The Rupiah's Tightrope Walk: Bank Indonesia's Strategy Amid Global Uncertainty and Shifting Capital Flows

This provides an analysis of Bank Indonesia's strategic response to complex global conditions in early 2025, highlighting its priority on Rupiah stability amid uncertainties from U.S. monetary policy shifts, escalating trade tensions, and volatile capital flows. Bank Indonesia maintained its benchmark rate (BI-7DRRR) at 5.75% since January 2025, signaling a cautious approach focused primarily on exchange rate stability. Despite proactive interventions, the Rupiah faced persistent depreciation pressure driven by portfolio outflows of USD 2.8 billion amid global market volatility linked to U.S. trade policies. Interestingly, foreign exchange reserves reached a record high (USD 157.1 billion), largely supported by government loans and BI’s issuance of market instruments like SRBI and SVBI. Nonetheless, Indonesia's external position showed strains, with a widening current account deficit in 2024, though balanced by financial inflows. Inflation remained subdued domestically, but BI adjusted its growth forecast downward for 2025 due to global uncertainties, particularly from U.S.-China tensions. Looking ahead, BI’s policy will remain data-dependent, closely monitoring Rupiah stability, global market conditions, and capital flow dynamics.

Shifting Global Tides: The External Environment

The environment in which Bank Indonesia operates is shaped significantly by global monetary conditions, US policy developments, and the resulting shifts in international capital flows. These external factors have created persistent headwinds for emerging markets, including Indonesia.

The Federal Reserve's Evolving Stance and Global Rate Dynamics

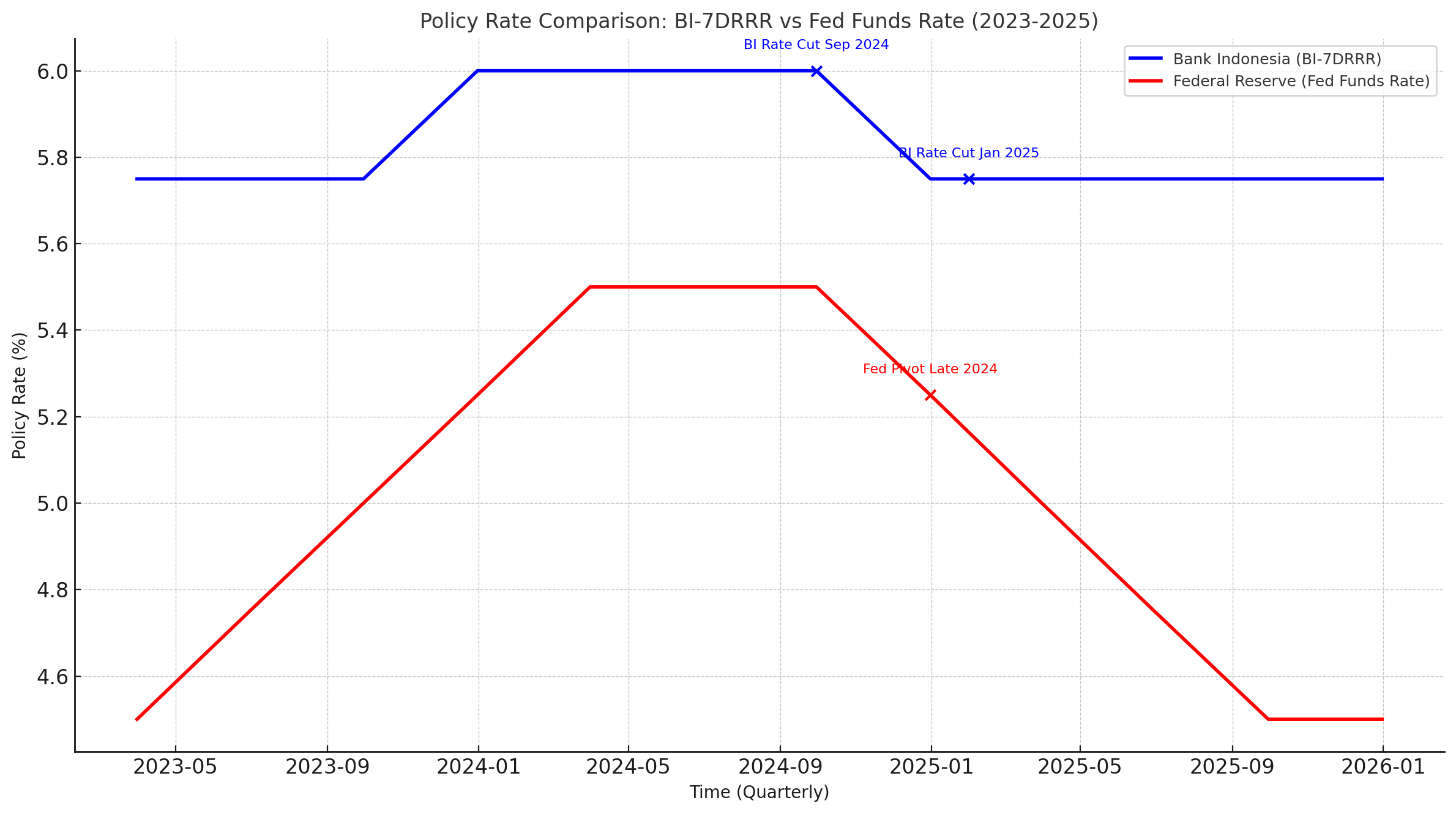

Following a series of aggressive rate hikes through mid 2023, the US Federal Reserve (Fed) initiated a policy pivot, implementing three consecutive 25 basis point cuts between September and December 2024, bringing the target range for the federal funds rate to 4.25-4.50%. However, the path forward in 2025 has proven less dovish than initially anticipated by markets. The Federal Open Market Committee (FOMC) maintained its policy rate steady in its early 2025 meetings, including the March 18-19 meeting.

Recent communications from Fed officials, including Chair Jerome Powell in April 2025, highlight ongoing concerns about the persistence of inflation, despite some signs of economic slowing. Powell noted that while inflation has eased significantly from its peaks, progress has slowed, and recent readings remain above the Fed's 2% objective. He also acknowledged the high degree of uncertainty surrounding the economic impact of new US administration policies, particularly tariffs, which are seen as potentially inflationary. Consequently, the Fed has adopted a cautious, data dependent "wait and see" approach, emphasizing the need to assess incoming information before considering further policy adjustments. This stance has tempered market expectations for rapid rate cuts in 2025.

For emerging markets like Indonesia, the Fed's cautious posture continues to exert pressure. While the peak of US rate hikes has passed, the maintenance of relatively high US interest rates keeps the US dollar attractive, influences global risk sentiment, and complicates capital flow dynamics for economies sensitive to yield differentials. The divergence between the Fed's stance and easing measures undertaken by some other major central banks, such as in Europe, adds another layer of complexity to the global monetary landscape.

