Insight

macroecnomics

The Hidden Trigger: How Japan's Carry Trade Bubble Could Unleash the Next Global Shock

By Ang

June 20, 2025

10 min read

Japan's transition from the world's primary source of cheap funding to monetary normalization represents the most significant underpriced tail risk in global financial markets. After three decades of ultra-accommodative policy that transformed the yen into the foundation of global leverage, the Bank of Japan (BOJ) faces mounting pressure to normalize rates amid persistent inflation above target and political backlash against currency weakness. This policy pivot threatens to trigger an unwinding of carry trade positions estimated between $1-4 trillion, with the potential to destabilize markets far beyond traditional currency channels. The systemic importance of this risk stems from three interconnected factors. First, Japan's unique position as the world's largest creditor nation with $3.4 trillion in net foreign assets means that capital repatriation would drain liquidity from global markets on an unprecedented scale. Second, the multi decade stability of Japan's zero-rate policy has created deeply embedded market structures and risk models that systematically underestimate the probability and impact of a regime change. Third, modern financial markets have created hidden linkages between yen funding and seemingly unrelated asset classes, from U.S. technology stocks to emerging market debt, amplifying contagion channels. The August 2024 episode provided a preview of this vulnerability. A modest 15 basis point BOJ rate hike triggered a 10% yen appreciation, a 12% Nikkei plunge, and synchronized selling across global risk assets. Critically, this unwinding was only partial speculative positioning data suggests 50-60% of positions remained intact, leaving substantial dry powder for future volatility. Unlike the Swiss franc, which serves a niche role constrained by active central bank intervention and limited market depth, the yen's systemic importance makes its normalization a global event that no single policy authority can control

