Green Bonds, Sukuk and Sustainability-linked Loans in Renewable Energy Projects in Indonesia: Unlocking Islamic Financing as New Frontier

Indonesia, as the largest archipelagic state in Southeast Asia, holds immense renewable energy potential ranging from geothermal and hydropower to solar and wind. Yet despite these natural advantages, the country remains heavily dependent on fossil fuels. To meet its Paris Agreement commitments and achieve the national target of 23% renewable energy in its energy mix by 2025, Indonesia must accelerate its green energy transition through strategic investments, policy reform, and infrastructure development

Indonesia, as a rapidly developing nation, faces the dual challenge of meeting its growing energy demands while simultaneously mitigating the environmental impact associated with traditional energy sources. This has led to an increased focus on renewable energy projects and the exploration of innovative financing mechanisms to support their development. Green bonds and sustainability-linked loans have emerged as prominent instruments in the global sustainable finance landscape, offering opportunities to channel capital towards environmentally beneficial projects and incentivize sustainable practices.

The Indonesian economy's susceptibility to both domestic and international economic shocks underscores the importance of resilient financial systems that can navigate global economic turbulence. Against this backdrop, this research article delves into the application of green bonds and sustainability-linked loans in the context of renewable energy projects in Indonesia, examining their potential benefits, challenges, and implications for the country's sustainable development goals.

Green Bonds in Renewable Energy

Green bonds, characterized as debt instruments earmarked for financing projects with environmental benefits, have gained significant traction in recent years as a means of mobilizing capital for sustainable initiatives. The Indonesian government, through the Ministry of Finance, has demonstrated its commitment to green finance by issuing several series of green bonds, including green sukuk, which adhere to Islamic Sharia principles. This is particularly important considering that Indonesia has a predominantly Muslim population, creating a substantial potential market for Islamic financial products and services.

The issuance of green sukuk reflects a strategic effort to align financial instruments with ethical and environmental values, attracting a wider range of investors and fostering sustainable development. These bonds serve as a financial mechanism that directs investments towards environmentally friendly projects, distinguishing themselves from conventional bonds through their explicit commitment to environmental stewardship. The Green Bond Principles provide a widely recognized framework for defining and structuring green bonds, encompassing project selection criteria and reporting requirements. Indonesia's experience with digital waqf systems demonstrates the potential for innovative financial technologies to enhance fundraising and promote sustainable economic development, offering valuable lessons for scaling up green finance initiatives.

Examining specific examples of renewable energy projects financed through green bonds in Indonesia can provide insights into the types of projects that are attracting investment and the environmental impact they are achieving. However, project-based green sukuk issuances are too closely linked with only renewable energy and green real estate projects. This constrained diversification makes the risk assessment of the project difficult, and because of the small number of green projects, it leads to the underdevelopment of the green sukuk market. The rise of Islamic stocks alongside sukuk further illustrates the growing importance of Sharia-compliant investments in the Indonesian capital market, providing additional avenues for financing sustainable development.

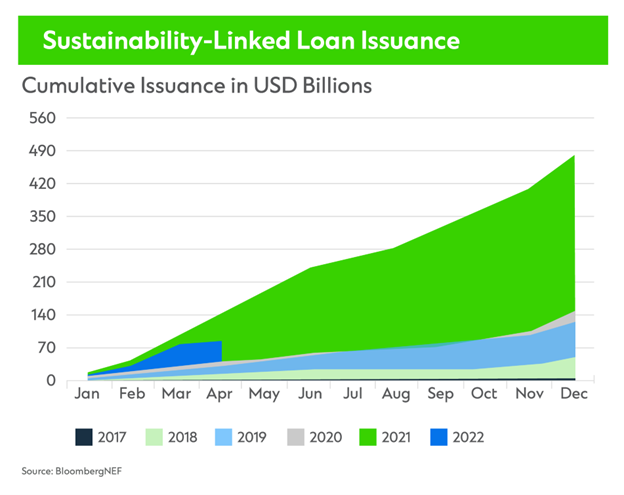

Sustainability-linked Loans

Sustainability-linked loans represent another innovative financing mechanism that incentivizes borrowers to achieve predetermined sustainability performance targets. Unlike green bonds, the proceeds from sustainability-linked loans are not necessarily restricted to specific green projects, but rather linked to the borrower's overall sustainability performance. The interest rate or other terms of the loan are tied to the borrower's ability to meet specific environmental, social, and governance targets. Sustainability-linked loans have the potential to drive broader adoption of sustainable practices across various sectors, as companies are incentivized to improve their environmental and social performance to reduce their borrowing costs.

