industries

energy

The Role of Liquefied Natural Gas in the Global Energy Transition

By SD

June 3, 2025

10 min read

This article provides a comprehensive analysis of the evolving role of Liquefied Natural Gas (LNG) in the global energy transition, highlighting its dual nature as both an enabler of energy security and a source of climate risk. LNG has emerged as a pivotal “bridge fuel,” supporting nations in diversifying their energy mix and stabilizing grids as they integrate more renewables, especially amid geopolitical upheavals like the Russia-Ukraine war. The article details the technological, geopolitical, and financial dynamics driving LNG demand, with a special focus on Europe’s pivot away from Russian pipeline gas and Southeast Asia’s surging consumption. While LNG offers operational flexibility and emits less CO₂ than coal or oil, its climate benefits are undermined by methane leakage and the risk of locking in long-term fossil fuel dependence through expensive infrastructure investments. The analysis concludes that LNG’s future as a sustainable energy solution hinges on aggressive methane mitigation, responsible investment, and alignment with Environmental, Social, and Governance (ESG) standards otherwise, its continued expansion may impede global decarbonization goals rather than facilitate them.

Liquefied Natural Gas (LNG) represents natural gas that has undergone a significant transformation: it is cooled to approximately -162°C (-260°F), which reduces its volume by about 600 times while preserving its energy content. This process of liquefaction is fundamental to the global energy market, as it renders natural gas economically viable for long-distance transportation, particularly across oceans where pipeline infrastructure is impractical. The global LNG market operates as an intricate international system of trade and commerce, encompassing the entire value chain from the extraction and liquefaction of natural gas to its maritime transport, regasification at import terminals, and subsequent distribution to end-users. This technological advancement has unlocked vast global trade opportunities, effectively bridging geographical divides between regions with abundant natural gas reserves and those with high energy demand but limited domestic supplies, thereby enhancing energy security and diversifying energy sources.

The significance of LNG in the context of global energy transitions is multifaceted. It is frequently positioned as a "bridge fuel" due to its comparatively cleaner-burning properties than other conventional fossil fuels such as coal and oil. For example, the shift from coal to natural gas in the United States power sector has already contributed to a 40% reduction in carbon emissions since 2000. This transition is particularly relevant as global energy demands continue to escalate, driven by factors such as sustained economic growth and the burgeoning power requirements of emerging sectors like AI data centers. In this dynamic environment, LNG's versatility enables nations to address immediate energy needs while simultaneously pursuing long-term decarbonization objectives. Industry leaders, such as ENGIE, view LNG as an indispensable element for ensuring energy security and market stability, integrating it strategically alongside renewable energy sources and green gases within their broader energy portfolios.

Despite its perceived benefits, a critical examination of LNG's climate impact reveals a more complex picture, leading to a fundamental debate about its true role in climate mitigation. While the industry frequently highlights LNG's lower carbon dioxide (CO2) emissions at the point of combustion compared to coal and oil, a comprehensive life-cycle analysis, which includes upstream emissions and methane leakage, presents a different conclusion. A peer-reviewed study by Robert Howarth of Cornell University, for instance, estimates that the full life-cycle greenhouse gas (GHG) footprint of LNG can be 33% larger than that of coal. This significant difference stems from the potent global warming potential of methane, the primary component of natural gas, which is approximately 80 times more powerful than CO2 over a 20-year period. Even small methane leaks, estimated at around 2.8% to 3.5% of total gas volume, can effectively negate any climate benefits gained from reduced CO2 emissions during combustion. This discrepancy underscores that a simplistic view of LNG as inherently "cleaner" is insufficient and potentially misleading. For LNG to genuinely contribute to global climate goals, comprehensive and verifiable methane mitigation efforts across its entire value chain are paramount. Without such measures, the extensive expansion of LNG infrastructure risks locking in substantial GHG emissions, thereby undermining global climate commitments rather than supporting them.

Nevertheless, LNG is also recognized for its operational flexibility and its capacity for integration with renewable energy sources. It provides crucial grid stability, serving as a reliable backup power source when intermittent renewables like wind and solar are not generating electricity. This characteristic is vital for integrating higher shares of variable renewable energy into national grids. The Hawaii State Energy Agency, for example, has emphasized LNG's role as a "bridge fuel" to meet the state's energy needs while supporting long-term decarbonization goals, noting its flexibility in integrating with renewables. Beyond providing backup power, there are ongoing efforts to directly integrate renewable energy sources, such as wind, solar, and hydropower, into LNG facilities themselves. This integration aims to further reduce the carbon footprint of LNG production and optimize operational costs. Moreover, infrastructure originally built for LNG offers the potential for future adaptation to hydrogen-based energy, indicating a pathway for long-term decarbonization beyond its immediate role as a natural gas source. This dual benefit suggests that for many nations, particularly those with high energy demand but limited domestic fossil fuel resources or nascent renewable grids, LNG is not merely a temporary measure but a strategic enabler. Its reliability and flexibility allow for the integration of intermittent renewables by providing stable backup power, thus facilitating a managed transition rather than an abrupt shift. This highlights that the energy transition is not a linear, uniform process but a complex, multi-speed endeavor shaped by diverse national circumstances, where immediate energy security often dictates the pace and pathway of decarbonization.

The Geopolitical Shifts and LNG's Growing Role

The global energy landscape underwent a profound transformation following the Russian invasion of Ukraine, as Europe, in particular, had a substantial reliance on Russian gas for both electricity generation and heating. This geopolitical upheaval led to a dramatic surge in fuel prices and necessitated an urgent re-evaluation of energy security strategies across the continent, prompting a concerted effort to diversify energy sources away from Russia. In response, Europe significantly reduced its dependence on Russian pipeline gas, with imports plummeting from 140 billion cubic meters (bcm) in 2021 to a mere 30 bcm in 2024, and further decreasing to 15 bcm in early 2025 due to the cessation of transit through Ukraine. The European Union's REPowerEU plan, introduced in 2022, explicitly underscored the dual urgency of climate action and energy security, setting an ambitious target to increase the share of renewables to 45% of total energy use by 2030.

In this context of urgent energy diversification, Liquefied Natural Gas emerged as a vital alternative to Russian pipeline gas for Europe. United States (U.S.) LNG exports, in particular, played a critical role in filling the supply void created by the reduction in Russian gas flows, demonstrating their strategic value in global supply chains. U.S. LNG exports have fundamentally reshaped global energy markets by introducing flexible contracts and competitive pricing mechanisms, offering a crucial alternative to traditional suppliers whose supplies were often constrained by geopolitical considerations. This flexibility has significantly enhanced energy security for nations seeking to diversify their energy supplies amidst escalating geopolitical tensions.