Carry Trade 101: The Architecture of Global Leverage

The Mechanics: Profiting from Policy Divergence

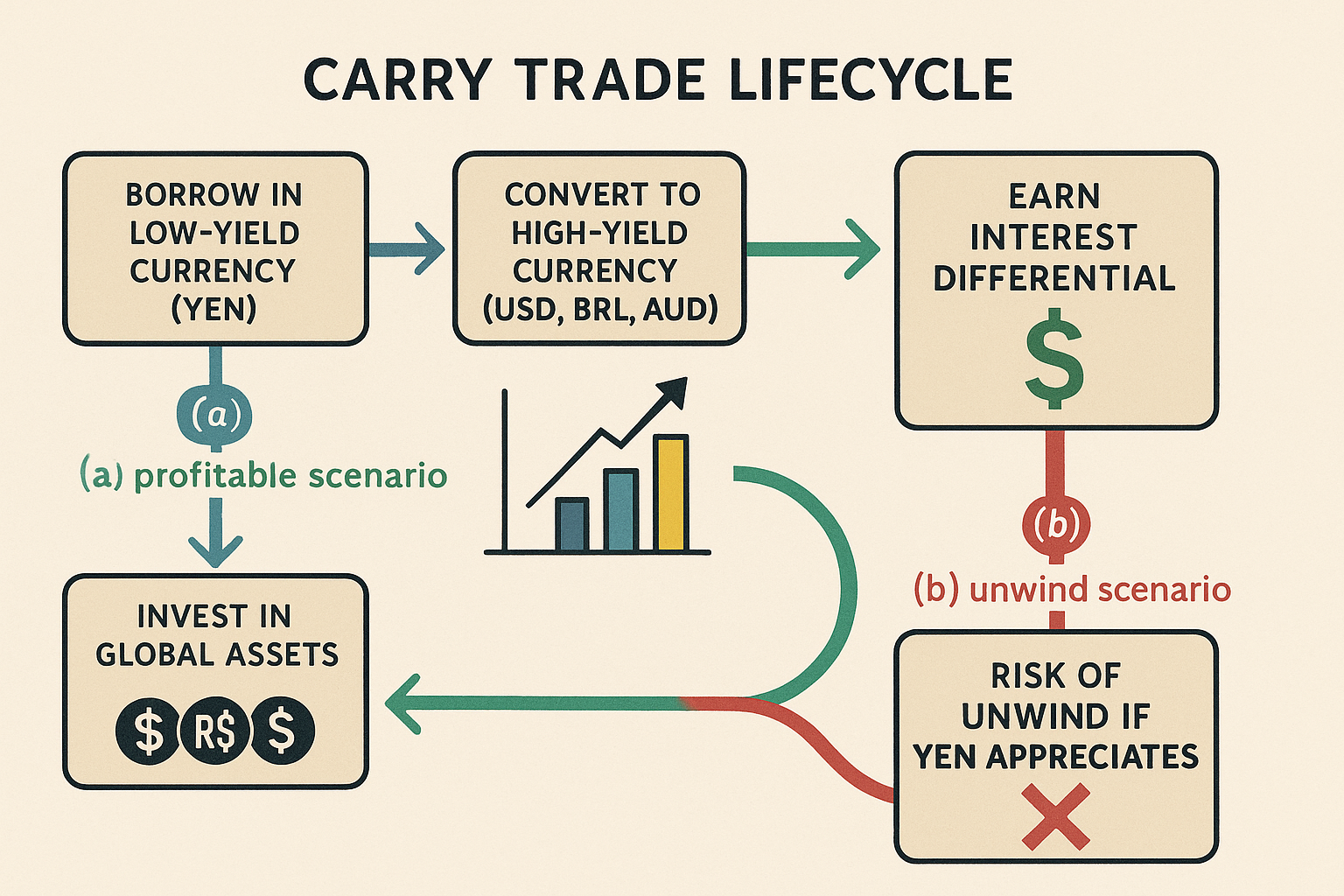

The currency carry trade exploits persistent interest rate differentials between countries, transforming monetary policy divergence into investment returns. The strategy's elegance masks its inherent fragility: borrow in a low-yielding currency (the "funding currency"), convert to a higher-yielding currency, invest in interest-bearing assets, and profit from the spread while hoping exchange rates remain favorable.

Three conditions create ideal carry trade environments:

- Wide and stable interest rate differentials that provide substantial positive carry

- Low foreign exchange volatility that minimizes the risk of adverse currency movements

- Predictable central bank behavior that allows traders to model future funding costs with confidence

The profitability derives from two sources. The primary return comes from the interest rate differential itself borrowing at 0% to invest at 5% generates a 5% annual carry. The secondary, often larger, return comes from currency movements. When funding currencies depreciate against target currencies (as economic theory suggests they should to maintain equilibrium), carry traders capture additional gains. This dual profit source can generate returns of 10-20% annually in favorable conditions, attracting massive leverage.

The strategy's Achilles heel is its vulnerability to sudden reversals. Carry trades are inherently short volatility positions they profit from stability but suffer catastrophic losses when correlations break down and funding currencies appreciate rapidly. The non-linear payoff profile means years of steady gains can evaporate in days when market conditions shift.

The Psychology of Complacency

The most dangerous aspect of carry trades is how success breeds vulnerability. Extended periods of profitability create powerful psychological and institutional biases that systematically underestimate tail risks. Risk models calibrated on recent history show low volatility and stable correlations, encouraging higher leverage. Performance based compensation incentivizes fund managers to maximize current returns rather than prepare for low-probability events. The competitive dynamics of financial markets punish conservative positioning during boom periods, creating herding behavior.

This complacency manifests in position sizing that assumes normal market conditions will persist indefinitely. Hedge funds routinely leverage carry trades 10-50 times, while retail investors access similar leverage through FX platforms. The proliferation of structured products embeds carry trade exposure throughout portfolios, often without investors' explicit knowledge. Exchange-traded funds (ETFs) targeting "income" or "yield enhancement" frequently incorporate carry strategies, distributing risk to unsophisticated investors.

Historical Precedents: Recurring Patterns of Boom and Bust

The carry trade's history reveals consistent patterns of multi-year accumulation followed by violent unwinding. Each episode follows a similar script but catches a new generation of investors unprepared.

The 1998 Russian/LTCM Crisis demonstrated how carry trades amplify contagion. When Russia defaulted, the yen strengthened 20% in weeks as leveraged positions unwound. Long-Term Capital Management's collapse revealed how sophisticated investors using complex models still underestimated correlation risks during stress events.

The 2008 Global Financial Crisis produced the most severe carry trade unwinding in modern history. The yen appreciated 35% against high-yielding currencies like the Australian dollar as global deleveraging accelerated. The episode revealed how carry trades had become systemically important, with unwinding contributing to credit market seizures and requiring coordinated central bank intervention.

