industries

technology

The API Economy: Business Models in the Composable Enterprise

By Ang

April 24, 2025

10 min read

The API economy represents a fundamental shift in how businesses create, deliver, and capture value in the digital age, generating over $1 trillion in market value through programmable interfaces that enable modular architectures and ecosystem driven growth. With 83% of internet traffic now flowing through APIs and the API management market projected to grow from $7.6 billion in 2024 to $16.9 billion by 2029 (CAGR ~17%), organizations face a strategic imperative to embrace API driven models. API-first companies command 32% higher valuation multiples than industry peers, while composable enterprises achieve 30% faster product launches and 40% lower IT costs through API-driven modularity. This analysis examines the architectural foundations, monetization strategies, governance frameworks, and future directions of API business models. As major platforms process trillions in transaction value annually and regulatory frameworks increasingly mandate API access, API strategy has evolved from technical consideration to competitive differentiator with enterprises lagging in API maturity risking 40% higher digital transformation costs compared to leaders.

Modern digital businesses increasingly treat APIs (Application Programming Interfaces) not as mere technical connectors but as strategic business assets that drive value creation across ecosystems. According to Gartner, by 2025, more than 80% of enterprise data will be exchanged via APIs, while 82% of enterprises already report internal API usage for core business functions. This represents a fundamental shift in how organizations architect their capabilities and engage with partners and customers.

The API economy refers to the marketplace created by exposing data and functionality via APIs, enabling new products, services, and revenue streams. McKinsey estimates that APIs could enable the creation of $1 trillion in business value globally, a figure validated by the exponential growth in API adoption and investment. Rather than treating APIs as technical afterthoughts, leading organizations now "design and manage APIs as products," reflecting their role as value drivers across digital ecosystems.

The concept of the composable enterprise extends this idea organizations built from interchangeable building blocks of business capability that can be rapidly reconfigured to respond to market changes. This architectural approach enables unprecedented agility: according to Google/Apigee's 2021 survey, 32% of organizations were raising their digital transformation budgets specifically to enable API-driven composability, with 16% planning a complete shift to "digital-first" strategies.

The economic impact is substantial: in retail alone, 52% of companies report that APIs accelerate innovation, while 36% explicitly view APIs as strategic business assets rather than technical infrastructure. As we'll explore, this shift toward API-centricity isn't merely a technological evolution but a fundamental transformation in how business value is created and captured in the digital age.

The Evolution of the API Economy

From Technical Integration to Business Strategy

The journey of APIs from technical connectors to business model enablers represents one of the most significant shifts in enterprise technology strategy of the past two decades. This evolution can be traced through three distinct generations:

First Generation: Private APIs (Internal Integration)

In the early 2000s, APIs primarily served as internal integration tools, enabling different systems within an organization to communicate. These private APIs reduced redundancy, improved efficiency, and laid the groundwork for service oriented architectures. Early examples include Salesforce's CRM SOAP APIs and eBay's internal commerce APIs. While valuable, these APIs were viewed strictly as IT infrastructure rather than business assets.

The inflection point came in 2002 when Amazon CEO Jeff Bezos issued his famous mandate: all teams must expose their data and functionality through APIs, and teams could only communicate with each other through these interfaces. This organizational decree transformed Amazon's internal architecture and set the stage for Amazon Web Services, which would later revolutionize cloud computing.

Second Generation: Partner APIs (Controlled Collaboration)

As organizations recognized the value of controlled external integration, partner APIs emerged to enable B2B collaboration. Salesforce led this transition in the mid-2000s, launching its API in 2000 and gradually expanding its capabilities. By 2005, Salesforce was processing more API calls than user interface interactions, signaling the growing importance of machine to machine interactions in its ecosystem.

Partner APIs allowed organizations to extend their reach, create new distribution channels, and build value added services on top of their core offerings. eBay and PayPal demonstrated the power of this approach by opening their platforms to developers, creating vibrant ecosystems of complementary services that enhanced their core value propositions.

Third Generation: Public/Productized APIs (Business as a Platform)

The current generation of APIs represents the full maturity of "API as a Product" thinking. Companies like Stripe, Twilio, and Plaid have built their entire business models around public APIs that provide specific capabilities as services. These companies exemplify the API-first approach, where the API is not just a channel for service delivery but the primary product itself.

