Decoding Market Dynamics: Navigating the Interplay Between Volume, Liquidity, and Market Making

This article explores how the combination of volume and liquidity defines four distinct market environments, and how market makers act as central players in maintaining, exploiting, or stabilizing these conditions. The insights are tailored for traders, analysts, institutional investors, and system designers seeking to understand the microstructure of financial markets from a functional and strategic lens.

The Pulse of the Market

Fundamental Concepts

-

Volume: The number of transactions within a given timeframe an indicator of market interest and activity. Volume reflects not just the quantity of trades but also the conviction of market participants. When Apple releases earnings, the spike in volume isn't just numeric data it's a collective expression of certainty or uncertainty about the company's future.

-

Liquidity: The ease with which assets can be traded without significantly impacting the price. Consider the difference between selling 100 shares of Microsoft versus selling 100 shares of a penny stock. The former barely creates a ripple; the latter might cause a tidal wave in price.

Relevance and Urgency

Volume and liquidity directly affect price discovery, risk management, and execution efficiency. In March 2020, as COVID-19 fears peaked, even U.S. Treasury markets traditionally the most liquid in the world experienced severe liquidity strains, causing unprecedented price dislocations and execution problems for risk-averse institutions. Markets don't just move on information they are shaped by their structure and the quality of participants. The Flash Crash of May 6, 2010, wasn't triggered by fundamental news but by structural weaknesses in liquidity provision and volume distribution across fragmented markets.

Microstructure as the Underlying Mechanism

The market is not a black box it operates through systems like order books, bid-ask spreads, depth, and the influence of market makers. Understanding these mechanisms isn't academic; it translates directly into trading edges. While retail traders often focus exclusively on price action, institutional traders know that reading the order book can reveal impending price moves before they materialize on the chart.