The 2015 Swiss Franc Shock illustrated the violence possible when central bank policies shift unexpectedly. The Swiss National Bank's abandonment of its euro peg caused the franc to appreciate 30% in minutes, bankrupting retail FX brokers and causing hundreds of millions in losses. While smaller in scale than yen episodes, it demonstrated how quickly modern markets can gap when positioning is extreme.

These precedents establish clear patterns: carry trades accumulate slowly over years but unwind rapidly over days or weeks; the trigger often comes from unexpected policy shifts or external shocks; contagion spreads through multiple channels simultaneously; and the speed of unwinding accelerates with each iteration as technology enables faster position adjustment.

Japan: The Ultimate Carry Trade Machine

The Genesis: From Bubble to Permanent Accommodation

Japan's role as the world's primary funding currency emerged from economic trauma. The 1990 collapse of twin real estate and equity bubbles initiated a deflationary spiral that resisted conventional policy responses. The Nikkei's 75% decline from its peak and nationwide property values falling 70% created a balance sheet recession that paralyzed credit creation.

The BOJ's initial response followed orthodox playbook cutting rates from 6% to 0.5% by 1995. But with deflation entrenched and banks saddled with non-performing loans, these measures proved insufficient. In February 1999, the BOJ crossed the Rubicon, becoming the first major central bank to adopt an explicit Zero Interest Rate Policy (ZIRP). This wasn't merely low rates it was an institutional commitment to maintain rates at zero "until deflationary concerns are dispelled."

This commitment fundamentally altered global capital flows. For the first time in modern finance, a major currency with deep, liquid markets offered essentially free funding with minimal policy uncertainty. The psychological impact was profound: investors began viewing yen borrowing not as a tactical opportunity but as a structural feature of portfolios.

Policy Innovation: From ZIRP to YCC

When ZIRP alone failed to generate inflation, the BOJ pioneered increasingly unconventional tools that further entrenched the carry trade:

Quantitative Easing (2001-2006) shifted the policy target from interest rates to bank reserves, flooding the system with liquidity. This created excess yen seeking returns abroad, institutionalizing outward capital flows.

Quantitative and Qualitative Easing (2013-present) under Governor Kuroda represented "shock and awe" monetary policy. The BOJ committed to purchasing ¥80 trillion annually in JGBs, eventually owning over 50% of the market. This suppressed volatility across the yield curve, making yen funding even more attractive.

Yield Curve Control (2016-2024) perfected the carry trade ecosystem. By explicitly capping 10-year JGB yields at zero through unlimited purchase commitments, the BOJ removed duration risk from yen funding. This transformed the yen from merely cheap to uniquely stable, creating an unprecedented convergence of low cost, deep liquidity, and minimal volatility.

The cumulative effect was staggering. Bank for International Settlements data shows cross-border yen lending surged from ¥150 trillion in 2012 to ¥328 trillion by 2024 a 119% increase that made yen the second-most borrowed currency globally after the dollar. More tellingly, the share of yen borrowing by non-Japanese entities increased from 20% to 40%, indicating its transformation into a truly global funding currency.