According to ProgrammableWeb, the directory of public APIs has grown from approximately 2,000 in 2010 to over 24,000 in 2023, representing a compound annual growth rate of nearly 20%. Postman's 2023 State of APIs Report documents even more dramatic growth, with 58% year over year increase in API projects within organizations.

The emergence of public cloud platforms accelerated this trend by normalizing the consumption of capabilities as services. The 2007 smartphone revolution further catalyzed API adoption, as mobile applications required consistent, reliable interfaces to backend services.

Today, API-first companies command 32% higher valuation multiples than industry peers, with Stripe's $70 billion valuation demonstrating the premium investors place on API native business models. This evolution reflects a broader shift in how businesses conceptualize their value chains from linear, integrated models to modular, reconfigurable ones powered by programmable interfaces.

The Architecture of Value in API Business Models

Understanding how APIs create and capture value requires a framework that accounts for their diverse implementations and strategic roles. API driven value creation operates through four primary architectural patterns:

Infrastructure APIs

Infrastructure APIs provide fundamental technical capabilities as services, delivering high-reliability, scalable functionality that would be inefficient for individual companies to build and maintain themselves.

Examples:

- Twilio: Communications infrastructure processing 100 billion annual interactions

- Stripe: Payment processing infrastructure handling $1.4 trillion in annual payment volume (over 1% of global GDP)

- AWS S3: Storage infrastructure serving trillions of objects

These providers create value through economies of scale, specialized expertise, and regulatory compliance management. Their business models typically feature transaction-based or consumption-based pricing, with high volumes compensating for thin margins per transaction.

Platform APIs

Platform APIs expose capabilities of comprehensive software platforms, enabling developers to extend, customize, and integrate with these systems. These APIs create significant ecosystem advantages by increasing switching costs and enabling complementary innovations.

Examples:

- Salesforce API: CRM platform extensibility

- Shopify API: E-commerce platform supporting 13,000+ apps, generating 60% of the company's merchant solutions revenue

- Microsoft Graph API: Microsoft 365 platform integration

Platform APIs typically monetize indirectly by enhancing the value of the core platform offering. They create value by enabling ecosystems of complementary applications that address specific customer needs beyond the platform's core functionality.

Marketplace APIs

Marketplace APIs facilitate discovery, distribution, and transactions between API providers and consumers. These meta platforms create value by reducing search and integration costs across the API ecosystem.

Examples:

- RapidAPI: Hosts 40,000+ APIs with 4 million developers, taking 20% revenue share on transactions

- Postman API Network: API collaboration and governance using 150M+ collections for recommendations

- AWS Marketplace API products: Curated API offerings

Marketplace APIs monetize through transaction fees, subscription models for enhanced features, or revenue-sharing arrangements with providers. Their value increases with the number of participants on both sides of the marketplace, creating strong network effects.

Aggregator APIs

Aggregator APIs unify access to multiple underlying services, providing a simplified interface for developers who would otherwise need to integrate with numerous providers individually. They create value through standardization, simplified authentication, and reduced integration complexity.

Examples:

- Plaid: Unified financial data access to 12,000+ institutions, reducing integration costs by 80% for fintech developers

- MuleSoft: API integration platform

- Nylas: Unified communications API

Aggregator APIs typically monetize through subscription fees or connection based pricing, capturing a portion of the value they create through reduced integration costs for their customers.

The API Value Stack

These four patterns form an "API Value Stack" a hierarchy where infrastructure enables platforms, which power marketplaces, that ultimately feed aggregator networks. Successful implementations exhibit three characteristics: developer-centric design, metered value capture, and exponential ecosystem effects.

This framework illustrates how APIs transform from technical components to strategic business assets, enabling new forms of value creation through modularity, reuse, and ecosystem effects. Organizations that understand and leverage these patterns can position themselves advantageously in the rapidly evolving API economy.

API Monetization Strategies

The diverse landscape of API business models is matched by an equally diverse range of monetization strategies. Successful API monetization requires balancing immediate revenue with ecosystem growth through well-designed pricing models.

Direct Monetization Models

Consumption-Based Pricing

Consumption-based models charge based on the volume of API usage, typically measured in API calls, data processed, or resources consumed.