These loans encourage a holistic approach to sustainability, as companies are motivated to integrate environmental and social considerations into their core business strategies. The growth of green banking, driven by the green behaviour of Islamic bankers, further supports the adoption of sustainable finance practices in Indonesia. By integrating environmental considerations into financial decision-making, green banking contributes to a more sustainable and resilient financial system.

The government's efforts to promote sustainable finance and reduce greenhouse gas emissions align with the global agenda for sustainable development, underscoring the importance of innovative financial mechanisms in achieving environmental goals.

Challenges and Opportunities

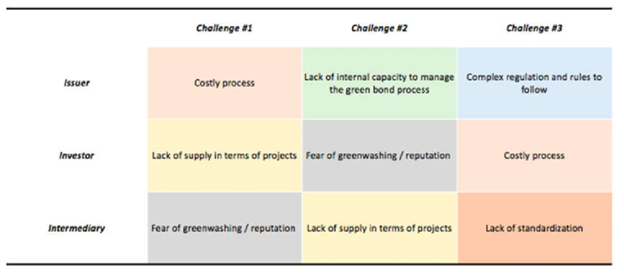

Despite the growing interest in green bonds and sustainability-linked loans, several challenges remain in their widespread adoption in Indonesia. One significant obstacle is the lack of standardized definitions and reporting frameworks for green projects and sustainability performance indicators. This ambiguity can lead to greenwashing, where projects are falsely marketed as environmentally beneficial, undermining investor confidence and hindering the credibility of the green finance market. The absence of clear classification of green assets and projects by financial institutions impedes the pooling of green assets for green sukuk issuances. To address this challenge, the development of robust and transparent certification schemes and reporting standards is crucial.

The OJK, along with the Ministry of Environment and Forestry, has developed a Sustainable Finance Roadmap to guide banks and non-bank financial institutions in conducting due diligence on environmental and social risks in their lending practices. The roadmap implementation requires financial institutions to integrate sustainability principles into their lending and investment decisions.

While this represents an important step forward, further regulatory clarity and standardization are needed to promote investor confidence and facilitate the growth of the green finance market. The current regulations related to sustainable development goals are dispersed and partial, hindering the optimal implementation of responsible banking principles.

In addition to regulatory challenges, limited awareness and understanding of green finance among investors and project developers can also hinder market growth. Greater educational efforts are needed to raise awareness of the benefits of green bonds and sustainability-linked loans and to build capacity among stakeholders to develop and evaluate green projects. Furthermore, the limited supply of bankable green projects can pose a constraint on the growth of the green finance market. Overcoming these challenges requires a concerted effort from governments, financial institutions, and project developers to create a supportive ecosystem for green finance.

Another challenge is the limited availability of green projects that meet the investment criteria of institutional investors. Many renewable energy projects in Indonesia, particularly smaller-scale initiatives, may lack the scale or financial viability to attract large-scale investments. The financial services sector is expected to contribute to the development of services and products that integrate economic, social, and environmental aspects. To overcome this challenge, there is a need to develop a pipeline of bankable green projects through technical assistance, capacity building, and project preparation support.

Additionally, exploring innovative financing structures such as blended finance, which combines public and private capital, can help de-risk green projects and attract a wider range of investors. The rise of fintech platforms offers new opportunities to overcome financial barriers and support the financing needs of sustainable businesses. One of the major levers for alleviating the impact of climate change is the financial system. A resilient financial system is critical for a successful and just transition to net-zero emissions and climate-resilient development. Islamic finance, encompassing Islamic banking, capital markets, and social finance, can play a vital role in optimizing financial instruments for national economic growth.

The integration of environmental, social, and governance factors is also deemed important for increasing financial performance. The commitment to environmental-based economic development is contained in the 2015 Paris Agreement, which is an agreement to save and conserve natural resources and reduce the negative impacts of climate change. The realization of a green economy requires large funding, especially for renewable energy projects. There is an increasing attention worldwide to improve the financial system's ability to mobilize private capital for green investment and to manage the risks of climate change.

The Indonesian Renewable Energy Landscape

Indonesia's commitment to reducing greenhouse gas emissions and achieving its Nationally Determined Contribution target requires substantial investments in renewable energy. The country has abundant renewable energy resources, including solar, hydro, geothermal, wind, and biomass, offering significant potential for clean energy development. However, the development of these resources has been slow, hampered by various challenges, including regulatory uncertainties, financing constraints, and infrastructure limitations. The role of the financial sector is pivotal in supporting and accelerating the transition to a low-carbon economy by channeling investments into renewable energy projects and other green initiatives.

Green bonds and sustainability-linked loans can play a crucial role in mobilizing private capital for renewable energy projects in Indonesia, helping to bridge the financing gap and accelerate the deployment of clean energy technologies. The increasing use of paper in Indonesia highlights the need for environmentally friendly practices, such as green banking, which can indirectly benefit the ecosystem. The issuance of sovereign green sukuk demonstrates Indonesia's commitment to funding environmentally friendly projects and promoting sustainable development.