The response to Europe's energy crisis, while successful in immediate decoupling from Russian pipeline gas, has inadvertently created new vulnerabilities. The short-term necessity of replacing Russian gas with LNG has led to significant, long-term infrastructure commitments across Europe, including the rapid deployment of Floating Storage and Regasification Units (FSRUs) and the expansion of onshore terminals. This extensive infrastructure build-out, driven by a "gold rush" for new fossil gas production, risks creating a new form of fossil fuel lock-in. Projections indicate that the expanded EU gas supply capacity is likely to exceed demand by 26% (131 bcm) by 2030, leading to potential underutilization and a waste of public funds. This overbuilding could make price volatility a permanent feature of European energy markets, as the region remains exposed to global LNG market fluctuations. Despite the stated goals for decarbonization and increased renewables, the continued and even increased reliance on LNG—including a paradoxical 18% increase in Russian LNG imports in 2024—highlights the complex and often contradictory nature of energy policy in times of crisis. This situation underscores the tension between immediate crisis response and long-term strategic energy transition planning, where emergency measures can become entrenched, potentially hindering the broader energy transition by locking in fossil fuel use and making renewables less competitive.

Major LNG suppliers have played a pivotal role in meeting global demand shifts. The United States solidified its position as the world's largest LNG exporter in 2024, exporting a record 88.4 million tonnes (MT) and surpassing both Qatar and Australia. The U.S. is on track to triple its export capacity by 2030, further cementing its influence in the global market. Qatar remained the third-largest exporter in 2024, with 77.2 MT, while Australia held the second position with 81.0 MT. These major suppliers are actively expanding their liquefaction capacities; for instance, Qatar plans to increase its North Field capacity by an additional 49 MT by 2027. While Europe initially drove a surge in LNG imports following the invasion, Asia reclaimed its position as the leading demand region in 2024, with net imports climbing to 117.97 MT compared to Europe's 100.07 MT. China, Japan, and South Korea collectively accounted for nearly half of global LNG imports in 2024.

Investments in LNG infrastructure across Europe have accelerated significantly. Countries like Poland are advancing their FSRU Terminal Program in the Gulf of Gdańsk, which is projected to satisfy approximately 30% of Poland's current annual natural gas demand by Q1 2028. Italy has also embraced the floating regasification approach, with Snam operating multiple FSRUs. FSRUs offer the advantage of rapid deployment and flexibility, bypassing lengthy permitting procedures often associated with onshore terminals. However, this mobility can also introduce instability; for example, a FSRU charter in Germany was terminated due to pricing disagreements. Some projects, such as France's Cape Ann FSRU, have encountered challenges with high operational costs, raising questions about their long-term commercial viability.

The global LNG market is undergoing a profound transformation, becoming more competitive but also more volatile and complex. The U.S.'s rapid emergence as the world's largest LNG exporter, characterized by flexible contracts and Henry Hub-linked pricing, has fostered greater market liquidity and price convergence globally. This new competitive landscape is compelling other major suppliers, such as Qatar and Russia, to accelerate their own expansion plans to maintain market share. This dynamic is moving the market away from the "old LNG club" with its opaque rules and oil-indexed pricing. However, while increased supply and flexibility offer diversification benefits for importing nations, this dynamic also introduces new forms of risk. The increased global supply, driven by a "race to monetize" resources, contributes to market volatility, which can make LNG unaffordable for developing countries during supply shocks. Furthermore, the sheer volume of new supply coming online raises concerns about a looming glut, which could depress prices below production costs and create significant financial risks for the industry. This competitive dynamic, while potentially lowering prices in the long run, also risks incentivizing an oversupply of LNG infrastructure that could hinder the broader energy transition by locking in fossil fuel use and making renewables less competitive.

The global political significance of LNG lies in its role in diversifying energy sources and enhancing energy security. U.S. LNG exports, in particular, have contributed to global price stability and supply security, fostering novel competition in the LNG trade. This has reduced reliance on adversarial energy suppliers and traditional fossil fuel-extractive regions. However, rising global dependence on natural gas also creates new vulnerabilities, including pricing fluctuations, shipping route bottlenecks, and inherent health, safety, and environmental hazards, particularly from methane leakage. Geopolitical risks, such as the Russian invasion of Ukraine, have been shown to significantly increase the cost of spot charter rates for LNG carriers, highlighting the market's sensitivity to global tensions.

Table 1: Global LNG Trade by Region (2024 Data)

| Category | Metric | Value (2024) | Source |

|---|---|---|---|

| Total Global LNG Trade | Million Tonnes (MT) | 411.24 | IGU, 2025; ET EnergyWorld, 2024; Safety4Sea, 2024 |

| Top Exporting Regions | |||

| Asia Pacific | MT (Change YOY) | 138.91 (+4.10) | IGU, 2025; Safety4Sea, 2024 |

| Middle East | MT (Change YOY) | 94.25 (-0.44) | IGU, 2025 |

| North America | MT (Change YOY) | 88.64 (+4.11) | CompressorTECH², 2025; Energy In Depth, 2025 |

| Africa | MT (Change YOY) | 37.98 (-2.31) | Safety4Sea, 2024 |

| Top Exporting Countries | |||

| United States | MT | 88.4 | CompressorTECH², 2025; Energy In Depth, 2025 |

| Australia | MT | 81.0 | CompressorTECH², 2025 |

| Qatar | MT | 77.2 | CompressorTECH², 2025 |

| Russia | Change YOY (MT) | +2.16 | Safety4Sea, 2024 |

| Indonesia | Change YOY (MT) | +2.02 | Safety4Sea, 2024 |

| Mexico & Congo | Status | New exporters (FLNG) | CompressorTECH², 2025; IGU, 2025 |

| Top Importing Regions | |||

| Asia Pacific | MT (Change YOY) | 165.09 (+9.77) | IGU, 2025; Safety4Sea, 2024 |

| Asia (broader) | MT (Change YOY) | 117.97 (+12.48) | CompressorTECH², 2025; IGU, 2025; Safety4Sea, 2024 |

| Europe | MT (Change YOY) | 100.07 (-21.22) | CompressorTECH², 2025; IGU, 2025; Safety4Sea, 2024 |

| Top Importing Countries | |||

| China | MT (Change YOY) | 78.64 (+7.45) | CompressorTECH², 2025; IGU, 2025; Safety4Sea, 2024 |

| Japan | MT | 67.72 | CompressorTECH², 2025; IGU, 2025; Safety4Sea, 2024 |

| South Korea | MT (Change YOY) | 47.01 (+1.84) | CompressorTECH², 2025; IGU, 2025; Safety4Sea, 2024 |

| India | MT (Change YOY) | 26.1 | CompressorTECH², 2025; IGU, 2025; Safety4Sea, 2024 |

| UK | MT (Change YOY) | 8.03 (-6.48) | IGU, 2025 |

| Global Liquefaction Capacity | Million Tonnes Per Annum (MTPA) | 494.4 (+6.5 YOY) | CompressorTECH², 2025; IGU, 2025 |

| Global Regasification Capacity | Million Tonnes (MT) | 1064.7 (+66.6 YOY) | Safety4Sea, 2024 |

