industries

technology

Beyond Marketplaces: Navigating the Future of E-commerce Amid High Fees and Talent Inflation

By Ang

May 21, 2025

10 min read

This article is a strategic analysis of Southeast Asia’s shifting e-commerce landscape, focusing on the growing challenges faced by SMEs and startups due to rising marketplace fees and inflated tech talent costs. The article critically examines how platforms like Shopee, Tokopedia, and Amazon have evolved from enablers into margin-compressing ecosystems, while also exposing the inefficiencies of overfunded startup cultures driven by unsustainable hiring practices. In response, it outlines actionable strategies such as embracing Direct-to-Consumer (D2C) models, adopting omnichannel approaches, optimizing cost structures, and implementing competency-based recruitment. With projections showing Southeast Asia’s e-commerce GMV doubling by 2030, the article urges businesses to rethink their dependence on marketplaces, reclaim brand autonomy, and position themselves for long-term growth through agility, efficiency, and customer-centric innovation.

The Marketplace Paradox

E-commerce marketplaces, once celebrated as equalizing platforms for small sellers, have progressively transformed into double edged swords. In their early years, platforms like Tokopedia, Shopee, Lazada, and Amazon offered low fees and generous subsidies to attract sellers, allowing many SMEs to reach millions of customers at minimal cost. This proved transformative, especially in markets like Indonesia, by rapidly digitizing retail and driving e-commerce's share of retail sales from 5% to about 20% in just a few years.

However, a critical "marketplace paradox" has emerged: the very platforms which enabled growth are now eroding seller margins through rising fees and commissions. Over the past year, major marketplaces across Southeast Asia and globally have sharply increased seller fees in some cases doubling take-rates by adding new commissions and service charges.

The significance of this shift is profound. Amazon's effective take rate for third-party sellers has reached 47% in 2025, a significant increase from 40% just five years prior. This comprehensive figure encompasses not only standard referral fees (8-15%), but also Fulfillment by Amazon (FBA) costs (20-35% of revenue), and increasingly mandatory advertising expenditures (up to 15% of sales). Some sellers report that these combined fees can consume as much as 70% of their total revenue, making sustained profitability extraordinarily challenging.

Compounding these platform-specific challenges are broader macroeconomic pressures that further erode online business profitability. The e-commerce industry is grappling with volatile tariff situations, international shipping costs that have surged by 35% year over year, and raw material prices that have risen by an average of 22% since 2023.

In this environment, businesses face a precarious position: they must either absorb significant margin erosion, risk losing customers by raising prices, or strategically pivot to alternative channels. Southeast Asian e-commerce, and indeed global digital commerce, stands at a crossroads: what was once an efficient growth engine for merchants now threatens to become a profit trap. This report delves into these challenges and offers strategic pathways forward.

The Evolving Marketplace Business Model: Fee Structures and Their Impact

Comparative Fee Structures Across Major Marketplaces

To understand the squeeze on sellers, we must dissect how marketplaces make money. Platforms primarily earn through commissions and service fees on each transaction. For years, these fees were minimal – Shopee famously charged 0% commission in its early days to lure sellers, relying on investor subsidies. Lazada too offered 0% commissions for new sellers and low single digit rates thereafter.

This has changed dramatically. By Q4 2024, the effective take-rate (total commission + payment fee) for Shopee Mall sellers climbed to roughly 12–16% in Indonesia and higher in some markets (15–20% in Malaysia and Philippines) compared to single-digit levels a year prior. Tokopedia, Indonesia's largest marketplace, likewise increased its charges with new merchant service fees up to 10% for Power Merchant sellers.

While other platforms offer comparatively lower fee structures, the overall trajectory points to a tightening squeeze on margins across the entire e-commerce landscape:

-

Walmart Marketplace: Generally presents a more cost effective option, with most product categories incurring referral fees between 8% and 15%. For a $50 electronic item, Walmart's $5 fee is notably 50% lower than Amazon's $7.50. Additionally, Walmart's no subscription model offers a direct annual saving of $480 for small sellers compared to Amazon's $39.99/month professional selling fee.

-

eBay: Features an average referral fee of 12.9% plus a $0.30 per-transaction fee, approximately 35% higher than Walmart's 10% average.

-

Niche Platforms: Etsy charges 6.5% plus a $0.20 listing fee, while TikTok Shop offers a competitive 5% commission, though its sales are largely influencer-driven.

To provide a clearer picture of these varying costs, the following table presents a comparative analysis of key e-commerce marketplace fees:

Table: Comparative Analysis of Key E-commerce Marketplace Fees (2023-2024)

| Marketplace Name | Typical Referral/Commission Fee Range (%) | Subscription/Listing Fees | Additional Key Fees/Considerations | Effective Take Rate/Impact on Seller Margins |

|---|---|---|---|---|

| Amazon | 8-15% | $39.99/month (Pro) | FBA (20-35%), Advertising (up to 15%) | ~47% effective take rate; up to 70% of revenue can be consumed by fees |

| Walmart | 8-15% (most categories), 6% (jewelry >$250), 10% (electronics <$100) | None | WFS fees ($3-5/unit) | 20-50% lower than Amazon/eBay in key categories; saves $480/year vs. Amazon subscription |

| eBay | 12.9% average | $0.30 per transaction | Varies by category; can be 35% higher than Walmart average | Fees are approximately 35% higher than Walmart's average |

| Etsy | 6.5% | $0.20 per listing | Niche-focused (handmade/vintage) | Costlier for non-handmade goods |

| TikTok Shop | 5% | None | Limited to influencer-driven sales | Low fees, but specific sales model |

| Mirakl (average) | 6-15% (e.g., 12-15% food, 6-10% electronics) | Varies by platform | Platform provider, not direct marketplace | Reflects typical industry averages for platform services |

In effect, a merchant on any major platform today often surrenders 8–15% of every sale to the marketplace, whereas a few years ago the cut might have been near zero for the same sale.

