and policy rates still elevated (Fed Funds target range 4.50%-4.75% before potential cuts later in 2025), real interest rates appeared positive and likely exceeded the negative growth rate, indicating restrictive conditions (r > g).

-

Eurozone Real GDP growth accelerated slightly to 0.4% quarter-on-quarter in Q1 2025, translating to roughly 1.2% year-on-year. Inflation (HICP) was projected around 2.3% for 2025. With the ECB deposit facility rate lowered to 2.50% in March 2025, the real interest rate was likely close to zero or slightly positive, potentially near or slightly above the underlying growth trend, suggesting less severe but still present restraint.

-

United Kingdom Real GDP grew 0.6% in the three months to February 2025, suggesting positive momentum entering Q1 (official Q1 data due mid-May). CPI inflation was 2.6% in March 2025. The Bank of England cut its policy rate to 4.25% in May 2025. This implies a positive real interest rate (around 1.65%), likely exceeding the underlying trend growth rate, indicating restrictive policy.

-

Japan Real GDP growth was sluggish in FY2024 (ending March 2025) at an estimated 0.3-0.4%, though projected to pick up to 1.1-1.2% in FY2025. Inflation was around 2.5%. With the Bank of Japan having exited negative rates and gradually raising its policy rate towards 0.5%, real interest rates remained negative but were tightening, moving closer to the low potential growth rate. Across major economies, the trend points towards real interest rates being less accommodative and, in several key cases (US, UK), potentially exceeding real growth rates, consistent with late-cycle dynamics.

-

Market Behavior Divergence The strong performance of certain market segments, notably AI-related stocks driven by massive capital expenditure plans and monetization hopes, contrasts with the broader economic indicators of slowing growth and rising stress. Analysts have noted this potential disconnect, questioning whether the AI rally reflects sustainable economic expansion or speculative froth characteristic of late-cycle behavior where capital chases fewer growth themes. The slump in Super Micro Computer shares after a forecast cut, despite analyst attempts to frame it as company-specific, highlighted investor sensitivity to signs that AI demand might not be immune to broader economic headwinds.

Dalio's Likely Assessment

Considering these signals rising corporate and consumer financial stress, tightening real interest rates relative to growth in key economies, and pockets of potentially speculative market behavior disconnected from fundamentals Dalio's framework strongly suggests the global economy, particularly the US, is positioned late in the short-term debt cycle. The conditions appear ripe for a further slowdown or contraction as the effects of prior monetary tightening continue to ripple through the system. As Dalio explained the mechanism: "When spending is faster than the production of goods... [it] results in inflation. The Central Bank manages inflation by raising interest rates... [which] decreases borrowing, spending and incomes. This results in... economic activity decreases... [potentially] a recession". The simultaneous pressure on both businesses and households, coupled with restrictive real rates, points towards a systemic cyclical turning point rather than isolated issues.

Table 1: Late-Cycle Indicators Dashboard (Q1 2025 Snapshot)

| Indicator | Q4 2024 / Q1 2025 Status/Trend | Data Source(s) |

|---|---|---|

| US Corporate Bankruptcies (Business Filings) | Rising (14.7% YoY Mar 2025) | US Courts |

| EU Corporate Bankruptcies (Declarations) | Elevated (slight dip Q4 '24) | Eurostat |

| Global Corporate Defaults | Elevated (145 in 2024) | S&P Global, Moody's |

| US Consumer Delinquencies (Auto/Credit Card) | Above Pre-Pandemic Levels | Federal Reserve |

| Real Interest Rate vs. Real GDP Growth (r vs g) | ||

| - United States | Likely r > g | BEA, Fed, Analysis |

| - Eurozone | Likely r ≈ g (slightly >?) | Eurostat, ECB, Analysis |

| - United Kingdom | Likely r > g | ONS, BoE, Analysis |

| - Japan | r < g (but tightening) | Cabinet Office/BOJ, Analysis |

The Long-Term Debt Cycle: Are We Near a Big Reset?