Examples:

- Twilio: Charges $0.0075 per SMS, generating predictable revenue scaled to customer usage

- Google Maps API: Charges approximately $7 per 1,000 map loads with volume-based tiers ranging from $200-$1,400/month

- OpenAI: Prices based on tokens processed for its language models

Consumption-based pricing works best for APIs where usage correlates with value received and variable costs scale with usage. According to OpenView Partners, companies with usage-based pricing models achieved 38% higher revenue growth compared to those with purely subscription-based models.

Transaction Based Pricing

Transaction fee models capture a percentage of the economic value flowing through the API, typically applied in payment, financial, or marketplace contexts.

Examples:

- Stripe: Takes 2.9% + $0.30 per successful payment transaction, aligning costs with customer revenue

- Plaid: Fees based on successful account connections

- RapidAPI Marketplace: 20% transaction fee on API consumption

This approach aligns provider success directly with customer success, creating a strong value proposition when the economics work for both parties.

Subscription Models

Subscription pricing provides access to APIs for a fixed recurring fee, often with tiered plans offering different levels of functionality or usage limits.

Examples:

- Moz API: Tiered monthly plans based on query volume and features

- Algolia: Search API with plans based on records and operations

- Clearbit: Data enrichment API with annual subscriptions

Subscription models work best for APIs with predictable, consistent usage patterns and services where value doesn't directly correlate with volume.

Indirect Monetization Approaches

Ecosystem Enhancement

Many companies offer APIs as extensions of their core products, monetizing indirectly through increased adoption, retention, and upsell opportunities.

Examples:

- Salesforce API ecosystem: Increases customer retention by 27% compared to non-API users

- GitHub API: Drives greater engagement with the core platform

- Slack API: Increases platform stickiness and ecosystem value

This approach works when the API extends a profitable core product and increases switching costs for the primary offering.

Data Network Effects

Some API providers derive value from the aggregate data and insights generated through API usage, either to improve their own offerings or as a separate monetization channel.

Examples:

- Plaid's financial data graph: Improves fraud detection accuracy by 40% as more institutions join the network

- Weather APIs: Aggregate usage patterns reveal demand for specific forecasts

- Traffic APIs: Usage data reveals mobility patterns valuable for urban planning

Data monetization requires careful attention to privacy considerations but can provide significant value when implemented ethically and transparently.

Developer Experience and Pricing Psychology

Beyond the mechanics of pricing models, successful API monetization requires careful attention to developer experience:

Time to Value Optimization

Developer adoption is heavily influenced by time-to-value: APIs with 3 minute onboarding see 5x higher adoption than those requiring 15+ minutes to implement. According to Postman's 2024 survey, 63% of developers can deliver an API within a week when using structured API development tools.

Key elements include:

- Comprehensive, accessible documentation

- Interactive API explorers and sandboxes

- Code samples in multiple programming languages

- Frictionless registration and authentication

Predictable Pricing

Developers strongly prefer transparent, predictable pricing that allows them to forecast costs as their usage scales. Twilio's per-message pricing creates predictable scaling, while Stripe's percentage model aligns incentives with customer growth.

Successful API monetization aligns pricing models with value creation and developer expectations, establishing a clear and fair value exchange that supports sustainable growth while maintaining strong developer relationships.

The Composable Enterprise

The rise of the API economy is enabling a profound shift in organizational architecture: the emergence of the composable enterprise. This approach treats business capabilities as modular, interchangeable building blocks that can be rapidly reconfigured to address changing market conditions.

From Monoliths to Modules

Composable enterprises achieve 30% faster product launches and 40% lower IT costs through API-driven modularity compared to organizations with traditional architectures. According to Gartner, organizations that have adopted composable principles can outpace competitors by 80% in the speed of implementing new features.

The shift from monolithic to composable architecture is accelerating: Postman's 2024 survey found that 74% of organizations now follow an API-first approach, up from 66% in 2023. This trend reflects growing recognition that composability enables the agility required in rapidly changing markets.