D2C (Direct to Consumer) Economics: The Cost Comparison

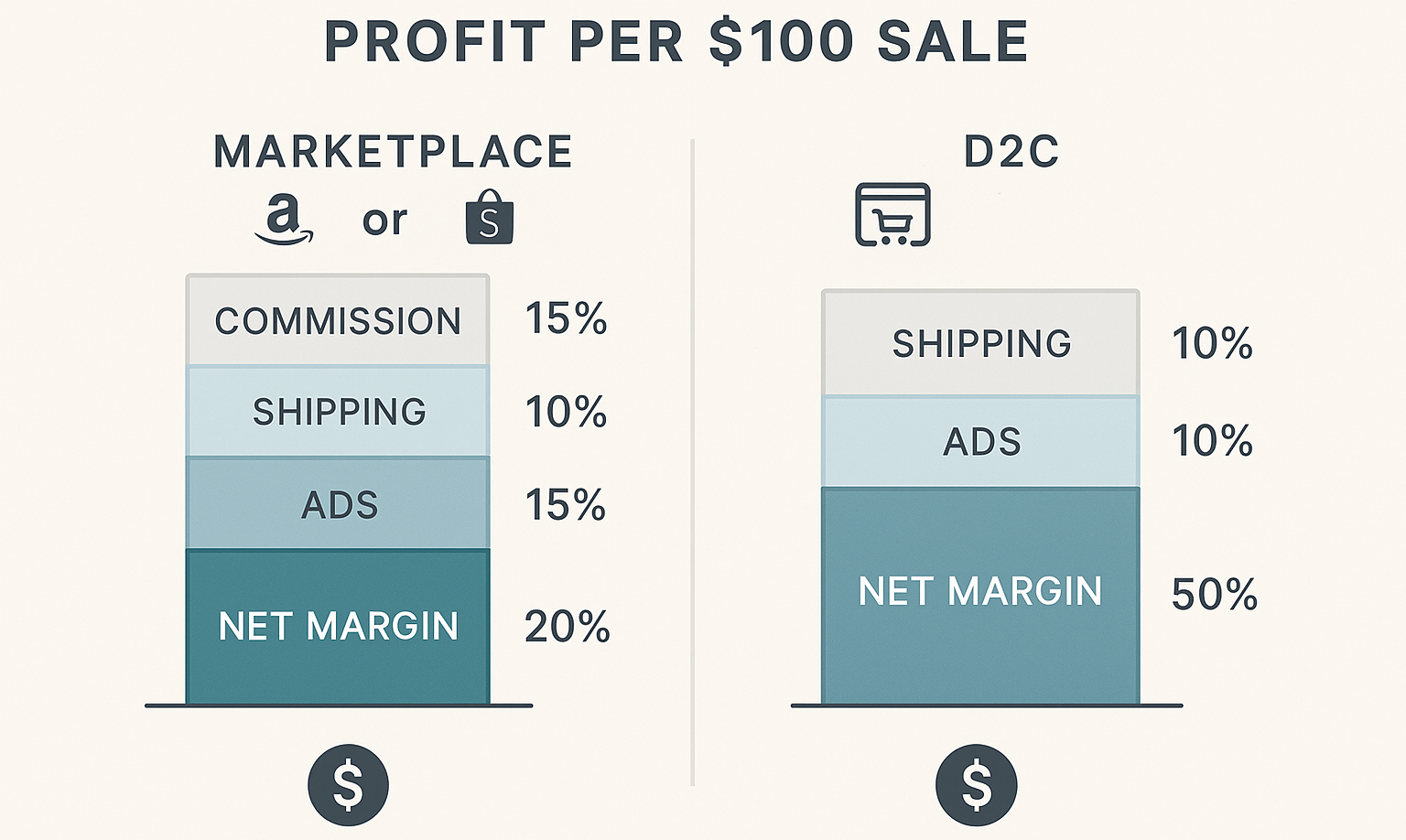

In contrast to marketplace fees, selling through one's own website or social media channels involves a fundamentally different cost structure. There is no hefty commission to a third-party platform; instead, the costs are mainly in technology and marketing.

Running an independent online store (via Shopify, WooCommerce, etc.) might cost a fixed platform fee ($30–$70 per month) plus payment gateway fees of ~2–3% per transaction. On a $100 sale, that payment fee equates to only $2–3, a fraction of the ~$15 a marketplace might charge for the same sale.

This simple illustration highlights the financial impact:

- If a product costs $70 and sells for $100, the gross profit is $30

- Selling on Amazon or a local marketplace with ~15% commission would cut the profit in half leaving about $15 net per sale

- By selling on one's own site, the merchant could theoretically keep most of that $30 (minus small transaction fees and site costs)

However, the trade off is traffic and visibility. Marketplaces deliver millions of ready to buy shoppers. Sellers are essentially paying "rent" (commission) for access to this audience. With D2C, businesses must attract shoppers themselves through marketing, which can be expensive. Digital advertising, social media content, and influencer partnerships become customer acquisition costs. It's not uncommon for young D2C brands to spend 10–20% of sales on marketing initially, effectively substituting one kind of cost (marketplace fees) with another (advertising spend).

Dependency vs. Autonomy: The Strategic Dilemma

Small and Medium sized Enterprises (SMEs) face a significant strategic dilemma: whether to leverage the vast customer reach and established infrastructure of marketplaces or to invest in building independent sales channels.

Marketplaces offer undeniable advantages through powerful network effects, where each new participant enhances the platform's value, and aggregated data insights providing visibility into consumer behavior across multiple vendors. However, the trade-off is often a distinct lack of direct brand control and limited access to granular customer data.

This reliance has created structural dependency for many businesses, rendering them vulnerable to escalating costs and unfavorable terms. SMEs frequently encounter highly unbalanced terms and conditions, as well as instances of unjustified blocked accounts, which directly threaten their competitiveness and even survival. The Platform to Business (P2B) Regulation was introduced to promote fairness and transparency for business users, particularly SMEs, on online platforms. Yet, SMEs United indicates that the regulation has largely failed to deliver the intended protective effects, stating that "significant shortcomings still exist."

In contrast, Direct to Consumer (D2C) models provide complete brand control, direct customer relationship management, and invaluable access to first-party customer data. Establishing a D2C website requires an initial investment ranging from $1,000-$5,000 for basic sites to $20,000+ for enterprise-level platforms but eliminates recurring marketplace commissions, allowing businesses to retain a significantly larger share of their revenue and build direct customer relationships.

