Insight

macroeconomics

Navigating Turbulence: Trump's Tariff Volatility Meets the Digital Dollar Revolution

By Ang

June 3, 2025

15 min read

This article analyzes the paradoxical financial environment of 2025, where erratic U.S. tariff policies under President Trump have triggered significant market volatility and disrupted global trade, especially impacting Asian economies. Simultaneously, the advancement of the GENIUS Act signals a transformative push toward regulated Treasury-backed stablecoins, promising to reinforce U.S. dollar dominance through digital currency innovation. This dual dynamic creates a complex interplay of risks and opportunities, urging Asian policymakers and investors to strategically navigate tariff-induced uncertainty while leveraging emerging digital financial technologies to foster economic resilience, financial inclusion, and technological leadership in a rapidly evolving global monetary landscape.

The global financial landscape of 2025 presents a paradox of unprecedented proportions. On one hand, President Donald Trump's mercurial tariff policies have unleashed waves of market volatility, disrupting established trade relationships and sending Asian equity markets into periodic tailspins. On the other, the United States Congress has advanced the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), a legislative framework that promises to revolutionize dollar hegemony through regulated digital currencies. These seemingly contradictory forces one sowing uncertainty, the other promising stability are reshaping the architecture of international finance.

This analysis examines how Trump's erratic trade policies and the emergence of Treasury-backed stablecoins create a complex matrix of risks and opportunities for global markets, with particular attention to implications for Asian economies. The convergence of these dynamics represents not merely a policy shift but a fundamental recalibration of how the United States exercises economic power in an increasingly digital world.

As Asian investors navigate between the Scylla of tariff-induced market turbulence and the Charybdis of digital currency disruption, understanding these intersecting forces becomes essential for strategic positioning in the evolving global financial order.

The Volatility of Trump's Tariff Policy: A Market Disruptor

Historical Context and the Return of Protectionism

President Trump's second administration has witnessed an unprecedented escalation in protectionist measures, with tariff policies changing at a pace that economists describe as "without precedent." Since the inauguration on Jan. 20, Trump administration officials have announced new or revised tariff policies more than 50 times, according to a tally by The Washington Post. This represents approximately one tariff-related executive order per week, creating a regulatory environment characterized by extreme unpredictability.

The scope of these measures is staggering. Between January and April 2025, the average effective US tariff rate rose from 2.5% to an estimated 27% the highest level in over a century. Chinese imports have faced particularly severe treatment, with Trump's broad-based tariffs have raised levies on Chinese imports, the second-largest source of US imports after Mexico, from 20% to 54%.

The "TACO" Phenomenon: Market Psychology and Reality

Wall Street's response to this volatility has crystallized around the "TACO" trade an acronym for "Trump Always Chickens Out." An acronym for "Trump Always Chickens Out," That assumption has fueled a market tailwind in recent months as traders bet on policy pivots, buoyed by an initial US-China tariff deescalation earlier this month. However, this market assumption has proven problematic. As Yahoo Finance columnist Rick Newman observed, "The only problem with the TACO trade is that the premise isn't true. Trump doesn't always chicken out. His threats are often worse than his actions, but five months into Trump's term, it is abundantly clear that taxes on imports will be considerably higher for as long as Trump is in charge."

The pattern of policy reversals has created a whiplash effect. Trump has substantially changed tariffs on goods from China, Canada and Mexico at least a half-dozen times each. He has reversed himself at least three times on auto tariffs, on steel and aluminum, and on agriculture and energy. This constant recalibration reflects what Douglas Irwin, a Dartmouth economist, describes as unprecedented in American trade history: "that was changing every year. This is changing every day. The sheer amount of activity is unprecedented, overwhelming."

Legal Challenges and Constitutional Questions

The administration's tariff regime faces significant legal headwinds. The US Court of International Trade struck down many of Trump's tariffs Wednesday, ruling that the International Emergency Economic Powers Act (IEEPA) cannot be used to address trade deficits. An appeals court on Thursday allowed Trump's duties to temporarily stay in place while legal arguments continue. The administration has invoked the precedent of Nixon's 1971 tariffs, which were ultimately upheld on appeal, but the legal landscape remains uncertain.

The constitutional questions extend beyond mere precedent. During Biden's presidency, the court's conservative majority ruled that federal agencies can't decide sweeping political and economic matters without clear congressional authorization. This "major questions doctrine" now looms as a potential threat to Trump's unilateral tariff authority.