The Indonesian government has set ambitious targets for renewable energy deployment, aiming to increase the share of renewable energy in the energy mix to 23% by 2025 and 31% by 2050. Achieving these targets will require significant investments in renewable energy infrastructure, creating opportunities for green bonds and sustainability-linked loans to play a pivotal role.

Indonesia, with its vast archipelago of over 17,000 islands, faces unique challenges in ensuring a sustainable energy supply. The government's target of achieving a 23% renewable energy mix by 2025 necessitates a comprehensive strategy that includes supportive regulations, financial incentives, and technological innovation. Moreover, Indonesia aims to reduce its national greenhouse gas emissions by 29% by 2030, with the energy sector expected to make a significant contribution.

Green Bonds and Sukuk for Renewable Energy Projects

Green bonds and sustainability-linked loans offer innovative financing solutions for renewable energy projects in Indonesia, aligning financial returns with environmental and social benefits. Green bonds are debt instruments specifically designated to finance projects with environmental benefits, while sustainability-linked loans incentivize borrowers to achieve predefined sustainability performance targets. Green sukuk, which adhere to Islamic finance principles, provide an additional avenue for mobilizing capital for green projects. Indonesia holds a substantial portion of the world's Sukuk, demonstrating its capacity to fulfil financial obligations.

Green bonds and sustainability-linked loans can attract a wider range of investors, including institutional investors and impact investors, who are increasingly seeking investments that align with their environmental, social, and governance goals. The rise of digital waqf systems has shown the effectiveness of digital fundraising and its potential to contribute to sustainable economic development in Indonesia.

The Indonesian government has actively promoted the issuance of green bonds and sukuk to finance renewable energy projects and other green initiatives. Sovereign green sukuk, in particular, have gained traction as a means of attracting Sharia-compliant investors and supporting the country's sustainable development agenda. Indonesia's status as the world's largest Muslim country presents a significant market for Islamic financial products, including sharia bonds The development of the Sukuk market can greatly benefit from the establishment of a primary dealer system to address liquidity issues and promote its growth.

Green sukuk can be a key instrument for financing clean energy and resilient infrastructure projects, especially in countries with large Muslim populations like Indonesia. Sukuk can mobilize capital, increase investor enthusiasm, and provide an alternative investment option for investors. The issuance of green sukuk in Indonesia adheres to both sharia principles and green finance standards, requiring compliance with both OJK regulations on sukuk issuance and environmentally friendly debt securities.

Conclusion

Indonesia is dedicated to environmentally conscious economic development, exemplified by its commitment to the Paris Agreement and Nationally Determined Contribution targets. Green finance, especially green bonds and sukuk, plays a vital role in mobilizing private capital for renewable energy projects. While Indonesia possesses abundant renewable energy resources, it faces challenges such as regulatory uncertainties and financing constraints. The Indonesian government actively promotes green bonds and sukuk to attract investors and support sustainable development, leveraging its large Muslim population for Islamic financial products like sharia bonds.

Financial innovation, government support, and collaboration among stakeholders are critical in unlocking the potential of green finance and creating a thriving green market in Indonesia. Sukuk can significantly impact the country's economic size in the short term, while Islamic banks and Islamic mutual funds can substantially influence the GDP in the long term. Therefore, policymakers and industry stakeholders should continue utilizing Islamic financial instruments like Sukuk, Islamic banking financing, and Islamic mutual funds to influence Indonesia’s GDP and economic growth in both the short and long term.

To achieve its renewable energy targets and reduce greenhouse gas emissions, Indonesia needs substantial investments in renewable energy infrastructure. Green bonds and sustainability-linked loans can play a pivotal role in bridging the financing gap and accelerating the deployment of clean energy technologies. Indonesia's unique archipelagic geography presents challenges in ensuring a sustainable energy supply, necessitating supportive regulations, financial incentives, and technological innovation.

References

- Abubakar, L. and Handayani, T. (2019) “Implementation of the Principles for Responsible Banking in Indonesian Banking Practices to Realize Sustainable Development Goals.” doi:10.2991/icglow-19.2019.26.

- Alifah, E.I. and Bawono, A. (2020) “Strengthening Indonesia’s Economic Growth with Islamic and non-Islamic Macroeconomic Variable,” Economica Jurnal Ekonomi Islam, 11(1), p. 107. doi:10.21580/economica.2020.11.1.4907.

- Aziz, A. (2021) “SWOT analysis on geothermal energy development in Indonesia and fiscal incentives needed,” International Journal of Smart Grid and Clean Energy, p. 234. doi:10.12720/sgce.10.3.234-243.