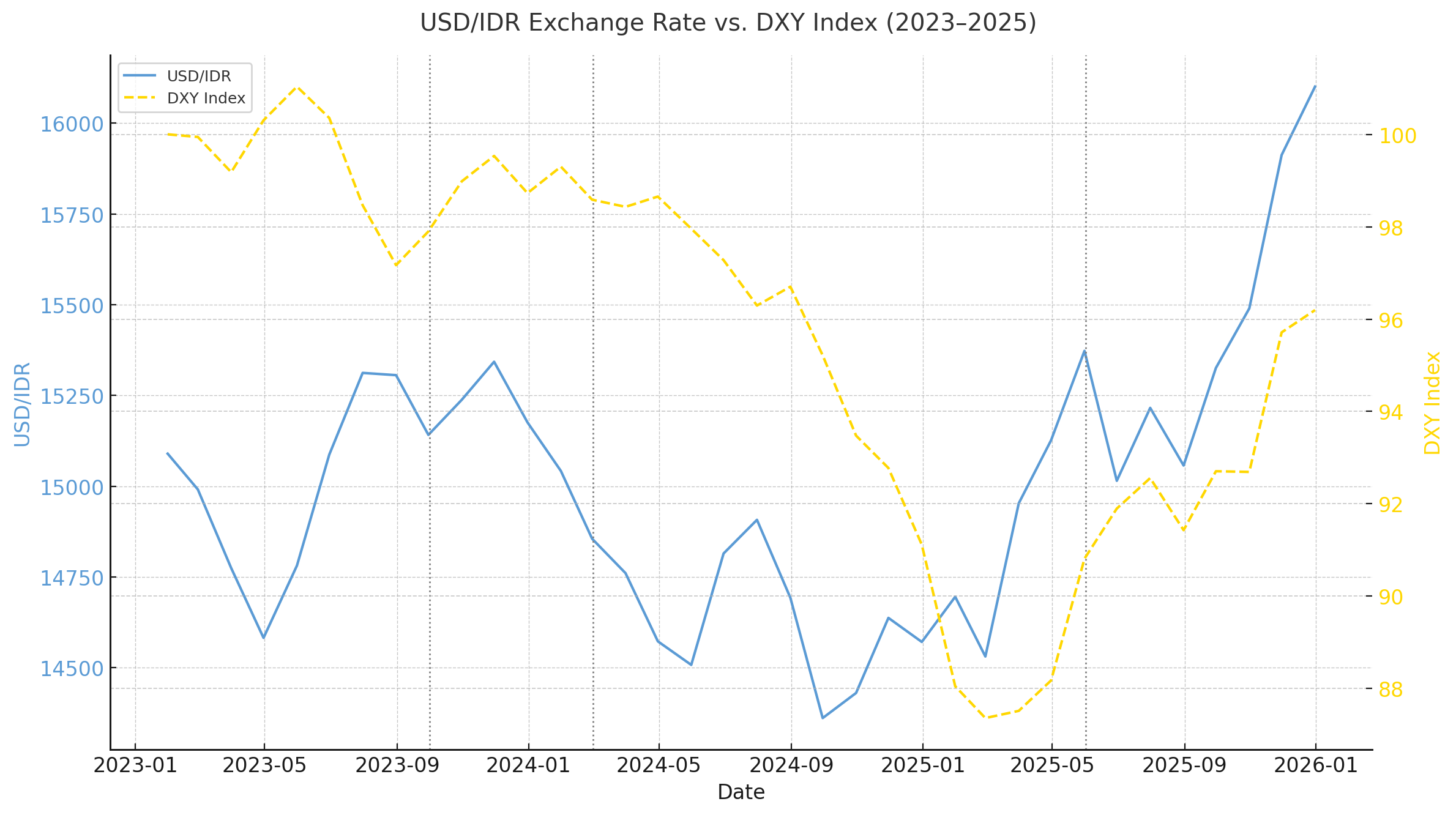

The US dollar, as measured by the DXY index, reflected this environment. After reaching multi year highs in 2024, the index eased but remained historically strong, generally fluctuating in the 98-103 range during the first quarter of 2025 before showing further volatility in April, dipping below 100 at times but maintaining overall resilience. This sustained dollar strength acts as a persistent headwind for currencies like the Indonesian Rupiah.

Navigating US Policy Uncertainty: Trade Tensions and Political Risk

Beyond monetary policy, the direction of US economic policy under the new administration elected in late 2024 has become a dominant source of global uncertainty. The implementation and potential escalation of tariffs have significant implications for international trade and investment flows. Concerns over a potential US-China trade war, along with tariffs applied to other trading partners, have led to downward revisions in global growth forecasts and increased volatility in financial markets.

Bank Indonesia explicitly identified negative sentiment stemming from US tariff policies as a key factor pressuring the Rupiah in early April 2025, prompting direct intervention actions. These trade tensions contribute to a broader trend of global economic fragmentation, potentially disrupting established supply chains and dampening global trade volumes, which directly affects export oriented economies like Indonesia. Indonesia faces impacts both through direct trade channels with the US and China, and indirectly via the slowdown in overall global economic activity.

Adding another layer of complexity is the heightened political discourse surrounding the Federal Reserve's independence. Public criticism of the Fed's policy decisions and speculation about its leadership could potentially influence market perceptions and risk premia, particularly for longer term interest rates. While the Fed maintains its operational independence, such political pressures contribute to the overall climate of uncertainty facing global markets.

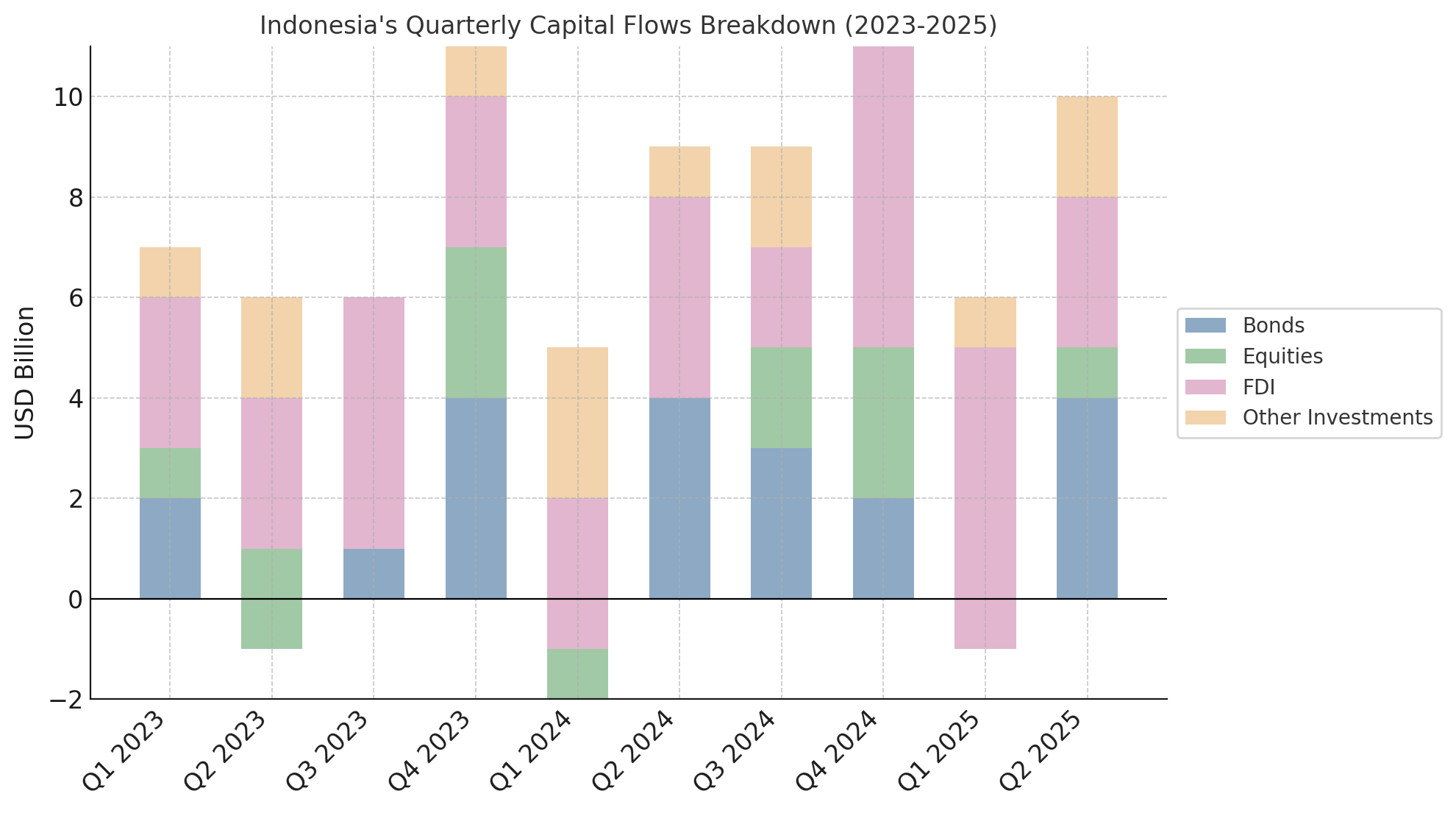

Capital Flow Volatility in Emerging Markets: Indonesia's Experience

Reflecting the challenging global backdrop, capital flows to Indonesia exhibited significant volatility. Following substantial outflows earlier in 2024, the final quarter saw a mixed picture. While the overall Financial Account Surplus strengthened, this masked underlying weakness in traditional investment flows. Portfolio investment saw net outflows from the private sector amounting to USD 3.1 billion in Q4 2024, overwhelming slight inflows to the public sector. This was partly attributed to the market's adverse reaction to the US election outcome (the "Trump trade") and negative net issuance of BI's SRBI instruments during that period.