Comprehensive Timeline of 2025 Tariff Actions and Market Impacts

| Date | Tariff Action | Market Impact |

|---|---|---|

| Feb 1 | IEEPA tariffs announced on Canada, Mexico (fentanyl), China (10%) | S&P 500: -0.5%, VIX: +3.6% |

| Mar 3-4 | Tariffs implemented on Canada, Mexico, China increased | Market volatility, Asian markets decline |

| Mar 12 | 25% steel/aluminum tariffs, auto tariffs effective | Supply chain disruptions accelerate |

| Apr 2 | "Liberation Day": 10% global baseline, 125% on China post-retaliation | S&P 500: -2.1%, VIX: +13.9%, $6.6 trillion loss in 48 hours |

| Apr 9 | 90-day pause on reciprocal tariffs (except China) | S&P 500: +3.0% (+9.5% intraday), VIX: -10.2% |

| May 12 | 90-day pause on China tariff escalation | S&P 500: +1.5%, Asian markets rebound |

| May 28-29 | Court rules IEEPA tariffs unlawful; appeal filed | Dollar surges on legal uncertainty |

The pattern reveals how each policy shift triggers massive capital flows, with single-day market swings exceeding those seen during major financial crises.

Market Impact and Economic Consequences

The economic toll has been severe. On Friday, the S&P 500 closed down nearly 6 percent and the Dow Jones Industrial Average shed 5.5 percent. The tech-heavy Nasdaq was off 5.8 percent -firmly in bear market territory, or down more than 20 percent from its recent peak. The April 2 tariff announcement alone triggered the worst two-day loss in U.S. stock market history, with an astonishing $6.6 trillion in market value evaporating in just 48 hours. By the following Monday, the global equity market had shed roughly $10 trillion in value about 10% of world GDP. JPMorgan economists have dramatically revised their forecasts, now estimate the tariffs will result in full-year U.S. gross domestic product declining by 0.3%, down from an earlier estimate of 1.3% growth, and that the unemployment rate will climb to 5.3% from 4.2% now.

The Economic Policy Uncertainty Index reached unprecedented levels in 2025, reflecting an environment where business planning has become nearly impossible. This uncertainty manifests not just in aggregate statistics but in market behavior: after a 90 day partial reprieve in tariff rates, the S&P 500 soared nearly 9.5% in a single day its largest one-day gain since 2008 only to give back much of those gains when Trump threatened new tariffs via social media.

The human cost extends beyond macroeconomic indicators. Jay Foreman, CEO of Basic Fun!, a company that is known for classic toys like Care Bears and Tonka trucks, told NPR's Morning Edition that the sudden shift from a 145% tariff to a 30% rate felt like a lifeline but still feeling the pain of paying increased tariff rates. His experience illustrates how the policy volatility creates operational chaos for businesses dependent on global supply chains.

GENIUS Act: A Regulatory Game-Changer in Digital Currency

Legislative Progress and Bipartisan Support

The GENIUS Act represents a rare instance of bipartisan cooperation in an otherwise polarized political landscape. On March 13, 2025, the US Senate Banking Committee passed the Guiding and Establishing National Innovation for US Stablecoins Act of 2025 or "GENIUS Act," out of committee by a vote of 18-6. The bill subsequently advanced in the full Senate with a 66-22 vote late Monday to advance the GENIUS Act, a bill that aims to regulate some cryptocurrencies.

The legislation's momentum reflects strong administration support. White House AI and Crypto Advisor David Sacks (also known as the "crypto czar") held a press briefing focused on digital assets. He outlined the Trump administration's legislative priorities for the crypto industry, emphasizing two key legislative efforts: the GENIUS Act and a regulatory framework for market structure.

Core Provisions and Regulatory Framework

The GENIUS Act establishes a comprehensive regulatory architecture for payment stablecoins. The GENIUS Act establishes federal safeguards that protect stablecoin holders and enhance consumer confidence in the permitted payment stablecoin market, including requiring: 100% reserve backing with U.S. dollars and short-term Treasuries, or similarly liquid assets as determined by the primary regulator.

Key requirements include:

-

Reserve Requirements: Issuers must back their stablecoins with tangible, liquid assets such as U.S. Treasuries or cash equivalents.