The Six-Layer Composable Enterprise Framework

Modern composable enterprises implement a six-layer architecture that enables modularity across all aspects of the organization:

-

Business Capability Layer

- ING Bank decomposed 250+ capabilities into API products, enabling 80% reuse across digital channels

- Defines core business functions exposed as reusable services

-

Process Orchestration Layer

- DBS Bank's API marketplace reduced process integration time from 6 months to 2 weeks

- Coordinates flows across capabilities and systems

-

Application Layer

- BBVA's microservices architecture decreased core banking system latency by 300ms through API optimization

- Implements business logic through modular applications

-

Data Fabric Layer

- Event-driven APIs at JPMorgan Chase process 1.5 billion daily transactions with 99.999% reliability

- Provides consistent data access across the enterprise

-

Ecosystem Layer

- Salesforce's API ecosystem contributes $8.2 billion annually in partner revenue

- Connects internal capabilities with external partners

-

Governance Layer

- FedEx's API gateway enforces 98% compliance with OpenAPI specifications across 400+ services

- Ensures quality, security, and compliance

This architecture enables "composability ROI" each 10% increase in API reuse correlates with a 4.2% reduction in development costs. However, successful implementation requires cultural shifts: 63% of enterprises cite organizational silos as the primary barrier to composability.

API-First vs. API Enabled Approaches

Organizations pursuing composability typically follow one of two strategic paths:

API-Enabled: These organizations view APIs primarily as integration mechanisms for existing systems. While valuable, this approach often falls short of realizing the full potential of the API economy.

API-First: These organizations design their business capabilities with APIs as the primary interface from the outset. This approach emphasizes well-designed API contracts, developer experience, and APIs as products with dedicated ownership.

Teams using collaborative API tools demonstrate the advantages of an API-first approach: 67% of teams using Postman "Workspaces" can release an API in under a week, compared to 58% without such tools.

BBVA's transition from an API-enabled to an API-first approach illustrates this evolution. Initially, BBVA created APIs to expose existing banking capabilities. In 2018, they launched a public API marketplace, exposing accounts, payments, and identity services to fintechs through an API-first model.

According to MuleSoft's connectivity benchmark, organizations with mature API strategies reported 73% faster time-to-market for new applications, demonstrating that composable, API-centered architecture is now a strategic differentiator in the digital economy.

API Marketplaces and Ecosystems

As the API economy matures, marketplaces have emerged as critical infrastructure for discovery, distribution, and consumption of APIs. These platforms reduce transaction costs between API providers and consumers, accelerating the growth of the overall ecosystem.

The Evolution of API Marketplaces

API marketplaces have evolved through three distinct maturity stages:

| Maturity Stage | Characteristics | Example |

|---|---|---|

| Directory | Basic discovery and documentation | ProgrammableWeb |

| Transactional | Integrated provisioning and billing | RapidAPI (Rakuten) |

| Intelligent | AI-driven composition and recommendations | Postman API Network |

This evolution reflects the increasing sophistication of the API economy and the need for more advanced discovery and integration mechanisms as the number of available APIs grows exponentially.

External API Marketplaces

External API marketplaces serve as centralized hubs where developers can discover, test, and integrate with APIs from multiple providers.

Key marketplace dynamics:

- Cross-side network effects: More developers attract more API providers (RapidAPI grew 300% after reaching 1 million developers)

- Same-side network effects: Popular APIs drive ecosystem standards (Twilio's API design influenced 82% of communication APIs)

- Data network effects: Aggregate usage data improves API discoverability (Postman's API Network uses 150M+ collections for recommendations)

Leading examples include:

- RapidAPI: Hosts 40,000+ APIs with 4 million developers, taking 20% revenue share on transactions

- Postman API Network: API collaboration and governance platform

- AWS API Marketplace: Integration with existing AWS billing and infrastructure

According to RapidAPI's State of APIs Report, 61% of developers now use API marketplaces to discover new APIs up from 38% just three years ago.

Internal API Marketplaces

Beyond public marketplaces, enterprises are increasingly implementing internal API marketplaces to facilitate discovery and reuse of capabilities within their organizations.

Value drivers for internal marketplaces:

- Capability reuse: Gartner reports organizations with internal API marketplaces achieve 40% higher reuse rates for common capabilities

- Governance and standardization: Marketplaces provide natural enforcement points for API standards

- Developer productivity: Internal marketplaces significantly improve developer productivity through centralized documentation and self service access

However, governance challenges persist: 68% of enterprises report "shadow APIs" not cataloged in official marketplaces, creating security risks. Solutions like federated API gateways reduce sprawl by 40% through centralized visibility.