These outflow pressures carried into 2025. Driven by rising global uncertainty, portfolio outflows reached USD 2.8 billion year to date by April 21. Data for March 2025 showed nuanced activity within fixed income, with non-residents recording net purchases of government bonds (IDR 1.72 trillion, approx. USD 100 million) but net sales of corporate bonds (IDR 0.43 trillion, approx. USD 25 million). Indonesian equity markets also faced significant headwinds, with the Jakarta Composite Index (JCI) declining sharply year to date by April 2025. Foreign investors remained cautious and market volatility was underscored by a JCI circuit breaker being triggered post Eid holiday in April due to panic selling, reportedly linked to retail investor margin calls.

The drivers behind these outflows are multifaceted. Global risk aversion, fueled by US policy uncertainty and trade war fears, played a major role. Relative yield differentials, influenced by the Fed's cautious stance, also contributed. Additionally, some analysts pointed to domestic factors potentially weighing on sentiment, including concerns about the fiscal implications of the new Indonesian administration's programs, temporary disruptions related to a new tax system implementation impacting state revenue early in the year and broader worries about weakening corporate earnings or sluggish on the ground economic activity.

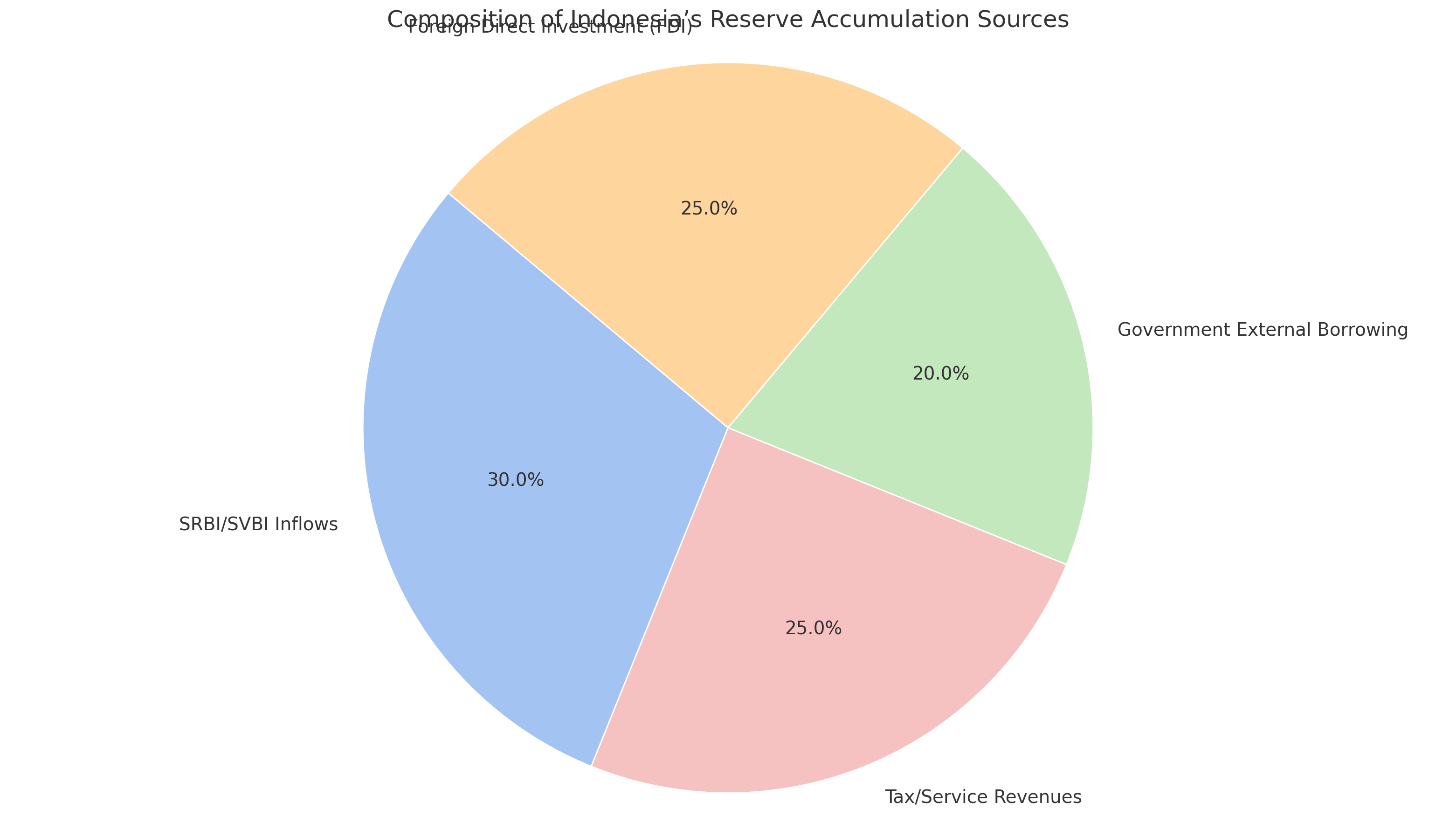

Foreign Direct Investment (FDI), typically considered a more stable form of capital inflow, also showed signs of weakening. Inbound FDI dropped significantly in Q4 2024 to USD 5.3 billion from USD 7.5 billion in Q3. Analysts suggest this highlights a potential gap between the announcement of investment projects and the actual realization of financial flows. While the full year 2024 Financial Account Surplus (FAS) appeared robust at USD 16.4 billion, a closer look reveals that this strength was heavily reliant on inflows categorized under 'Other Investments' such as government external loans and central bank swaps and inflows into BI's newly introduced SRBI instruments. These components effectively compensated for the simultaneous weakening observed in both FDI and traditional portfolio investment flows.

This shift in the composition of Indonesia's capital inflows raises important considerations. The increased reliance on 'Other Investments' and potentially market-sensitive SRBI/SVBI flows to maintain a positive financial account balance, especially while FDI and portfolio flows are weakening, suggests a potential increase in external vulnerability. FDI provides stable, long term financing, whereas portfolio flows can reverse quickly ('hot money') and 'Other Investment' sources like external loans or central bank swaps may not be consistently available or sustainable. Coupled with a widening Current Account Deficit and forecasts pointing towards a possible overall BoP deficit in 2025, this reliance on less 'sticky' capital could expose Indonesia to heightened balance of payments pressure should global risk sentiment deteriorate further or these specific inflow sources diminish.

Commodity Market Crosscurrents and China's Influence

Indonesia's external balance remains intrinsically linked to global commodity markets. Key exports like coal, crude palm oil (CPO), and nickel are significant contributors to trade performance. While Indonesia maintained a monthly trade surplus through March 2025 (Jan: USD 3.45bn, Feb: USD 3.12bn, Mar: USD 4.33bn), the widening CAD in 2024 indicated pressure on overall export values relative to import growth.