Marketplaces as Price Comparison Hubs

An increasingly critical view of large marketplaces is that they function less as loyalty-driven storefronts and more as commodity price comparison engines. With multiple sellers listing identical or similar products, consumers often treat these platforms like shopping search engines filtering by price, ratings, and reviews to find the best deal.

According to Statista, a staggering 8 out of 10 shoppers actively compare prices across various online stores before finalizing a purchase. A Facebook–Bain study found that Southeast Asian shoppers visit an average of 3.8 different platforms before making a purchase, essentially shop hopping to compare prices and options.

This pervasive price transparency is facilitated by numerous dedicated price comparison websites, such as Google Shopping, PriceGrabber, and Shopzilla, which leverage advanced web crawling and API technologies to aggregate real time pricing data from multiple retailers.

For merchants, the result is that a marketplace may drive volume, but the customers "belong" to the platform, not the brand. Loyalty is to the marketplace's convenience and discounts, not necessarily to individual sellers. Some SMEs complain that they have become "tenants" on these platforms, forced to participate in discount wars and pay for visibility just to keep up.

The intense transparency, when combined with rising marketplace fees, forces businesses to operate on tighter margins. Companies cannot simply "set and forget" prices; they must adopt sophisticated pricing strategies that leverage data analytics to remain competitive while protecting profitability.

Direct-to-Consumer Renaissance: Breaking the Dependency Cycle

The Direct to Consumer (D2C) model is experiencing a significant renaissance as brands strategically pivot to counteract marketplace fee pressures and cater to evolving consumer demands for value, authenticity, and direct engagement.

The Economics and Strategic Value of D2C

By eliminating intermediaries such as retailers and wholesalers, D2C brands can retain a significantly larger share of their revenue, leading to higher profit margins. This substantial cost saving can then be reinvested into product development, enhancing customer experience, or bolstering other core operations, fostering sustainable growth.

A key advantage of the D2C model is the complete control it affords over brand presentation and the entire customer journey. This comprehensive control allows for consistent brand messaging across all touchpoints, the implementation of tailored marketing campaigns, and rapid iteration on user interface (UI) and user experience (UX) elements based on direct customer feedback.

D2C models also provide unparalleled access to valuable first party customer data. This rich data empowers brands to implement sophisticated personalization strategies, offer highly targeted recommendations, and ultimately enhance customer lifetime value (LTV).

Success Stories and Implementation Strategies

The efficacy of the D2C model is evident in the success stories of numerous brands across the region and globally:

-

Nayz (Indonesia): This baby food brand built a loyal following for its healthy baby porridge products through direct to consumer channels. Nayz embraced a D2C strategy via its own online store and social media engagement and saw remarkable business growth; the company's revenue jumped 41% post-IPO as it capitalized on its direct model. By owning the customer relationship and distribution, Nayz could introduce subscription plans for parents and gather feedback directly.

-

L'Oreal's Color&Co: This brand exemplifies advanced personalization by leveraging data to tailor hair dye kits and offering online consultations, creating a unique and highly engaging customer experience that builds loyalty.

-

Gymshark: This fitness apparel brand transformed into a global $500 million enterprise largely through its strategic and authentic use of influencers, showcasing the immense power of social commerce in building brand awareness and driving sales.

-

Nike: The global sportswear giant has aggressively invested in its D2C channels, including Nike.com, the SNKRS app, and flagship stores, while strategically reducing wholesale partnerships. Their focus on exclusive product drops and loyalty programs reinforces direct customer relationships and comprehensive brand control.

-

Glossier: The beauty brand optimized its supply chain by establishing micro fulfillment centers, resulting in 24% faster deliveries and a significant 17% reduction in shipping costs, demonstrating operational efficiency gains through D2C.

The Social Commerce Explosion

Another trend is the explosion of social commerce across Southeast Asia. Thousands of micro entrepreneurs across Indonesia, Thailand, and Vietnam now sell directly through Facebook Live, WhatsApp groups, TikTok Shop, and Instagram, effectively bypassing traditional marketplaces.

In Indonesia, social commerce has evolved from a fringe channel to the mainstage accounting for an estimated 79.5% of digital transactions in 2024 (a figure that includes C2C selling via social media and live-stream commerce). Platforms like TikTok Live, YouTube Live, and Facebook have enabled "live shopping" experiences where consumers buy products during real-time video streams, a format that 6 in 10 Indonesians used to make purchases in 2024.

For savvy SMEs, these channels offer a way to recreate the personal, trust-based selling of the offline world in a digital format. Many have found that while these D2C approaches take effort to build an audience, they engender stronger customer loyalty and better margins since there's no hefty commission to hand off.

The multitude of D2C advantages including higher margins, direct customer relationships, comprehensive brand control, invaluable data access, and faster iteration cycles directly addresses the vulnerabilities created by marketplace dependency. D2C is no longer merely an alternative sales channel but a strategic necessity for long-term brand resilience, profitability, and direct ownership of the customer relationship.

Changing Consumer Behaviors: The Price-Conscious, Research-Oriented Shopper

The power balance in e-commerce is subtly shifting as consumers themselves grow more savvy and discerning. This evolution in consumer behavior has profound implications for how businesses approach their e-commerce strategy.

The New Consumer Mindset

The modern consumer is characterized by heightened price sensitivity and an acute cost-consciousness. A 2024 Nielsen report indicates that consumers are feeling more "pressured" than ever, leading them to "trade down" to lower-cost alternatives, including private label goods. This global shift, though seemingly small at 0.8% towards lower priced tiers, translates into billions of dollars in sales.

The traditional consumer decision-making process has fundamentally "flipped" in 2025. Instead of starting with a desired product and then seeking out its price, consumers now frequently begin with a fixed budget and subsequently make trade offs between product categories based on perceived value and price. This profound shift results in a noticeable decrease in traditional brand loyalty and a prevalence of "promo seekers" who actively search for discounts and deals.

