education

dear traders

Decoding Market Movements: Between Chaos and Calculation

By Ang

April 9, 2025

10 min read

This article explores how a quant trader decodes market movements through data and statistical frameworks rather than emotional narratives or conspiracy theories. It demystifies popular beliefs around market manipulation and introduces four analytical tools regime identification, order flow imbalance, volatility clustering, and liquidity mapping to explain how markets truly operate. A mindset shift from paranoia to pattern recognition is emphasized as the foundation for sustainable trading success.

Today, anyone with a smartphone can execute trades with a few taps while waiting for their morning coffee. The barriers have collapsed: zero commission trading, fractional shares, 24/7 crypto markets, and trading communities that span continents have democratized financial markets in ways unimaginable just a decade ago. The pandemic only accelerated this trend, as millions of newly minted retail traders entered the arena, armed with stimulus checks and limitless time during lockdowns.

Yet this accessibility creates a dangerous illusion: that markets are simple to understand and easy to profit from. The interfaces are clean, the execution is instant, but beneath this veneer of simplicity lies a system of breathtaking complexity. It's as if we've given everyone access to a commercial airliner's controls without providing flight training. The tools are there, but the comprehension often isn't. This complexity gap creates a particular narrative among retail traders one built around conspiracy rather than computation. Which brings us to the foundational question I've spent fifteen years trying to answer.

Why Do Markets Move?

If you spend enough time in trading forums or Discord channels, you'll encounter the prevailing retail narrative: markets move because they're manipulated. You'll hear about "smart money" deliberately hunting stop losses, market makers pinning prices to maximize option pain, or shadowy forces engineering liquidation cascades.

While sipping coffee with a group of retail traders last month, I heard one confidently explain how "they" pushed Bitcoin down precisely to trigger his stop loss before the price rocketed upward. The head nodding around the table was unanimous. This paranoid perspective is comforting in its simplicity if markets are rigged, then your losses aren't your fault. They're attributable to invisible adversaries with unlimited resources.

As a trader, I see markets through a different lens. Markets move due to structure, sentiment, and statistical imbalance not just intention. Think of markets as complex adaptive systems, like weather patterns or migration behaviors, where individual actors following simple rules create emergent phenomena that appear orchestrated but aren't. This isn't to say manipulation doesn't exist it absolutely does. But attributing every price movement to manipulation is like blaming every traffic jam on a conspiracy. Most of the time, it's just the natural consequence of system dynamics.

The Market Isn't Always Manipulated

Let's be clear about what genuine manipulation looks like: spoofing (placing and quickly canceling large orders to create false impressions of supply/demand), wash trading (trading with yourself to generate artificial volume), or spreading false information to influence prices. These practices exist and regulatory bodies rightfully pursue them. However, what many retail traders call "manipulation" is often just market physics at work. When a stock plunges after breaking a key support level, it's rarely because someone specifically targeted your stop loss. More likely, a critical mass of technical traders had similar stop placements, creating a liquidity pocket that the market naturally exploited.

Consider dark pools, often mentioned in conspiratorial tones. These alternative trading venues aren't sinister conspiracies they're efficiency mechanisms that help institutional investors execute large block trades with minimal market impact. Without them, large pension funds rebalancing portfolios would create massive price dislocations that harm everyday investors. The "stop loss hunting" narrative particularly frustrates me as a quant. What looks like targeted action is usually the market doing what markets inherently do: seeking liquidity. Prices move toward areas where execution is possible and away from areas where it isn't. Stop losses create clusters of potential liquidity, so prices naturally gravitate toward them not because of malicious intent, but because that's where trades can be executed.

As Hanlon's razor suggests "never attribute to malice what can be adequately explained by math."

How a Quant Trader Interprets the Market

Quantitative traders replace these narratives with statistical frameworks. Instead of asking "Who's manipulating the market today?" we ask "What regime are we operating in?" and "How might the statistical properties of price action inform probability distributions of future states?"