- Dhesinta, W.S. (2019) “Sustainable Finance on Management and Protection of Environment (Study of sustainable finance implementation in Indonesia),” Proceedings of the Social and Humaniora Research Symposium (SoRes 2018) [Preprint]. doi:10.2991/sores-18.2019.133.

- Edmark, K. and Persson, L. (2021) “The impact of attending an independent upper secondary school: Evidence from Sweden using school ranking data,” Economics of Education Review, 84, p. 102148. doi:10.1016/j.econedurev.2021.102148.

- Ferdian, I.R. and Dewi, M.K. (2017) “No Way Out for Sukuk Illiquidity? Proposing a Primary Dealer System for the Sukuk Market,” in Springer eBooks. Springer Nature, p. 39. doi:10.1007/978-3-319-45029-2_2.

- Fitrah, R. and Soemitra, A. (2022) “Green Sukuk For Sustainable Development Goals in Indonesia: A Literature Study,” JURNAL ILMIAH EKONOMI ISLAM, 8(1), p. 231. doi:10.29040/jiei.v8i1.4591.

- Fuadi, M.F., Suriani, S. and Zulham, T. (2022) “Can Sharia Finance Affect Indonesia’s Economic Growth?,” International Journal of Finance Economics and Business, 1(3). doi:10.56225/ijfeb.v1i3.32.

- Goncharenko, N. and Shapoval, V. (2021) “ECO-INNOVATION FINANCING AS AN ELEMENT OF A ‘GREEN’ ECONOMY FORMATION IN THE GLOBALIZATION CONDITIONS OF SUSTAINABLE DEVELOPMENT,” Green Blue and Digital Economy Journal, 2(2), p. 15. doi:10.30525/2661-5169/2021-2-3.

- Handayani, T., Abubakar, L. and Sukmadilaga, C. (2020) “GREEN LOAN BANKS POLICY TO PROVIDE ENVIRONMENT FRIENDLY PROJECT,” Diponegoro Law Review, 5(2), p. 215. doi:10.14710/dilrev.5.2.2020.215-230.

- Ichsani, S., Pratiwi, L.N. and Saputera, D. (2024) “Financial Performance Measurement Using the Value Added Method to Determine the Effect on Stock Prices,” International Journal of

- Finance & Banking Studies (2147-4486), 13(3), p. 11. doi:10.20525/ijfbs.v13i3.3626.

- Nugrahaeni, R. and Muharam, H. (2023) “The Effect of Green Credit and Other Determinants of Credit Risk Commercial Bank in Indonesia,” Journal of Business Social and Technology, 4(2), p. 135. doi:10.59261/jbt.v4i2.148.

- Pebruary, S. and Hani’ah, I. (2024) “Examining the impact of zakah and Islamic finance on national economic growth,” Jurnal Ekonomi & Keuangan Islam, p. 115. doi:10.20885/jeki.vol10.iss1.art9.

- Pioneering the Green Sukuk (2020) World Bank, Washington, DC eBooks. doi:10.1596/34569.

- Puschmann, T., Hoffmann, C.H. and Khmarskyi, V. (2020) “How Green FinTech Can Alleviate the Impact of Climate Change—The Case of Switzerland,” Sustainability, 12(24), p. 10691. doi:10.3390/su122410691.

- Pusva, I.D. and Herlina, E. (2017) “Analysis of the implementation of green banking in achieving operational cost efficiency in the banking industry,” The Indonesian Accounting Review, 7(2), p. 203. doi:10.14414/tiar.v7i2.1602.

- Ramadhan, I.A. and Wirdyanigsih (2020) “Green Sukuk Issuance as an Investment Instrument for Sustainable Development.” doi:10.2991/assehr.k.200306.189.

- Rossolini, M., Pedrazzoli, A. and Ronconi, A. (2021) “Greening crowdfunding campaigns: an investigation of message framing and effective communication strategies for funding success,”

- International Journal of Bank Marketing, 39(7), p. 1395. doi:10.1108/ijbm-01-2021-0039.

- Ruggie, J.G. (2013) “Just Business: Multinational Corporation and Human Rights.”

- Sahabuddin, M. et al. (2019) “Digitalization, Innovation and Sustainable Development: An Evidence of Islamic Finance Perspective,” International Journal of Asian Social Science, 9(12), p. 651. doi:10.18488/journal.1.2019.912.651.656.

- Setiawan, S. et al. (2021) “GREEN FINANCE IN INDONESIA’S LOW CARBON SUSTAINABLE DEVELOPMENT,” International Journal of Energy Economics and Policy, 11(5), p. 191. doi:10.32479/ijeep.11447.

- Wanta, D. (2019) “The First Payment Mechanism on Domestic Biogas in Indonesia (Indonesia Domestic Biogas Programme).” doi:10.2991/iscogi-17.2019.38.