In Southeast Asia especially markets like Indonesia, Malaysia, and Thailand digital consumers are now highly price-conscious, mobile savvy, and research oriented. Years of exposure to online shopping have taught buyers how to sniff out deals and compare offerings. According to one regional survey, over 40% of consumers had tried an online store they'd never heard of in the past year indicating a willingness to switch if a deal is compelling.

Economic currents in recent years have heightened this price sensitivity. Inflationary pressures exacerbated by global events and local currency fluctuations have made Southeast Asian consumers scrutinize their spending. A 2023 year end poll found that consumers in the region are "more price sensitive, looking for affordability not just in terms of price but also in product durability." In other words, shoppers are seeking greater bang for their buck: not only low prices but products that last, as a way to stretch their money.

The Hidden Costs of Consumer Expectations

Consumers also exhibit extreme sensitivity to hidden costs. Over 90% of consumers are likely to abandon their shopping carts if confronted with high shipping costs for standard items. Furthermore, approximately 50% of consumers express an unwillingness to pay anything for shipping, regardless of delivery speed. While delivery speed was once a top priority, reliability has now superseded it, with on-time delivery being the foremost concern.

The "return rate explosion" represents another critical shift with significant implications for e-commerce profitability. Average return rates have surged to 29% in 2025, a notable increase from 20% in 2022. Each return costs merchants an average of $27-$33 in processing expenses, encompassing logistics, repackaging, and restocking.

"Bracketing" the practice of purchasing multiple sizes or versions of an item with the explicit intention of returning those that do not fit or are not desired has become a standard consumer behavior, particularly prevalent in categories like apparel and home goods. This practice significantly drains profitability, transforming what appears to be a sale into a costly operational burden.

Smart consumers have also learned to leverage the system: some will fill their marketplace carts and then wait for big campaign days (11.11 sales, etc.) to check out at a lower price. Others might use a marketplace as a showroom to identify a product, then search for the brand's direct website or Instagram page to see if it's cheaper or offering a loyalty perk off-platform.

The significant increase in return rates and the high per-return cost reveal a systemic issue, not just individual consumer behavior. Consumers are leveraging liberal return policies as a "try before you buy" mechanism, which shifts a substantial operational burden and cost onto merchants.

The "Tech Monkey" Phenomenon: Talent Inflation and Operational Inefficiencies

While the revenue side of e-commerce faces pressure from fees and savvy consumers, the cost side particularly talent presents its own paradox. Southeast Asia's startup ecosystem in the past decade saw a surge of investment capital and a scramble to hire tech talent, leading to what some observers dub the "Tech Monkey" phenomenon: inflated tech salaries and talent mismatches that reduce operational efficiency.

Salary Inflation in Tech Startups

In simple terms, many startups, flush with VC funding between 2016 and 2021, hired large numbers of developers, engineers, and other tech staff at rapidly escalating salaries often beyond the actual value those employees were able to deliver.

In Indonesia, the average salary for tech talent more than doubled between 2018 and 2021, especially for senior and managerial positions. A report by Monk's Hill Ventures and Glints found that by 2021, most startup founders acknowledged base salaries had at least doubled since 2016 due to fierce competition for skilled engineers. It was not unusual for a software engineer in Jakarta to jump jobs and receive 30-50% pay increases each time during the peak of the talent war.

This rapid rise was fueled by a perfect storm: global tech giants (Amazon, Google, Tencent, etc.) entering Southeast Asia and hiring locally, generous funding allowing startups to burn cash on talent, and a genuine shortage of experienced tech professionals in the region. The result was salary wars, companies poaching each other's engineers with ever higher offers and a tendency to equate hiring more people with achieving more progress.

Despite recent market corrections and a general slowdown in wage growth, compensation for tech professionals generally remains higher than in other industries. The average technology professional earned $112,521 in 2024, representing a modest 1.2% year over year increase. Tech companies continue to offer a premium for tech professionals, paying 5.7% more than their peers in other industries, and this gap is widening.

The "Growth at All Costs" Mindset and Its Consequences

The recent past witnessed an era of "easy-money funding" within the tech and e-commerce startup ecosystem, which inadvertently fueled a "growth at all costs" mentality. This environment often led to inflated salary expectations across the industry and created a highly competitive talent market.

Unfortunately, throwing money at the problem created its own issues. Many startups ended up with "mismatched" talent, too many people in roles that weren't critical, or hiring senior titles without a clear need or cultural fit. In some cases, relatively inexperienced developers were being paid like Silicon Valley veterans, but lacked the mentorship or processes to be fully effective.

Cultural factors played a role as well. In certain contexts, there was prestige in saying "our startup has a team of 100 engineers" even if 30 of them were under utilized, a relic of old-school corporate thinking meshing awkwardly with startup culture. Easy money from investors meant some startups over-hired, anticipating growth that didn't materialize at the projected pace.

The Market Correction and Long-term Risks

When the funding cycle tightened in 2022 and 2023, the cracks showed. Numerous high-profile Southeast Asian tech companies implemented layoffs or hiring freezes to correct the course. A 2023 Startup Talent report noted that many top startup executives even accepted pay reductions of 10–30% (some up to 80% less) as part of broader cost-cutting to improve cash flow.

The "bear market" of 2023-2024 has served as a critical "reality check" for the industry. As VC funding has significantly dried up, startups have been compelled to adopt a more cautious and strategic approach to hiring and compensation. This shift has resulted in widespread hiring freezes and significant layoffs, with over 18,000 employees laid off in early 2023 alone, and a net decline in headcount for startups for the first time in years.

In 2025, most startups are focusing on stability in compensation, with 61% planning no changes to cash pay and 72% maintaining equity grants. This indicates a discernible shift from aggressive, growth driven compensation strategies to more measured and sustainable approaches amid ongoing market uncertainty.

The "Tech Monkey" phenomenon, if left unaddressed, poses significant long-term risks to the operational sustainability and efficiency of tech and e-commerce startups. The historical emphasis on "decision velocity" and rapid scaling, often pursued at the expense of meticulous strategic planning, can lead to a "speed vs. sustainability" paradox. This can result in rushed decisions, costly rework, and alarmingly high rates of employee burnout, undermining long-term organizational health.