-

Transparency Mandates: Monthly public disclosure of reserve composition. Annual audited financial statements for issuers with more than $50 billion in market capitalization.

-

Consumer Protection: Prioritizes claims of holders of permitted payment stablecoins over all other creditors in the event a payment stablecoin issuer goes bankrupt.

-

Federal-State Balance: State regulators will oversee stablecoin issuers with a market capitalization of less than $10 billion. Larger issuers face federal oversight.

Strategic Implications for Dollar Hegemony

The GENIUS Act positions stablecoins as instruments of American financial power. Treasury staff already model a $2 trillion stable-coin float by 2028 enough to rival the entire Eurodollar stock of the early 1990s. This projection reflects the transformative potential of what some analysts call "Stabledollars."

The strategic logic is compelling. By embedding U.S. debt within these digital currencies, stablecoins reinforce trust in the dollar while expanding its reach. This possible strategy aligns strongly with a broader push for "dollarization," leveraging stablecoins as tools for geopolitical and economic influence. As the global stablecoin market approaches $232 billion as of May 2025, the opportunity to cement dollar dominance through digital means becomes increasingly tangible.

The scale of Treasury demand from stablecoins is already substantial. Tether, the largest stablecoin issuer, holds an estimated $120 billion in U.S. Treasuries, making it one of the world's top 20 holders of U.S. government debt larger than many sovereign nations. The GENIUS Act would formalize and expand this dynamic, potentially channeling trillions more into U.S. debt markets. White House "crypto czar" David Sacks argues that bringing stablecoins into the regulated fold could "create trillions of dollars of demand for our Treasuries practically overnight."

The transaction volume already flowing through stablecoins underscores their systemic importance: some $28 trillion in 2024, exceeding Visa and Mastercard combined by transaction value. Much of this activity originates in Asia's active crypto markets, suggesting the region's central role in the digital dollar ecosystem.

Historical Parallels: The Free Banking Era Reimagined

Lessons from the 19th Century

The current regulatory approach to stablecoins bears striking similarities to America's Free Banking Era (1837-1864). Free banking allowed anyone with a certain minimum amount of capital to start a bank, which could issue bank notes provided that the bank deposited government bonds (typically those issued by the state) with the state banking authority as collateral.

During this period, Thousands of different types of bank notes circulated during this period and were exchanged at various discount rates according to the perceived soundness of their issuers and the distance from the issuing bank. The parallels to today's cryptocurrency ecosystem are evident multiple issuers, varying levels of trust, and questions about backing and redeemability.

Successes and Failures

The Free Banking Era produced mixed results that offer valuable lessons. The stability of the free banking system varied in different states. New York was considered a well-functioning free banking system, while Midwest free banking states experienced severe banking unrest. The key differentiator was regulatory quality and enforcement mechanisms. States with robust collateral requirements and regular examinations saw fewer failures, while those with lax oversight experienced "wildcat banking" banks in remote locations that issued notes with little intention or ability to redeem them.

Some banknotes in New York and New England did indeed come closest to fulfilling the functions of money under a regulatory regime, enforced by the government or the private sector. The Suffolk Bank system in Boston, for instance, created an early clearinghouse that maintained note values at par within its network. This historical precedent suggests that properly regulated stablecoins could succeed where poorly regulated ones might fail.

However, the era also demonstrated how bond collateral could become a vulnerability. When state bonds used as backing depreciated during economic downturns, banks faced simultaneous runs that no amount of local regulation could prevent. This systemic risk highlights why the GENIUS Act's emphasis on U.S. Treasury backing rather than diverse collateral represents a crucial evolution.

Modern Applications

The GENIUS Act appears to have learned from history. Unlike the laissez-faire approach of some free banking states, it mandates strict reserve requirements and transparency. Both the GENIUS Act and the STABLE Act specify high-quality liquid assets that qualify to be used as reserves, but they differ slightly in categories of assets that qualify.

The legislation also addresses a critical weakness of the Free Banking Era the lack of inter-operability and standardization. By creating federal standards while allowing state-level innovation for smaller issuers, the GENIUS Act attempts to balance the benefits of competition with the need for systemic stability.