The Scale: Quantifying the Unquantifiable

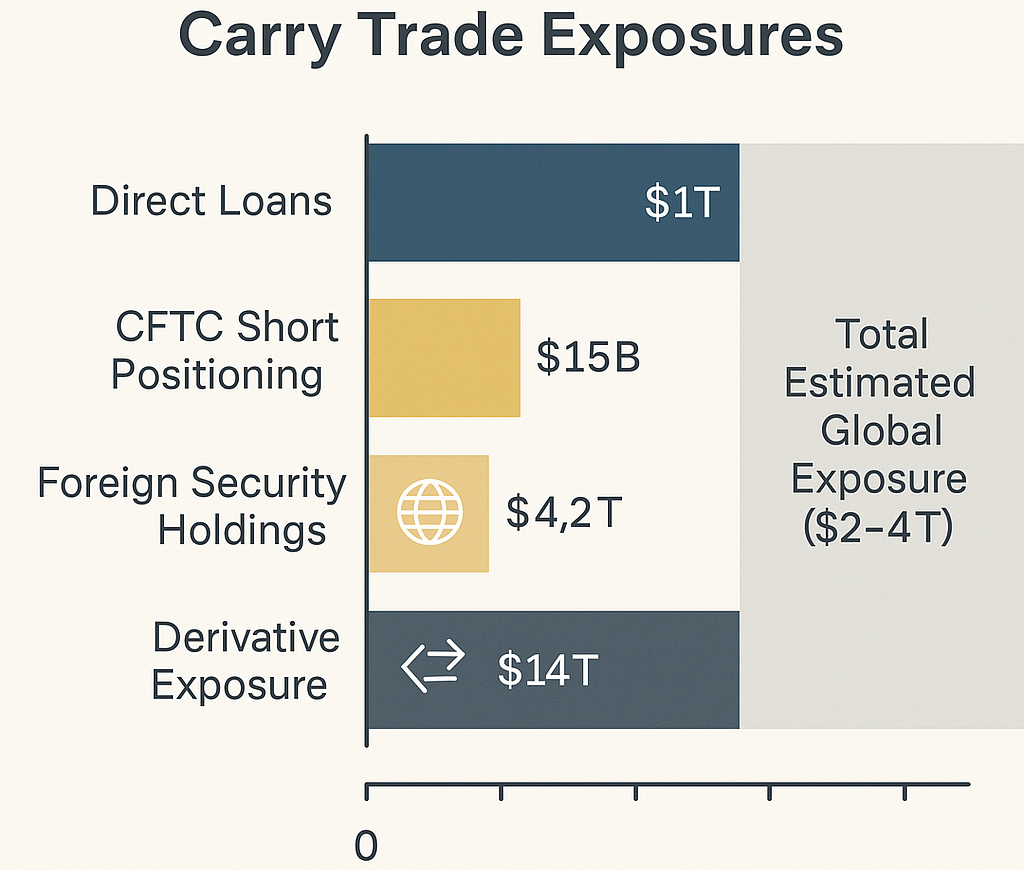

Precisely measuring the carry trade's size remains challenging due to its execution through multiple channels direct loans, FX swaps, derivatives, and structured products. However, triangulating various data sources reveals its systemic scale:

Direct Lending Metrics: BIS data shows $1 trillion in cross-border yen loans as of March 2024, up 52% since 2021. This represents only formal banking system exposure, excluding shadow banking and derivative positions.

Positioning Indicators: CFTC data revealed speculative short positions of 190,000 contracts ($15.6 billion notional) in July 2024 a 17-year high. IMM positioning data corroborates extreme one-sided betting against the yen.

Institutional Flows: Japanese institutions hold $4.2 trillion in foreign securities, much funded by cheap domestic yen. Government Pension Investment Fund (GPIF) alone manages $400 billion in unhedged foreign assets. Life insurers traditionally maintain 20-30% foreign allocations, creating structural yen selling.

Synthetic Exposure: Currency forwards and swaps create additional leverage. BIS data indicates $14 trillion in outstanding yen-denominated derivatives, suggesting synthetic carry trades multiples larger than cash positions.

Aggregating these measures suggests total global exposure to yen carry trades between $2-4 trillion. The wide range itself indicates systemic risk opacity prevents accurate measurement, meaning policymakers and risk managers operate partially blind.

The Breaking Point: Why Normalization is Inevitable

Three converging forces make continued ultra-accommodation increasingly untenable:

1. Inflation Persistence: Japan's core inflation has exceeded the 2% target for 24 consecutive months, reaching 3.7% in 2024. Unlike past temporary spikes, current inflation shows broadening pressures services inflation at 2.8% indicates wage-price dynamics taking hold. The BOJ's own projections show inflation remaining above target through 2026, creating credibility risk if policy remains unchanged.

Currency Weakness Backlash: The yen's depreciation to 160 per dollar in 2024 a 38-year low transformed from economic stimulus to political liability. Import price inflation directly reduced household purchasing power, creating unusual public pressure on the traditionally independent BOJ. Corporate Japan increasingly questions yen weakness as production shifts overseas reduce export benefits while input costs soar.

3. Financial Stability Concerns: Prolonged ultra-low rates created domestic distortions requiring attention. Regional banks face existential profitability challenges. Pension funds struggle to meet obligations with negative real yields. The life insurance sector's solvency depends on higher rates to match long-term liabilities. These domestic constituencies increasingly outweigh international considerations.

