Smart Investing Isn't About Being Right, It's About Protecting Your Capital

Smart investing isn’t about predicting the market or being right all the time, it’s about protecting your capital and staying in the game. The article breaks down how overconfidence, psychological biases, and obsession with being “smart” often lead to costly mistakes, while true long-term success comes from risk management, capital preservation, and building disciplined systems. In investing, survival not ego is the real alpha.

The financial markets provide one of humanity's greatest arenas for intellectual humility. Despite the sophisticated models, advanced degrees and confident predictions that populate Wall Street, market participants repeatedly discover that being intellectually "right" offers little protection against catastrophic capital loss. The paradox of successful investing lies not in demonstrating superior intelligence but in embracing a disciplined approach to capital preservation that allows investors to endure market cycles and compound returns over decades.

Many people spent three decades watching brilliant minds enter the financial markets with impressive credentials and unwavering confidence, only to exit with diminished capital and shattered expectations. The distinction between those who survive and those who don't isn't found in their intellectual horsepower, but rather in their approach to capital preservation.

The Market Doesn't Care If You're Smart

Many people enter the markets to prove they're smart. But the market doesn't care if you're smart it only cares if you avoid being consistently stupid.

The investment industry attracts some of the world's brightest minds PhDs, mathematicians, and strategic thinkers who believe their intellectual horsepower will translate into market outperformance. Yet the market remains persistently indifferent to individual intelligence. As Charlie Munger famously noted, "It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent."

Many investors enter markets seeking to validate their intelligence through successful trades. They view investing as an intellectual contest where the smartest participants inevitably win. This fundamental misunderstanding leads to a dangerous approach wheres ego protection trumps capital protection. The market doesn't distribute returns based on IQ scores or sophisticated analysis it rewards those who can consistently avoid catastrophic mistakes while maintaining the emotional discipline to stay invested.

Consider the collapse of Long Term Capital Management (LTCM) in 1998. Despite boasting two Nobel Prize winners and some of the brightest minds in finance, LTCM imploded spectacularly, requiring a $3.6 billion bailout coordinated by the Federal Reserve. Their sophisticated models failed to account for the possibility of multiple improbable events occurring simultaneously, leading to a classic case of brilliant minds failing to protect capital.

The market is the ultimate equalizer. It doesn't reward your SAT scores, your pedigree, or your elegant theories. It rewards only one thing: your ability to endure. And endurance in markets isn't about being correct more often than you're wrong. It's about ensuring that when you're wrong and you will be wrong you're still standing to invest another day.

The Misconception of Being a "Smart Investor"

Being Right is Cheap. Staying Alive is Expensive

The investment landscape is littered with brilliant analyses that led to financial ruin. This paradox exists because being intellectually correct about a market thesis represents only a fraction of successful investing. The larger component capital preservation determines whether an investor survives long enough for their thesis to materialize.

Three cognitive biases consistently undermine even the most brilliant investors:

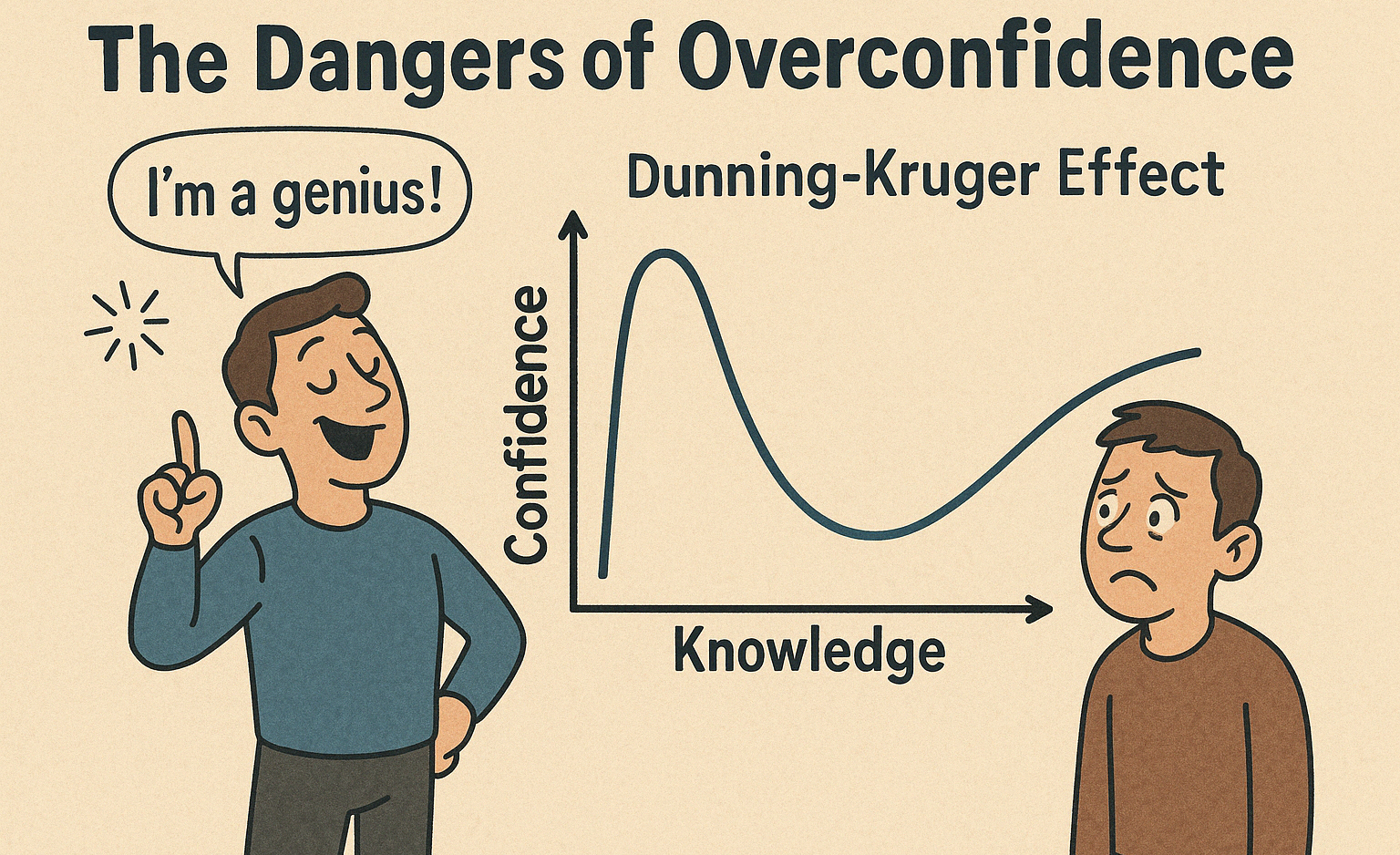

Overconfidence Bias leads investors to overestimate the accuracy of their forecasts and the quality of their information. This manifests when traders increase position sizes based on conviction rather than proper risk parameters, or when they average down on losing positions without appropriate stop loss limits. In his study on overconfidence in financial markets, Terrance Odean found that the most active traders often underperform the market, partly due to excessive confidence in their ability to pick winners.

The Dunning-Kruger Effect appears when novice investors experience initial success perhaps through fortunate timing and subsequently overestimate their competence. A beginner who makes one successful speculative investment might erroneously conclude they've "cracked the code" of the markets, leading to increasingly risky behavior without the corresponding skill to manage those risks.

Survivorship Bias causes investors to focus exclusively on successful investment strategies while ignoring the vastly larger population of failed approaches. We celebrate Warren Buffett's philosophy but rarely acknowledge the thousands of value investors who failed to achieve similar results. According to DALBAR's Quantitative Analysis of Investor Behavior, the average equity fund investor has consistently underperformed the S&P 500 over multiple time periods, largely due to poor timing decisions and behavioral mistakes.

Technical Insight: Truly sophisticated investors understand that win rate is merely one metric and often a misleading one. A strategy with a 70% win rate can still destroy capital if the 30% of losing trades are catastrophic. Professional investors instead evaluate performance through metrics like:

-

The total equity curve's smoothness and trajectory

-

Maximum drawdown (the largest peak-to-trough decline)

-

Risk-adjusted returns (Sharpe ratio, Sortino ratio)

-

Calmar ratio (return relative to maximum drawdown)

These metrics reveal that capital preservation often matters more than being right about individual trades. As Seth Klarman notes, "Good investing is really about risk control more than return maximization."

Capital Protection is the Real Alpha

Before You Make Money, You Must Learn to Keep It

In my years consulting with institutional investors and family offices, I've observed a consistent pattern: those who prioritize avoiding losses consistently outperform those who chase outsized gains. This isn't merely theoretical the mathematics of loss recovery demands this approach.

The mathematics of loss recovery reveals why capital preservation forms the bedrock of successful investing. Most investors fail to appreciate the asymmetric nature of percentage gains and losses:

This mathematical reality explains why even small improvements in downside protection can dramatically enhance long-term performance. An investor who experiences a 50% drawdown must double their remaining capital just to break even a monumental task that may take years to achieve. Meanwhile, an investor who limited their drawdown to 25% needs only a 33.3% gain to recover.