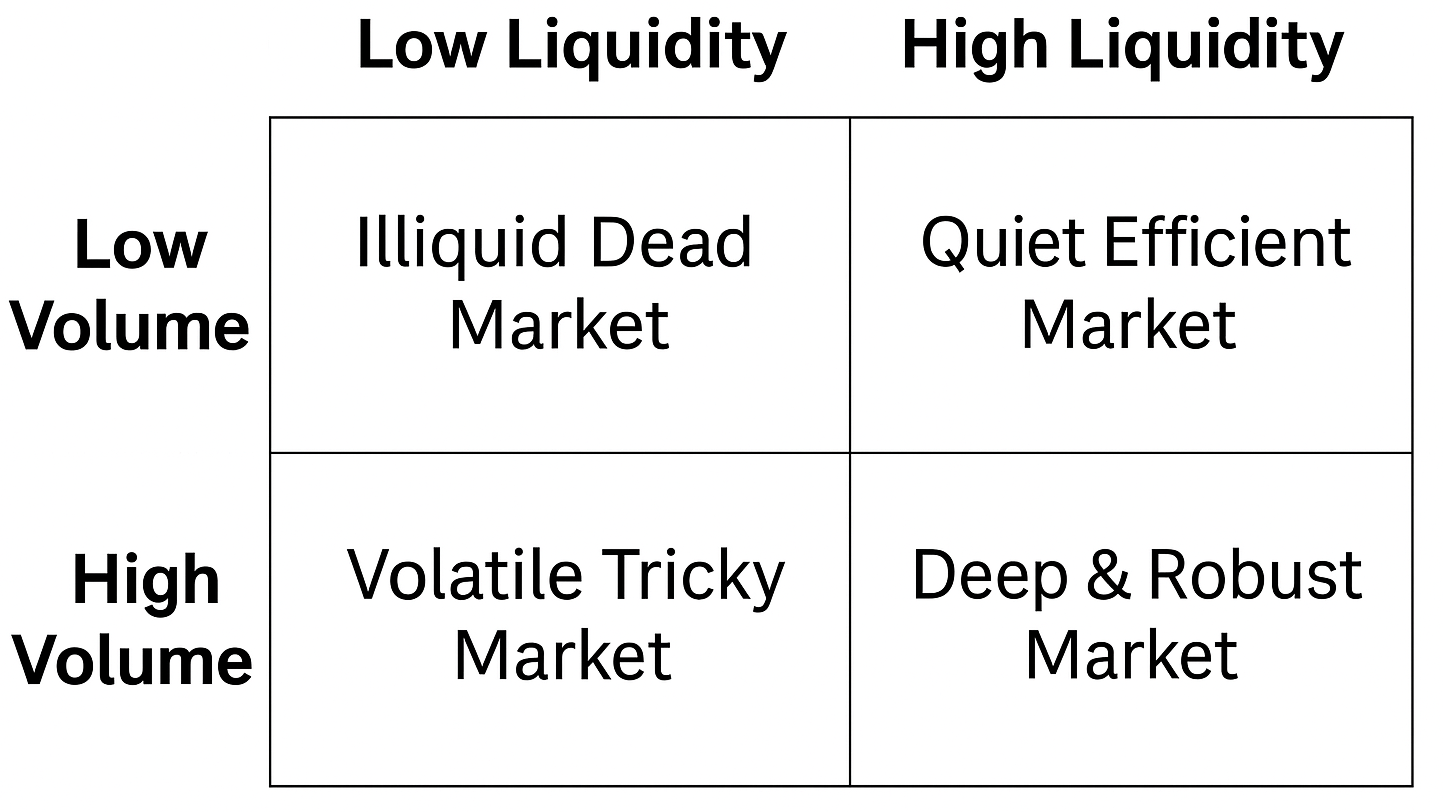

Foundational Matrix: The Volume-Liquidity Landscape

Structural Table

Matrix Interpretation

High/low volume ≠ good/bad market context matters deeply. For ex, bitcoin traded with high volume but low liquidity during parts of the 2017 bull run, creating a volatile environment where prices could move 5-10% on relatively modest order flows. Conversely, EUR/USD often trades with modest volume but exceptional liquidity during Asian trading hours, offering traders precise executions with minimal slippage. Liquidity is the lubricant of execution, while volume is the pressure that tests it. When Robinhood restricted trading in GameStop (GME) in January 2021, we witnessed how volume pressure against artificially constrained liquidity created extreme price action.

Key implications include: slippage, spread width, and execution cost. A trader moving $1 million in Bitcoin will experience dramatically different outcomes depending on the market condition from negligible impact in deep markets to potentially moving the price 1-2% in thinner conditions.

Profiling the Four Market Conditions

1. Low Volume, Low Liquidity "The Desert"

- Minimal activity, wide spreads, shallow order book. In this environment, a $10,000 trade might move prices by 5% or more. You'll observe gaps between price levels in the order book, sometimes with no orders at all for several price increments.

- Common in: illiquid altcoins, speculative stocks, or exotic currency pairs. Consider mid-cap cryptocurrencies outside the top 100, or thinly traded stocks on the OTC markets, where daily volume might be just a few hundred thousand dollars.

- Risks: price manipulation, delayed execution, false volume spikes. The notorious "pump and dump" schemes thrive in desert conditions, where organized groups can easily move prices with relatively small capital deployments.

2. High Volume, Low Liquidity – "The Mirage"

High trading volume but a thin order book → extreme volatility. The market appears active but lacks depth. A perfect example was Dogecoin during Elon Musk's SNL appearance in May 2021 tremendous volume, but liquidity evaporated as prices began falling, accelerating the decline.

Often seen in: hype driven tokens, news driven surges. When GameStop (GME) experienced its short squeeze in January 2021, it exemplified this condition astronomical volume but with liquidity that couldn't match the demand, causing wild price swings. Typical of pump and dump schemes and arbitrage traps. Traders often mistake high volume for market health, only to discover they cannot exit positions without significant slippage when sentiment reverses.