Specific commodity markets faced unique dynamics in early 2025. The Indonesian coal sector grappled with uncertainty surrounding new pricing regulations mandating the use of the domestic benchmark price (HBA - Harga Batubara Acuan) for exports from March 2025, alongside potential increases in royalty rates, particularly for lower CV coal when the HBA exceeds certain thresholds. CPO prices exhibited volatility, influenced by Malaysian market movements and domestic supply/demand factors. Nickel prices on the London Metal Exchange (LME) saw significant declines from early 2025 highs before showing some stabilization in April. This is particularly relevant given Indonesia's strategic focus on nickel downstreaming and proposed royalty adjustments for nickel products.

The economic trajectory of China remains a critical factor for Indonesia's commodity sector and overall external balance. China's GDP grew by 5.4% year on year in the first quarter of 2025, indicating a relatively solid start to the year, supported by industrial production. However, the economy faces persistent challenges from a subdued property market, the impact of trade tensions, and potentially weakening external demand. Major institutions forecast a moderation in China's growth for the full year 2025, with projections ranging from 4.0% (IMF) to 4.7% (ADB). Importantly for Indonesia, demand growth for key commodities in China, such as oil, is expected to remain sluggish compared to historical averages. Any significant slowdown in China's economic activity would likely translate into reduced demand for Indonesian exports, particularly coal, CPO, and base metals, thereby impacting Indonesia's trade balance and external position.

Bank Indonesia's Multi-Pronged Defense

Confronted by these complex external pressures and domestic considerations, Bank Indonesia has deployed a comprehensive policy arsenal, employing a combination of interest rate adjustments, active foreign exchange management, targeted monetary operations, macroprudential measures, and close policy coordination.

Calibrating the BI Rate: Balancing Stability and Growth

The BI-7DRRR serves as the central bank's primary signaling tool. Following two 25 basis point cuts in September 2024 and January 2025, BI opted to hold the rate steady at 5.75% during its February, March, and April 2025 policy meetings. The accompanying Deposit Facility and Lending Facility rates were also maintained at 5.00% and 6.50%, respectively.

The official rationale consistently emphasized the need to maintain Rupiah stability amidst heightened global financial market uncertainty, particularly stemming from US policy direction, while ensuring inflation remains within the target corridor of 2.5% ±1% for 2025 and 2026. Governor Warjiyo explicitly stated that exchange rate stability is the "short term priority".

This cautious stance persists despite a domestic inflation backdrop that would typically argue for further easing. Headline inflation remained remarkably low in early 2025, hovering near or below 1% year on year (Jan: 0.76%, Feb: -0.09%, Mar: 1.03%), significantly below the lower bound of the target range. Core inflation also remained well controlled, recorded at 2.48% year on year in February and estimated around 2.5% in March, influenced partly by rising gold prices rather than broad demand pressures. This low inflation environment theoretically creates policy space for rate cuts.

However, this space is constrained by external stability concerns and acknowledged moderation in domestic growth. BI itself revised down its 2025 growth forecast, anticipating headwinds from global trade tensions impacting exports and potentially spilling over into domestic demand. This presents the classic emerging market policy dilemma: cutting rates to support growth could risk exacerbating currency depreciation and capital outflows in the current fragile external environment.

BI's forward guidance reflects this balancing act. While remaining open to the possibility of future rate cuts, the central bank stresses that any such moves are contingent on a careful assessment of Rupiah stability, inflation trends, and growth prospects. This data dependent approach, with a clear hierarchy prioritizing stability, signals that further easing is unlikely unless external pressures demonstrably subside.

The decision to maintain the policy rate at 5.75% despite exceptionally low headline inflation and acknowledged growth concerns effectively represents an implicit tightening of monetary conditions relative to what purely domestic factors might warrant. The real interest rate (policy rate adjusted for inflation) stands relatively high, potentially dampening domestic activity. This underscores the dominance of the exchange rate stability objective, driven by external vulnerabilities, in BI's current policy calculus. This cautious stance contrasts with some market expectations, such as Goldman Sachs forecasts predicting substantial rate cuts later in 2025. Such divergence highlights a potential risk: if external pressures persist and BI maintains its hold, market disappointment could potentially trigger further volatility as expectations are forced to realign with BI's constrained reaction function.

Active FX Management: Intervention and Reserve Dynamics

Direct intervention in the foreign exchange market remains a cornerstone of BI's stabilization strategy. The central bank has repeatedly confirmed its commitment to implementing "stabilization measures" to support the Rupiah amidst ongoing global financial market uncertainty. This involves active market operations "when necessary", including spot market transactions, the use of domestic non deliverable forwards (DNDFs), and potentially leveraging its suite of monetary instruments (SRBI/SVBI/SUVBI) to influence FX flows.

A specific example of this proactive approach occurred in early April 2025, when BI conducted coordinated interventions across Asian, European, and New York trading sessions. This action was explicitly aimed at countering negative sentiment arising from US tariff policy announcements that were pressuring the Rupiah. The intervention reportedly contributed to a slight strengthening of the currency at the time.

Despite these interventions, which typically draw down reserves, and the documented portfolio outflows, Indonesia's official foreign exchange reserves paradoxically reached a record high of USD 157.1 billion at the end of March 2025. This level was up from USD 154.5 billion in February 2025 and represented a substantial increase from approximately USD 136 billion in April 2024. BI stated this reserve position is equivalent to financing 6.7 months of imports or 6.5 months of imports and government external debt payments, comfortably exceeding international adequacy standards (typically around 3 months of imports).

The stated drivers for this reserve accumulation include tax and service revenues, as well as drawdowns of government external loans. Furthermore, the successful issuance and attractive yields of BI's SRBI and SVBI instruments are also cited as contributing factors, helping to attract or retain foreign currency within the domestic system.

The effectiveness of BI's FX management strategy is judged not by maintaining a specific exchange rate level, but by its ability to moderate volatility and prevent disorderly depreciation. While the Rupiah has undeniably depreciated over the past year, the interventions, backed by the substantial and growing reserve buffer, appear to have facilitated a more gradual adjustment compared to potential outcomes in previous periods of external stress. This large reserve cushion provides BI with significant capacity for continued stabilization efforts should external pressures intensify further.

Deepening Monetary Operations: The Role of SRBI, SVBI, SUVBI

Bank Indonesia has increasingly relied on its suite of "pro market" monetary operation instruments Sekuritas Rupiah Bank Indonesia (SRBI), BI Foreign Exchange Securities (SVBI), and BI Foreign Exchange Sukuk (SUVBI) as integral parts of its policy mix. These instruments serve multiple objectives: managing domestic liquidity, deepening financial markets, attracting capital inflows, and ultimately supporting Rupiah stability.

SRBI, the Rupiah denominated securities introduced in 2023, have played a particularly prominent role. They are credited with contributing significantly to the Financial Account Surplus in 2024, attracting USD 6.1 billion in inflows and are viewed as a key factor supporting the accumulation of foreign exchange reserves. By offering attractive yields, SRBI aims to encourage portfolio inflows and provide an alternative domestic investment avenue, thereby helping to stabilize the Rupiah.

The FX denominated instruments, SVBI and SUVBI, complement SRBI by providing tools to absorb or supply foreign currency liquidity directly. Outstanding amounts of SVBI and SUVBI reached USD 2.5 billion in March 2025. While this represented a slight decrease from February, it marked a substantial increase since their inception in late 2023. The yields on these instruments (e.g., the 1 month SVBI yield was around 4.55% in late April 2025) are calibrated to be competitive and encourage the placement of FX funds within the domestic system. The combined outstanding value of SRBI, SVBI, and SUVBI reached approximately IDR 892 trillion (equivalent to roughly USD 53 billion) as of mid March 2025, indicating their significant scale within BI's operational framework.