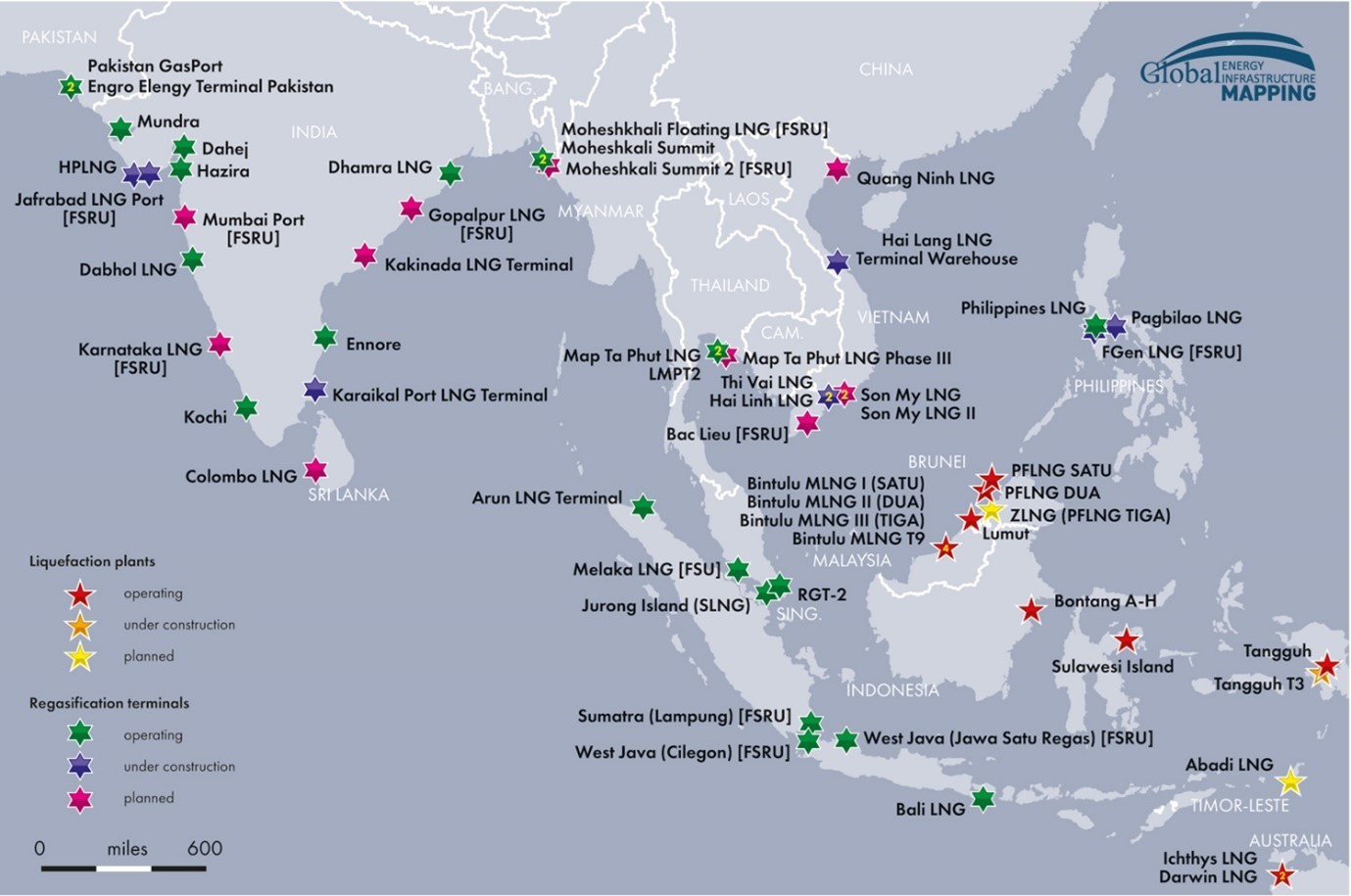

LNG Infrastructure in Southeast Asia

Southeast Asia is currently experiencing rapid economic growth and urbanization, which is driving a substantial increase in its energy consumption. The region is projected to become one of the primary engines of global energy demand growth over the next decade, anticipated to account for 25% of the total global increase between 2025 and 2035. Within this burgeoning demand, electricity consumption alone is forecast to surge at an annual rate of 4%. In response to these escalating energy needs, natural gas is poised to become a cornerstone of Southeast Asia's energy landscape, with projections indicating it could account for up to 30% of the region's primary energy mix by 2050. The demand for natural gas is expected to surpass that of both oil and coal, driven by continued economic expansion, the proliferation of data centers, the intermittent nature of renewable energy sources, and a deliberate shift from coal to gas-fired power generation. The region is expected to transition to a net LNG importer by 2025, with annual imports potentially exceeding 130 bcm by 2050. Overall LNG demand in Asia, encompassing Southeast Asia, is projected to nearly double by 2050.

In light of this growing demand, countries across Southeast Asia are making substantial investments in LNG infrastructure, including import terminals, storage facilities, and gas-fired power plants. Thailand, for example, is actively pursuing ambitions to become a regional LNG trading hub. This involves plans to increase LNG imports and the construction of a third LNG storage facility at Map Ta Phut with a 5 MTPA capacity, complementing its existing terminals with capacities of 11.5 MTPA and 7.5 MTPA. Thailand already possesses sufficient storage capacity and is exploring opportunities for LNG re-export. Vietnam has demonstrated its commitment to this transition by reducing its preferential import tariff on LNG from 5% to 2%, aiming to incentivize clean energy investment. Under its Power Development Plan VIII, Vietnam intends to construct 23 gas-fired power projects by 2030, with 13 of these, totaling a combined capacity of 22,400 MW, designed to run on imported LNG. The Nhơn Trạch 3 power plant, Vietnam's inaugural LNG-to-power facility utilizing imported gas, was connected to the national grid in February 2025. Similarly, the Philippines has expanded its regasification infrastructure, commencing LNG imports in 2023.

The ambitious LNG growth projections for Southeast Asia, while responding to immediate energy needs, are underpinned by a fragile foundation of financial, regulatory, and supply chain challenges. Securing international financing for LNG projects in Southeast Asia remains a significant hurdle, partly due to the "novelty" of the investment model in certain countries. International lenders often require stringent guarantees, such as minimum purchase volumes of 70-80%, and clear pass-through pricing mechanisms, which are frequently lacking in the region. Furthermore, the affordability of LNG itself presents a substantial challenge, often necessitating government support through subsidies, tax incentives, or other favorable policies to ensure project viability. Beyond financial considerations, fragmented or unclear regulatory frameworks, particularly concerning power purchase agreements and pricing, create considerable uncertainty and complicate long-term project planning and sustainability. These issues collectively increase the risk profile of LNG investments in the region, potentially leading to higher costs for consumers and governments, and making LNG less competitive against rapidly deploying renewables. A holistic and integrated policy approach, addressing these systemic challenges, is crucial to de-risk the energy sector and ensure a more resilient and truly sustainable energy future for Southeast Asia.