Strategic Pathways for Adaptation and Growth

Facing thinner margins on marketplaces and the need for leaner operations, how can e-commerce businesses particularly SMEs and startups adapt strategically? The future will favor those who diversify channels, optimize efficiency, and hire smartly. Here we outline key pathways and frameworks to thrive amid these challenges.

1. Embrace Omnichannel Diversification

The first strategic pillar is to diversify beyond a single marketplace and toward an omnichannel presence. Instead of relying 100% on one platform for sales, SMEs should spread their risk and reach across multiple channels.

An omnichannel strategy is no longer merely a competitive advantage but a fundamental requirement for e-commerce businesses seeking to thrive in a complex and dynamic market. It involves unifying the customer experience seamlessly across all online and offline touchpoints, including websites, mobile apps, social media, live chat, email, phone support, and physical stores.

Key Implementation Steps for an Effective Omnichannel Strategy:

-

Comprehensive Assessment of Current Operations: Before embarking on an omnichannel transformation, businesses must conduct a thorough audit of their existing channels and technological infrastructure. This involves meticulously mapping out all customer touchpoints to identify gaps in service and data flow, establishing baseline performance metrics for each channel, and identifying areas requiring immediate attention.

-

Define Clear Objectives and Key Performance Indicators (KPIs): Successful omnichannel implementation necessitates well-defined, measurable goals that are precisely aligned with the overall business strategy. Objectives should adhere to the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-bound.

-

Integrate Technology Platforms: The technological foundation of an effective omnichannel strategy is a unified commerce platform that seamlessly connects all customer touchpoints with back-end systems. This includes critical integrations with Point of Sale (POS) systems, inventory management, Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), and existing e-commerce platforms.

A practical approach is to use marketplaces for customer acquisition and broad visibility, but gradually encourage repeat customers to engage on owned channels. For example, a small electronics seller might sell entry-level products on marketplaces (where new customers discover them), but include inserts or promotions directing buyers to the brand's own website for accessories and refills.

Social media and messaging apps are integral to omnichannel strategy in Southeast Asia where apps like Instagram, Facebook, and Line are already used for shopping. Businesses can leverage social commerce by setting up Facebook Shops or Instagram product catalogs, posting interactive content (tutorial videos, user testimonials), and facilitating transactions directly through chat.

In markets like Indonesia and Thailand, live streaming commerce is booming (20% of SEA's e-commerce GMV in 2024 came from live stream sales), so brands should consider hosting live sale sessions to engage consumers in real time.

By implementing omnichannel strategies, an SME is not overly beholden to any single platform's fees or algorithm; if one channel changes policy (as marketplaces have with fees), the business can pivot focus to others.

2. Re-calibrate Value Proposition and Pricing

In a world where consumers compare prices relentlessly, competing purely on being the cheapest is a race most SMEs can't win. Instead, businesses should compete on value and differentiation.

This might mean bundling products or services in ways that marketplaces can't easily replicate. For instance, an SME selling coffee beans could offer a "home barista starter kit" on its own site beans + a drip filter + an e-book of recipes creating a unique product bundle that is harder to price-compare.

While maintaining competitive baseline prices is important, smart pricing can improve margins:

-

Dynamic and Value-Based Pricing: Implementing sophisticated pricing strategies that leverage real time data and demand fluctuations is critical for maximizing revenue. Employing psychological pricing techniques, such as prices ending in 9, has been shown to boost sales by up to 24%. Personalized pricing strategies, informed by granular customer data, can increase sales by 10% while improving margins by 2-5%.

-

Consider channel-specific pricing: Adjust for platform fees where you slightly adjust for platform fees. It's common for some brands to price items a bit higher on marketplaces to cover commissions, while offering the same item a bit lower on their own site (since they keep the margin).

-

Transparent communication: Educate customers that buying direct supports the brand and often comes with better service or perks. We've seen Southeast Asian consumers respond well to value-added offerings – remember that one top reason for online purchase, aside from price, is positive reviews and unique product features.

Another strategy is implementing loyalty programs or memberships on owned channels to encourage direct purchasing. Focusing on quality, curating customer reviews, and telling your brand story can justify a modest premium and reduce sole reliance on price wars.

3. Optimize Operations for Efficiency

With margins under pressure, operational efficiency is the name of the game. SMEs should scrutinize their entire value chain for cost saving and productivity boosting opportunities.

Supply Chain & Fulfillment Optimization:

- Evaluate your sourcing and logistics. Can you negotiate better rates with suppliers if you order in bulk?

- Is there a local supplier that reduces import costs?

- Consider using third-party logistics (3PL) providers that specialize in e-commerce; they might bundle many sellers' shipments to get volume shipping discounts that you alone couldn't.

- Streamline the supply chain and optimize inventory management to reduce overhead costs by improving inventory turnover and avoiding overstocking.

- Establish micro fulfillment centers like Glossier, which resulted in 24% faster deliveries and a significant 17% reduction in shipping costs.

- Apply automation in supply chains, which can lead to operational cost reductions of up to 20%.

Strategic Shipping Management:

- Given consumer sensitivity to shipping costs (which can lead to cart abandonment), offer flexible shipping options, such as free shipping thresholds.

- Nearly 80% of shoppers are willing to spend more to qualify for free shipping, indicating the effectiveness of this strategy.

- Understand fulfillment costs in detail including storage, pick & pack fees, postage, supplies, and return processing fees for effective negotiation with logistics partners.

Payment Processing Optimization:

- Payment processing fees (typically 2-3.5% per transaction for credit cards) can silently erode profits on every sale.

- Understand fee structures, leverage transaction volume to negotiate better rates, implement intelligent payment routing, and explore alternative payment methods like bank transfers (0.5-1.0% fees).

Returns Management:

- Proactively mitigate returns given their high processing costs ($27-$33 per unit) and increasing frequency.

- Improve product descriptions, integrate virtual try on technologies, provide accurate sizing guides, and enhance customer service to address potential issues before they lead to returns.

Technology and Automation:

- Invest in affordable tech tools to streamline workflows, such as inventory management software that syncs stock across marketplace and D2C channels to prevent overselling.