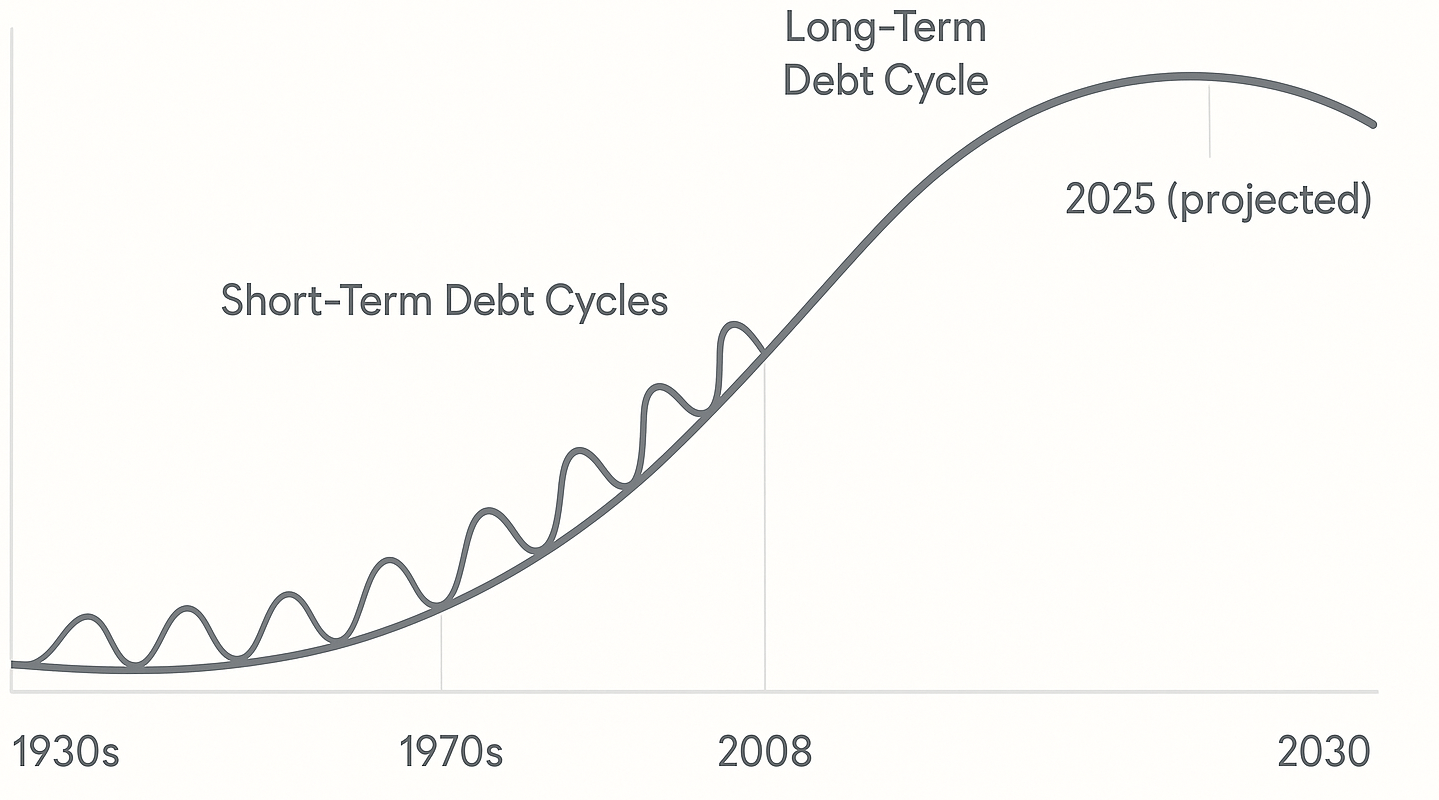

Beyond the typical 5-8 year business cycle, Dalio emphasizes the importance of the long-term debt cycle, a multi-decade phenomenon spanning 50-75 years or more. This grander cycle tracks the slow accumulation of debt burdens across an economy relative to income and the eventual, often painful, process of deleveraging. In the initial phase, debt grows faster than income, but rising asset prices and optimistic expectations sustain creditworthiness, fueling further borrowing and spending. Eventually, however, debt service costs become overwhelming, exceeding income growth. At this peak, "debt burdens have simply become too big", creditworthiness collapses, spending contracts sharply, asset prices fall, and a deleveraging process begins. Dalio identifies four primary mechanisms for reducing the debt burden during a deleveraging: 1) austerity (spending cuts), 2) debt defaults and restructurings, 3) wealth redistribution (often via taxes), and 4) money printing by the central bank. The last major global deleveraging occurred during the 1930s and 1940s, culminating in the Bretton Woods agreement. The 2008 Global Financial Crisis represented another significant deleveraging event, primarily in the private sector of advanced economies, but arguably left sovereign debt issues unresolved and potentially larger.

Examining the current global financial architecture through Dalio's long-term lens reveals compelling evidence that we may be approaching the later stages of this grand cycle, potentially nearing a significant reset.

Current Position - Evidence of High Leverage

-

Record Debt-to-GDP Ratios: A primary indicator of the long-term cycle's maturity is the aggregate level of debt relative to the economy's output. Global debt (public and private) stood at 237% of GDP in 2023, significantly higher than the pre-pandemic level. Global public debt reached 94% of GDP in 2023, resuming a rising trend. In the United States, federal debt held by the public is projected to surpass its previous post-WWII record (106% of GDP in 1946) around 2029 and surge to 156% of GDP by 2055 under current law, according to the Congressional Budget Office (CBO). Total US gross federal debt already exceeded 122% of GDP at the end of 2023. This massive accumulation of debt, particularly sovereign debt since the 2008 crisis and accelerated by the pandemic response, fits Dalio's description of the leveraging-up phase reaching its limits. It directly challenges his first rule of thumb: "Don't have debt rise faster than income (because debt burdens will eventually crush you)".

-

Extreme Interest Rate Sensitivity: The sheer scale of outstanding debt makes the global financial system exceptionally sensitive to changes in interest rates. Decades of falling rates culminated in the near-zero or negative rates post-2008, encouraging further borrowing. The recent normalization of rates, while necessary to combat inflation, exerts immense pressure on borrowers governments, corporations, and households alike. Rising interest costs are consuming ever-larger portions of government budgets; OECD government interest payments reached 3.3% of GDP in 2024, exceeding aggregate defense spending. In the US, CBO projects interest costs will hit a record 3.2% of GDP in 2025 and climb to 5.4% by 2055. This dynamic, where even modest rate increases can trigger significant financial strain and potentially defaults, is a defining characteristic of the late stage of the long-term debt cycle.

-

Central Bank Constraints: The architects of monetary policy find themselves increasingly constrained. The high debt levels make aggressive rate hikes to quell inflation risky, as they could precipitate widespread defaults and a severe recession. Conversely, significant easing to support growth or stabilize markets risks reigniting inflation and potentially devaluing the currency, especially if fiscal deficits remain large. This policy dilemma, where traditional tools lose effectiveness or have unacceptable side effects, is what Dalio describes as being "boxed in". It occurs when "borrowers debt burdens have simply gotten too big and can't be relieved by lowering interest rates", often because rates are already low or because the scale of debt is simply too vast. The extensive use of quantitative easing (QE) post-2008 and post-COVID has also left central bank balance sheets bloated, further complicating policy normalization.