The massive expansion of LNG infrastructure, including the construction of numerous LNG carriers and floating terminals, introduces significant environmental concerns. This build-out threatens to lock in decades of carbon emissions, potentially undermining global climate commitments. LNG carriers themselves are highly emissions-intensive, with a single vessel contributing nearly 370 million tonnes of CO2 equivalent emissions over its 30-year lifespan. A persistent problem throughout the entire LNG value chain is methane leakage; even leaks as small as 3.5% of total gas volume can negate any potential CO2 advantages LNG might have over coal in electricity generation over a 20-year timeframe. The environmental impact of these projects is also directly felt by local coastal communities. Moreover, despite the region's focus on LNG, clean energy technologies are not expanding quickly enough to meet decarbonization targets. Southeast Asia attracts only 2% of global clean energy investment despite accounting for 6% of global GDP, highlighting a significant investment gap. If this gap is not addressed, the continued reliance on fossil fuels, including LNG, will lead to an increase in CO2 emissions, hindering the region's climate goals. This situation exemplifies the global dilemma of balancing immediate energy security and economic development with long-term climate action. While LNG offers a pragmatic solution for current energy needs, the risk of creating entrenched fossil fuel dependencies is high. This suggests that without robust policy interventions to accelerate clean energy investment and clear exit strategies for LNG, the region's energy transition may be slower and more carbon-intensive than global climate targets require, potentially leading to stranded assets in the future.

Furthermore, the region's increasing reliance on imported LNG exposes it to global market volatility, supply constraints, and shipping bottlenecks. Delays in new liquefaction projects and geopolitical tensions affecting trade routes can lead to tighter supply conditions and increased price volatility, directly impacting the affordability and demand for LNG within Southeast Asia. For instance, despite Vietnam receiving its first LNG shipment in 2023, delays in power plant commissioning have hindered full-scale adoption, while Thailand has sought to minimize LNG imports by balancing gas-fired generation with domestic energy sources.

Table 2: Projected LNG Consumption and Production in Southeast Asia (2025-2050)

| Metric | Projection | Source |

|---|---|---|

| Projected LNG Demand Growth | ||

| Increase over next decade | ~182% | Wood Mackenzie, n.d. |

| Demand nearly doubles by | 2050 | ANGE Association, n.d. |

| Natural gas demand CAGR (until 2035) | 3.1% | Wood Mackenzie, n.d. |

| Overall natural gas consumption increase (2025-2050) | ~89.5% | Wood Mackenzie, n.d. |

| Natural Gas Share in Primary Energy Mix | Up to 30% by 2050 | Wood Mackenzie, n.d. |

| Net Importer Status for Natural Gas | By 2025 | IEA, 2022 |

| Projected Natural Gas Import Volume | >130 bcm/year by 2050 | IEA, 2022 |

| Clean Energy Investment Gap | Region attracts only 2% of global clean energy investment despite 6% of global GDP | IEA, 2025 |

| Potential Coal Use (if US LNG not built) | Additional 95 million tonnes annually by 2035 | ANGE Association, n.d. |

LNG as a Transition Fuel: Technical and Economic Considerations

Liquefied Natural Gas is commonly characterized as a "bridge fuel" or "transition fuel," serving as an intermediary energy source between more carbon-intensive fossil fuels and a future dominated by renewable energy. This designation stems from its ability to offer a cleaner alternative to traditional fossil fuels like coal and oil. When combusted, natural gas produces significantly fewer greenhouse gas emissions, notably lower levels of carbon dioxide (CO2), sulfur dioxide (SO2), and nitrogen oxides (NOx), and nearly 100% fewer particulate pollutants compared to coal and oil. This reduction in emissions at the point of combustion is a key argument for its transitional role. Furthermore, LNG's inherent flexibility and broad applicability make it a vital component for ensuring energy security, particularly in balancing electricity grids that are increasingly integrating intermittent renewable energy sources. LNG-fired power plants can provide crucial grid stability, acting as a reliable backup power source when renewable generation from sources like wind and solar fluctuates or dips. This characteristic makes LNG a pragmatic choice for regions aiming for high renewable integration, such as Hawaii, where it is considered "necessary to meet state's renewable goals". Beyond its immediate role in power generation, infrastructure initially developed for LNG has the potential for future adaptation to transport hydrogen-based energy, suggesting a pathway for long-term decarbonization beyond its current use as a fossil fuel.

From a technical standpoint, modern LNG-fired power plants primarily utilize Combined Cycle Gas Turbine (CCGT) technology, which significantly enhances their operational efficiency. CCGT plants achieve a best-in-class thermal efficiency of approximately 64% in base-load operation. This efficiency stands in stark contrast to single-cycle steam power plants, which are typically coal-fired and limited to efficiencies ranging from 35% to 42%. Consequently, advanced natural gas plants can emit between 50% and 60% less CO2 than traditional coal plants and about 30% less than oil-fired plants for equivalent energy output. A key operational advantage of gas turbines is their ability to start very quickly, providing immediate power response, although the full efficiency of the combined cycle is realized over a longer period as the steam cycle ramps up. This rapid response capability is crucial for grid stability, especially when integrating variable renewable energy sources.

However, the economic considerations surrounding LNG infrastructure are complex, marked by high costs, market volatility, and the implications of long-term contracts. Developing large natural gas resources and the associated LNG export projects is inherently capital-intensive and expensive. Developers of LNG terminals face escalating costs, labor shortages, and intense competition for skilled personnel, which can significantly impact project timelines and budgets. The global LNG market is characterized by substantial price volatility, which complicates long-term forecasting and exposes investors to considerable risk. Instances such as Venture Global experiencing significant shareholder value losses due to an inability to accurately project short-term results underscore the unpredictable nature of LNG exports. In this environment, feedstock price volatility is often cited as the only consistent expectation.

Long-term LNG contracts have traditionally dominated the international market, providing the necessary security to finance large, long-lived, capital-intensive investments by reducing cash flow variability. However, these contracts can also introduce market inflexibility. While they secure financing for liquefaction plants and pipelines, they may limit the ability of contracting parties to capitalize on profitable short-term trading opportunities that arise from increased market liquidity. The market has seen a trend towards more flexible long-term contracts, allowing for quantity adjustments and greater destination flexibility, but geopolitical fragmentation can still lead to trade disruptions and impact efficiency. For instance, Qatar has increasingly pushed for destination clauses in its contracts, which restrict the resale or redirection of its LNG, straining relations with traditional markets like Japan. The European Union's proposed "maximum methane intensity values" for imported fossil fuels by 2030 could also create a two-tier LNG market, adding another layer of complexity and potential trade tensions.