The dot-com bubble of 2000 provides a painful case study. Many brilliant analysts correctly identified revolutionary technologies that would transform the economy, yet their investments produced devastating losses. Cisco Systems, widely acknowledged as a transformative networking company, fell over 86% from its March 2000 peak to its October 2002 trough. An investor who was "right" about Cisco's importance but failed to implement risk controls needed a subsequent 614% gain just to break even.

More recently, Archegos Capital Management's 2021 collapse demonstrates how insufficient risk management can destroy capital regardless of investment thesis accuracy. Despite correctly identifying several high-performing stocks, the fund's excessive leverage and concentration led to a $20 billion implosion when positions moved against them.

Practical capital preservation techniques that sophisticated investors employ include:

-

Position sizing rules limiting exposure to 2-5% of capital per position

-

Predetermined exit strategies before entering trades

-

Trailing stop losses that lock in gains while limiting downside

-

Sector exposure limits to prevent overconcentration

-

Systematic rebalancing to maintain target allocations

These techniques share a common philosophy: prioritize longevity over maximizing short-term gains. As Ray Dalio emphasizes, "He who lives by the crystal ball will eat shattered glass."

Risk Management: The Unsung Hero

Good Investing is 20% Strategy, 80% Risk Control

While financial media celebrates stock picks and market calls, professional investors recognize that systematic risk management represents the primary differentiator between sustainable success and eventual failure. The market continuously presents opportunities, but only those who preserve their capital can capitalize on them.

After analyzing thousands of portfolios, I've found that superior risk management rather than superior security selection typically explains long-term outperformance. The best investors aren't those with the most sophisticated valuation models but those with robust risk management frameworks.

Diversification prevents single point failures from devastating portfolios. Modern Portfolio Theory demonstrates that properly diversified portfolios can achieve better risk adjusted returns than concentrated ones. However, true diversification requires exposure across genuinely uncorrelated assets rather than simply owning many similar securities. During the 2008 financial crisis, previously uncorrelated assets suddenly moved in tandem, revealing the limits of naive diversification.

Stop Loss Strategies establish predetermined exit points to limit potential damage. These may be price-based (e.g., 10% below purchase price) or support-based (using technical analysis to identify critical price levels). Research by Thomas Basso found that even simple mechanical stop-loss strategies can significantly reduce portfolio volatility without proportionally reducing returns.

Cash Allocation provides both defensive protection and offensive optionality. Maintaining 10-20% in high-quality cash equivalents allows investors to weather volatility while positioning for opportunities during market dislocations. Seth Klarman, who has achieved extraordinary long term returns, frequently holds substantial cash positions despite criticism for "missing out" on bull markets.

Hedging Techniques provide portfolio insurance through instruments like inverse ETFs, put options, or non-correlated assets. Ray Dalio's All-Weather Portfolio exemplifies this approach, using a balanced asset allocation designed to perform reasonably well across economic environments. While hedging reduces portfolio efficiency during strong bull markets, it significantly enhances survival probability during market stress.

Position Sizing may be the single most important risk control element. By limiting individual position sizes to a small percentage of total capital, investors ensure that no single mistake can significantly impair their long-term results. Paul Tudor Jones, who has delivered exceptional returns over decades, attributes much of his success to strict position sizing: "Don't focus on making money; focus on protecting what you have."

The behavioral aspect of risk management is equally important. Never allow yourself to develop an emotional attachment to any investment, regardless of past performance or narrative appeal. Constantly ask yourself: "Am I protecting my capital, or am I justifying my ego?" The moment you find yourself making excuses for an underperforming position is the moment you've shifted from investing to gambling.

The Dangers of Overconfidence and Dunning-Kruger

One of Your Worst Enemies is Yourself

The greatest threat to your portfolio often isn't market volatility but your own psychology. Recognizing the warning signs of overconfidence can save your capital:

Several warning signs indicate when psychology may be compromising investment discipline:

- Attributing a successful trade to skill while blaming unsuccessful trades on external factors

- Dismissing contrary opinions as uninformed without genuine consideration

- Increasing position sizes after a string of winners

- Abandoning risk management protocols when convinced of a "sure thing"

As Michael Mauboussin aptly observed, "Intelligence without humility is a recipe for disaster in investing." The markets have a remarkable capacity to humble even the most brilliant minds.