Here's how I view market movements:

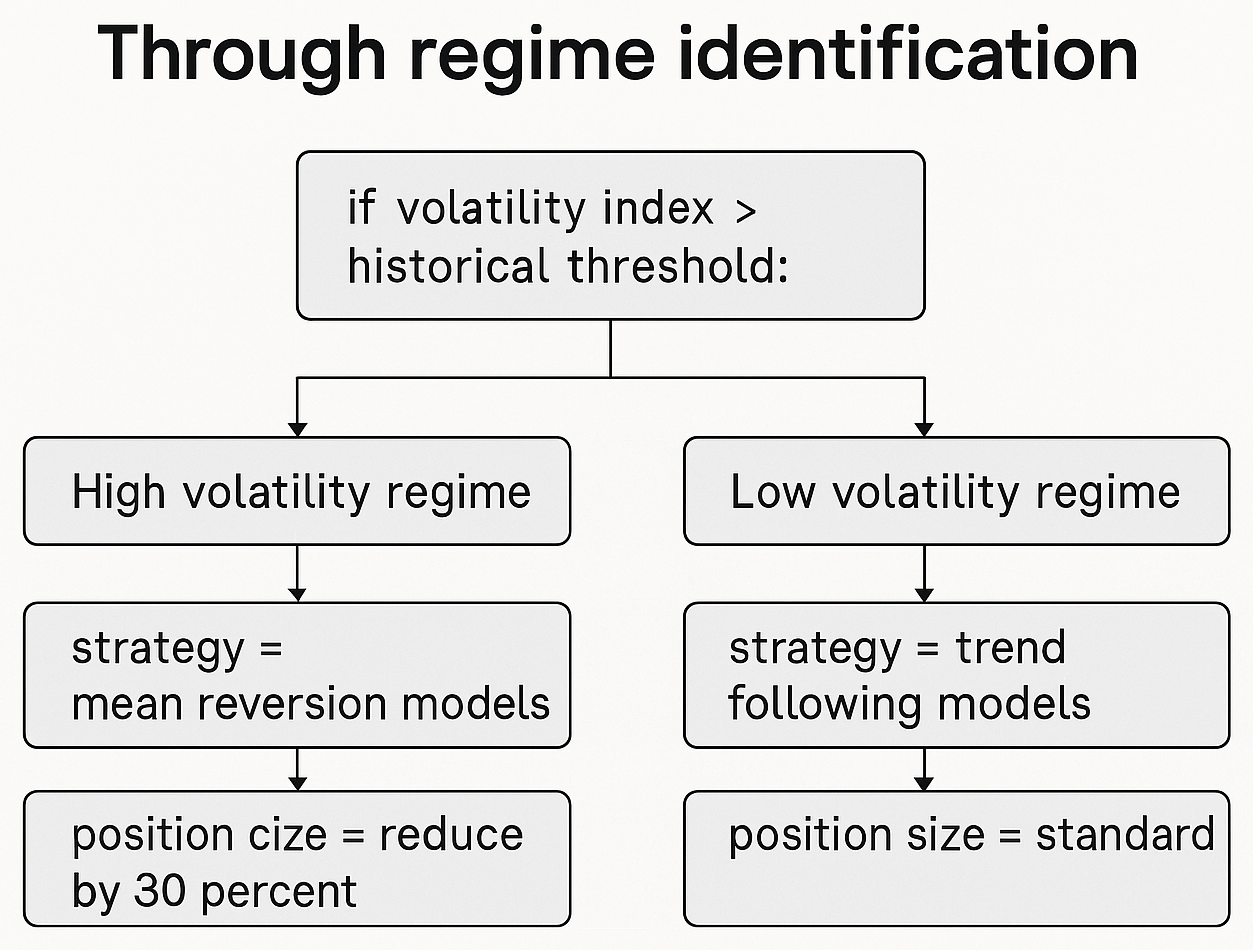

- Through regime identification, markets shift between distinct behavioral states or "regimes" trending, ranging, or chaotic. Identifying the current regime determines appropriate strategies:

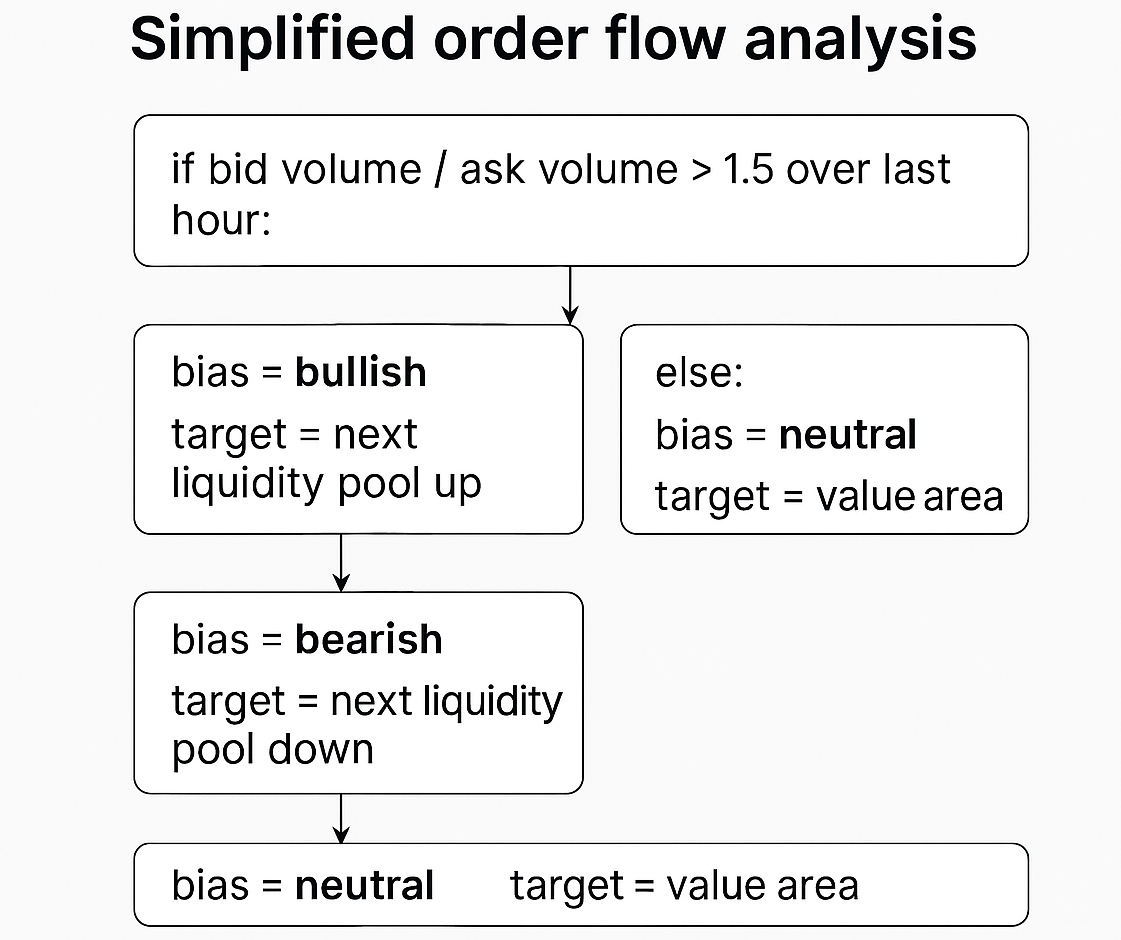

- Through order flow imbalance, rather than seeing conspiracies in price movements, I track the statistical imbalance between buying and selling pressure across time frames:

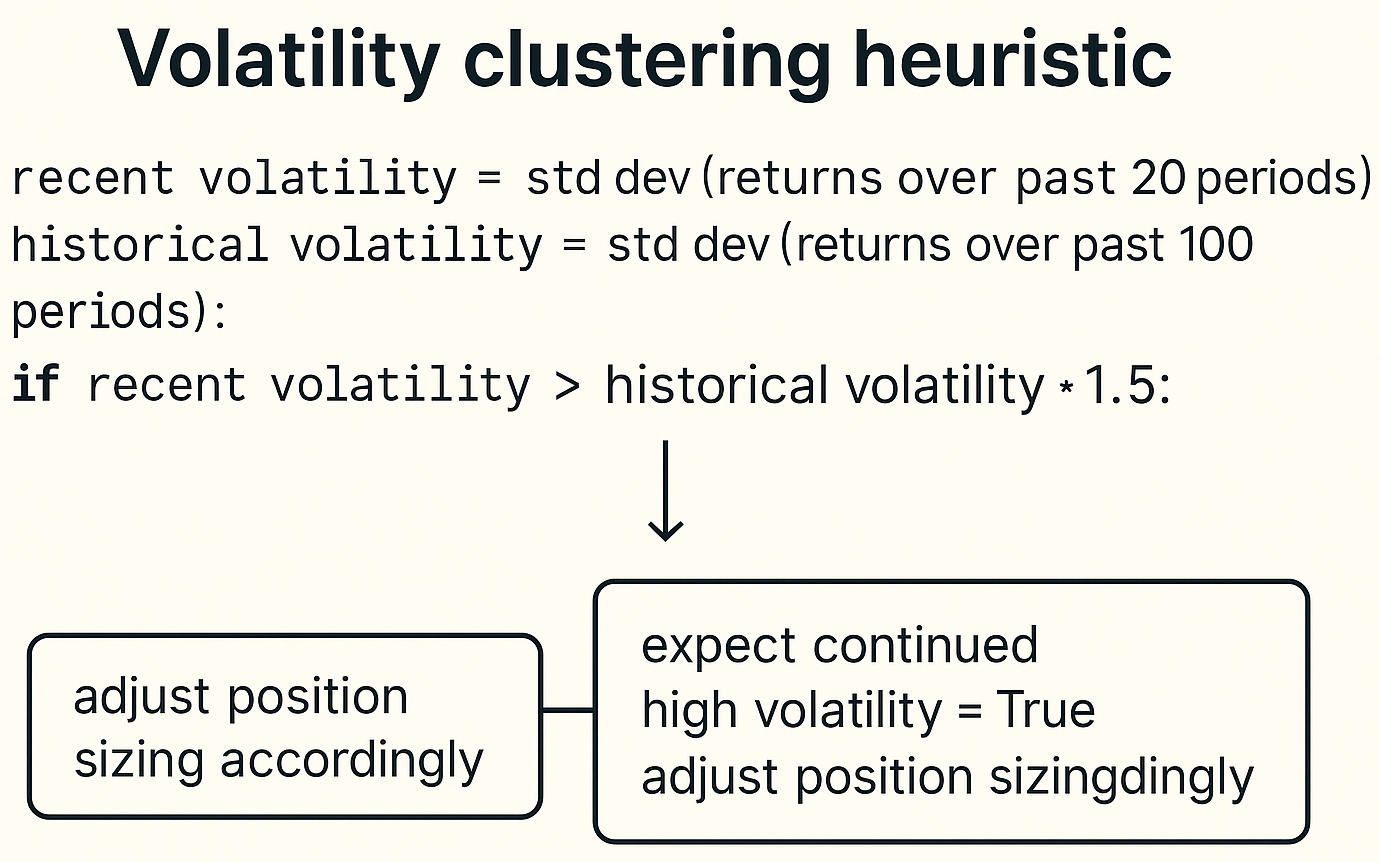

- Through volatility clustering, financial markets demonstrate a peculiar property: volatile periods tend to cluster together, as do calm periods. This isn't manipulation but a statistical property that creates predictable patterns:

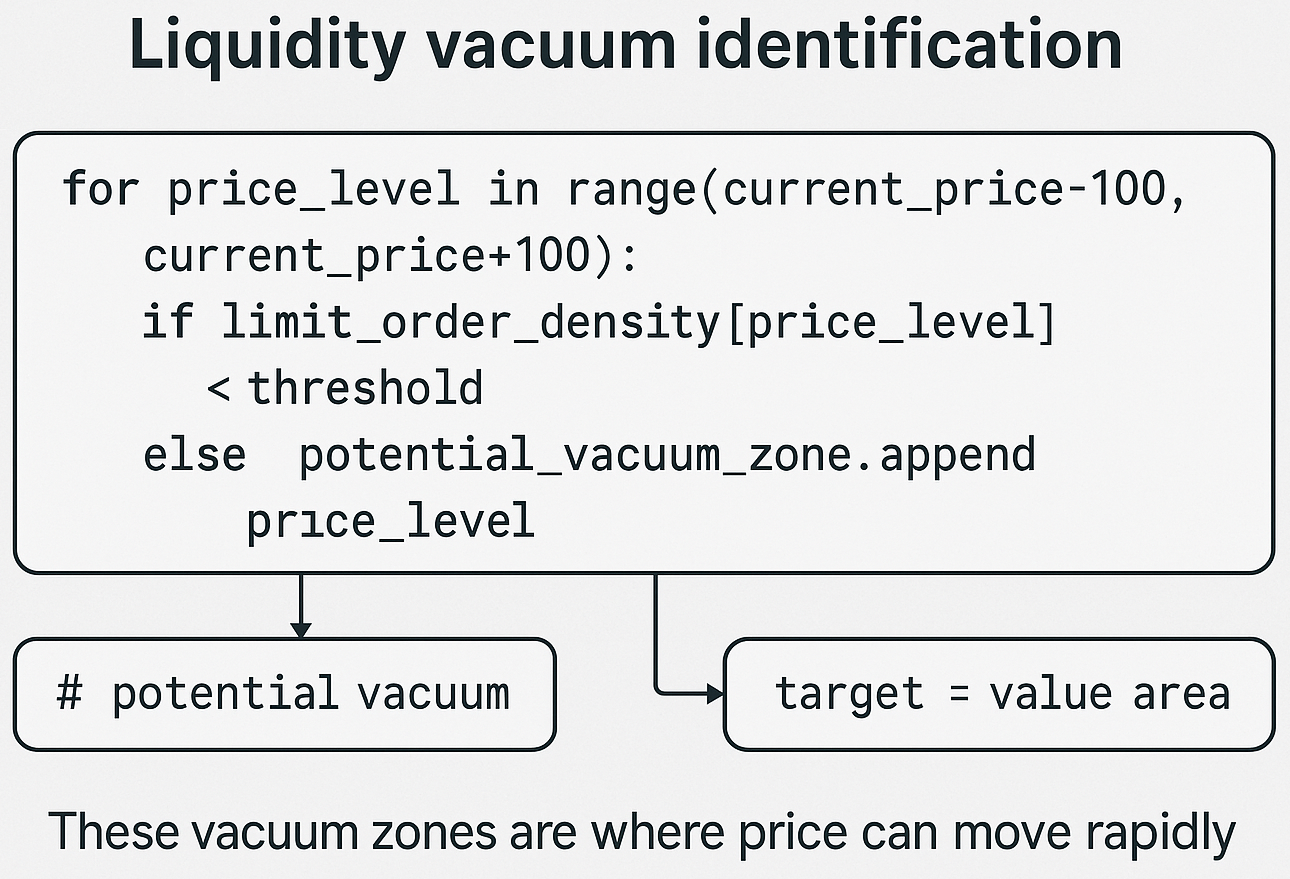

- Through liquidity mapping, I map where executable volume exists in the market and where it's absent. Prices tend to move rapidly through areas of low liquidity (creating those dramatic spikes) and slow down in areas of high liquidity:

The quantitative mindset treats price action as a probabilistic field, not deterministic storytelling. We don't need villains or heroes in our market narrative just statistical properties and behavioral finance. This approach transforms how you interpret market movements. A sudden price drop isn't "the whales trying to shake out weak hands" it's the natural consequence of overleveraged positions meeting a liquidity vacuum, creating a mathematical inevitability rather than a conspiracy.

From Paranoia to Pattern Recognition

The most significant evolution in my trading journey wasn't learning more indicators or strategies it was shifting from paranoia to pattern recognition. This mental model transformation is what separates consistent performers from perpetual victims of market "manipulation." Markets aren't fair or unfair they're complex adaptive systems governed by mathematical principles and human psychology. Successful traders stop asking "Who's against me?" and start asking "What patterns are emerging?" and "How can I position myself probabilistically?"

This mindset shift comes with liberating implications:

- You stop feeling personally targeted by market movements

- You focus on statistical edges rather than perfect entries and exits

- You embrace uncertainty instead of seeking perfect prediction

- You build systems that thrive on market structure rather than fighting it

As the legendary quant James Simons once said, "I look for markets that can be systematized. I'm not interested in the narrative," or as Paul Tudor Jones put it more bluntly, "Don't be a hero. Don't have an ego. Always question yourself and your ability."

The market isn't a battlefield where you're constantly under attack it's more like a complex game of probability and psychology where the rules are constantly evolving. Your job isn't to expose the game but to understand its statistical properties well enough to extract consistent value. The true edge in markets doesn't come from uncovering conspiracies. It comes from understanding market microstructure, building robust statistical models, and maintaining psychological equilibrium when others are swinging between fear and greed.

You don't beat the market by exposing it. You beat it by understanding how it really works as a complex system of probability, liquidity, and human behavior that can be systematically analyzed, not a rigged game designed to separate you from your money. The next time you feel personally targeted by a price movement, remember: it's not about you. It's about math.