However, the regulatory framework may inadvertently create new challenges. By establishing stringent requirements for compliant stablecoins, the Act could push certain financial innovations into less transparent "shadow DeFi" spaces decentralized finance protocols operating outside traditional regulatory perimeters. Recent enforcement actions by FinCEN against entities like the Cambodia-based Huione Group, which was found to be involved in laundering proceeds from cyber scams using stablecoins, underscore the ongoing challenge of preventing regulatory arbitrage.

The dual federal/state regulatory system envisioned by the GENIUS Act with federal oversight for issuers exceeding $10 billion in market capitalization and state-level regulation for smaller entities creates potential for regulatory competition. While this mirrors the federalist approach of American banking regulation, it also introduces complexity that sophisticated actors might exploit.

Intersecting Dynamics: Political Uncertainty vs. Financial Innovation

The Paradox of Simultaneous Disruption and Stabilization

The Trump administration presents a fascinating paradox: while its tariff policies inject massive uncertainty into global markets, its support for stablecoins offers a potential stabilizing force. This duality reflects deeper tensions in American economic strategy.

On one hand, the tariff volatility has created what Bill Ackman described as risking "an economic nuclear winter" unless Trump moderates his approach. The constant policy shifts undermine business planning and investment decisions. As "Sometimes you have to take medicine to fix something," Trump said, defending his approach despite market turmoil.

On the other hand, the administration's embrace of stablecoins represents a sophisticated understanding of monetary power in the digital age. As "The dollar has reinvented itself again this time as a monetary API: a permissionless, programmable unit that clears in seconds for a fraction of a cent."

Strategic Calculus: Short-term Pain for Long-term Gain?

The administration appears to be pursuing a high-risk strategy of using tariff threats as leverage while simultaneously building the infrastructure for enhanced dollar dominance through stablecoins. This approach assumes that short-term market disruption is acceptable if it achieves longer-term strategic objectives.

The evidence suggests mixed results. While tariff threats have occasionally produced concessions as seen in the temporary US-China détente they have also triggered retaliatory measures and economic damage. Beijing announced an additional 34 percent tariff on U.S. goods, the same rate Trump had imposed on Chinese imports Wednesday a move that Chinese officials called "inconsistent with international trade rules."

The inherent contradiction is stark: aggressive trade protectionism undermines international trust in US economic leadership, potentially encouraging de-dollarization efforts, while the stablecoin initiative aims to achieve the opposite. As analysts note, "Trump's renewed tariff policy risks undermining dollar dominance by disrupting the economic relationships that have sustained the global dollar system," while the GENIUS Act aims to "enshrine dollar dominance." This policy incoherence may reflect the influence of distinct domestic constituencies tariff policies catering to industrial interests and nationalist sentiments, while financial innovation initiatives are championed by the technology and financial sectors.

The administration's approach might represent a strategic pivot: maintaining US global financial leadership through technological supremacy even as its role as champion of multilateral trade diminishes. By setting global standards for digital money while pursuing protectionist trade policies, the US attempts to preserve centrality through control over financial infrastructure rather than trade relationships. Whether this dual strategy can succeed remains an open question, particularly as global partners struggle to interpret seemingly contradictory signals from Washington.

The Role of Technology in Monetary Evolution

The GENIUS Act represents a recognition that monetary power increasingly flows through digital channels. "Stablecoins haven't replaced the banking system; they have tunneled around its slowest, most expensive choke points." This "tunneling" effect could prove more consequential than traditional trade policies in determining future economic hierarchies.

Implications and Strategic Opportunities for Asia and Indonesia

Exposure Assessment: Navigating the Tariff Minefield

Asian economies face severe exposure to Trump's tariff volatility. "The U.S. accounts for approximately 15% of exports from the region, meaning that tariff increases ranging between 20% and 35% would pose a meaningful headwind to growth this year, especially for the more open trade-oriented economies," according to T. Rowe Price analysis.

The impact varies by economy:

- China: Facing cumulative tariffs of 54%, with "falling U.S demand for Chinese goods, the potential global economic slowdown and the hit on export re-routing"

- Japan: Hit with 24% tariffs, particularly affecting its $40 billion automotive export sector

- South Korea: 25% tariffs pushing the Kospi into bear market territory

- India: 26% tariffs deemed "much worse than expected" by Macquarie Capital

For Indonesia specifically, the challenges are multifaceted. The rupiah has depreciated to "a fresh record low of 16,965 per dollar", with some reports indicating it reached its weakest level since the 1998 Asian Financial Crisis at IDR 16,600. Indonesia faces a potential 34% US "reciprocal" tariff, which could affect nearly 9% of its total exports and lead to an estimated $11.2 billion reduction in exports to the US, with sectors like electronics, textiles, footwear, and animal/vegetable fats being particularly vulnerable. While Indonesia's direct exposure to US tariffs may be lower than manufacturing hubs like Vietnam or Taiwan, the secondary effects through regional supply chains and currency movements pose significant risks.