These psychological traps create cascade risks that compound over time:

- Refusing to cut losses leads to capital impairment

- Confirmation bias prevents objective reassessment

- Lack of post-analysis perpetuates mistakes

- Damaged capital reduces future opportunity

Practical approaches to mitigate these psychological pitfalls include:

- Maintaining a detailed trading journal that documents not just positions but your reasoning, emotional state, and market conditions

- Conducting rigorous post mortems on all significant trades, especially losses

- Actively seeking disconfirming views from trusted colleagues, online communities, or AI tools

- Implementing pre commitment strategies like automated stop-losses that execute regardless of your emotional state

Research by Dr. Teresa Amabile at Harvard Business School demonstrates that systematic reflection significantly improves decision quality over time. Even successful trades may have resulted from flawed processes that will eventually lead to failure. By contrast, unsuccessful trades executed with proper risk management should be viewed as acceptable costs of doing business.

Remember: markets don't test your intelligence; they test your discipline and emotional control.

Smart Investors Build Systems, Not Predictions

It's Not About Knowing Everything. It's About Knowing What to Do When You Know Nothing

After decades in the markets, I've observed that consistent success doesn't come from predictive accuracy. It comes from having robust systems that function effectively even when predictions fail.

The most sophisticated investors recognize a fundamental truth: markets are inherently unpredictable in the short term. Rather than attempting to forecast precise outcomes, they build robust systems that can navigate uncertainty.

Professional investors develop several interlocking systems:

Evaluation Systems provide structured feedback loops. These typically include weekly performance reviews, attribution analysis (what worked and why), and continuous refinement of decision criteria. James Simons' Renaissance Technologies, one of history's most successful investment firms, employs systematic evaluation processes where every investment decision is reviewed regardless of outcome.

Decision Frameworks create consistency across market environments. These often take the form of pre-trade checklists ensuring that each investment meets predetermined criteria for risk/reward characteristics, position sizing, and alignment with broader strategy. Research from both medicine and aviation demonstrates that checklists significantly reduce error rates even among experts.

Probabilistic Thinking replaces binary predictions with ranges of possible outcomes and their associated likelihoods. This approach acknowledges uncertainty while still enabling decisive action. Howard Marks emphasizes this perspective: "We have to practice thinking in terms of a range of outcomes rather than a single point estimate."

Emotional Discipline systems manage the inevitable psychological pressures of investing. These might include meditation practices, scheduled breaks during high-stress periods, or rules that limit decision making during emotional extremes. Ray Dalio's Bridgewater Associates famously uses "radical transparency" to help team members identify when emotions might be clouding judgment.

Practical tools to implement these approaches include:

- Risk reward calculators that quantify the mathematical expectancy of each investment

- Structured trade logs that include pre-trade rationale, exit criteria, and post-trade analysis

- Monte Carlo simulations that model portfolio performance across thousands of possible market scenarios

- Backtesting frameworks that subject strategies to historical market conditions

These tools aren't merely academic exercises they're practical implements that transform market noise into actionable intelligence. As Michael Mauboussin explains, "The goal is not to be right all the time but to establish a process that separates skill from luck and leads to consistent positive expected value decisions over time."

From Ego to Endurance

Your Job Isn't to Be the Smartest, Just to Stay in the Game

In the end, it's not the smartest investor who wins. It's the one who still has money to keep playing.

The investment journey ultimately rewards those who remain in the game, not those who burn brightest before flaming out. Howard Marks captured this principle perfectly: "If we avoid the losers, the winners will take care of themselves."

Consider two hypothetical investors: Investor A achieves spectacular 50% returns for three years before a 90% drawdown. Investor B achieves consistent 15% returns with maximum drawdowns of 20%. After five years, despite Investor A's apparent "brilliance," Investor B has significantly more capital:

Investor A: $100 → $150 → $225 → $337.5 → $33.75

Investor B: $100 → $115 → $132.25 → $152.09 → $174.90

The mathematics of compounding ruthlessly punishes large drawdowns while rewarding consistency. As Benjamin Graham noted, "The essence of investment management is the management of risks, not the management of returns."

To transition from ego-driven to endurance-focused investing:

-

Evaluate your portfolio through the lens of risk rather than potential return

-

Replace vague hopes with specific, documented investment theses

-

Establish and honor risk parameters regardless of conviction level

-

Build systems that survive your worst psychological moments

-

Focus on process quality rather than outcome in the short term

The market offers no medals for elegance or intellectual prowess. It rewards only one thing: survival with capital intact. As you evaluate your investment approach, ask yourself:

- Have I structured my portfolio to weather prolonged adverse conditions?

- Am I protecting capital, or am I trying to prove something?

- Does my investment process include robust risk management, or is it primarily focused on finding the next winner?

- Am I building a sustainable advantage, or am I simply gambling on being right more often than wrong?

The investment profession continues to attract brilliance, but it rewards discipline. As investors, our challenge isn't demonstrating intellectual superiority but developing the structured approach and emotional discipline to protect our capital through market cycles.

In the end, it's not the smartest investor who wins. It's the one who still has money to keep playing.