The Deleveraging Question:

Given these conditions unprecedented debt levels, heightened sensitivity to interest rates, and constrained central banks the crucial question arises: Are we on the cusp of a major long-term debt cycle deleveraging, a "Big Reset"? If so, what form might it take? Dalio outlines two possibilities:

-

"Beautiful Deleveraging": This is the ideal, though difficult, path. It involves policymakers skillfully balancing the four deleveraging tools austerity, defaults/restructuring, wealth redistribution, and money printing to reduce debt-to-income ratios over time without causing either a deflationary depression or runaway inflation. It requires careful calibration, coordination between fiscal and monetary authorities, and political will. The goal is to achieve positive real economic growth alongside debt reduction.

-

"Messy Deleveraging": This occurs when the balancing act fails. It can manifest as deep, prolonged depressions with widespread defaults (deflationary), or as periods of high inflation or hyperinflation fueled by excessive money printing to monetize debt (inflationary), often accompanied by significant social unrest and political instability. Historically, transitions between world orders (discussed next) have often coincided with messy deleveragings.

Assessment for 2025:

Evaluating the current landscape, achieving a "beautiful deleveraging" appears increasingly challenging. The sheer magnitude of global debt, particularly sovereign obligations, makes orderly restructuring difficult. Political polarization (discussed in Section IV) hinders the necessary fiscal discipline (austerity) and wealth redistribution measures. Central banks are already grappling with inflation, limiting their capacity for non-inflationary money printing. Furthermore, rising geopolitical tensions create an environment less conducive to the global cooperation often required for smooth deleveragings. While policy choices remain paramount, the confluence of factors suggests a higher probability of a more difficult, potentially inflationary, deleveraging process ahead. The structural fragility stemming from decades of debt accumulation, now meeting the end of the low-rate era, makes the system vulnerable to shocks that could initiate such a reset.

Table 2: Long-Term Debt Cycle Pressure Points (Early 2025)

| Key Indicator | Current Level / Projection | Comparison | Implication | Data Source(s) |

|---|---|---|---|---|

| US Federal Debt Held by Public (% GDP) | ~100% (FY25); 156% (2055 proj.) | Near/Above Post-WWII High; Rising Rapidly | Unsustainable Trajectory | CBO |

| Global Public Debt (% GDP) | ~94% (2023) | > Pre-pandemic; Rising Trend | High Global Burden | IMF |

| Avg. OECD Gov Interest Payment (% GDP) | 3.3% (2024) | Rising; > Aggregate Defense Spend | Increasing Fiscal Strain | OECD |

| Central Bank Policy Constraints | Rates near/above neutral est.; High Debt | Limited Easing/Tightening Room | "Boxed In" Scenario; Reduced Effectiveness | Fed/ECB, Analysis |

| System Sensitivity to Rate Hikes | High | Higher than previous cycles | Risk of widespread defaults/recession | Analysis based on debt levels & yields |

Visual Idea: Debt Cycles vs. Market Performance (Description)

A conceptual line graph could visually represent this section's core idea. The x-axis represents time spanning several decades (e.g., 1920-2030). The y-axis represents levels (e.g., Debt/GDP ratio, Market Index). One line depicts the long-term debt cycle: rising gradually for decades, accelerating post-2008, peaking around the present, and implying a future decline (deleveraging). Superimposed on this is a smaller, oscillating line representing the short-term debt cycle, moving above and below the long-term trend. A third line shows a historical index like the S&P 500 (potentially on a logarithmic scale), illustrating market performance relative to these cycles. Key historical periods like the Great Depression (1930s), the post-war boom, the 1970s stagflation, the 2008 crisis, and the current period (circa 2025) would be annotated to highlight the correlations Dalio emphasizes.