- Implement chatbots for customer service inquiries on social media to reduce support team needs.

- Use data analytics to identify which products sell best on which channel, then focus efforts accordingly.

- Process automation can also reduce manpower needs for instance, using an ERP system to handle accounting, or an email marketing tool to automatically re-engage past customers.

Cost Discipline and Unit Economics:

- Track your unit economics meticulously. This means knowing, for each order, the breakdown of costs (product cost, packaging, shipping, fees, advertising) and ensuring that, on average, you are not spending more to fulfill orders than you earn from them.

- Every SME should aim for a sustainable contribution margin per order. If marketplace fees or paid ads are making certain products barely break-even, consider raising the price, reducing the paid marketing on those, or discontinuing them in favor of more profitable lines.

4. Sustainable, Competency-Based Hiring

The discussion of the "Tech Monkey" phenomenon underscored the pitfalls of inflated, mismatched hiring. Going forward, e-commerce businesses must be very intentional in building their teams, hiring for specific competencies that drive the business and structuring compensation sustainably.

Competency-Based Recruitment:

- Focus on selecting candidates based on their demonstrable skills, behaviors, and abilities rather than solely on academic degrees or past job titles.

- This approach leads to improved on-the-job performance, higher employee retention (skills-based hires stay 9% longer), and significant cost and time efficiencies in the hiring process.

- Define core competencies clearly, use structured assessments, train hiring managers properly, and continuously refine your approach based on outcomes.

Prioritize Revenue-Driving and Critical Roles:

- As noted, many startups in 2023 refocused on sales and business development talent roles that directly increased income.

- Ask: do I have the needed skills to market and sell my products effectively? This might mean investing in a good digital marketer or a couple of charismatic live-stream hosts, even if it means fewer hires in other areas.

- Technical roles remain important, but the key is quality over quantity – one proficient developer or IT lead who can maintain your website and optimize page speed might be more valuable than three junior coders.

Right-Size Compensation:

- Conduct benchmarking to ensure salaries are fair but not overblown.

- In the current climate, there is more availability of talent, so you may not need to offer unsustainable salaries to attract good people.

- Focus on other aspects of compensation too: offer growth opportunities, flexible work arrangements, or equity/profit sharing for key hires.

- Build a strong employer brand to attract high caliber talent. Organizations that invest in employee well-being, offer clear career development opportunities, and maintain transparency can reduce the cost per hire by as much as 50%.

Upskill and Retrain Existing Talent:

- Instead of hiring a new expensive specialist for every new challenge, consider upskilling existing team members.

- If your operations person can be trained to also manage your ad dashboard, that might eliminate the need for a separate hire.

- Investing in continuous learning and skill development ensures that the workforce remains adaptable to new technologies and evolving market trends.

- This addresses the "executive growth gap" by providing internal career progression paths, which is a significant factor in retaining talent.

Implementing competency-based hiring also means being willing to use outsourcing or project-based talent when appropriate. The overall principle is to stay lean and flexible; a smaller, well-coordinated team can often outperform a larger, bloated one, especially if they are all focused on the core objectives.

5. Leverage Data and Customer Insights

As a final strategic note, SMEs should make the most of one advantage D2C channels offer: direct customer data. Unlike on marketplaces where the platform often hoards customer information, selling on your own site or social media gives you a window into who your customers are, what they like, and how they behave.

Use this data to refine your strategy – identify your most profitable customer segments and cater to them with targeted products or marketing. Build a CRM (customer relationship management) practice, even a simple one: collect emails or WhatsApp contacts, send personalized follow-ups or offers, solicit feedback and product reviews.

Smart use of customer insights can increase repeat purchase rates and word-of-mouth, which improves profitability by lowering the cost of acquisition over time. It's essentially turning the "savvy consumer" trend to your advantage: if you know your customers deeply, you can be savvy in how you serve them, creating loyalty that transcends pure price competition.

Customer retention should be a priority, as acquiring new customers costs significantly more (5-10 times) than retaining existing ones. Focus on delivering exceptional customer satisfaction, providing robust post-purchase support, and implementing personalized marketing to boost Customer Lifetime Value (CLV).

Future Outlook: Predicting E-commerce Shifts (2025-2030)