3. Low Volume, High Liquidity – "The Quiet Depth"

Efficient, tight spreads, but lacks movement incentive. This environment feels like a sleeping giant everything works smoothly, but little happens. Major forex pairs during low-volatility periods often exhibit this pattern. Best for passive traders using limit orders. Patient traders can place limit orders slightly better than market price and collect the spread over time, essentially acting as amateur market makers. Common during off-peak sessions of mature markets. The S&P 500 E-mini futures contract often displays these characteristics in the hours before the US market opens or during holiday-thinned trading sessions.

4. High Volume, High Liquidity – "The Sweet Spot"

Ideal environment: active, deep, and stable. This is where most trading strategies perform as designed, with minimal slippage and maximum execution certainty. When the E-mini S&P 500 futures contract trades during core market hours, it typically represents this ideal condition. Optimal for all trader types and algorithms. Large institutional orders can be worked through the market with minimal price impact, while retail traders enjoy tight spreads and reliable executions.

Examples: BTC/USDT, EUR/USD, S&P Futures. During normal market conditions, these instruments maintain sufficient depth to absorb substantial order flow without dramatic price dislocations.

Market Makers: Stabilizers or Saboteurs?

Definition and Core Functions

Provide two-sided quotes (bid and ask). Unlike directional traders, market makers simultaneously offer to buy and sell the same asset, profiting from the spread between these prices rather than from price direction. Ensure price efficiency, reduce spreads, and facilitate order execution. When functioning properly, market makers enhance market quality by narrowing spreads and providing the counterparty for natural buy and sell flow. The NYSE's Designated Market Makers (DMMs) are formally tasked with maintaining fair and orderly markets in their assigned securities.

Interaction with Each Market Type

- In "The Desert": often the only source of liquidity. For emerging cryptocurrencies or microcap stocks, a single market maker might provide 80% or more of the available liquidity, creating dependency risks.

- In "The Mirage": may intensify volatility through strategies like spoofing or layering. During the 2010 Flash Crash, some high frequency traders were accused of withdrawing liquidity precisely when it was most needed, exacerbating price declines.

- In "The Quiet Depth": fill the book to ensure continuity. Market makers thrive in these conditions, collecting small but consistent spreads with minimal risk. The FX market during Asian trading hours often features dominant market maker activity maintaining orderly trading despite limited natural flow.

- In "The Sweet Spot": become active liquidity engines (e.g., HFTs and algo MMs). In the E-mini S&P 500 futures market, automated market makers might refresh their quotes thousands of times per second, creating a seamless trading experience even during high-volume periods.

Ethical Concerns and Transparency

Risks include: front-running, wash trading, and conflicts of interest especially in centralized exchanges. The 2014 publication of Michael Lewis's "Flash Boys" highlighted concerns about high frequency traders potentially seeing and acting on order flow before it reached exchanges, raising questions about market fairness.

Dynamic Interplay: Volume, Liquidity, and Market Making

a. Adaptive Behavior of Market Makers

Adjust inventory risk and spread tolerance based on current market conditions. As volatility increases, market makers widen their spreads to compensate for heightened risk. During the March 2020 COVID crash, bid-ask spreads in even the most liquid instruments widened dramatically as market makers adjusted to unprecedented uncertainty.

Scale up or down participation depending on volatility and cost. Market makers aren't obligated to provide liquidity in all conditions. When Knight Capital Group (a major market maker) experienced a technology glitch in 2012, their sudden absence from the market caused significant liquidity disruptions in hundreds of stocks.

b. Impacts on Price Discovery Absence of market makers may lead to inefficient prices. When market makers stepped back from providing liquidity in less liquid ETFs during the 2015 ETF Flash Crash, prices temporarily disconnected from fair value, with some ETFs trading at 30-40% discounts to their underlying assets. Overdominance may distort fair value and suppress organic volatility. Some cryptocurrency exchanges have been accused of allowing market makers to engage in wash trading, artificially inflating volume figures while preventing natural price discovery.

c. Strategic Navigation for Traders

Go beyond chart-watching learn to interpret depth, flow, and liquidity structures. Professional traders don't just look at price; they observe the order book imbalances, trade tape, and liquidity distribution. Tools like Bookmap, Jigsaw, and exchange depth charts provide windows into these dimensions.