The BOJ has already taken initial steps ending negative rates in March 2024, raising to 0.5% by 2025, and abandoning strict YCC. Markets expect further normalization, with overnight index swaps pricing 100 basis points of additional tightening by 2027. While glacial by historical standards, this represents a regime change for markets accustomed to permanent accommodation.

The Swiss Comparison: Same Policy, Different Systemic Impact

Switzerland provides crucial perspective on why Japan's carry trade poses unique systemic risks. Despite maintaining negative rates from 2015-2024 and currently easing back toward zero, the Swiss franc never achieved the yen's central role in global funding. Understanding why illuminates Japan's unique vulnerabilities.

Structural Differences in Currency Characteristics

The franc's true safe-haven status contrasts sharply with the yen's corrupted haven properties. Switzerland's currency strength derives from fundamental factors political stability, fiscal prudence (debt to GDP below 40%), and current account surpluses. Capital flows into francs during crises reflect genuine demand for safety.

The yen's "safe-haven" behavior, conversely, is largely technical. Appreciation during risk-off episodes primarily reflects forced carry trade unwinding rather than fundamental demand. This creates self-fulfilling dynamics: the larger the carry trade, the stronger the "haven" behavior during unwinding, which paradoxically makes the yen appear safer than its fundamentals suggest.

Policy Framework Divergence

The Swiss National Bank's approach to currency management differs fundamentally from the BOJ's historical stance. The SNB actively intervenes to prevent excessive franc strength, spending over CHF 110 billion in 2020 alone. This creates two-way risk for carry traders sudden intervention can inflict losses on short franc positions.

The BOJ, until recently, maintained predictable accommodation regardless of currency movements. YCC's explicit yield targeting removed uncertainty about future funding costs. This predictability a feature, not a bug, of Japanese policy enabled massive position accumulation that similar Swiss policies would have prevented through intervention uncertainty.

Market Depth and Liquidity Constraints

Scale ultimately determines systemic importance. Japan's economy is nine times larger than Switzerland's, with correspondingly deeper financial markets. Daily yen trading volumes exceed $2 trillion versus $300 billion for francs. JGB markets dwarf Swiss bond markets, providing collateral and hedging capacity essential for large-scale carry trades.

Switzerland's financial system simply cannot absorb trillion-dollar flows without severe distortions. The SNB's balance sheet already equals 140% of GDP from past interventions further expansion would risk political backlash and financial stability. These constraints make the franc structurally unsuitable as a systemic funding currency.

Economic Structure and Trade Dependencies

Japan's export-oriented economy historically benefited from yen weakness, creating political economy support for accommodation. While these benefits diminished as production shifted overseas, the institutional momentum remained. Switzerland's concentration in high-value, price-inelastic exports (pharmaceuticals, precision machinery) makes franc strength less economically damaging, enabling different policy choices.

The comparison reveals why Japan's normalization poses unique risks: the yen's scale enables systemic positioning; decades of predictable policy created unprecedented complacency; and structural factors prevented natural correcting mechanisms that constrained Swiss franc carry trades.