The Changing World Order: Hegemony in Transition

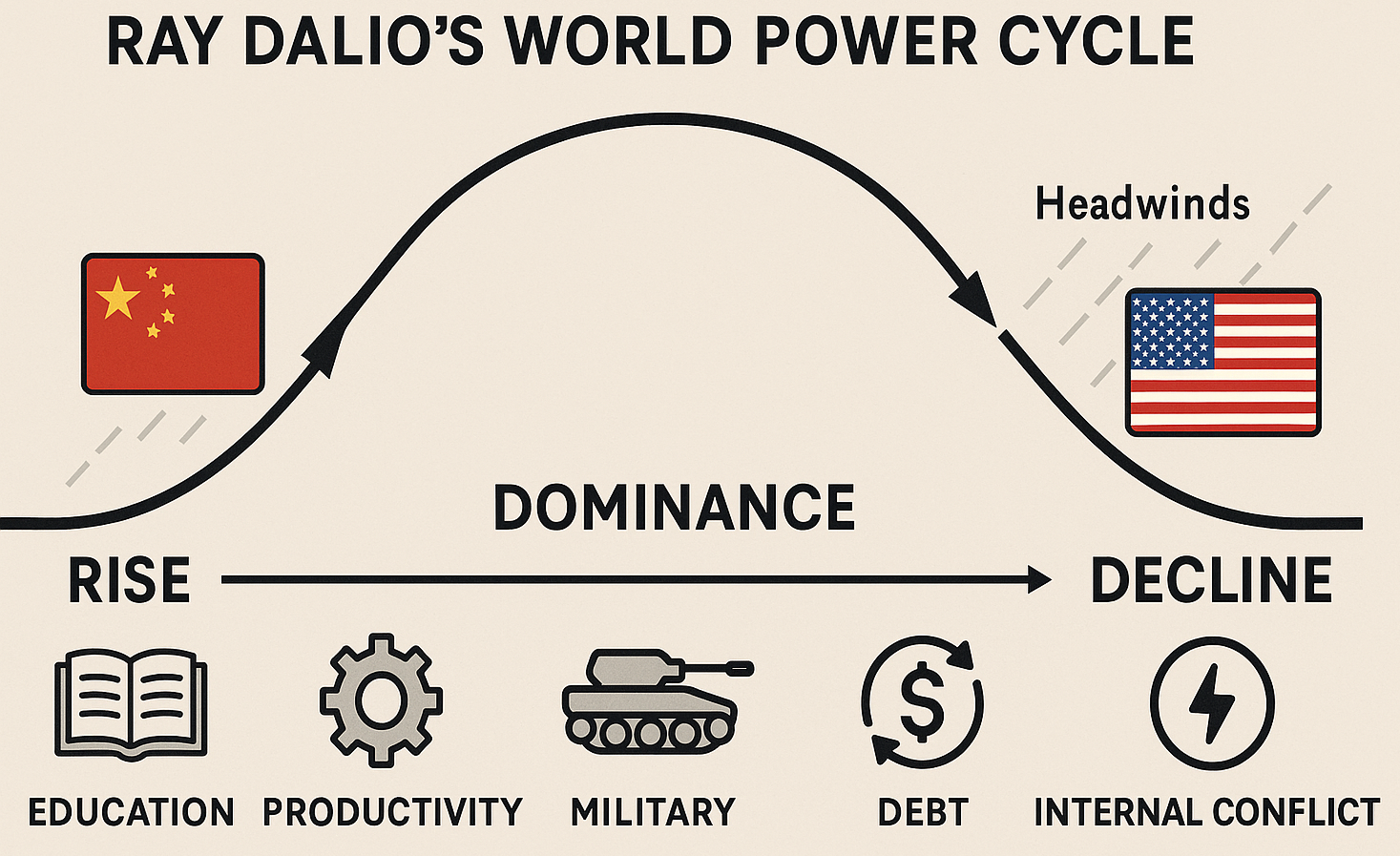

Ray Dalio extends his cyclical analysis beyond economics to encompass the rise and fall of empires and the global order itself. In his framework, detailed in Principles for Dealing with the Changing World Order, nations traverse a "Big Cycle" typically lasting 150-250 years, marked by periods of ascent, peak power, and eventual decline. A nation's rise is often fueled by strong education, innovation, technological leadership, competitive production, robust trade, a strong military, and a reserve currency status, underpinned by sound finances and internal order (low debt, social cohesion, effective governance). Conversely, decline is often preceded by deteriorating internal conditions excessive debt, large wealth gaps leading to social and political conflict, declining competitiveness, and overextension and challenged externally by a rising rival power. The transition between dominant powers is frequently turbulent, sometimes involving economic warfare or military conflict.

Applying Dalio's diagnostic checklist to the global landscape circa 2025 reveals several signals consistent with a potential transition phase in the current world order, primarily centered around the established US-led system and the rise of China.

Dalio's Checklist Applied to Today:

-

U.S. Internal Conflict: One of the most potent indicators of a declining power, according to Dalio, is severe internal conflict. Contemporary America exhibits significant evidence of this. Political polarization has reached historical highs, with deep ideological divides between Republicans and Democrats. Gallup data shows that in 2024, the percentage of Republicans identifying as conservative (77%) and Democrats identifying as liberal (55%) both reached record highs for the past 30 years, while the share of moderates hit a record low. This polarization manifests in legislative gridlock, social tensions, and differing views on fundamental economic and social issues, often linked to underlying economic distress in certain regions or demographics. The contentious political climate surrounding and following the 2024 US elections further underscores these divisions. Dalio's framework suggests such internal fragmentation weakens a nation's capacity to address external challenges and manage its own structural problems, like burgeoning debt.

-

Declining Trust in Institutions: Closely linked to internal conflict is the erosion of trust in key institutions. Dalio views strong, trusted institutions as vital for maintaining order and facilitating collective action. Recent surveys, like the 2025 Edelman Trust Barometer, paint a picture of widespread grievance and declining trust globally, particularly towards government and media. While trust in business, including financial services, has shown some resilience, a significant gap persists between high-income and low-income groups, and overall trust levels remain fragile. This decline in faith in established institutions including potentially the electoral process and legal systems in the eyes of some segments of the population is a critical vulnerability according to Dalio's model, hindering effective governance and societal problem-solving.

-

China Rising (with Headwinds): The rise of China as an economic and military power challenging US dominance is undeniable and fits the pattern of a rising power confronting an established one. However, Dalio's framework also acknowledges that rising powers face their own significant challenges. China in 2025 is grappling with substantial structural headwinds. The protracted crisis in its massive property sector continues to drag on investment and confidence. Consumer confidence remains weak despite government stimulus efforts. Exports face pressure from slowing global demand and, critically, escalating trade tensions and tariffs, particularly with the US. Demographic pressures from an aging and potentially shrinking population also loom large. This complex picture a powerful nation facing significant internal constraints aligns with Dalio's nuanced view of power transitions, where the path of the challenger is rarely smooth.

-

Currency & Financial Fragmentation: The status of the dominant reserve currency (currently the US dollar) is a key pillar of hegemony, though Dalio views it as a lagging indicator of underlying power shifts. Recent years have seen increased discussion and some tangible steps towards de-dollarization. Efforts by BRICS nations (now expanded) to conduct more trade in local currencies, bilateral agreements bypassing the dollar (like Russia-China), and the accumulation of gold reserves by central banks signal a move, albeit gradual, away from dollar dominance. Concurrently, the global proliferation of Central Bank Digital Currency (CBDC) projects (excluding the US, where progress is currently stalled) represents another potential vector of financial fragmentation. While the dollar remains preeminent, these trends towards diversification and the exploration of alternative payment and reserve systems are consistent with Dalio's indicators of a weakening hold by the incumbent reserve currency during a world order transition.