When comparing LNG's competitiveness with renewable energy sources, a nuanced perspective emerges. While LNG offers reliability and lower combustion emissions than coal, it faces intense competition from renewables in terms of both cost and energy security. In many emerging markets, electricity generation from LNG can be significantly more expensive than some renewable energy options. For example, in China, solar and onshore wind are the cheapest sources of power, often $30-90 per megawatt-hour (MWh) lower than gas generation, hindering LNG's ability to displace coal. This cost differential is a major factor, as high and volatile LNG prices have led some buyers to reverse plans centered on greater LNG consumption, opting instead for new coal generation and renewables. From an energy security perspective, renewables generally offer greater long-term security due to their local availability, reduced dependence on imports, and lower vulnerability to geopolitical disruptions compared to LNG, which relies on complex global supply chains. The volatility in global markets and escalating tensions with suppliers have further weakened the economic case for LNG in some regions.

The Methane Leakage Issue and LNG's Climate Impact

The environmental implications of Liquefied Natural Gas extend beyond its combustion emissions, with a significant concern revolving around methane leakage throughout its entire value chain. Methane, the primary component of natural gas, can escape into the atmosphere during extraction, processing, liquefaction, transportation, and regasification. This fugitive methane poses a substantial environmental challenge because of its potent global warming potential (GWP). Methane is a powerful heat-trapping gas, estimated to be more than 80 times more powerful than carbon dioxide (CO2) over a 20-year period. Scientists estimate that the increase in atmospheric methane concentration over the past two centuries is responsible for 20% to 30% of climate warming since the Industrial Revolution. Even small methane leaks, as low as 2.8% to 3.5% of total gas volume, can negate any potential climate benefits LNG might offer over coal in terms of CO2 emissions at the point of combustion. This means that while LNG may burn cleaner, its overall greenhouse gas footprint, when considering upstream emissions and leakage, can be significantly higher than coal.

Recognizing the critical impact of methane emissions, significant advancements have been made in technologies for their detection and mitigation. Satellite monitoring has emerged as a game-changer, offering the potential to revolutionize methane detection at a global scale. Organizations like the Environmental Defense Fund have launched satellites specifically to spot methane emissions globally and share data with governments and industries. Instruments such as NASA's Airborne Visible InfraRed Imaging Spectrometer - Next Generation (AVIRIS-NG) and the Earth Surface Mineral Dust Source Investigation (EMIT) instrument on the International Space Station can detect large methane sources, known as "super-emitters," from oil and gas production, pipelines, refineries, and landfills. These space-based technologies provide frequent and spatially continuous observations, although they may have lower sensitivity to smaller methane concentration enhancements. The data from these satellites has been instrumental in identifying large methane plumes, for instance, in the Permian basin.

Beyond satellite capabilities, ground-based and aerial technologies also play a crucial role. Optical Gas Imaging (OGI) cameras, which use infrared technology, allow operators to "see" otherwise invisible methane emissions as dark plumes or clouds. These handheld or portable cameras can instantly confirm the presence of a leak, with high-end models capable of detecting small leaks from significant distances. Laser-based sensors, typically portable handheld devices, can be aimed at suspected sources to detect methane from distances exceeding 300 feet, offering high accuracy and ease of use. Fixed sensors, installed onsite, can provide uninterrupted or scheduled air quality sampling and instant analysis, allowing for comprehensive coverage of large facilities and immediate alerts at the first sign of leakage. Drones equipped with laser-based systems can sweep over large areas, while smaller, vertically agile drones are well-suited for identifying leaks from individual pieces of equipment or hard-to-reach places. While these technologies are powerful, some limitations exist, such as the need for a temperature difference for OGI cameras, reduced effectiveness in adverse weather conditions, and the challenge of pinpointing the exact source of a leak within a large industrial site from satellite imagery.

In addition to methane mitigation, Carbon Capture and Storage (CCS) technologies are being explored as a means to further reduce LNG's climate impact. CCS involves capturing CO2 emissions from fossil fuel-based power generation and industrial processes before they enter the atmosphere and storing them permanently, typically in underground geological formations. This technology is considered a crucial tool for mitigating climate change, enabling the continued use of fossil fuels while reducing CO2 emissions. Qatar, a major LNG exporter, has included 7 MTPA of CCS capacity as part of its upcoming LNG expansion plans, positioning itself among leaders in emissions-reduction initiatives within the LNG value chain. While CCS primarily addresses CO2, its deployment alongside methane mitigation efforts could contribute to a lower overall carbon footprint for LNG operations, helping to "green" fossil fuel industries for future viability.

The Financial Risks of LNG Infrastructure Investment

Investing in Liquefied Natural Gas infrastructure carries significant financial risks, particularly concerning the potential for stranded assets and the broader transition to cleaner energy systems. Stranded assets refer to investments that become obsolete or lose value prematurely due to unforeseen changes, such as policy shifts, technological advancements, or market dynamics. In the context of LNG, this risk is amplified by global climate policies, including net-zero emission targets and carbon budgets, which necessitate a reduction in fossil fuel consumption. For instance, the International Energy Agency's (IEA) net-zero roadmap suggests that no new oil and gas fields should be approved for development from 2021 onwards, implying a very limited role for LNG by 2050. Companies building LNG assets with expected lifespans of 50 years face a disparity between their financial analysts' predictions and the realities of sustainability targets, creating a real potential for stranded assets if these facilities cannot meet future emissions targets or be repurposed.

Beyond policy, economic drivers also contribute to stranding risk. Price volatility in the global gas market can significantly impact profitability. The IEA's World Energy Outlook 2024 points to a challenging decade for the LNG industry, forecasting a surge in supply that is set to outstrip demand, creating an LNG supply glut that could persist well into the 2030s. This oversupply is likely to depress LNG prices well below long-run production costs, representing a major financial risk for new LNG projects. Furthermore, the rapid advancement and cost reduction of renewable energy technologies pose a direct competitive threat, potentially leading to an economically driven decarbonization of the power sector that reduces demand for fossil fuels. For example, in emerging markets, LNG has been found to be uncompetitive with renewables, leading some countries to reverse plans for LNG-to-power projects in favor of solar PV.

The reliance on long-term LNG contracts, while crucial for securing financing for capital-intensive projects, can also create market inflexibility. These contracts, which traditionally dominated the LNG market, provide debt capacity by ensuring predictable cash flows. However, they may limit the ability of contracting parties to adapt to rapid market changes or take advantage of profitable ephemeral trading opportunities. While contracts have evolved to include more flexibility in terms of volume and destination, geopolitical fragmentation and new regulations, such as the EU's methane intensity values, could further reduce the efficiency of global LNG trade and lead to market polarization. The need for long-term commitments to secure investment clashes with the increasing competitiveness of renewables and the imperative to decarbonize, creating a dilemma for investors and governments.