Bank Indonesia's strategy involves actively optimizing the issuance volume and interest rate structure of these instruments to enhance overall monetary policy transmission, foster deeper and more liquid domestic financial markets, and crucially, attract foreign capital inflows needed to offset external pressures.

Macroprudential Levers and Liquidity Support (KLM/PLM)

Complementing its monetary and exchange rate policies, Bank Indonesia utilizes macroprudential tools, primarily the Macroprudential Liquidity Policy (Kebijakan Likuiditas Makroprudensial - KLM), to support financial system stability and encourage bank lending towards specific priority sectors, thereby fostering economic growth. This allows BI to provide targeted stimulus without compromising the stability objective of its main policy rate.

The scale of KLM incentives has been substantial. As of the second week of April 2025, the total disbursed incentives reached IDR 370 trillion (approximately USD 22 billion), marking a significant increase of IDR 78.3 trillion from just a few weeks prior in late March 2025. This recent surge was partly attributed to an enhancement of the incentive specifically targeting the housing sector, which was increased from 4% to 5% of banks' Third Party Funds (DPK), effective April 1, 2025. This adjustment was explicitly linked to supporting the government's housing programs. National private commercial banks and state-owned banks were the primary recipients of these liquidity incentives.

The KLM policy targets a range of sectors deemed crucial for economic growth and job creation. These priority areas include housing, agriculture, real estate, construction, trade and manufacturing, transportation and warehousing, tourism and the creative economy, as well as Micro, Small, and Medium Enterprises (MSMEs).

By maintaining an accommodative macroprudential stance through KLM, BI aims to revive bank lending and financing activities, particularly towards these vital sectors, thereby supporting sustainable economic growth and employment. This targeted approach helps ensure ample liquidity within the banking system and counteracts potential credit tightening that might otherwise result from the stability focused monetary policy stance.

The Strength of Coordination: BI, MoF, and OJK Alignment

A key strength underpinning Indonesia's policy response has been the effective coordination and synergy between Bank Indonesia, the Ministry of Finance (MoF), and the Financial Services Authority (OJK). This institutional alignment ensures a coherent policy mix and enhances overall credibility.

Coordination occurs through formal mechanisms, such as the Financial System Stability Committee (KSSK) meetings, where joint assessments of risks and policy responses are discussed. It is also evident in aligned public messaging regarding stability priorities and the implementation of complementary policy actions. For instance, BI's macroprudential KLM incentives are designed to support broader government economic programs, such as housing initiatives. Similarly, OJK's supervision ensures banking sector resilience, which supports the effectiveness of BI's monetary policy. BI also coordinates with the government on initiatives like payment system digitalization (through the TP2DD framework) and strengthening international partnerships.

This strong inter agency coordination has proven particularly valuable in navigating the complex and rapidly evolving external environment, characterized by shifting US policies and heightened global uncertainty. By presenting a united front and ensuring policy actions are mutually reinforcing, the authorities can more effectively manage market expectations and bolster confidence in Indonesia's economic management framework.

Gauging Success: Performance, Trade-off and Resilience

Assessing the effectiveness of Bank Indonesia's strategy requires examining the outcomes in terms of exchange rate stability, the balance between inflation control and growth support, and the overall resilience of the financial system.

The Rupiah's Path: Stability Amidst Pressure

The Rupiah has undeniably faced significant depreciation pressure over the past year. Trading around IDR 16,300 per US dollar in April 2024, it weakened to the IDR 16,800-16,860 range by late April 2025. The currency experienced notable weakness in early 2025, breaching the IDR 16,800 level and even testing levels near IDR 17,000 at certain points. Year to date depreciation by late April 2025 was significant.

However, when viewed in a regional context, the Rupiah's performance has been broadly consistent with that of other ASEAN currencies, such as the Malaysian Ringgit and Thai Baht, which faced similar pressures from a strong US dollar, US policy uncertainty, and capital outflows. Bank Indonesia officials have noted the Rupiah's relative stability compared to some other emerging market currencies and its strength against a basket of non USD developed country currencies.

Bank Indonesia's policy actions, particularly its foreign exchange interventions and the deployment of instruments like SRBI/SVBI aimed at attracting inflows, have played a crucial role in managing this depreciation. The objective has not been to defend a specific exchange rate level but rather to mitigate excessive volatility and prevent a disorderly adjustment that could destabilize the broader economy. The accumulation of record high foreign exchange reserves provides a substantial buffer, signaling BI's capacity to continue these stabilization efforts. While depreciation occurred, the management appears to have been more controlled compared to potential scenarios witnessed in previous episodes of severe external stress.

The Inflation Growth Conundrum: Striking a Delicate Balance

Bank Indonesia has achieved considerable success in maintaining price stability. Headline inflation remained well within the 2.5% ±1% target range throughout early 2025, even dipping into deflation briefly in February before settling at 1.03% year on year in March. Core inflation also remained contained and consistent with the target. BI remains confident in its ability to keep inflation anchored within the target band for both 2025 and 2026.

This success on the inflation front, however, starkly highlights the policy trade-off BI faces. The decision to hold the policy rate steady at 5.75% since January 2025, despite inflation running significantly below target and acknowledged concerns about slowing economic growth, underscores the overriding priority given to exchange rate stability. While the rate cuts in late 2024 and early 2025 were intended to provide some support to the economy, the subsequent pause demonstrates that external constraints are currently binding. Instead of using the policy rate for broad stimulus, BI has relied on its macroprudential KLM incentives as a more targeted tool to encourage bank lending to specific sectors and support growth without jeopardizing the Rupiah.

The economic impact of this policy mix requires careful monitoring. Official growth moderated towards the lower end of BI's target range in 2024 and projections for 2025 point towards further slowing. While overall bank credit growth remained positive, the combination of relatively high real interest rates (resulting from the low inflation environment) and heightened external uncertainty likely acts as a drag on domestic investment and consumption. Underlying structural challenges related to productivity, human capital, and reliance on commodities also constrain Indonesia's long term growth potential.

The persistence of very low inflation, including the deflationary episode in February 2025, alongside slowing growth projections and reports of weakening conditions in some labor intensive sectors, may point towards an underlying softness in domestic demand that extends beyond the direct impact of external shocks. While Bank Indonesia's hands are tied externally regarding the policy rate, the domestic economy might possess greater slack than headline growth figures suggest. This situation raises questions about the long term sufficiency of the current policy mix. If domestic weakness were to deepen significantly while external pressures remain high, the reliance on macroprudential tools alone to support growth might prove inadequate, potentially forcing BI into a more difficult choice between accepting greater currency volatility or risking a more pronounced domestic slowdown.

Table 1: Key Indonesian Economic Indicators (Q4 2024 - Q1 2025/Latest & FY2025 Forecasts)

| Indicator | Period | Value | Source / Note |

|---|---|---|---|

| GDP Growth (YoY) | 2024 Q4 | 3.2% | (Thailand data, used as proxy for context, needs update with actual IDN Q4 data if available) |

| 2024 FY | ~5.0% | (Near lower end of 4.7-5.5% range) | |

| 2025 FY Fcst | < Midpoint 4.7-5.5% | (BI Forecast) | |

| 2025 FY Fcst | 4.7% | (IMF Forecast) | |

| 2025 FY Fcst | 5.0% | (ADB Forecast) | |

| CPI Inflation (YoY) | Mar 2025 | 1.03% | Indonesia Interest Rate - Trading Economics |

| 2025 Target | 2.5% ±1% | Indonesia Interest Rate - Trading Economics | |

| BI 7-Day Reverse Repo Rate | Apr 2025 | 5.75% | Indonesia Interest Rate - Trading Economics |

| IDR/USD Exchange Rate | Late Apr 2025 | ~16,800 - 16,860 | BI maintains benchmark interest rate amid threat of global economic |

| Current Account Balance (% GDP) | 2024 Q4 | -0.32% | PIER Snapshot: FY2024 Balance of Payment The 2024 Balance of ... |

| 2024 FY | -0.63% | PIER Snapshot: FY2024 Balance of Payment The 2024 Balance of ... | |

| 2025 FY Fcst | Deficit 0.5% - 1.3% | Indonesia Interest Rate - Trading Economics | |

| Balance of Payments | 2024 FY | USD +7.2 billion | Rupiah under control, supported by stabilization policies: BI - ANTARA News |

| 2025 FY Fcst | Slight Deficit | (Permata Bank Forecast) | |

| Foreign Exchange Reserves | End-Mar 2025 | USD 157.1 billion | Indonesia Interest Rate - Trading Economics |

Note: GDP data requires confirmation for Indonesia Q4 2024 actuals.