The Unwinding Scenario: Mapping Contagion Channels

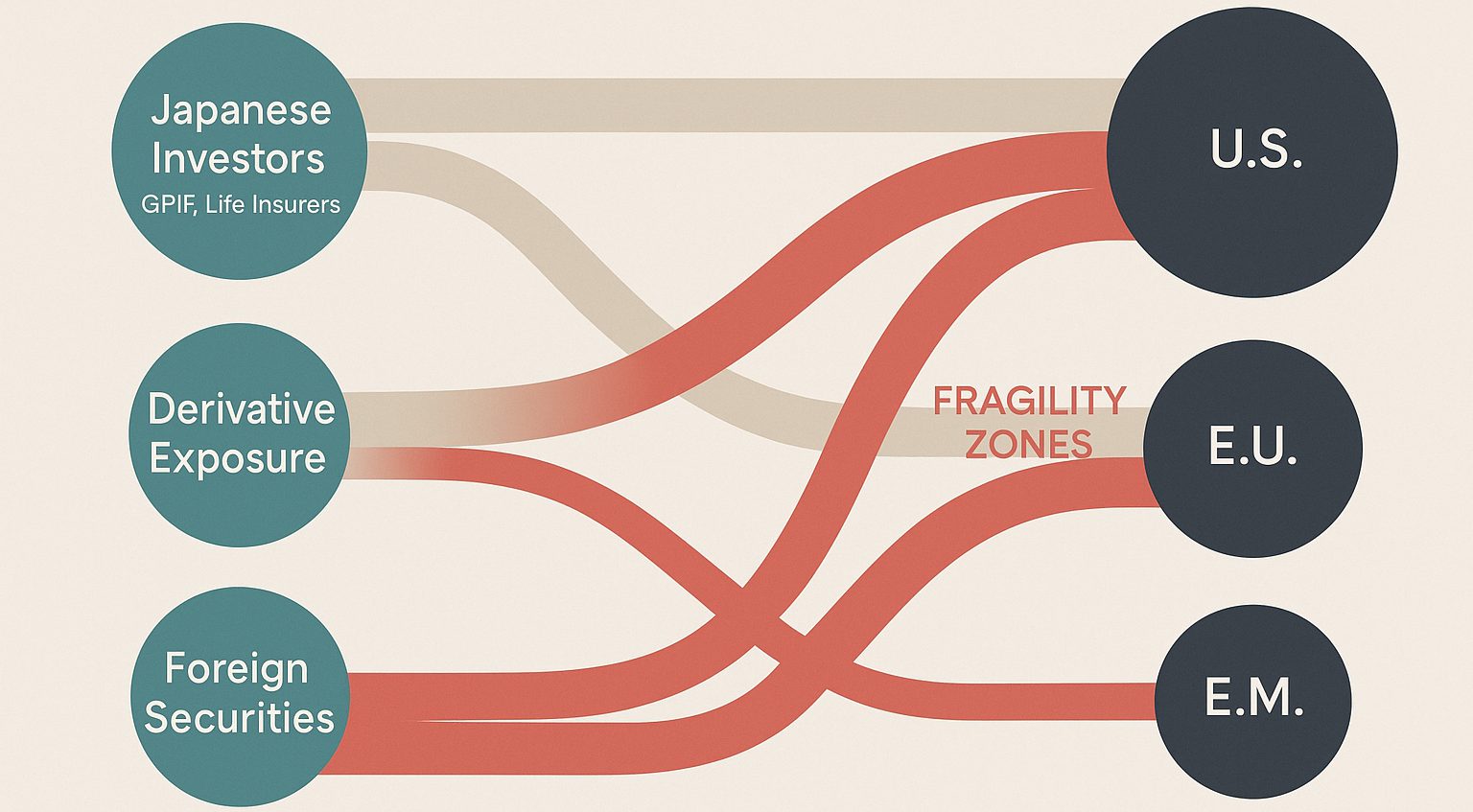

A disorderly carry trade unwinding would propagate through multiple, reinforcing channels. Understanding these transmission mechanisms is crucial for anticipating where risks concentrate and how quickly contagion might spread.

Primary Channel: The Currency Cascade

The initial shock would manifest in foreign exchange markets as a violent yen appreciation. Historical episodes suggest potential moves of 20-30% within weeks as positioned get squeezed. The August 2024 episode saw 10% appreciation in days from a modest trigger a full unwinding could far exceed this.

The dynamics would be self-reinforcing:

- Margin calls force position closure regardless of fundamental views

- Stop-losses trigger automatically, accelerating moves

- Dealer hedging amplifies directional moves as gamma turns negative

- Liquidity evaporates as market makers widen spreads defensively

Currency pairs with the highest carry USD/JPY, AUD/JPY, BRL/JPY would experience the most violent moves. Cross-currency correlations would spike as systematic strategies unwind positions across all pairs simultaneously.

Secondary Channel: The Treasury Transmission

Japan holds $1.1 trillion in U.S. Treasuries the largest foreign holding. Yen appreciation makes these holdings less attractive on an FX-hedged basis. With 10-year JGBs yielding 1.5% and hedging costs at 5%, U.S. Treasuries effectively yield negative 2% for Japanese investors. This math drives repatriation.

The selling pressure would be unprecedented:

- GPIF's $400 billion foreign bond portfolio faces rebalancing pressure

- Life insurers must match yen liabilities, forcing foreign asset sales

- Banks face regulatory pressure to reduce currency mismatches

- Retail investors through mutual funds follow institutional flows

A 10% repatriation would dump $400+ billion in Treasuries on markets already struggling with heavy issuance. Yields could spike 50-100 basis points, tightening financial conditions globally.