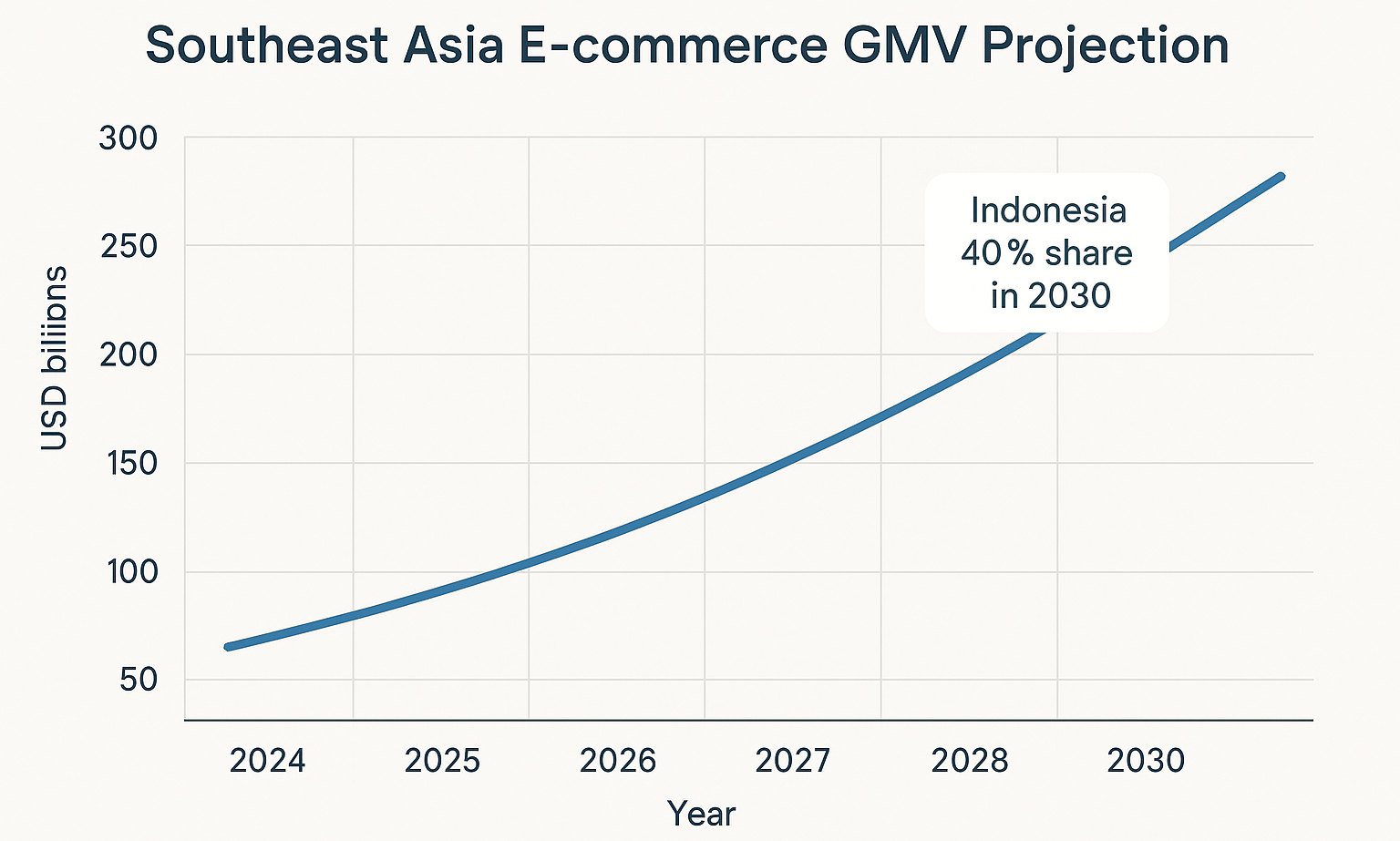

Peering into the latter half of this decade, the e-commerce landscape is poised for substantial growth and notable shifts in structure. Global e-commerce sales are projected to reach an astounding USD 60 trillion by 2030, representing a compound annual growth rate (CAGR) of 8% over the period of 2022-2030. The Asia Pacific region, particularly Southeast Asia, is expected to be the primary engine of this future growth, attributed to its large population, improving digital infrastructure, and robust economic expansion.

Total e-commerce sales in SEA are expected to more than double from around US$180–190 billion in 2024 to roughly US$370–410 billion by 2030. This growth will be driven by tens of millions of new online consumers and increasing spend per consumer as e-commerce penetration in retail deepens. Indonesia, in particular, will lead the charge. It's projected to account for about 40% of the region's e-commerce GMV by 2030, thanks to its large, young population coming online quickly.

Key Transformative Shifts

Several transformative shifts are likely to shape the e-commerce ecosystem:

Direct-to-Consumer (D2C) Growth and Brand.com Renaissance:

- We anticipate a significant rise in D2C e-commerce, wherein brands and manufacturers sell directly via their own websites or dedicated apps.

- By 2030, a larger chunk of online retail may bypass third-party marketplaces than ever before, fueled by enabling technology and the necessity for businesses to reclaim margins.

- In Southeast Asia, social media and chat platforms might effectively become the "infrastructure" of D2C, think shopping on WhatsApp in Indonesia or through LINE in Thailand.

- The concept of "community commerce" could thrive: brands building communities via Telegram groups, TikTok follower bases, etc., and monetizing through those engaged followers.

Marketplace Evolution and Platform Innovation:

- The big marketplaces will not stand still; they will innovate to retain both sellers and buyers.

- One likely development is differentiated service tiers for sellers: premium programs that offer lower commission rates or better visibility in exchange for monthly subscriptions or guaranteed service levels.

- By 2030, marketplaces might morph into something more akin to ecosystems offering a suite of services (financing, logistics, advertising, analytics) to sellers as value-added services beyond just listing products.

- We can expect further consolidation, with smaller marketplaces or new entrants either getting acquired or finding specialized niches.

- Chinese e-commerce giants are aggressively entering Southeast Asia platforms like TikTok Shop (ByteDance) and Temu (Pinduoduo) have already made waves, potentially altering the marketplace competitive landscape.

Technological Integration:

- Artificial Intelligence (AI) will significantly expand in e-commerce, with its market valuation projected to reach $8.65 billion in 2025 and $17.1 billion by 2030.

- By 2028, 33% of e-commerce enterprises are expected to incorporate agentic AI, and AI is projected to handle 80% of all customer interactions by 2030.

- AI-powered personalization is becoming standard, with approximately 71% of e-commerce sites already offering product recommendations and 91% of consumers more likely to shop with brands that provide personalized offers.

- Augmented Reality (AR) shopping could become common: currently, 32% of people use AR while shopping, and 40% of consumers are likely to pay more for a product that is initially available to test with AR.

- Payment innovations will also influence e-commerce growth, with seamless cross border e-commerce payments reducing friction in buying from another ASEAN country.

Changing Consumer Expectations:

- By 2030, Southeast Asian consumers will demand faster delivery, richer experiences, and greater transparency.

- Same day or next day delivery might become the norm in major cities, pushing both marketplaces and individual businesses to invest in logistics networks.

- Consumers will also expect personalization product recommendations tailored to their tastes, shopping apps that know their preferences, etc.

- Trust and authenticity will become increasingly important: with the proliferation of online sellers, consumers may gravitate more to brands or channels they truly trust.

- Social commerce is projected to reach a value of $2.9 trillion by 2026, highlighting the increasing integration of shopping within social media platforms.

- The market for sustainable products is expected to grow at a CAGR of 10% by 2025, with 62% of consumers expressing a willingness to pay more for such products.

Regulatory and Policy Environment:

- Governments will play a role in shaping this future, with potential regulatory actions on marketplace practices if fees become prohibitive or if anti-competitive behavior is observed.

- There may be requirements for transparency in how search algorithms treat sellers, or ensuring marketplaces cannot unfairly promote their own private labels over third-party sellers.

- Governments might also invest in digital infrastructure and SME training: initiatives to help more SMEs go online independently, grants for building D2C websites, or public e-commerce platforms for local producers.