Postman's survey also found that "multiple gateways reflect a new era of API management" organizations now commonly support separate gateways for public and private APIs, reflecting hybrid environments.

Developer Experience as Competitive Advantage

In the API marketplace ecosystem, developer experience (DX) has emerged as a critical competitive differentiator. Organizations that excel in DX focus on:

- Comprehensive documentation

- Frictionless onboarding

- Support and community

- Tooling and SDKs

According to a study by Nordic APIs, developers make API adoption decisions within the first 5-10 minutes of exploration, emphasizing the critical importance of first impressions in the developer experience.

Stripe exemplifies excellence in developer experience, with documentation consistently cited as the gold standard in the industry. Their approach has been a key factor in Stripe's rapid adoption and growth to over 470 integration partners and usage by 1.6 million websites.

Case Studies: API First Success Stories

Stripe: Payments Infrastructure as API

Founded in 2010, Stripe transformed payment processing into a simple API that developers could implement in minutes. By 2022, Stripe processed $1.0 trillion in payment volume (up ~22% YoY) and earned $14.4 billion in revenue. This grew to approximately $1.4 trillion in 2024, representing over 1% of global GDP.

Stripe's developer-centric model featuring rich documentation, global currency support, and prebuilt UI components has helped it reach a $70 billion valuation. With over 1.6 million websites using its services, Stripe demonstrates how an API-first approach can redefine an entire industry.

Twilio: Communications as API

Twilio pioneered the Communications Platform as a Service (CPaaS) model by transforming telecommunications capabilities into simple APIs. The company reported $4.15 billion in revenue for 2023, processing over 100 billion annual interactions through its communications APIs.

Twilio's consumption-based pricing model (charging $0.0075 per SMS) enabled frictionless adoption with costs that scale proportionally to usage. This approach has helped Twilio grow to hundreds of thousands of active customer accounts, demonstrating the power of usage-based API business models.

Plaid: Financial Data as API

Plaid connects applications to 11,000-12,000+ financial institutions, with approximately 450 million accounts under management by 2020. The company's APIs for accounts, transactions, and identity became essential infrastructure for fintech applications like Robinhood and Venmo.

Plaid's value proposition includes reducing integration costs by 80% for fintech developers and improving fraud detection accuracy by 40% as more institutions join its network. These network effects and the company's strategic position in the financial services ecosystem led to a valuation of approximately $13.4 billion in its last funding round.

Algolia: Search as API

Algolia offers instant search indexes for applications via API, with a focus on performance (sub-30ms queries) and developer experience. By 2022, Algolia reached "hundreds of millions in ARR" and served companies like Stripe and Slack.

Rather than enterprise licensing, Algolia adopted transparent usage-based pricing aligned with the value delivered to customers. This approach, combined with comprehensive SDKs and documentation, helped Algolia grow to process billions of search queries monthly.

These case studies illustrate several common patterns in successful API-first businesses:

- They transform complex capabilities into accessible services

- They maintain an unwavering focus on developer experience

- They align pricing models with the value they create

- They build competitive moats through network effects and ecosystem development

Governance, Risk, and Compliance

As APIs move from technical components to strategic business assets, governance, risk management, and compliance considerations become increasingly important.

API Security Challenges

Security risks are significant: Akamai's 2024 API Security Impact Study found that 84% of organizations experienced an API security incident in the past year. Gartner warns that the average API breach leaks 10× more data than a typical breach.

Common vulnerabilities (per OWASP API Security Top 10) include broken object-level authorization and excessive data exposure. The average cost to remediate an API incident in the U.S. exceeds $591,000, with costs even higher in financial services.

Perhaps most concerning, only 27% of respondents had full visibility into which APIs expose sensitive data, underscoring the need for comprehensive API inventory and continuous monitoring.

Regulatory Landscape

Regulation adds complexity to API governance:

- PSD2 in the EU mandates open banking APIs for account access

- Global privacy laws (GDPR, CCPA) and industry standards (PCI DSS, HIPAA) require API data controls

- The EU's Digital Markets Act mandates API access for "gatekeeper" platforms

These requirements make API governance not just a best practice but a compliance necessity.