Tertiary Channel: The Equity Exodus

Equity markets would suffer through multiple mechanisms:

- Direct selling of foreign stocks by Japanese investors (¥300 trillion held abroad)

- Liquidation by leveraged funds facing margin calls

- Systematic strategy deleveraging as correlations break down

- Sentiment contagion as risk appetite evaporates

U.S. technology stocks show particular vulnerability. The August 2024 episode revealed unexpected correlations between Nasdaq performance and yen movements. Momentum strategies funded by yen leverage would forced unwind, potentially triggering 20-30% corrections in crowded positions.

Quaternary Channel: Emerging Market Meltdown

Emerging markets face existential risks from carry trade unwinding:

- Currency depreciation as hot money flees

- Bond yields spiking as foreign demand evaporates

- Corporate stress from unhedged dollar/yen debt

- Banking sector pressure from deposit flight

Countries with high foreign ownership of local bonds Indonesia (40%), Malaysia (25%), Mexico (35%) face acute vulnerabilities. The "original sin" of foreign currency borrowing would reassert itself as debt burdens balloon in local currency terms.

Feedback Loops and Amplification

Modern market structure amplifies contagion through several mechanisms:

Systematic Strategies: Risk parity, volatility targeting, and CTA strategies mechanically reduce exposure as volatility rises, creating procyclical selling pressure across asset classes.

ETF Flows: Passive vehicles force selling regardless of fundamentals as investors redeem. The growth of thematic ETFs created hidden carry trade exposures in seemingly unrelated products.

Dealer Constraints: Post-2008 regulations limit dealers' ability to warehouse risk, reducing market-making capacity precisely when needed most. This amplifies price gaps and volatility.

Algorithmic Trading: High-frequency strategies withdraw liquidity during stress, while execution algorithms struggle with gapping markets. The May 2010 "Flash Crash" demonstrated these vulnerabilities on a smaller scale.

Strategic Implications for Global Stakeholders

Institutional Investors: Beyond Traditional Risk Metrics

Standard risk management frameworks systematically underestimate carry trade vulnerabilities. Value-at-Risk models calibrated on recent history miss regime change risks. Correlation matrices assume stability that breaks down during unwinding. Liquidity assumptions prove optimistic when crowded trades reverse.

Required adaptations include:

- Stress testing specifically for yen appreciation scenarios

- Reducing leverage before volatility forces deleveraging

- Diversifying funding sources beyond yen dependence

- Building option protection while volatility remains cheap

- Maintaining higher cash buffers for margin calls

Central Banks: The Coordination Challenge

No single central bank can manage a global carry trade unwinding. The Federal Reserve's experience in 2008 demonstrates that unilateral action is insufficient when dealing with systemic deleveraging. Required coordination mechanisms include:

Dollar Swap Lines: The Fed's standing swap arrangements with major central banks would need immediate activation and expansion. The BOJ paradoxically might need dollar liquidity to support Japanese institutions facing margin calls on foreign positions.

Synchronized Communication: G7/G20 coordination on messaging would be essential to prevent competitive policy responses. The 1985 Plaza Accord provides a template for managing yen appreciation, though modern markets move far faster.

Macroprudential Tools: Central banks need pre-positioned tools to address specific vulnerabilities capital controls for emerging markets, circuit breakers for equity markets, and repo facilities for funding markets.

The greatest challenge is timing. Acting too early wastes political capital and moral hazard concerns. Acting too late allows contagion to spread beyond containment. The August 2024 episode suggests markets give little warning before regime changes.

Emerging Market Policymakers: Impossible Trinity Revisited

Emerging markets face the classic trilemma during carry trade unwinding—unable to simultaneously maintain independent monetary policy, fixed exchange rates, and free capital flows. Country-specific factors determine optimal responses:

High Reserve Countries (China, India, Thailand) can deploy reserves to smooth adjustment but risk rapid depletion if outflows persist. Intervention should focus on preventing overshooting rather than defending specific levels.

Flexible Rate Regimes (Brazil, Mexico, Indonesia) should allow depreciation while using rates to prevent spirals. The temptation to match developed market easing must be resisted if currency stability matters more than growth.