Financial System Stability: Navigating External Stress

Despite the challenging external environment and domestic policy trade offs, the Indonesian financial system has demonstrated resilience. Regulatory authorities, including OJK, assess that financial sector stability was maintained through early 2025. Key indicators support this view: the banking sector continues to exhibit strong capital adequacy ratios (CAR stood at a high 26.98% in February 2025), providing a substantial buffer against potential shocks. Liquidity conditions remain ample, supported by BI's policies, and non-performing loan (NPL) ratios have generally remained contained.

Stress tests conducted as part of the IMF's Financial Sector Assessment Program (FSAP), using mid 2023 data, largely corroborated this picture of resilience. The banking sector, in aggregate, was found to be resilient to various severe macroeconomic shock scenarios. However, the tests also highlighted potential vulnerabilities. Smaller banks, often characterized by lower initial capital buffers and profitability, showed greater susceptibility to capital depletion under stress. Furthermore, while the overall corporate sector showed recovery post-pandemic, stress tests indicated that corporate debt at risk could increase significantly under adverse recession or stagflation scenarios, potentially impairing debt servicing capacity. The analysis also identified potential, albeit manageable, foreign exchange liquidity shortfalls within the banking system and funding concentration risks, particularly in smaller regional banks reliant on interbank deposits or funding from public entities.

Ongoing risks requiring monitoring include potential credit deterioration in sectors heavily impacted by the pandemic or among highly leveraged corporations. The increasing holdings of government bonds by domestic banks and concentrated lending to State Owned Enterprises (SOEs) have intensified the "sovereign bank nexus," although stress tests suggested the solvency impact remained contained thus far. External debt, particularly unhedged foreign currency borrowing by corporations, remains a perennial vulnerability. Additionally, the financial system faces longer term structural risks related to climate change, including both transition risks associated with the shift away from fossil fuels and physical risks from climate related natural disasters.

Regional Perspectives: ASEAN Central Banking in Focus

Comparing Bank Indonesia's actions with those of its regional peers provides valuable context for understanding the specific constraints and priorities shaping its policy decisions. While facing similar external shocks, ASEAN central banks have charted somewhat divergent paths in early 2025.

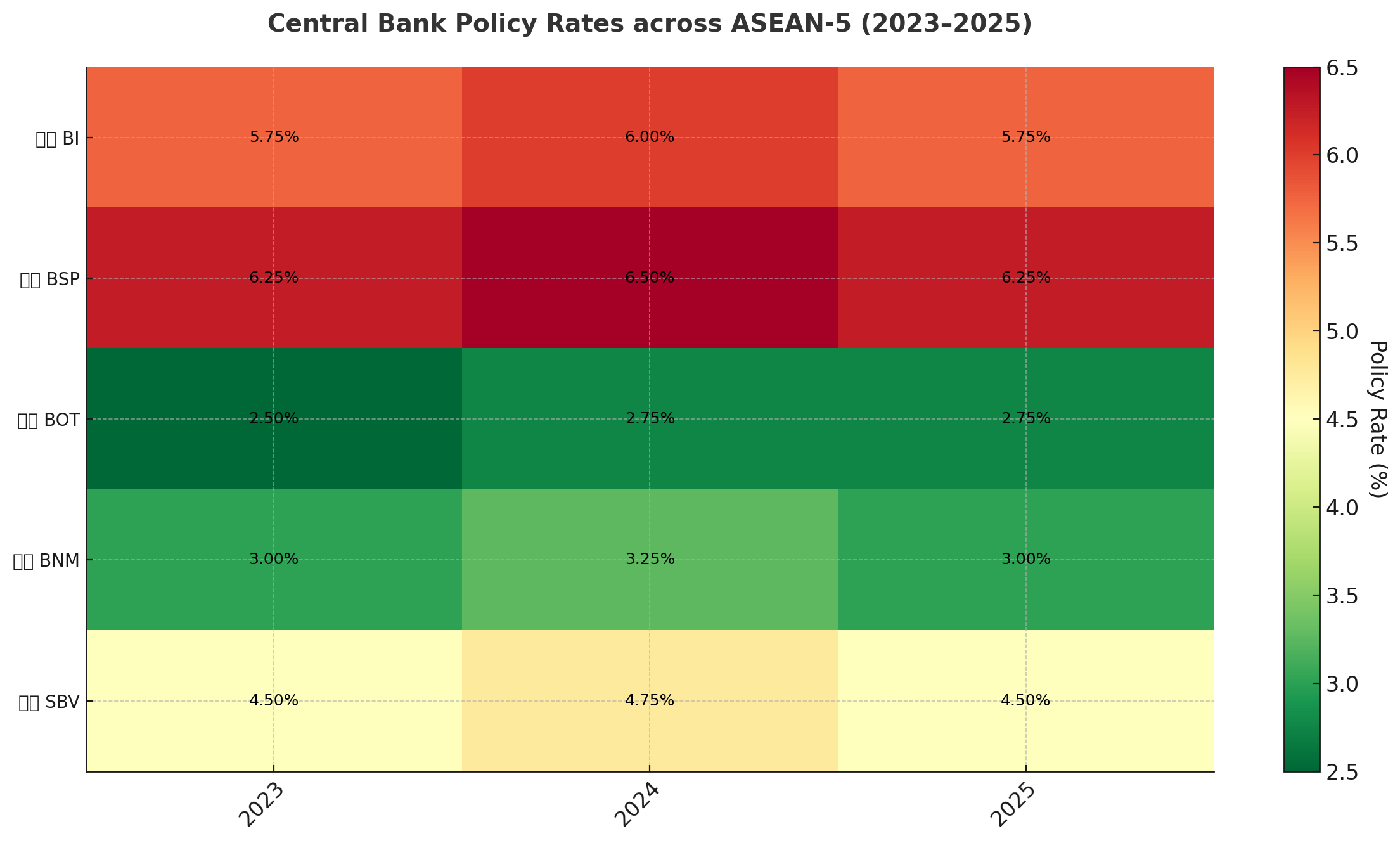

Divergent Paths: Policy Rate Strategies Across ASEAN

As of April 2025, policy rates across key ASEAN economies varied, reflecting different domestic conditions and policy responses:

- Indonesia (BI): 5.75% (Held steady Feb-Apr)

- Philippines (BSP): 5.50% (Cut 25bps in April)

- Thailand (BoT): 2.00% (Cut 25bps in Feb, held Apr)

- Malaysia (BNM): 3.00% (Held steady, next meeting May 8)

- Vietnam (SBV): 4.50% (Refinancing Rate, held steady since June 2023)

This divergence occurred despite shared external pressures emanating from the Federal Reserve's policy stance and US trade policy uncertainty. The Bangko Sentral ng Pilipinas (BSP) initiated a rate cut in April, citing a more favorable inflation outlook with forecasts declining significantly. The Bank of Thailand (BoT) implemented an unexpected cut in February, motivated by a weaker than anticipated growth outlook, structural challenges in manufacturing, and very low inflation, aiming to preemptively guard against downside risks.