API Governance Frameworks

Effective API governance balances standardization and innovation through:

API Lifecycle Management

- Clear processes from planning to retirement

- Stage-gate reviews at key transitions

- Versioning and deprecation policies

Design Governance

- Naming conventions and resource modeling

- Error handling and status codes

- Documentation requirements

Operational Governance

- Service level agreements (SLAs) and objectives (SLOs)

- Monitoring and alerting requirements

- Incident response procedures

FedEx's API gateway enforces 98% compliance with OpenAPI specifications across 400+ services, demonstrating how effective governance can scale across large API portfolios.

Investing in robust API management (including automated tests, automated IAM, and anomaly detection) is now essential risk mitigation for composable enterprises, particularly as they expand their API footprints and ecosystem participation.

Investor's Guide to the API Economy

For investors, the API economy presents unique opportunities and challenges. Understanding how to evaluate API businesses, their growth potential, and their competitive dynamics is essential for making informed investment decisions.

Evaluating API Companies

Investors should consider several key metrics when assessing API-focused businesses:

Developer Adoption Metrics

- Developer signups and activation rates

- Time to first call

- API call volume growth

- Developer NPS

Economic Metrics

- Gross margins (typically >60% for public API companies)

- Net dollar retention (successful APIs often show 120%+ NDR)

- Customer acquisition cost (often lower than traditional SaaS)

- Revenue per API call

Strategic Position Indicators

- Category leadership

- Ecosystem strength (30% organic ecosystem contribution is a benchmark)

- Switching cost dynamics

- Competitive moats

The API Maturity Index

For evaluating API maturity within enterprises or potential investments, the following formula provides a useful framework:

$$ \text{API Maturity} = 0.3(\text{Reuse Rate}) + 0.4(\text{Ecosystem Revenue}) + 0.3(\text{Developer NPS}) $$

This index balances internal efficiency (reuse), external traction (ecosystem revenue), and developer satisfaction (NPS) to create a comprehensive view of API program success.

Valuation Considerations

API businesses display distinctive valuation patterns:

- API-first companies command 32% higher valuation multiples than industry peers

- Public API-centric companies like Twilio have been valued at ~$50B at peaks, while Stripe reached ~$70B in private markets

- Transaction volumes provide useful benchmarks: Stripe processed ~$1.4T in 2024 with ~$14B revenues, demonstrating the scale of leading API businesses

For early-stage API startups without significant revenue, developer metrics can provide insight into future growth potential. The strong network effects and ecosystem advantages of successful API businesses often justify premium valuations, particularly when they demonstrate platform expansion potential.