The scale of Indonesia's engagement with digital assets adds another dimension to these challenges. With over 11 million crypto investors by some estimates, Indonesia has one of Southeast Asia's most active digital asset communities. Many already use U.S. stablecoins to store savings in dollars or facilitate peer-to-peer payments, creating both opportunities and sovereignty concerns for policymakers.

Enforcement Mechanisms and Systemic Risks

The GENIUS Act establishes robust enforcement mechanisms to prevent the systemic risks that plagued earlier eras of private money. Stablecoin issuers must maintain technical capability to "freeze" or "burn" tokens in response to lawful orders, addressing concerns about illicit finance. Recent enforcement actions by the Financial Crimes Enforcement Network (FinCEN) against entities like the Cambodia-based Huione Group, which laundered proceeds from cyber scams using stablecoins, demonstrate the government's commitment to preventing regulatory arbitrage.

However, these stringent requirements may inadvertently push innovation into "shadow DeFi" spaces decentralized protocols operating outside traditional regulatory perimeters. The risk is that overly restrictive regulation could bifurcate the market: compliant stablecoins serving institutional needs while underground alternatives cater to those seeking privacy or avoiding oversight. This echoes historical patterns where excessive regulation drove financial activity into less transparent venues.

The Act's dual federal/state regulatory structure adds complexity. Issuers with over $10 billion in market capitalization fall under federal oversight (the OCC for nonbanks, parent regulators for bank subsidiaries), while smaller issuers can opt for state regulation if deemed "substantially similar" to federal standards. This creates potential for regulatory competition and complexity that sophisticated actors might exploit a modern version of the "charter shopping" that characterized some Free Banking Era excesses.

Stablecoin Opportunities: Leveraging Digital Dollar Infrastructure

The GENIUS Act opens significant opportunities for Asian economies to engage with the evolving digital dollar ecosystem:

-

Cross-Border Payment Efficiency: "A Lagos merchant can accept USDC on her phone, skip 20% naira slippage, and restock inventory the same afternoon." Similar efficiencies could benefit Indonesian businesses dealing with currency volatility.

-

Financial Inclusion: Treasury-backed stablecoins could provide dollar access to underbanked populations, particularly relevant for Indonesia's archipelagic geography.

-

Trade Finance Innovation: Stablecoins could streamline trade finance, reducing costs and settlement times for Asian exporters.

-

Reserve Diversification: While maintaining appropriate dollar reserves, Asian central banks could explore stablecoins as a complementary reserve asset.

Regional Regulatory Responses

Asian financial centers are proactively positioning themselves for the regulated stablecoin era. Singapore's Monetary Authority (MAS) has classified certain stablecoins as "digital payment tokens" and is formulating specific capital and reserve requirements for stablecoin issuers. Japan's Financial Services Agency implemented a comprehensive legal framework (effective 2023) that allows banks and licensed trust companies to issue stablecoins, provided they maintain equivalent fiat reserves. Hong Kong's Monetary Authority announced plans to license stablecoin activities by 2024, creating a regulatory sandbox for innovation while maintaining oversight.

These preparations suggest that key Asian markets will likely recognize and facilitate the use of U.S. federally-approved stablecoins within their financial systems. The regulatory convergence creates opportunities for cross-border financial integration while maintaining local oversight a delicate balance between innovation and sovereignty.

As a defensive measure, ASEAN has accelerated its Local Currency Transaction (LCT) framework. Indonesia, Malaysia, Thailand, and others have expanded this initiative to facilitate trade in rupiah, ringgit, baht, and other regional currencies, explicitly aiming to "reduce reliance on the US dollar" for regional commerce. These efforts, endorsed at recent ASEAN finance ministers' meetings, represent a direct response to dollar volatility while creating complementary infrastructure to stablecoin adoption.