The risks of overbuilding LNG infrastructure are substantial, as demand might not meet current projections due to increasing competitiveness from renewable energy and energy efficiency improvements. Campaign groups warn that plans for new LNG export terminals could unleash more than 10 gigatonnes of carbon emissions, with banks and investors providing hundreds of billions in financing despite nominal net-zero commitments. The IEA's most conservative transition scenario, aligned with 2.4°C of warming, indicates no need for any new LNG projects beyond those existing and under construction until 2040 at the earliest, with significant oversupply expected before then. Absorbing such a large new supply would necessitate new LNG demand, effectively displacing renewable technologies and energy efficiency improvements, thereby slowing the energy transition and jeopardizing climate goals. This oversupply creates a critical financial risk for the LNG industry, as revenues may fail to meet expectations, leading to asset impairment and write-downs, as seen in other sectors facing demand collapse. The "stranded asset hypothesis," though sometimes dismissed, remains a very real risk as fossil fuel demand begins to peak.

ESG Considerations and the LNG Industry

Environmental, Social, and Governance (ESG) factors have become increasingly critical in shaping investment decisions and operational strategies within the LNG industry. The long-lived and capital-intensive nature of LNG projects—with a single liquefaction train potentially costing around $3 billion and operating for over thirty years—naturally attracts investors' current and long-term ESG assessments. There has been a marked increase in sustainable investing, with capital flows into sustainable funds quadrupling in 2019 compared to 2018, and a significant rise in funds that incorporate ESG criteria. This trend indicates that ESG compliance is no longer merely a moral imperative but a business necessity, influencing credit ratings, access to capital, and overall competitiveness. Companies with strong ESG profiles can secure more attractive and flexible financing and potentially lower capital costs, reinforcing their cost competitiveness.

The social and environmental impacts of LNG projects are central to ESG considerations. Environmentally, the primary concern remains methane emissions throughout the LNG value chain, from production to transportation and regasification. While the industry aims to reduce these emissions, their potent global warming potential means that even small leaks can undermine LNG's role in climate mitigation. Socially, LNG projects have significant implications for local communities. This includes managing socioeconomic impacts such as road traffic, potential spread of diseases, and population shifts, as well as ensuring fair treatment of all stakeholders, including employees and local populations. Community engagement and grievance management are crucial for building positive, long-term relationships and obtaining a "social license to operate". On the positive side, LNG projects can contribute to job creation and economic development in host regions.

Strong ESG practices are instrumental in helping LNG companies access capital and secure regulatory approvals. Robust climate reporting frameworks, which provide reliable and audit-ready data, are pivotal for investors to understand and price climate risk. Companies that invest early in building internal capabilities for climate scenario modeling, geospatial risk analysis, and emissions forecasting are better positioned to attract patient capital. Regulatory bodies, particularly in Europe, are increasing scrutiny on methane emissions, leading to greater transparency and compliance obligations within the LNG trade. Adhering to these evolving standards is essential for maintaining market access and avoiding potential trade barriers. The integration of ESG considerations into decision-making can also lead to increased operational efficiencies, reduced costs, and higher valuations.

Several companies are actively incorporating ESG considerations into their LNG projects. NextDecade, for example, emphasizes its commitment to operating in an ethically, environmentally, and socially responsible manner, focusing on safety, environmental protection, community support, and employee development. Their Rio Grande LNG project is designed to meet or exceed all environmental and regulatory requirements, including strict standards governing impacts on air, land, water, and wildlife. ENGIE, another energy major, has detailed its strategy and action plan to achieve its Net Zero Carbon target by 2045, with an independent report confirming its climate strategy's alignment with a 1.5°C trajectory and assessing its implementation as "solid" and governance as "Tier 1". These examples illustrate a growing recognition within the industry that proactive ESG integration is not just about compliance but about strengthening competitiveness and ensuring long-term viability in a decarbonizing world. Studies on the Indonesian energy sector also indicate that companies with high ESG scores tend to have better financial performance and are more attractive to investors, despite some perspectives suggesting that ESG implementation might increase costs. This suggests that investing in ESG is increasingly viewed as an asset that positively contributes to financial performance and reputation.

Conclusion

Liquefied Natural Gas occupies a complex and often contradictory position within the global energy transition. It has undeniably emerged as a pivotal fuel, offering a flexible and geographically diverse energy source that enhances energy security, particularly evident in Europe's post-Ukraine invasion strategy. Its ability to displace more carbon-intensive coal and oil in power generation, coupled with the high efficiency of modern combined-cycle gas turbines, presents a compelling argument for its role as a transition fuel. Furthermore, the potential for LNG infrastructure to be adapted for future hydrogen use offers a pathway for long-term decarbonization.

However, the narrative of LNG as a straightforward "bridge" is significantly complicated by its full life-cycle environmental impact, particularly concerning methane leakage. The potent global warming potential of methane means that even small fugitive emissions can negate the greenhouse gas benefits achieved at the point of combustion, raising serious questions about LNG's compatibility with ambitious climate targets. The rapid expansion of LNG infrastructure, especially in energy-hungry regions like Southeast Asia, also presents substantial financial risks, including the potential for stranded assets due to evolving climate policies, increasing renewable energy competitiveness, and market volatility. The risk of overbuilding capacity, leading to a global supply glut, could further undermine the economic viability of new projects and inadvertently slow the broader energy transition by creating a disincentive for renewable energy adoption.

The future outlook for LNG is thus characterized by a delicate balance between its perceived benefits and its inherent challenges. While it will likely continue to play a crucial role in providing energy security and grid stability, especially as renewable energy penetration increases, its long-term viability hinges on aggressive and verifiable methane emissions mitigation across the entire value chain. The increasing importance of Environmental, Social, and Governance (ESG) factors in investment decisions underscores the growing pressure on LNG companies to demonstrate robust environmental stewardship and social responsibility. Strong ESG practices are becoming essential not only for regulatory approvals but also for accessing capital in a financial landscape increasingly prioritizing sustainability.

Ultimately, LNG's contribution to a sustainable energy future will depend on a concerted global effort. This includes continued technological advancements to minimize methane leakage and explore carbon capture and storage solutions, a commitment to integrating LNG with renewable energy systems in a manner that truly accelerates decarbonization, and robust governance frameworks that ensure transparency and accountability. Without these critical measures, the expansion of LNG risks becoming a prolonged dependency on fossil fuels rather than a genuine stepping stone towards a net-zero energy system.

References

Agarwal, R., Rainey, T. J., Steinberg, T., Rahman, S. M. A., Perrons, R. K., & Brown, R. (2020). LNG regasification — Effects of project stage decisions on capital expenditure and implications for gas pricing. Journal of Natural Gas Science and Engineering, 78, 103291.