Capital Controls become necessary evils for countries facing destabilizing outflows. Malaysia's 1998 controls, while controversial, prevented deeper crisis. Modern controls can be more targeted taxes on short-term flows, position limits on derivatives, or approval requirements for large transactions.

Corporate Risk Management: Hidden Exposures

Corporations face carry trade risks through multiple channels often outside traditional hedging frameworks:

- Treasury operations may have yield-enhanced through carry strategies

- Pension obligations face mark-to-market losses on foreign assets

- Supply chain financing might embed currency mismatches

- Customer payment terms in emerging markets create indirect exposure

Risk management must expand beyond simple transaction hedging to consider:

- Stress testing revenue/cost mismatches under extreme scenarios

- Pre-funding to avoid accessing markets during turmoil

- Diversifying banking relationships to ensure continued access

- Building buffer stocks to manage supply chain disruptions

Regulatory Implications: Closing Systemic Gaps

The carry trade's growth exposed regulatory blind spots that require attention:

Shadow Banking: Much carry trade activity occurs outside traditional banking through hedge funds, family offices, and proprietary trading firms. Expanding reporting requirements and stress testing to these entities would improve systemic visibility.

Derivative Markets: Central clearing of FX derivatives would reduce bilateral counterparty risks but might concentrate risk in clearinghouses unprepared for extreme moves. Margin requirements need recalibration for tail events.

Cross-Border Coordination: National regulators need better information sharing on concentrated positions. The BIS could serve as a central repository for systemic risk monitoring, though sovereignty concerns limit data sharing.

Early Warning Indicators: Reading the Tea Leaves

Markets rarely provide clear advance warning of regime changes, but several indicators deserve monitoring:

Positioning Metrics

- CFTC Commitment of Traders data on speculative yen shorts

- IMM positioning reaching historical extremes

- Risk reversals in option markets showing skew changes

- Cross-currency basis swaps indicating funding stress

Flow Indicators

- Japanese investor foreign bond purchases turning negative

- Foreign investor flows into Japanese equities reversing

- Corporate hedging activity increasing dramatically

- Retail FX margin trading volumes declining

Policy Signals

- BOJ communication shifting from "patient" to "vigilant"

- Political pressure on yen weakness intensifying

- Wage growth exceeding productivity consistently

- Inflation expectations becoming unanchored

Market Structure

- Bid-ask spreads widening in typically liquid pairs

- Correlation breakdowns between traditionally linked assets

- Volatility term structure inverting

- Dealer positioning becoming increasingly one-sided

The August 2024 episode demonstrated how quickly conditions can shift. Markets went from complacency to panic in 48 hours based on marginal BOJ communication changes. This suggests traditional early warning systems may be insufficient preparation must assume sudden discontinuities.

The Tsunami from the East?

Japan's carry trade represents a fundamental contradiction in the global financial system. A mechanism that provided essential liquidity for decades has morphed into a source of systemic instability. The very success of Japanese monetary policy in suppressing volatility created the conditions for its eventual violent return.

The unwinding is not a tail risk but an increasingly probable scenario as domestic Japanese considerations override international spillover concerns. The BOJ faces an impossible choice: maintain accommodation and lose credibility on inflation, or normalize and potentially trigger global deleveraging. Political economy suggests normalization will proceed, albeit gradually.

Market participants systematically underestimate this risk due to recency bias, model limitations, and competitive pressures. The August 2024 episode should have served as a wake-up call but was quickly dismissed as temporary volatility. This complacency creates the conditions for a more severe future dislocation.

The appropriate response is not panic but preparation. Investors must reduce leverage, diversify funding sources, and build hedges while protection remains affordable. Policymakers need coordination mechanisms ready for activation. Corporations should stress test for scenarios their risk models consider impossible.

Japan's monetary normalization represents a regime change comparable to the Volcker shock or the Asian crisis events that fundamentally reset market relationships. Unlike those episodes, this one is predictable in direction if not timing. The tsunami warning has been issued. The question is whether global markets will heed it or be swept away by the inevitable wave from the East.

The yen carry trade's unwinding won't be a single dramatic event but a series of increasingly severe episodes that test each level of support. Each iteration will claim casualties among the overleveraged and underprepared. The final unwinding may take years, but its conclusion is inevitable: the free lunch of zero-cost yen funding is ending. Those who recognize this early will survive; those who deny it will become cautionary tales in the next generation's financial history.