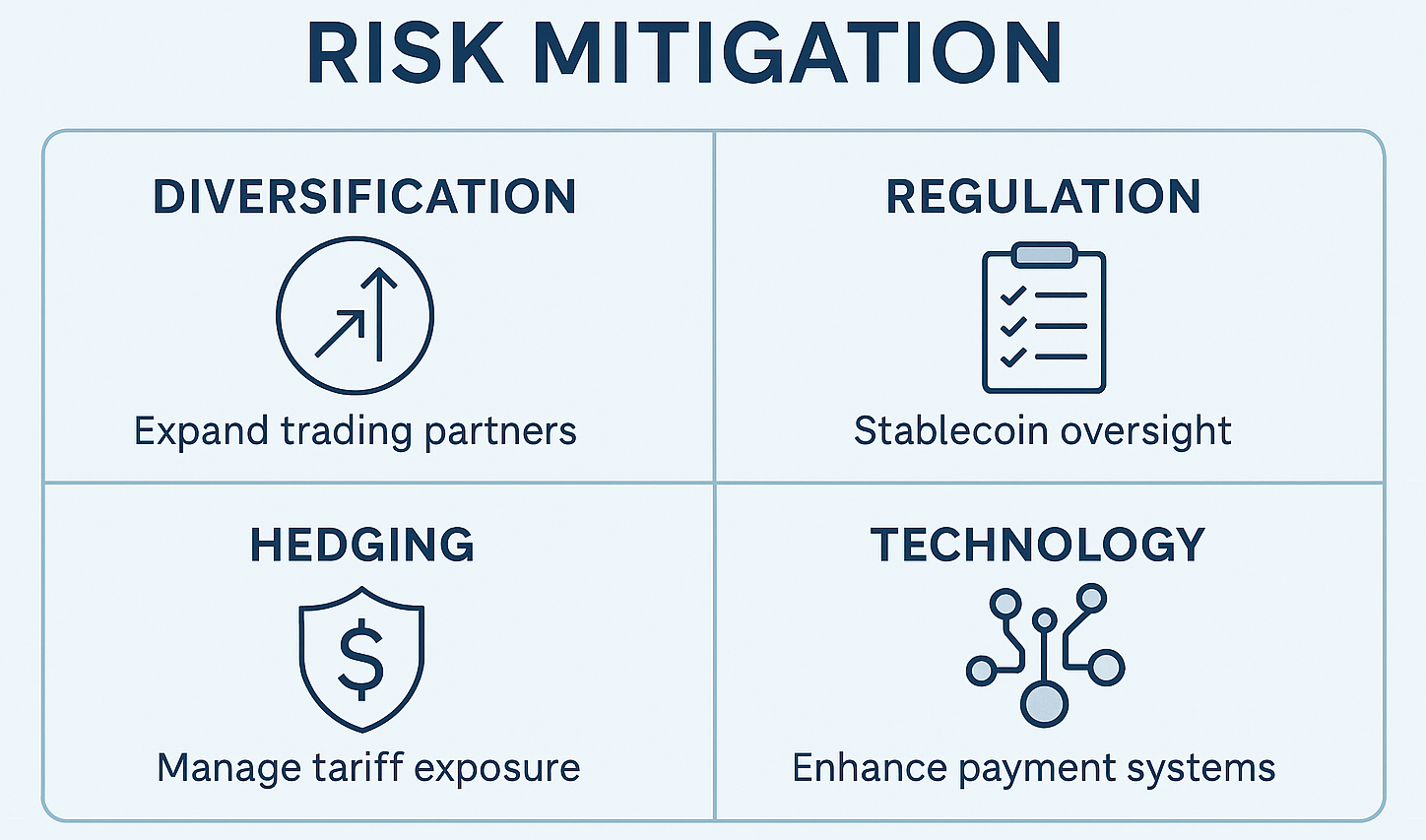

Risk Mitigation Strategies

Asian policymakers and investors should consider several risk mitigation approaches:

-

Diversification Beyond US Markets: The tariff volatility underscores the need for market diversification. "Engaging in a global trade war is the surest way to achieve a global recession," warned Finland's Foreign Minister, highlighting the importance of maintaining multiple trade relationships.

-

Regulatory Preparedness: Countries should develop regulatory frameworks for stablecoins that align with international standards while protecting local interests. Indonesia's financial authorities should study the GENIUS Act's provisions to prepare for increased stablecoin adoption.