American Security Project. (2025). White Paper: Strategic Implications of U.S. LNG Exports. Retrieved from https://www.americansecurityproject.org/white-paper-strategic-implications-of-u-s-lng-exports/

ANGE Association. (n.d.). Natural Gas Statistics. Retrieved from https://angeassociation.com/resource/natural-gas-statistics/

Atlantic Council. (2025). The importance of US LNG for economic growth and the global energy transition. Retrieved from https://www.atlanticcouncil.org/content-series/global-energy-agenda/the-importance-of-us-lng-for-economic-growth-and-the-global-energy-transition/

AXA IM. (2024). Liquefied natural gas and the energy transition: The methane challenge. Retrieved from https://www.axa-im.com/our-stories/liquefied-natural-gas-and-energy-transition-methane-challenge

Bangkok Post. (2025, May 10). LNG imports may create hub status. Retrieved from https://www.bangkokpost.com/business/general/3022182/lng-imports-may-create-hub-status

Barbosa, A. de S., Crispim, M. C., Silva, L. B. da, Morioka, S. N., & Souza, V. F. de. (2023). Integration of Environmental, Social, and Governance (ESG) criteria: their impacts on corporate sustainability performance. Humanities and Social Sciences Communications, 10(1).

Bauer, A., Denier van der Gon, H. A. C., & Maas, R. (2021). Methane emissions from the oil and gas industry: A review of recent data and implications for climate policy. Environmental Research Letters, 16(11), 114022.

Blessing, N. J. (2025). Carbon Capture and Storage Technologies: Mitigating Climate Change. World Journal of Advanced Research and Reviews, 18(3), 243-265.

Bressand, A. (2022). The geopolitical implications of LNG in global energy markets. Energy Policy, 156, 112427.

Búa, M. R., Fontes, C. E., & Vazquez, P. (2023). Environmental, Social, and Governance (ESG) Performance and Investment Efficiency: The Energy Sector Indonesia. Journal of Economics, Finance and Management Studies, 6(8).

Certrec. (2022, November 14). Natural Gas is More Efficient Than Coal-Fired Power Generation. Retrieved from https://www.certrec.com/blog/natural-gas-is-more-efficient-than-coal-fired-power-generation/

Chaabane, M., Al-Ghafri, S., & Al-Hashmi, A. (2011). LNG as a bridge fuel in the transition to renewable energy. Energy Procedia, 1(1), 295-302.

Climate Action Tracker. (2022, June 8). Energy crisis reaction: A global fossil gas gold rush. Retrieved from https://climateactiontracker.org/documents/1055/CAT_2022-06-08_Briefing_EnergyCrisisReaction.pdf

Columbia University. (2025). The Future of LNG Trade: Inflexible, Inefficient, and Polarized? Retrieved from https://www.energypolicy.columbia.edu/the-future-of-lng-trade-inflexible-inefficient-and-polarized/

Common Dreams. (2025, January 17). Expanding LNG Over Renewable Energy Is Economic and National Security Failure: Report. Retrieved from https://www.commondreams.org/news/lng-vs-renewables

CompressorTECH². (2025, May 22). Qatar holds firm in global LNG rankings despite slight export dip. Retrieved from https://www.compressortech2.com/news/qatar-holds-firm-in-global-lng-rankings-despite-slight-export-dip/8061874.article

Dechert. (n.d.). Significant potential for growth in LNG-to-power sector in Southeast Asia. Retrieved from https://www.naturalgasworld.com/significant-potential-for-growth-in-lng-to-power-sector-in-southeast-asia-interview-119096

DOE. (2018, March 15). Global LNG Fundamentals. Retrieved from https://www.energy.gov/sites/prod/files/2018/03/f49/Global%20LNG%20Fundamentals%2C%20Updated%203.15.18.pdf

DOE. (2024, December 20). 2024 LNG Export Study: Energy, Economic, and Environmental Assessment of U.S. LNG Exports. Retrieved from https://www.federalregister.gov/documents/2024/12/20/2024-30370/2024-lng-export-study-energy-economic-and-environmental-assessment-of-us-lng-exports

E&E News. (2025, April 7). Trump bid to spur LNG projects hits harsh economic realities. Retrieved from https://www.eenews.net/articles/trump-bid-to-spur-lng-projects-hits-harsh-economic-realities/

Eco-Business. (2023, February 15). LNG assets risk being stranded in net-zero scenario: experts. Retrieved from https://www.eco-business.com/news/lng-assets-risk-being-stranded-in-net-zero-scenario-experts/

Ember. (2025, March 19). The final push for EU Russian gas phase-out. Retrieved from https://ember-energy.org/latest-insights/the-final-push-for-eu-russian-gas-phase-out/

Energy In Depth. (2025, January 31). Hawaii State Energy Agency: LNG Necessary to Meet State's Renewable Goals. Retrieved from https://www.energyindepth.org/hawaii-state-energy-agency-lng-necessary-to-meet-states-renewable-goals/

ENGIE. (2025, February 13). LNG: A Cornerstone of Energy Transition and Security. Retrieved from https://gems.engie.com/lng-a-cornerstone-of-energy-transition-and-security/

ET EnergyWorld. (2024, May 23). Global LNG trade grows 2.4% to 411.24 MT in 2024; Asia leads rebound in demand. Retrieved from https://energy.economictimes.indiatimes.com/news/oil-and-gas/global-lng-trade-grows-2-4-to-411-24-mt-in-2024-asia-leads-rebound-in-demand/121351992

ExxonMobil. (2023). Managing socioeconomic impacts. Retrieved from https://corporate.exxonmobil.com/sustainability-and-reports/sustainability/contributing-to-communities/managing-socioeconomic-impacts

Gas Outlook. (2025, March 19). Satellites: a game-changer for methane leak detection? Retrieved from https://gasoutlook.com/analysis/satellites-a-game-changer-for-methane-leak-detection/

GAZ-SYSTEM. (2025, April 3). FSRU Terminal Program enters its crucial phase -- GAZ-SYSTEM has selected the Contractor for the jetty and the offshore pipeline. Retrieved from https://www.gaz-system.pl/en/for-media/press-releases/2025/april/03-04-2025-fsru-terminal-program-enters-its-crucial-phase-gaz-system-has-selected-the-contractor-for-the-jetty-and-the-offshore-pipeline.html

Guan, Q., & Zhang, L. (2021). Monitoring methane emissions using satellite technology. Environmental Monitoring and Assessment, 193(4), 12.