Implications for Investors:

A potential shift in the world order carries profound implications for investors. It suggests a future characterized by increased geopolitical risk premiums, greater volatility in currency markets, and potential disruptions to global trade and capital flows. The relative attractiveness of assets in different regions could change significantly based on shifting power dynamics and alignments. Long-term strategic asset allocation must increasingly factor in these geopolitical realities, likely favoring greater global diversification and potentially incorporating hedges against specific geopolitical or currency risks. The "safe haven" status of traditional assets, including US Treasuries, could be tested in such an environment.

The simultaneous appearance of multiple signals from Dalio's checklist US internal division and eroding trust, a potent but challenged rising power in China, and nascent financial fragmentation strongly suggests that the current period represents more than just typical geopolitical friction. It potentially marks a genuine phase of transition in the global order, demanding a strategic reassessment from investors and policymakers accustomed to the post-Cold War status quo.

Table 3: Dalio's World Order Shift Checklist (Early 2025 Assessment)

| Dalio's Key Indicator | Current Evidence/Metric (Early 2025) | Assessment | Dalio Framework Link |

|---|---|---|---|

| Internal Conflict (US) | Record ideological polarization; Post-election political tension; Economic distress links | High / Rising | Indicator of internal decay, weakens national capacity |

| Trust in Institutions (US/Global) | Declining trust in government/media; Significant trust gaps by income | Low / Declining | Erodes social cohesion, hinders effective governance |

| Rising Power Status (China) | Major economic/military power; BUT facing property crisis, weak consumption, trade pressure, demographics | Rising but Challenged | Typical pattern: challenger faces own internal/external headwinds |

| Financial/Currency Fragmentation | De-dollarization efforts (BRICS, bilateral deals); Global CBDC projects advancing (ex-US) | Increasing | Symptom of declining hegemon; reserve currency status lags |

The Economic Machine and Mispriced Risk

Ray Dalio conceptualizes the economy as a complex "machine" driven by the aggregate of transactions. These transactions are fueled by a combination of money and, more significantly in the short term, credit. Human psychology cycles of optimism and pessimism, greed and fear heavily influences credit creation and spending, thus driving economic cycles. While long-run improvements in living standards depend on productivity growth, the short to medium term fluctuations are largely governed by these credit cycles operating within the broader economic machine. Understanding this machine, its components, and its cyclical nature is fundamental to navigating markets effectively.

Applying this perspective to the current environment raises questions about whether markets are accurately pricing the risks embedded within the machine, particularly given the confluence of factors discussed earlier.

Potential Market Mispricing:

-

Legacy of Suppressed Volatility: The period following the 2008 crisis, and especially the years 2020-2021, witnessed unprecedented central bank intervention, including massive quantitative easing (QE) and near-zero interest rates. Research suggests such policies can have a dampening effect on market volatility, potentially by providing abundant liquidity and anchoring interest rates. While volatility, measured by indices like the CBOE VIX, spiked dramatically during the initial COVID shock in 2020, it subsequently subsided. Entering 2025, while the VIX has been elevated compared to pre-pandemic lows, trading often in the low to mid 20s, there's debate among analysts whether these levels adequately reflect the complex web of risks late stage debt cycles, sticky inflation, policy uncertainty, and significant geopolitical tensions. Some argue that a legacy of suppressed volatility might be contributing to a degree of market complacency, underestimating the potential for sharp adjustments. Financial stability reports highlight increased risks, suggesting market pricing may not fully capture downside potential.

-

Dalio's Principle on Probabilities: This potential complacency resonates with a core Dalio principle: "Don't mistake possibilities for probabilities. Anything is possible. It's the probabilities that matter. Everything must be weighed in terms of its likelihood and prioritized". In the context of 2025, this principle prompts a critical question: Are market participants assigning too high a probability to benign scenarios (e.g., a smooth soft landing, continued dominance of specific growth themes like AI, swift resolution of geopolitical issues) while underestimating the probability of more adverse outcomes? The combination of late-stage debt cycle dynamics (Sections II & III) and world order transition signals (Section IV) suggests the probability of negative tail events might be higher than implied by certain asset valuations or volatility metrics.

-

Under-allocated Hedges?: If risks are indeed underpriced, it implies that hedges against these risks might be under allocated in portfolios. Institutional investor surveys reveal high levels of concern regarding inflation and geopolitical risks. For instance, over 80% of LPs surveyed by Adams Street Partners expected geopolitical events to impact investment decisions, and 86% cited inflation as a top challenge. However, translating this concern into portfolio action can be complex. While interest in real assets (like infrastructure and real estate), often seen as inflation hedges, has increased significantly in 2025 compared to 2024, allocations to specific inflation-linked bonds (TIPS) or explicit geopolitical risk mitigation strategies may not fully reflect the perceived threats. TIPS funds saw positive returns in early 2025 as inflation fears persisted, but whether overall institutional allocation is sufficient relative to the risk environment remains an open question. The focus on private markets might also reflect a search for diversification and yield in a challenging environment, but doesn't necessarily equate to direct hedging of macro risks.

Rational Investor Response:

From a Dalio-esque perspective, characterized by risk awareness and adherence to principles, the current environment warrants a cautious and strategically defensive posture. A rational investor, recognizing the potential for mispriced risk and the heightened probability of negative surprises, would likely focus on:

-

Risk Parity: Ensuring the portfolio is balanced not just by capital allocation but by risk contribution across different asset classes and economic scenarios (as detailed in Section VI).

-

Diversification: Moving beyond traditional stock/bond diversification to include assets with different sensitivities to inflation and growth shocks (e.g., commodities, gold, inflation-linked bonds).

-

Downside Protection: Prioritizing capital preservation and resilience against potential market drawdowns, even if it means potentially lower returns during periods of market exuberance.

-

Optionality: Maintaining sufficient liquidity (e.g., cash, short-term treasuries) to capitalize on opportunities that may arise during market dislocations.