-

Currency Hedging: Given the "record low" levels reached by regional currencies, sophisticated hedging strategies become essential.

-

Supply Chain Resilience: The tariff volatility highlights the need for supply chain diversification and near-shoring options.

Indonesia-Specific Recommendations

For Indonesia, several strategic imperatives emerge:

-

Digital Payment Infrastructure: Accelerate development of digital payment systems compatible with stablecoin protocols to avoid being left behind in the digital dollar revolution.

-

Regulatory Sandbox: Establish a regulatory sandbox for stablecoin experimentation, learning from the GENIUS Act's approach while maintaining monetary sovereignty.

-

Regional Cooperation: Work with ASEAN partners to develop common approaches to stablecoin regulation and cross-border digital payments.

-

Cybersecurity Enhancement: As "monetary API" systems proliferate, robust cybersecurity becomes essential for financial stability.

-

Education and Capacity Building: Develop expertise in digital currency systems among regulators, financial institutions, and businesses.

Conclusion: Charting a Course Through Complexity

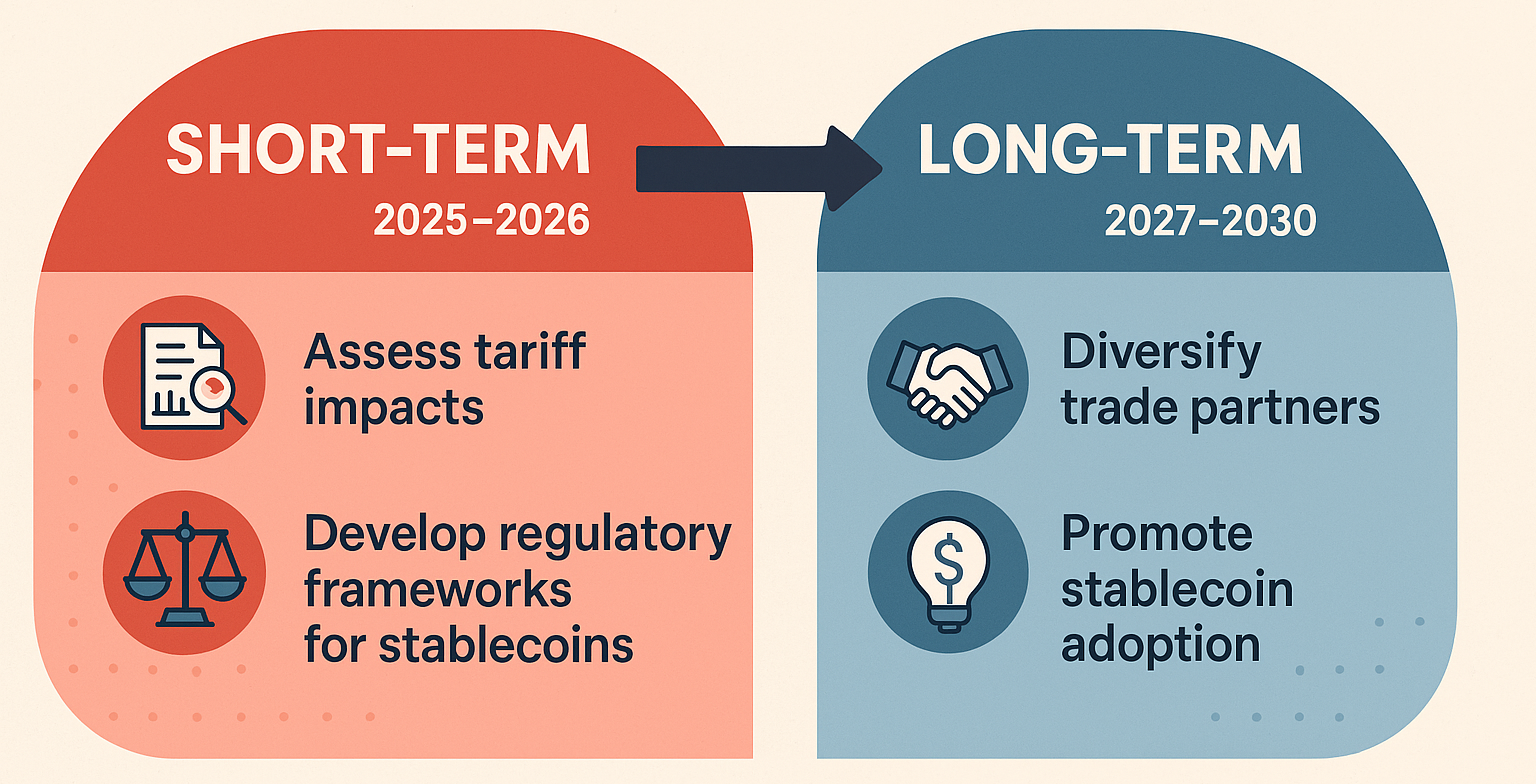

The convergence of Trump's tariff volatility and the digital dollar revolution through the GENIUS Act represents a watershed moment in global finance. While the tariff chaos creates immediate challenges from market volatility to supply chain disruption the emergence of regulated stablecoins offers a glimpse of a more efficient, accessible financial future.

For Asian economies, and Indonesia in particular, this dual dynamic demands sophisticated strategic responses. The temptation to view these developments as purely negative must be resisted. Instead, policymakers should recognize that periods of disruption often create opportunities for those prepared to adapt.

Summary Matrix: Dual Forces and Strategic Responses

| Dimension | Tariff Volatility Impact | Digital Dollar Opportunity | Strategic Response |

|---|---|---|---|

| Trade & Economy | • $11.2B potential loss for Indonesia<br>• Supply chain disruption<br>• Export sector uncertainty | • Efficient cross-border payments<br>• Reduced transaction costs<br>• New trade finance mechanisms | • Diversify export markets<br>• Strengthen ASEAN integration<br>• Develop bilateral swap lines |

| Financial Markets | • Currency depreciation (IDR 16,600)<br>• Capital flight risk<br>• Increased volatility | • Access to stable digital USD<br>• $28 trillion transaction volume<br>• Integration with global DeFi | • Build forex reserves<br>• Implement hedging strategies<br>• Develop local currency markets |