- A focus on talent development is likely as well – to address the tech skills gap so that the next generation of startup hires are better trained, mitigating the talent mismatch problem over time.

To summarize the outlook: Southeast Asian e-commerce in 2025–2030 will be larger, more diverse, and more integrated into daily life than ever. Marketplaces will still be major players but will coexist with thriving direct channels and innovative shopping experiences. The winners in this future will likely be those who can adapt to new consumer behaviors, leverage technology for efficiency, and maintain agility in strategy because change is the only constant in digital commerce.

Strategic Takeaways

For busy SME owners, startup founders, and e-commerce strategists, here is a condensed list of actionable recommendations derived from our analysis:

1. Diversify Beyond Marketplace Dependency

- Actively reduce over-reliance on dominant e-commerce marketplaces with their increasingly high fee structures (e.g., Amazon's effective 47% take rate).

- Strategically invest in and scale Direct to Consumer (D2C) channels such as proprietary websites and social media platforms.

- Reclaim brand control, foster direct customer relationships, and retain a larger share of revenue through owned channels.

2. Embrace Omnichannel Integration

- Implement a comprehensive omnichannel strategy to unify the customer experience across all online and offline touchpoints.

- Integrate technology platforms (POS, inventory, CRM, ERP) and ensure real-time data synchronization.

- Break down internal organizational silos to create a seamless customer journey regardless of channel.

- Use marketplaces strategically for customer acquisition while encouraging repeat purchases through owned channels.

3. Optimize for Efficiency and Margin Preservation

- Conduct rigorous, ongoing cost analyses across all operational areas, including supply chain, shipping, and payment processing.

- Leverage automation and advanced analytics to streamline operations and optimize inventory management.

- Consider micro-fulfillment centers to reduce shipping costs and improve delivery times.

- Strategically manage shipping costs, given high consumer sensitivity to these fees.

- Proactively address the "return economy" through improved product information and potentially revised return policies.

- Know your unit economics on a per-product or per-order basis, ensuring you have a clear handle on profit after all fees and costs.

4. Implement Value-Based Pricing and Differentiation

- In a market where 80% of consumers compare prices online, move beyond competing purely on price.

- Adopt dynamic pricing strategies that respond to real-time market conditions and demand fluctuations.

- Create unique product bundles or value-added services that are harder to price-compare on marketplaces.

- Consider channel-specific pricing that accounts for different commission structures.

- Focus on value communication, explaining why your products or services justify their prices.

- Implement loyalty programs or memberships on owned channels to encourage direct purchasing.

5. Redefine Talent Acquisition

- Shift from a "growth at all costs" hiring mentality to a sustainable, competency driven model.

- Prioritize skills, behaviors, and adaptability over traditional credentials when hiring.

- Focus on revenue driving roles (sales, marketing) and critical technical positions while staying lean in other areas.

- Right size compensation through proper benchmarking while offering growth opportunities and flexible work arrangements.

- Invest in upskilling existing team members rather than hiring new specialists for every challenge.

- Build a strong employer brand to attract high caliber talent at reasonable compensation levels.

6. Capitalize on Customer Data and Relationship Building

- Leverage the rich first party data available through D2C channels to understand customer preferences and behaviors.

- Build a customer relationship management practice, even a simple one, to foster direct connections.

- Use customer insights to increase repeat purchase rates and word of mouth, improving profitability by lowering acquisition costs.

- Prioritize retention, as acquiring new customers costs 5-10 times more than retaining existing ones.

- Personalize marketing and product recommendations based on customer data to enhance loyalty.

7. Prepare for Future Technology Integration

- Proactively integrate AI for personalization, chatbots, and supply chain optimization.

- Consider augmented reality (AR) for enhanced product visualization where appropriate.

- Monitor payment innovations to reduce friction in the purchasing process.

- Stay informed about social commerce trends and platform developments to position your business advantageously.

By following these action points, SMEs and startups can better navigate the high-fee marketplace environment and the talent challenges, positioning themselves for sustainable growth. The common thread is being proactive and strategic not waiting for margins to erode or costs to explode, but taking control of your e-commerce destiny through diversification, efficiency, and customer centric innovation.

Navigating the Future of E-commerce

The e-commerce industry stands at a critical juncture. The foundational assumptions that once underpinned its rapid expansion are being challenged by the escalating costs of marketplace participation and the enduring pressures of talent inflation. The era of effortless growth through third-party platforms is giving way to a more complex, nuanced reality where profitability is increasingly difficult to secure.

Businesses that continue to operate under outdated models, heavily reliant on marketplaces without robust D2C capabilities, risk significant margin erosion and diminished brand control. Similarly, organizations that fail to address internal inefficiencies stemming from talent mismatches and unsustainable compensation practices will struggle to maintain operational stability and innovate at the required pace.

On one side lies the convenience and scale of marketplaces, an ecosystem that has brought millions of consumers and sellers together and will undoubtedly remain a pillar of the digital economy. On the other side lie emerging paradigms of direct engagement, promising better margins and closer customer relationships. The dual challenge of high marketplace fees and inflated talent costs has been a wake-up call for the industry, exposing structural weaknesses but also creating impetus for positive change.

The coming years will likely redefine the commerce landscape, with further blurring of lines between marketplaces, social media, and traditional retail. For businesses and policymakers alike, the priority should be enabling this evolution in a way that maximizes value for end consumers and fair opportunity for sellers.

The strategic importance of critically evaluating and recalibrating e-commerce strategies cannot be overstated. The future belongs to agile, data-driven businesses that prioritize direct customer relationships, optimize operations for efficiency, and build resilient, competency focused teams. By embracing omnichannel approaches, leveraging advanced technologies, and fostering a culture of continuous adaptation, businesses can navigate these formidable challenges, reclaim their profitability, and thrive amidst heightened competition in the evolving digital marketplace.

E-commerce is at a crossroads the choices businesses make today will determine whether they merely survive or truly flourish in the exciting years ahead. By moving beyond a sole reliance on marketplaces and building robust, adaptable operations, companies can position themselves to not just navigate the future, but to lead it.