Hartley, P. R. (2009). The Future of Long-term LNG Contracts. Retrieved from https://www.researchgate.net/publication/272416905_The_Future_of_Long-term_LNG_Contracts

Honeywell. (2024, October 15). Liquefied Natural Gas: What to Know & Why It's Important. Retrieved from https://www.honeywell.com/us/en/news/2024/10/liquefied-natural-gas-what-to-know-and-why-its-important

Howarth, R. W. (2024). LNG is worse for the climate than coal -- new study. Gas Outlook. Retrieved from https://gasoutlook.com/analysis/lng-is-worse-for-the-climate-than-coal-new-study/

IEEFA. (2024, April 25). Risks mount: World Energy Outlook confirms LNG supply glut looms. Retrieved from https://ieefa.org/resources/risks-mount-world-energy-outlook-confirms-lng-supply-glut-looms

IEEFA. (2025, May 5). LNG market volatility clouds Venture Global forecasts, even with long-term contracts in place. Retrieved from https://ieefa.org/resources/lng-market-volatility-clouds-venture-global-forecasts-even-long-term-contracts-place

IEEFA. (2025, May 5). Understanding the competitive landscape of China's LNG market. Retrieved from https://ieefa.org/resources/understanding-competitive-landscape-chinas-lng-market

IEEFA. (2025, May 19). ESG investments may be fading, climate risk isn't. Retrieved from https://ieefa.org/resources/esg-investments-may-be-fading-climate-risk-isnt

IEEFA & SFOC. (2025, February 27). Is LNG Bad for the Environment? Panel Experts Say Yes. Retrieved from https://energytracker.asia/is-lng-bad-for-the-environment/

IGU. (2025, May 22). 2025 World LNG Report. Retrieved from https://www.igu.org/press-releases/2025-world-lng-report-press-release

IEA. (2022). Southeast Asia Energy Outlook 2022. Retrieved from https://www.iea.org/reports/southeast-asia-energy-outlook-2022/key-findings

IEA. (2025, May 15). Southeast Asia's role in the global energy system is set to grow strongly over next decade. Retrieved from https://www.iea.org/news/southeast-asias-role-in-the-global-energy-system-is-set-to-grow-strongly-over-next-decade

J.P. Morgan Research. (2025, February 20). Liquefied natural gas outlook. Retrieved from https://www.jpmorgan.com/insights/global-research/commodities/liquefied-natural-gas

JPT. (2025, April 1). The Influence of ESG on Oil and Gas Companies. Retrieved from https://jpt.spe.org/the-influence-of-esg-on-oil-and-gas-companies

Liu, M., Ma, X., & Zhang, X. (2022). Role of LNG in the transition to a low-carbon future. Energy Reviews, 42, 2568-2581.

LNG Industry. (2025, September 10). The pivotal role of LNG in the global energy transition. Retrieved from https://www.lngindustry.com/special-reports/10092024/the-pivotal-role-of-lng-in-the-global-energy-transition/

MBA-NRG. (2025, January 31). Embracing Renewable Energy Integration In LNG Construction For A Sustainable Future. Retrieved from https://mba-nrg.com/renewable-energy-integration-lng-construction/

Michail, N. A., & Melas, K. D. (2022). The impact of geopolitical risk on LNG and LPG carrier freight rates. The Journal of Energy Markets, 15(3), 243-265.

NASA. (n.d.). Methane: Vital Signs -- Climate Change. Retrieved from https://climate.nasa.gov/vital-signs/methane/

NextDecade. (2025). LNG ESG. Retrieved from https://www.next-decade.com/esg/

Palti-Guzman, E. (2021). The Geopolitics of U.S. LNG Exports. Center for Strategic and International Studies. Retrieved from https://csis-website-prod.s3.amazonaws.com/s3fs-public/210301_Palti-Guzman_US_LNG.pdf

Pembina Institute. (2025, January 22). Climate change as a financial risk: stranded assets. Retrieved from https://www.pembina.org/blog/climate-change-financial-risk-stranded-assets

Quantum Capital. (2025, January 9). QCG 2024 ESG Report. Retrieved from https://www.quantumcap.com/wp-content/uploads/2025/01/QCG_2024_ESG_Report_vF_01.09.2025.pdf

Reclaim Finance & BankTrack. (2025, May 20). LNG and plastics: The stranded asset risk stalking the fossil fuel industry. Retrieved from https://www.businessgreen.com/news-analysis/4386254/lng-plastics-stranded-asset-risk-stalking-fossil-fuel-industry

ResearchGate. (2024, September). Exploring the Impact of ESG Practices on Financial Performance: The Moderating Effect of Green Innovation in the Indonesian Energy Sector. Retrieved from https://www.researchgate.net/publication/383874206_Exploring_the_Impact_of_ESG_Practices_on_Financial_Performance_The_Moderating_Effect_of_Green_Innovation_in_the_Indonesian_Energy_Sector

Riviera Maritime Media. (2025, March 19). FSRUs on the move: Europe's shifting LNG map. Retrieved from https://www.rivieramm.com/news-content-hub/news-content-hub/fsrus-on-the-move-europes-shifting-lng-map-84406

Riviera Maritime Media. (2025, February 19). The fragile equilibrium between LNG demand growth in Asia. Retrieved from https://www.rivieramm.com/news-content-hub/news-content-hub/the-fragile-equilibrium-between-lng-demand-growth-in-asia-83754

Safety4Sea. (2024, May 23). IGU World LNG Report: LNG trade grew by 2.4% in 2024. Retrieved from https://safety4sea.com/igu-world-lng-report-lng-trade-grew-by-2-4-in-2024/

Saiz-Lopez, A., Cuevas, C. A., & Saiz-Lopez, A. (2023). Satellite-based detection of methane emissions from oil and gas production in Turkmenistan. Science Advances, 9(7), eade7159.

Spector, J. (2025, March 19). Three years into the Ukraine war, is Europe's energy system cleaner? Retrieved from https://www.canarymedia.com/articles/clean-energy/ukraine-russia-war-europe-clean-energy-transition

Sustainability Directory. (2025, April 17). Global LNG Markets. Retrieved from https://energy.sustainability-directory.com/term/global-lng-markets/

Süddeutsche Zeitung. (2022, September 28). Local activists protest German LNG infrastructure plans over environmental concerns. Clean Energy Wire. Retrieved from https://www.cleanenergywire.org/news/local-activists-protest-german-lng-infrastructure-plans-over-environmental-concerns

The Gulf Observer. (2025, April 17). Vietnam Reduces LNG Import Tariff to Spur Clean Energy Investment. Retrieved from https://thegulfobserver.com/vietnam-reduces-lng-import-tariff-to-spur-clean-energy-investment/

Verde.ag. (2025, January 10). Carbon Capture and Storage (CCS): The Future of Climate. Retrieved from https://blog.verde.ag/en/carbon-capture-and-storage-ccs/

Wood Mackenzie. (n.d.). Natural gas demand to outpace oil and coal in Southeast Asia. Retrieved from https://www.woodmac.com/press-releases/sea-gas--lng-demand-2025/

World Economic Forum. (2025, January 17). World Economic Forum sessions highlight LNG's economic, energy security, and climate risks. IEEFA. Retrieved from https://ieefa.org/articles/world-economic-forum-sessions-highlight-lngs-economic-energy-security-and-climate-risks