| Monetary Sovereignty | • Dollar weaponization concerns<br>• Policy transmission disruption<br>• External shock vulnerability | • Digital dollarization risk<br>• US regulatory influence<br>• Monetary policy dilution | • Advance CBDC initiatives<br>• Regulate stablecoin usage<br>• Maintain capital controls |

| Technology & Innovation | • Forced digitalization<br>• Cybersecurity challenges<br>• Regulatory complexity | • Fintech ecosystem growth<br>• 11M Indonesian crypto users<br>• Blockchain infrastructure | • Invest in cyber defense<br>• Create regulatory sandboxes<br>• Build technical capacity |

The historical parallel with the Free Banking Era reminds us that monetary innovation, when properly regulated, can enhance rather than undermine financial stability. The GENIUS Act's framework, requiring full reserves and transparency, addresses many of the weaknesses that plagued 19th-century free banking.

As we navigate this turbulent period, three principles should guide Asian policymakers and investors:

-

Embrace Innovation While Managing Risk: The digital dollar revolution is inevitable. Countries that engage constructively with this transformation while maintaining appropriate safeguards will benefit most.

-

Diversify and Adapt: Over-reliance on any single market or currency creates vulnerability. The current volatility underscores the importance of diversification across markets, currencies, and technologies.

-

Invest in Capabilities: Whether in regulatory expertise, technological infrastructure, or human capital, investments made now in understanding and engaging with digital currencies will pay dividends for decades.

The dual forces reshaping global finance tariff turbulence and digital currency innovation are not merely passing phenomena but harbingers of a fundamental restructuring of international economic relations. Success in this new environment requires not just reactive measures but proactive strategies that position Asian economies at the forefront of the digital financial revolution while managing the risks of an increasingly volatile trade environment.

As history has shown, periods of monetary transformation create both winners and losers. By understanding the forces at play, preparing for multiple scenarios, and maintaining strategic flexibility, Asia can emerge stronger from this period of disruption. The question is not whether to engage with these changes, but how to do so in ways that maximize opportunities while protecting economic sovereignty and stability.

The path forward demands courage, innovation, and strategic foresight. For those willing to embrace these challenges, the rewards in terms of economic resilience, financial inclusion, and technological leadership could be transformative. The turbulence of today may well prove to be the foundation for tomorrow's prosperity.