In contrast, Bank Negara Malaysia (BNM) maintained its policy rate at 3.00%, emphasizing a measured, data driven approach and stating there was no immediate pressure to adjust rates given subdued domestic inflation. The State Bank of Vietnam (SBV) has held its key rates steady for a longer period, though it faces growing exchange rate pressures that might influence future decisions.

Bank Indonesia's approach of two modest cuts followed by an extended pause positions it as relatively cautious compared to the recent easing moves by the BSP and BoT. While low domestic inflation could theoretically permit further cuts, BI's explicit prioritization of Rupiah stability in the face of persistent capital outflows and global uncertainty acts as the primary constraint. Forecasts suggest potential for further easing later in 2025 for BI and BSP, while Malaysia, Thailand, and Vietnam might remain on hold, contingent on US policy developments and currency stability.

Table 2: ASEAN-5 Central Bank Policy Monitor (As of April 2025)

| Country | Central Bank | Latest Policy Rate (%) | Date Last Changed | Latest Headline Inflation (YoY, %) | Latest GDP Growth (YoY, %) | Currency vs USD (Approx. YTD % Change, Apr 2025) |

|---|---|---|---|---|---|---|

| Indonesia | BI | 5.75 | Jan 2025 (-25bps) | 1.03 (Mar) | 5.05 (Q2 2024)* | ~ -4% to -5% |

| Philippines | BSP | 5.50 | Apr 2025 (-25bps) | 2.3 (2025 Fcst) | 5.2 (Q3 2024)* | ~ -2% to -3% |

| Thailand | BoT | 2.00 | Feb 2025 (-25bps) | 1.3 (Jan) | 3.2 (Q4 2024) | ~ -4% to -5% |

| Malaysia | BNM | 3.00 | May 2023 (+25bps) | 1.4 (Mar) | 3.3 (Q4 2024)* | ~ -3% to -4% |

| Vietnam | SBV | 4.50 (Refin. Rate) | Jun 2023 (-50bps) | 3.13 (Mar) | 6.72 (Q1 2025)* | ~ -4% to -5% |

Sources: BI, BSP, BoT, BNM, SBV, Inflation/GDP data from respective national sources or reports. Currency changes are indicative estimates based on market data around April 2025.

Currency Performance and Capital Flow Dynamics: A Regional View

The pressure on the Indonesian Rupiah was not an isolated phenomenon. Most ASEAN currencies experienced depreciation against the strengthening US dollar, particularly during periods of heightened global risk aversion, such as late 2024 and early 2025, driven by concerns over US interest rates and trade policies. Capital outflows were a common challenge across the region as investors reassessed risk and sought perceived safe havens.

The Rupiah's relative performance against its peers fluctuated but generally tracked regional trends. While Indonesia's improved macroeconomic fundamentals and policy framework compared to previous crisis episodes offered some resilience, vulnerabilities persist. Notably, the relatively high share of foreign ownership in the Indonesian government bond market, although lower than pre-pandemic levels, continues to make the country sensitive to shifts in global investor sentiment and portfolio reallocations.

The diverse policy responses observed across ASEAN, despite facing similar external shocks, underscore the importance of domestic factors in shaping outcomes. Countries entered this period with varying degrees of external buffers, different inflation and growth dynamics, and unique structural characteristics. For example, Thailand's decision to cut rates was heavily influenced by its specific concerns about structural impediments to manufacturing growth and extremely low inflation. Malaysia's relatively stable domestic picture allowed for a more patient approach. The Philippines found room to ease as its inflation outlook improved markedly. Indonesia's policy path appears particularly constrained by the exchange rate channel, likely reflecting its capital account structure and historical sensitivity to outflows. This highlights that while external forces set the overall tone, domestic conditions and specific vulnerabilities act as critical filters, dictating the available policy space and the trade offs central banks are willing to make. Consequently, a nuanced, country specific analysis is essential, rather than applying a uniform regional perspective.

Strategic Implications and Forward Outlook

The complex interplay of global forces and domestic priorities presents ongoing challenges and opportunities for policymakers, investors, and businesses operating in Indonesia.

Key Considerations for Policymakers (BI)

Bank Indonesia faces a continuing need to skillfully navigate the competing demands of maintaining stability and supporting growth. The current strategy holding the policy rate steady while actively managing the exchange rate through intervention (backed by substantial reserves) and utilizing macroprudential tools like KLM for targeted growth support appears prudent given the prevailing external uncertainties. However, this approach requires constant vigilance and assessment of the inherent trade offs.

Clear and consistent communication will be paramount. Given the divergence between BI's cautious stance and some market forecasts for easing, managing expectations is crucial to avoid unnecessary market volatility. Reinforcing the data dependent nature of policy decisions and clearly articulating the hierarchy of objectives with stability taking precedence under current conditions while reiterating the commitment to the inflation target, will be essential.

Optimizing the existing policy toolkit remains important. Continued refinement of the SRBI, SVBI, and SUVBI instruments can help manage liquidity and attract necessary inflows, but policymakers must remain cognizant of the potential volatility associated with over-reliance on portfolio flows compared to longer-term investments. The effectiveness and potential unintended consequences of prolonged and large-scale KLM deployment also warrant ongoing evaluation. Maintaining strong coordination with the Ministry of Finance and OJK is vital for ensuring policy coherence and maximizing effectiveness.

Beyond cyclical management, addressing underlying structural vulnerabilities is critical for long term resilience. This includes efforts to deepen domestic financial markets to reduce sensitivity to foreign portfolio flows, diversify the export base beyond primary commodities, improve the investment climate and capital efficiency (addressing the high ICOR), enhance human capital development and ensure sustainable fiscal management. Continued monitoring of corporate sector vulnerabilities, particularly SOE debt and FX exposures, also remains necessary.

Navigating the Landscape: Insights for Investors and Businesses

For investors and corporate decision makers, the Indonesian market presents a landscape of both opportunity and significant risk, demanding careful monitoring and strategic positioning. Key factors to track closely include: the trajectory of US policy (Fed rate decisions, tariff implementations, political developments), the strength of China's economic recovery and its implications for commodity demand, trends in Indonesia's own balance of payments (particularly the CAD and the composition of capital inflows), Bank Indonesia's policy signals (rate decisions, intervention intensity and language, SRBI/SVBI auction results) and domestic political and fiscal developments, including the implementation of the new administration's key programs.

Investment strategies should acknowledge Indonesia's improved macroeconomic framework and resilience compared to past crises, but also recognize the persistent vulnerabilities and the constraints imposed by the current global environment. While instruments like SRBI may offer attractive real yields, they carry inherent currency risk. Equity markets face headwinds from global uncertainty, potential domestic economic slowing, and cautious foreign investor sentiment. Relative value assessments should consider the diverging policy paths across the ASEAN region (Section V). Investors should internalize BI's strong commitment to stability, which may limit the scope or pace of anticipated rate cuts.

Corporate entities with operations or exposures in Indonesia must maintain prudent risk management practices. Consistent hedging of foreign currency exposures is advisable given the potential for continued Rupiah volatility. Businesses should engage in scenario planning, considering periods of market stress and potential shifts in borrowing costs if BI maintains its stability focused stance. Close monitoring of domestic demand indicators and understanding the potential impacts of new regulations, such as the export earnings retention rules (DHE) or changes in mining royalties, are also crucial for operational planning.

Conclusion: Charting the Course Ahead

Bank Indonesia has navigated an exceptionally challenging global environment over the past year with a pragmatic and flexible policy approach. By utilizing its comprehensive toolkit encompassing interest rates, foreign exchange intervention, enhanced monetary operations via SRBI/SVBI/SUVBI, and targeted macroprudential measures the central bank has prioritized macroeconomic and financial system stability, particularly concerning the Rupiah exchange rate. This stability first approach, clearly communicated by Governor Warjiyo, reflects a calculated response to persistent external pressures and has been supported by Indonesia's improved policy credibility and strong inter-agency coordination.