The confluence of factors, the potential after effects of past volatility suppression, the sheer complexity of current macroeconomic and geopolitical risks, and survey data indicating high investor concern possibly mismatched with hedging allocations points towards a significant likelihood that markets are underpricing tail risks. This necessitates a shift from optimizing for expected returns to prioritizing portfolio resilience across a wider, and potentially more adverse, range of future possibilities.

The All Weather Mindset: How to Prepare, Not Predict

Faced with inherent uncertainty and the limitations of forecasting, Ray Dalio developed the "All Weather" investment philosophy at Bridgewater Associates. Its core premise is not to predict the future but to construct a portfolio capable of weathering different economic environments. This approach is deeply rooted in Dalio's understanding of the "economic machine" and the primary forces driving asset returns: changes in economic growth and inflation relative to expectations. He identifies four potential "economic seasons": (1) Higher than expected growth, (2) Lower than expected growth, (3) Higher than expected inflation, and (4) Lower than expected inflation (deflation). "Every investment has an ideal environment in which it flourishes," Dalio explained, "...there's a season for everything".

The key mechanism for achieving this resilience is risk parity. Unlike traditional portfolios often dominated by equity risk (where stocks might constitute 60% of capital but 90% of risk), risk parity seeks to equalize the risk contribution from different asset classes. This means allocating capital such that assets sensitive to different economic environments (e.g., equities for growth, nominal bonds for falling growth/inflation, commodities/gold/TIPS for rising inflation) contribute roughly equally to the portfolio's overall volatility. Achieving this often requires using capital efficiently, potentially employing leverage on lower-volatility assets like bonds to bring their risk contribution up to par with higher-volatility assets like equities, thus allowing for meaningful diversification without sacrificing expected return.

Insulation Against Unknowns:

The primary benefit of the All Weather framework is its potential to insulate investors from the need for accurate economic forecasting. By holding a balanced mix of assets designed to perform across the four economic seasons, the portfolio aims for more consistent returns over the long term and, crucially, reduced drawdowns during periods of market stress or unexpected economic shifts. It embodies Dalio's principle of humility acknowledging the limits of prediction and prioritizing preparedness. While it might underperform concentrated equity portfolios during strong bull markets, its strength lies in navigating uncertainty and preserving capital through different phases of the economic and debt cycles.

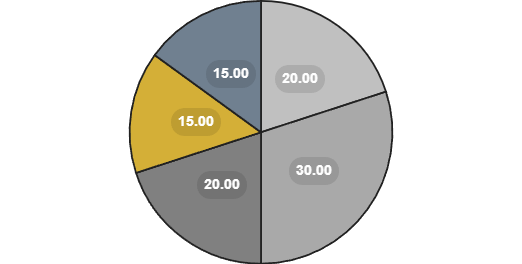

Suggested Updated Allocation for 2025 Environment:

Given the analysis in the preceding sections the late stage debt cycle dynamics, heightened geopolitical risks, policy constraints, and potential for mispriced risk a standard All Weather allocation might warrant adaptation. The following modified allocation reflects a more defensive posture suitable for the perceived challenges of 2025:

- Cash: 20%

- Short-term Treasuries: 30%

- Global Equities: 20%

- Gold/Commodities: 15%

- Defensive Alpha Strategies: 15%

Rationale for the Modified Allocation:

This specific structure represents a significant tilt towards safety and inflation/geopolitical hedging within the broader risk parity concept, reflecting the heightened probability of challenging economic conditions ("Winter" or stagflationary seasons in Dalio's terms) in the near term:

-

High Cash/ST Treasuries (50% total): This substantial allocation addresses the profound uncertainty identified throughout this report. It provides liquidity and optionality in a potentially volatile deleveraging scenario (Sections II, III, V). With short-term rates offering attractive yields relative to recent history ("Cash is pretty attractive now," as Dalio noted, shifting from his earlier "cash is trash" stance), this portion offers a positive real return with minimal duration risk, acting as a buffer against market drawdowns.

-

Reduced Global Equities (20%): This underweight acknowledges the late-stage cyclical position (Section II), potential headwinds from high starting valuations, and the impact of macroeconomic risks (debt, geopolitics, policy uncertainty) on corporate earnings and multiples.

-

Maintained Gold/Commodities (15%): This allocation retains exposure to assets historically favored during periods of rising inflation (a key risk identified) or heightened geopolitical stress (Section IV). Gold's strong performance YTD into May 2025 (up approx. 25%) underscores its relevance in the current climate. Broad commodities also offer inflation protection.

-

Defensive Alpha Strategies (15%): This allocation seeks returns that are uncorrelated, or lowly correlated, to traditional equity and bond markets. In an environment where traditional correlations might break down (a risk during deleveraging or high volatility), strategies like certain types of arbitrage, market neutral, long/short credit, or managed futures can provide valuable diversification and potentially positive returns even if broad markets decline.

Behavioral Lesson: Humility > Conviction

This adaptive approach aligns with Dalio's emphasis on intellectual humility. The All Weather philosophy itself is an admission that predicting the future is difficult, if not impossible. Adapting the allocation based on a rigorous assessment of current cyclical and structural conditions, while still maintaining balance across potential scenarios, reflects the principle: "Sincerely believe that you might not know the best possible path and recognize that your ability to deal well with 'not knowing' is more important than whatever it is you do know". Preparation, based on understanding timeless principles and current conditions, trumps confident prediction.