Strategic Implications for Traders, Institutions, and System Designers

a. For Traders

Align strategy with market type: limit orders in calm markets, market orders in deep ones. In "The Quiet Depth" environment, limit orders placed just inside the spread often get filled as market makers manage their inventory. Conversely, in "The Sweet Spot," market orders execute efficiently with minimal slippage. Monitor spread and volume-depth ratios before executing large trades. Before entering a position in Bitcoin, a savvy trader checks not just the price but also the bid-ask spread percentage and the depth available within 0.5% of the current price. This pre-trade analysis prevents execution surprises.

b. For Institutions

Choose execution venues based on liquidity quality and fee structure. When executing a large block of shares, institutional traders often route portions to different venues lit exchanges, dark pools, and crossing networks based on where liquidity is most favorable and information leakage is minimized. Utilize smart-order-routing (SOR) algorithms for optimal trade paths. Modern execution algorithms don't just split orders by time; they dynamically route to venues offering the best liquidity conditions at each moment, potentially accessing dozens of execution venues for a single order.

c. For Developers and Exchange Architects

Design transparent and incentive-aligned MM systems. The rebate structure on exchanges directly influences market maker behavior. Maker-taker fee models (where liquidity providers receive rebates) have dramatically increased liquidity in many markets but have also been criticized for potentially creating conflicts of interest. Implement anti-manipulation mechanisms like depth-volume audits. Modern exchanges increasingly employ sophisticated surveillance systems to detect potential manipulation tactics like spoofing, layering, and wash trading. The CME Group, for example, regularly brings enforcement actions against traders engaging in such practices.

Conclusion: Translating Market Microstructure into Strategic Edge

Each market condition presents a unique logic and risk-reward dynamic. The savvy trader doesn't apply the same approach in all environments but adapts tactics to match the prevailing volume-liquidity profile. Mean reversion strategies might excel in "The Mirage" while breakout strategies perform better in "The Sweet Spot."

Volume and liquidity are not just indicators they're instruments that define the market state. Rather than treating them as secondary to price, sophisticated market participants see them as primary signals that often precede price movements. A sudden liquidity withdrawal on one side of the order book frequently telegraphs imminent price movement. Market makers are the invisible hands shaping execution quality and trading opportunities. Their presence (or absence) fundamentally alters market behavior. Understanding their incentives, constraints, and tactics provides a window into the market's inner workings. Understanding their interactions creates smarter traders, sharper institutions, and healthier markets. The most successful market participants from retail day traders to institutional asset managers share one common trait: they've learned to read the market's structural language, not just its price movements.

Market Type Identification Tools:

- Volume to Liquidity Ratio (VLR): Calculated as trading volume divided by average order book depth at 1% from mid-price. High ratios indicate potential "Mirage" conditions, while low ratios suggest "Quiet Depth."

- Spread Persistence Metric: Measures how quickly spreads return to normal after large trades. In healthy markets, spreads widen briefly but quickly narrow again.

Strategic Adjustments by Market Type

- For "The Desert": Use carefully placed limit orders and expect longer holding times. Consider whether the potential reward justifies the execution risk.

- For "The Mirage": Be extremely cautious with market orders. Consider scaling into positions and implementing strict risk controls. Be prepared for sharp reversals.

- For "The Quiet Depth": Ideal for capturing spreads through limit orders placed inside the bid-ask range. Patience is rewarded here.

- For "The Sweet Spot": Capitalize on efficient execution with minimal market impact. Ideal for implementing complex strategies requiring multiple entries and exits.