Looking ahead, the path remains fraught with uncertainty. The evolution of US monetary and trade policies, the trajectory of China's economy and its impact on commodity demand, and the potential for further geopolitical shocks will continue to shape the external landscape. Domestically, managing the delicate balance between supporting growth aspirations and maintaining hard won stability amidst these external headwinds will remain Bank Indonesia's core challenge. The quality and sustainability of capital inflows needed to finance the current account deficit and bolster reserves warrant close attention, particularly the reliance on potentially less stable sources observed recently.

The experience of recent years suggests that emerging markets equipped with credible policy frameworks, adequate buffers (such as Indonesia's record FX reserves), and adaptive strategies can withstand significant external turbulence, albeit not without experiencing volatility and facing difficult policy trade offs. Bank Indonesia's performance offers valuable insights into managing these complexities. As the central bank continues its careful choreography of the "Rupiah's tightrope walk," sustained success will hinge on its continued policy flexibility, transparent communication to anchor expectations, robust coordination with other authorities, and crucially, progress on deeper structural reforms aimed at reducing Indonesia's underlying external vulnerabilities and fostering more resilient, broad based domestic growth. The course ahead demands unwavering vigilance and skillful navigation from policymakers and market participants alike.

Reference:

- "1 IDR to USD - Indonesian Rupiahs to US Dollars Exchange Rate." XE.com.

- "Alarming Capital Outflows from the Jakarta Composite Index on Tuesday." Indonesia Investments.

- "ASEAN-6 2025 Outlook: Crosswinds." DBS Bank.

- "Bangko Sentral ng Pilipinas Media and Research Press Releases." BSP.gov.ph.

- "Bank Indonesia Channels Rp 370 Trillion in Liquidity Incentives to Banks." Tempo.co.

- "Bank Indonesia Holds Interest Rate Steady at 5.75 Pct Amid Global Uncertainty." Xinhua.

- "Bank Negara May Cut OPR by 25bps if Growth Weakens." The Malaysian Reserve.

- "BI Cuts 2025 Growth Below 5.1 Percent Outlook Amid Escalating U.S.-China Trade Tension." Indonesia Business Post.

- "BI Maintains Benchmark Interest Rate Amid Threat of Global Economic Slowdown." Indonesia Business Post.

- "BNM's OPR Decisions Reflect Measured Approach, Not Pre-Emptive Action, Says Finance Minister." The Exchange Asia.

- "Bond Market Commentary: March 2025." Mandiri Manajemen Investasi.

- "BPS Records 1.65% Inflation in March." Business-Indonesia.

- "CPO Prices at KPBN Inacom Withdrawn on April 25, Palm Oil Prices Rise on Malaysian Exchange." InfoSAWIT.

- "Economic Forecasts: Asian Development Outlook April 2025." Asian Development Bank.

- "ESDM Announces Nickel Royalty Increase to a Maximum of 19%." Indonesia Miner.

- "Historical Price Charts of LME Nickel 3-Month." Shanghai Metal Market.

- "Indonesia and the IMF." International Monetary Fund.

- "Indonesia Balance of Trade." Trading Economics.

- "Indonesia Economic Outlook 2025." LPEM FEB UI.

- "Indonesia Forex Reserves Hit Record High." Trading Economics.

- "Indonesia Increases Mining Royalties in 2025; Opportunity or Risk?" Tura Consulting.

- "Indonesia Interest Rate." Trading Economics.

- "Indonesia Introduces a Reference Price to Regulate Its Coal Market from March 2025." EnergyNews.

- "Indonesia Macro Update - BI Rate Update 19 Mar 2025." KB Valbury Sekuritas.

- "Indonesia Monetary Operation: SVBI: Weighted Average Yield: 1 Month." CEIC Data.

- "Indonesia Outstanding of SVBI and SUVBI: Total." CEIC Data.

- "Indonesia's Balance of Payments Surplus Rises to 7.9 bln USD in Q4 2024." Xinhua.

- "Indonesia's Economic Plans - March 2025." New Zealand Ministry of Foreign Affairs and Trade.

- "Indonesia's Foreign Reserves Rise 1.68%, Reach USD 157.1 Billion." IDNFinancials.

- "Indonesian Coal Producers Wary of Proposed Royalty Hike." Argus Media.

- "Indonesian Government's Bid to Hike Coal Export Prices Faces Global Market Backlash." Asia News Network.

- "Interest Rate." NHNN (State Bank of Vietnam).

- "Interest Rate Trends in Vietnam: Signs of a Reversal?" VCCI.

- "Jerome Powell Addresses Economic Outlook, Tariffs, and Fed Strategy Amid Rising Uncertainty." Brimco.

- "Market Data - Westmetall Prices." Westmetall.com.

- "Minutes of the Federal Open Market Committee." Federal Reserve Board.

- "MNI Bank Indonesia Preview -- February 2025." Market News International.

- "Monetary Policy Committee's Decision 1/2025." Bank of Thailand.

- "National Economy Was Off to a Good Start in the First Quarter." Stats.gov.cn.

- "Nickel Futures Historical Prices." Investing.com.

- "Nominal Broad U.S. Dollar Index (DTWEXBGS)." FRED, St. Louis Fed.

- "Official Statistics News - BPS-Statistics Indonesia." Badan Pusat Statistik.

- "Palm Oil Prices Dip Slightly in Indonesia, Trade Tightens in Malaysia on Thursday (April 24)." Palm Oil Magazine.

- "Perry Warjiyo: Synergy to Strengthen Stability and National Economic Transformation." Bank for International Settlements.

- "PIER Snapshot: FY2024 Balance of Payment." Permata Bank.

- "Press Briefing Transcript: World Economic Outlook, Spring Meetings 2025." IMF.

- "Press Release Financial System Stability Remains Resilient Amid Global Economic Growth Divergence." OJK.

- "Press Release of the March 2025 Monthly Board of Commissioners Meeting." OJK.

- "Rupiah Under Control, Supported by Stabilization Policies: BI." ANTARA News.

- "Schroders Indonesia Monthly Market Recap & Commentary -- March 2025." Schroders Indonesia.

- "SMM In-Depth Analysis: Impact of New Indonesian Policies on the Nickel Market." Shanghai Metal Market.

- "Speech by Chair Powell on the Economic Outlook (April 4, 2025)." Federal Reserve Board.

- "Speech by Chair Powell on the Economic Outlook (April 16, 2025)." Federal Reserve Board.

- "Synergy to Strengthen Stability and National Economic Transformation." Bank for International Settlements.

- "Thailand: Further Monetary Easing in 2025 after Unexpected 25bps Cut." DBS Bank.

- "Thailand Interest Rate." Trading Economics.

- "The Bank of Thailand Lowers Its Policy Rate by 0.25 Percentage Points to 2%." Thailand Business News.

- "US Dollar Index Historical Data." Investing.com India.

- "US Dollar Index Live Chart." Capital.com.

- "US Dollar to Indonesian Rupiahs Exchange Rate History." Wise.com.

- "USD to IDR Exchange Rate and Currency Converter." OFX.

- "Why Trump's Call for the Fed to Cut Interest Rates May Not Help Consumers." AP News.

- "2025 Outlook China Commodities Watch: Oil Majors Brace For Stagnant Demand Growth." S&P Global Ratings.

- "BCA Economic Research Report: BOP Uncertain Road Ahead." Bank Central Asia.

- "Indonesia: Financial Sector Assessment Program - Technical Note." IMF eLibrary.

- "Amir Hamzah: Bank Negara's OPR Decisions Based on Measured Approach, Not Preemptive." Malay Mail.

- "Nation Won't Hike Interest Rates Preemptively, Says Amir Hamzah." The Vibes.