Future Directions and Emerging Trends

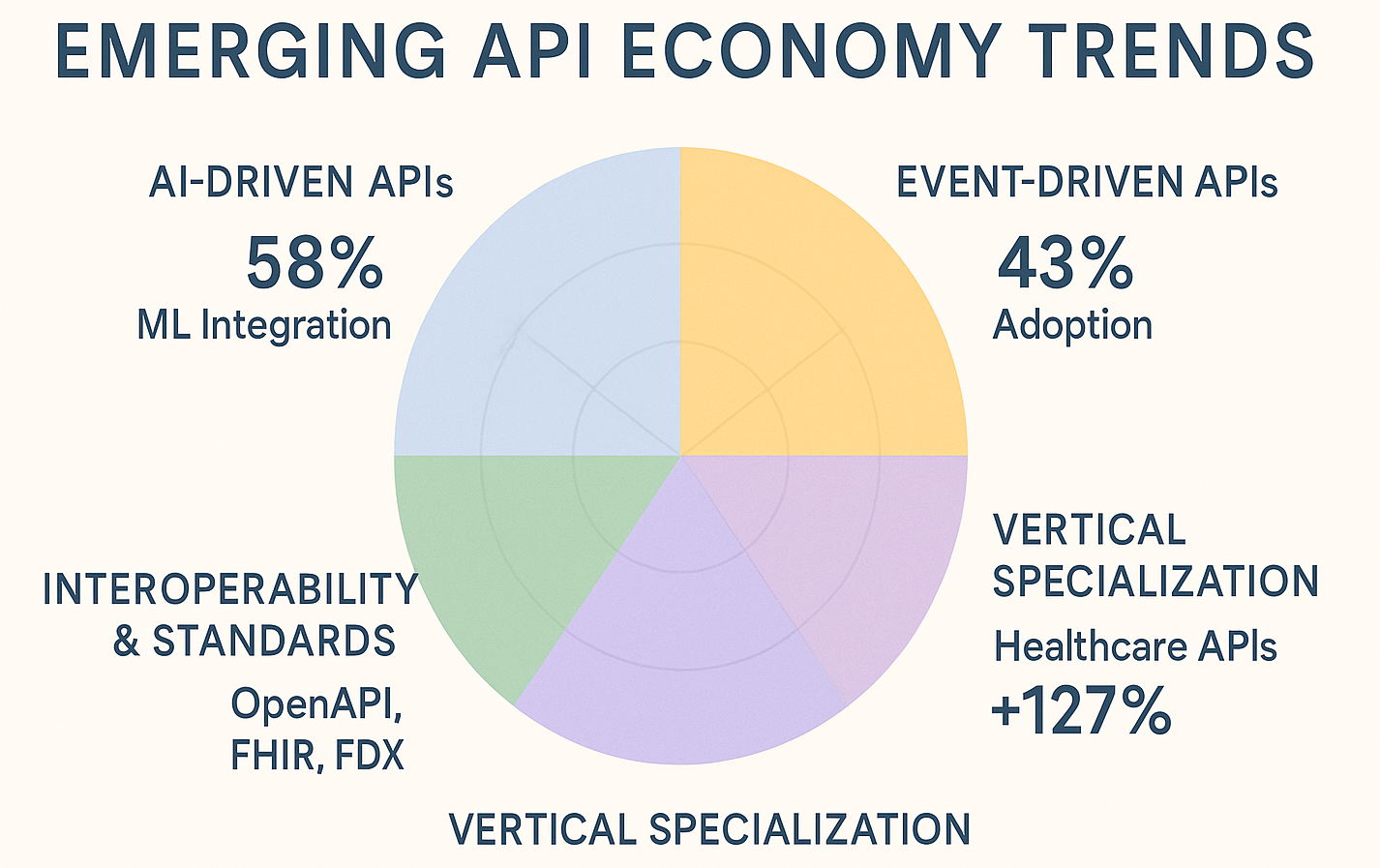

Several trends are shaping the next phase of the API economy:

AI-Driven APIs

AI is transforming both how APIs are created and consumed:

- 58% of new APIs now incorporate machine learning capabilities

- OpenAI's GPT-4 API processes 10 billion daily requests

- Postman reports a 73% surge in "AI driven" API traffic over one year

New "AI as a Service" APIs will become pervasive, with enterprises integrating these capabilities via APIs rather than building in-house models.

Event-Driven Architectures

The architectural patterns underlying the API economy are evolving beyond traditional request-response models:

- 43% of enterprises now use event streams vs. REST APIs for real-time use cases

- Event-driven APIs at financial institutions like JPMorgan Chase process billions of daily transactions

- Serverless architectures are enabling more responsive, event-based API interactions

These patterns enable more responsive, real-time applications and support the trend toward streaming data and real-time analytics.

Vertical Specialization

Industry-specific API platforms are gaining traction:

- Healthcare-specific APIs grew 127% in 2023, led by FHIR standards adoption

- Financial services APIs are expanding beyond payments into compliance, risk, and specialized lending

- Industry cloud initiatives from major providers are creating vertical-specific API ecosystems

This specialization enables deeper integration with industry specific processes and regulatory requirements.

Interoperability and Standards

As APIs proliferate, standards are becoming crucial for interoperability:

- OpenAPI Specification adoption continues to grow

- Industry-specific standards like FHIR (healthcare) and FDX (finance) are driving adoption

- API governance frameworks are standardizing approaches across organizations

These standards reduce fragmentation and accelerate adoption within specific sectors.

As regulatory frameworks like the EU's Digital Markets Act mandate API access, composable architectures will become compliance necessities rather than just strategic differentiators. Enterprises lagging in API maturity risk 40% higher digital transformation costs compared to leaders, making API strategy not just advisable but existential in the evolving digital economy.

Conclusion: Action Checklist

The API economy has transformed from a technical trend to a fundamental shift in how digital business value is created and captured. Organizations that embrace API-driven models can achieve greater agility, unlock new revenue streams, and participate in growing digital ecosystems.