Table 4: Economic Seasons & Asset Performance (YTD May 2025)

| Economic Season (Dalio) | Typical Favored Assets | Actual YTD Return (approx. early May 2025) | Data Source(s) |

|---|---|---|---|

| Rising Growth / Falling Inflation | Equities, Corporate Bonds | S&P 500: -4.9%<br>MSCI World (ACWI): -0.4% | (Note: MSCI World ex-USA was positive) |

| Rising Growth / Rising Inflation | Commodities, EM Debt, TIPS | Broad Commodities (BCOM): +3.6% to +4.2%<br>TIPS Funds: ~+3.4% | |

| Falling Growth / Falling Inflation | Nominal Gov't Bonds, Gold | Global Aggregate Bonds: +2.4% to +5.7% | (Note: Variations exist, e.g., US Agg vs Global Agg) |

| Falling Growth / Rising Inflation (Stagflation) | Gold, Commodities, TIPS | Gold: +25.3% | (Note: Specific gold price, not broad index)<br>See Rising Growth/Rising Inflation for commodities and TIPS returns |

Note: YTD returns are approximate as of early May 2025 based on available sources and can vary slightly. This table illustrates relative performance trends in the context of Dalio's seasons.

Table 5: Illustrative Adapted All Weather Allocation (2025)

| Asset Class | Allocation | Rationale for 2025 Environment |

|---|---|---|

| Cash | 20% | Maximize liquidity, optionality, safety amid high uncertainty; benefit from positive real yields. |

| Short-Term Treasuries | 30% | Provide yield with minimal duration risk; safe haven asset; attractive relative to bonds/stocks currently. |

| Global Equities | 20% | Maintain some growth exposure but underweight due to late-cycle risks, valuation concerns, and policy headwinds. |

| Gold / Commodities | 15% | Hedge against persistent inflation and geopolitical risks; benefit from potential currency debasement or supply shocks. |

| Defensive Alpha Strategies | 15% | Seek uncorrelated returns; provide diversification benefits if traditional asset correlations break down during market stress. |

| Total | 100% | A defensively positioned, risk-balanced portfolio adapted for heightened uncertainty, potential deleveraging, and persistent inflation/geopolitical risks. |

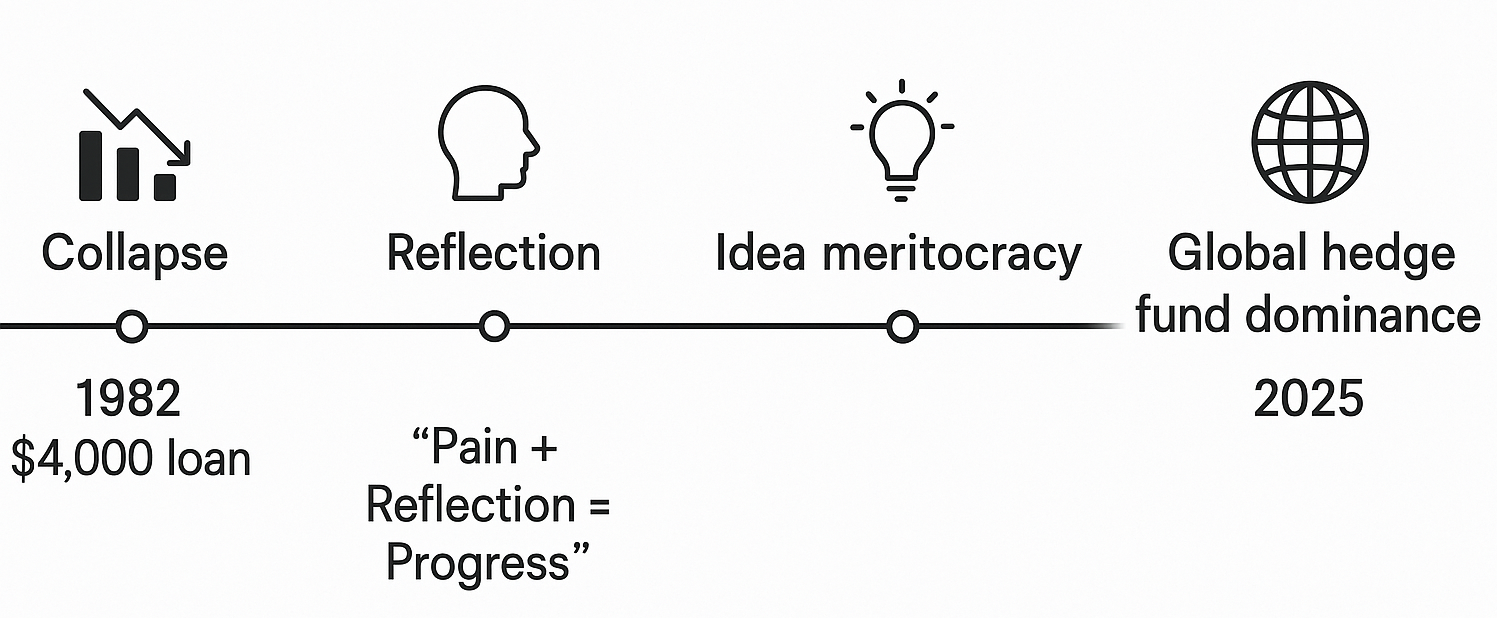

Dalio's Personal Lesson: Pain + Reflection = Progress

Beyond the analytical frameworks and quantitative models, Ray Dalio's philosophy is deeply shaped by personal experience, particularly his near-catastrophic failure in the early 1980s. This episode provides not only a compelling narrative but also a crucial lesson in humility, adaptation, and the psychological fortitude required to navigate volatile markets, lessons highly relevant to the challenges of 2025.

The 1982 Crisis:

In 1982, a younger, highly confident Ray Dalio, buoyed by earlier successes, made a strong public prediction: the global economy, burdened by Latin American debt defaults (Mexico had just defaulted), was heading for a depression. He positioned Bridgewater Associates aggressively based on this conviction, betting heavily against the market. However, his forecast proved dramatically wrong. Instead of collapsing, the US economy embarked on a powerful, multi year bull market. Bridgewater suffered devastating losses. Dalio was forced to lay off nearly all his employees and was so financially strained he had to borrow $4,000 from his father to cover household expenses. He described the experience as intensely painful and humbling, a series of "blows to the head" that shattered his prior arrogance. Reflecting later, he lamented his younger self's hubris: "Why are you so stupidly arrogant!?!".