Action Checklist for Enterprises

-

Assess API Maturity

- Catalog existing APIs and evaluate their strategic importance

- Measure API reuse rates and developer satisfaction

- Compare your API program against industry benchmarks

-

Adopt API-First Development

- Implement API design-first processes before implementation

- Establish API product management roles and responsibilities

- Invest in developer portals and documentation

-

Implement API Governance

- Establish clear API lifecycle management processes

- Implement security and compliance controls

- Create API discovery mechanisms for internal reuse

-

Measure API Success

- Track API adoption, usage, and performance metrics

- Measure business impact through reduced time-to-market

- Calculate ROI from API investments

Action Checklist for Investors

-

Evaluate API Business Fundamentals

- Assess developer adoption metrics and growth rates

- Examine pricing models and unit economics

- Evaluate competitive moats and ecosystem effects

-

Analyze Market Positioning

- Map competitive landscape in the API category

- Assess potential for horizontal expansion or vertical specialization

- Evaluate regulatory tailwinds or headwinds

-

Conduct Technical Due Diligence

- Assess API design quality and developer experience

- Evaluate security posture and compliance capabilities

- Examine scalability and reliability architecture

-

Project Growth Potential

- Model network effects and ecosystem growth

- Assess potential for pricing power as adoption increases

- Evaluate expansion paths beyond core API offerings

Action Checklist for Entrepreneurs

-

Identify API Opportunities

- Look for complex capabilities that can be simplified through APIs

- Identify integration pain points in specific industries

- Assess developer demand through community research

-

Design for Developer Success

- Invest heavily in documentation and onboarding

- Create frictionless authentication and testing environments

- Build for integration into existing developer workflows

-

Craft Sustainable Business Models

- Align pricing with value creation

- Create adoption paths from free to paid

- Design for network effects and ecosystem growth

-

Build Defensibility

- Create data network effects through API usage

- Establish ecosystem partnerships and integrations

- Develop unique IP in your API implementation

By treating APIs as strategic assets rather than technical afterthoughts, organizations can unlock new revenue streams, enable dynamic partnerships, and build resilient architectures that drive the next wave of the digital economy. As Postman's research suggests, API first firms are already pulling ahead the imperative is to move quickly and strategically into this rapidly evolving landscape.

References

- Akamai Technologies. 2024. 2024 API Security Impact Study.

- Bessemer Venture Partners. 2023. State of the Cloud Report.

- Clearbit, Moz, and Algolia. 2024. Public API Pricing Pages.

- Deloitte Consulting LLP. 2020. API Imperative: From IT Concern to Business Mandate.

- Forbes Media LLC. 2023. Plaid Valuation History.

- Forrester Research, Inc. 2022. The Forrester Wave™: API Management Solutions.

- Gartner, Inc. 2023. API Security Risks Report.

- Gartner, Inc. 2023. Composable Business Research.

- Gartner, Inc. 2023. Market Guide for API Management.

- Google Cloud. 2024. Maps API Pricing.

- Google/Apigee. 2021. Digital Transformation Survey.

- Harvard Business Review. 2021. APIs Aren't Just for Tech Companies.

- Harvard Business Review. 2022. Platforms and Ecosystems: Managing Value in a Digital World.

- International Data Corporation (IDC). 2022. Worldwide API Management Software Market Shares.

- McKinsey & Company. 2021. The API Economy: Driving Digital Transformation.

- MuleSoft, Inc. 2023. Connectivity Benchmark Report.

- Nordic APIs. 2023. Developer Experience Research.

- OpenView Venture Partners. 2023. Usage-Based Pricing Study.

- Plaid, Inc. 2023. Account Coverage Metrics.

- Postman, Inc. 2023. 2023 State of the APIs Report.

- Postman, Inc. 2024. 2024 State of the APIs Report.

- ProgrammableWeb. 2023. API Directory Growth Statistics.

- ProgrammableWeb. 2023. History of Web APIs.

- RapidAPI. 2023. State of APIs Developer Survey.

- Salesforce, Inc. 2023. Partner Ecosystem Impact.

- Stripe, Inc. 2022. 2022 Financial Highlights.

- Stripe, Inc. 2023. The API-First World.

- Stripe, Inc. 2024. Economic Impact Report.

- Twilio, Inc. 2023. Annual Report.

- Twilio, Inc. 2024. Q4 2023 Financial Results.