The Transformation: Pain + Reflection = Progress

This failure became the crucible for Dalio's transformation. Instead of abandoning his efforts, he engaged in deep introspection, confronting the painful reality of his mistake and its root causes primarily, overconfidence and insufficient stress-testing of his own views. This led to the formulation of one of his most fundamental life and work principles: Pain + Reflection = Progress. Dalio came to believe that pain, whether psychological or financial, is a signal that something is wrong or misaligned with reality. By confronting pain directly, reflecting on its causes, and designing principles to avoid repeating the mistake, one can achieve rapid learning and evolution. "If you can develop a reflexive reaction to psychic pain that causes you to reflect on it rather than avoid it, it will lead to your rapid learning/evolving," he wrote.

Implementing the Lesson:

This principle wasn't merely philosophical; it led to concrete changes in how Bridgewater operated. Recognizing the dangers of his own ego and potential blind spots, Dalio instituted practices aimed at fostering an "idea meritocracy". Key elements included:

-

Radical Truth and Transparency: Creating a culture where mistakes and weaknesses could be openly discussed without fear of reprisal, allowing for collective learning.

-

Thoughtful Disagreement: Actively seeking out and engaging with believable people who held different perspectives, recognizing that disagreement is an opportunity for learning, not a threat. The goal shifted from proving oneself right to collectively finding the truth. This principle is encapsulated in the advice: "You don't know what you don't know. Surround yourself with thoughtful disagreement".

Relevance Today:

Dalio's journey from near-ruin to building the world's largest hedge fund, driven by the lessons of 1982, holds profound relevance for investors and business leaders navigating the uncertainties of 2025. The current environment, characterized by conflicting signals, potential paradigm shifts, and the high probability of unexpected events, demands more than just analytical skill. It requires the psychological resilience to:

-

Acknowledge Uncertainty: Resist the allure of overconfident predictions and embrace the possibility of being wrong.

-

Stress-Test Views: Rigorously challenge assumptions and consider alternative scenarios, especially adverse ones.

-

Learn from Setbacks: View market downturns or strategic errors not as failures but as invaluable data points for reflection and improvement.

-

Seek Diverse Perspectives: Actively solicit and weigh dissenting opinions from credible sources to overcome individual biases and blind spots.

Just as Dalio's 1982 pain forced him to evolve, the challenges of the current market landscape offer a similar opportunity. Success may depend less on having the single "right" forecast and more on possessing the humility, reflectivity, and adaptive capacity to navigate a complex and potentially painful reality effectively. Dalio's framework isn't just about understanding the economic machine; it's about mastering the internal machine to make better decisions within it.

Conclusion: From Fog to Framework

The economic and geopolitical landscape of early 2025 presents a complex and often confusing picture for investors and policymakers. Sticky inflation, cautious central banks, late-cycle credit stress, simmering geopolitical tensions, and deep-seated political polarization create a "fog" that obscures the path forward. Attempting to navigate this environment solely through short-term forecasts or by chasing narrow market trends risks costly missteps.

Ray Dalio's comprehensive macro frameworks, however, offer a valuable set of tools for cutting through this fog. By applying his principles regarding debt cycles, the economic machine, and shifts in the world order, a clearer, albeit potentially more sobering, picture emerges:

-

Converging Cycles: The evidence suggests we are not merely in a typical business cycle downturn. Indicators point towards the confluence of a late-stage short-term debt cycle (rising defaults, consumer strain, restrictive real rates) and a mature, highly leveraged long-term debt cycle. This alignment significantly elevates systemic risk and constrains traditional policy responses.

-

World Order in Flux: Key signals identified in Dalio's "Changing World Order" framework significant internal conflict and declining institutional trust within the incumbent hegemon (US), the rise of a challenger facing its own structural issues (China), and growing financial fragmentation are visibly present, suggesting a period of heightened geopolitical instability and transition risk.

-

Mispriced Risks: The legacy of past policy interventions combined with the current complex risk matrix may be leading markets to underprice certain tail risks, particularly those associated with debt deleveraging or geopolitical shocks. Understanding the probabilities, not just the possibilities, as Dalio advises, is paramount.

-

The Need for Resilience: Given the inherent uncertainties and the difficulty of accurate prediction, an "All Weather" mindset, emphasizing risk parity and portfolio resilience across diverse economic scenarios, becomes strategically vital. Adapting such a framework for the current environment might involve a more defensive posture, increasing allocations to cash, short-term instruments, and inflation/geopolitical hedges.

-

The Power of Reflection: Dalio's personal journey underscores the critical importance of humility, embracing painful truths, and learning from mistakes. Navigating the current challenges successfully requires not only sound analysis but also the psychological and organizational capacity to adapt and evolve.

In essence, Dalio's work provides not a crystal ball, but a framework for structured thinking about the powerful, recurring forces that shape economic and market history. It encourages a shift away from chasing fleeting trends towards understanding deep-seated cycles, prioritizing downside protection alongside upside potential, and monitoring global signals far beyond the immediate focus of any single central bank.

As investors and strategists peer into the remainder of 2025 and beyond, the path remains uncertain. However, by applying these time-tested principles, one can move from navigating by fog to navigating by framework. The final, perhaps most crucial, takeaway comes from Dalio himself, a reminder of the value of proactive preparation in the face of uncertainty:

"If you worry, you don't have to worry. If you don't worry... you need to worry".

Constructive worry the process of identifying risks, stress-testing assumptions, and building resilient strategies is the most effective antidote to the potential shocks that lie ahead.